I will discuss the How to Stake Algorand (ALGO) and earning passive rewards in this article.

When you stake ALGO, you help support the network and earn returns at the same time. I will discuss important things like the best staking methods,

Platforms, and other tips and tricks in order for you to earn the maximum amount possible while ensuring the safety of your assets. Let’s get into the staking process!

What is Algorand?

Algorand is a decentralized blockchain that focuses on speed, security, as well as scalability. It was established by Silvio Micali, a Turing Award winning cryptographer, in 2017 and officially launched in 2019.

Algorand implements a Pure Proof-of-Stake (PPoS) consensus which enables fast transactions at low costs. The network supports smart contracts, as well as decentralized applications (dApps), making it suitable for both financial and enterprise applications.

Algorand strives to deliver an effective and fair blockchain ecosystem with sustainability and decentralization at the forefront.

How to Stake Algorand (ALGO)

Coinbase gives users the ability to stake Algorand (ALGO) with an Annual Percentage Yield (APY) of 5.75%.

You can stake your ALGO tokens on Coinbase if you have more than 0.01 ALGO in your account. Here are the steps to stake ALGO on Coinbase:

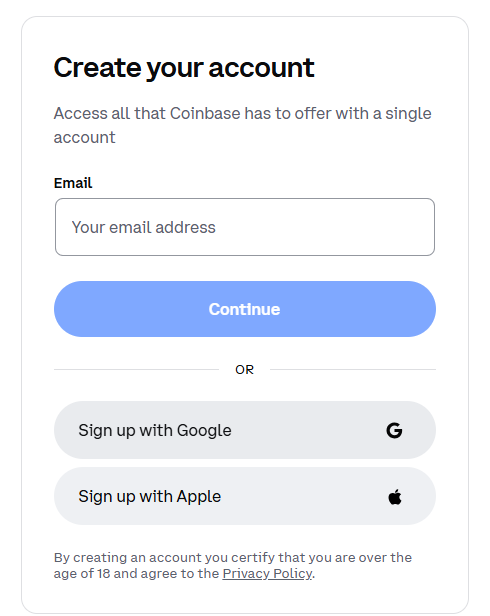

Log in or Register for a Coinbase Account

New users should create a Coinbase account and existing users should log in to their accounts.

Buy or Deposit ALGO Tokens

If you are new to ALGO, you can buy tokens on Coinbase using different payment methods. If you have ALGO stored in other wallets, simply transfer them to your Coinbase wallet.

Begin Staking

Go to your Coinbase wallet and once you have deposited ALGO tokens, go to the ‘Earn’ section on your account.

From there, search for Algorand (ALGO) and select ‘Stake’ or ‘Earn Rewards.’ You can now follow the instructions on screen to begin staking.

Key Points to Consider:

Commission Fee

There’s a copious catches relating to fees. Coinbase, for instance, will take 25% of all your staking rewards just for using their services and will deduct those fees automatically from your profits when you earn them.

Reward Payouts

Coin rewards for ALGO staking are issued every three months or quarterly in line with Algorand governance terms.

Availability

Staking accounts on Coinbase have geographical restrictions and may not be available to users in certain locations. Make sure that staking is supported in your region prior to going further.

Take the requisite actions, and claims for ALGO tokens on Coinbase are a few steps away. Expect passive income. Don’t forget that staking comes with terms and conditions, including fees and payout timelines, so make sure you monitor what’s going on in the platform.

Benefits of Stake Algorand

Earning Passive Income

Instead of focusing on the active income methods linked with crypto, you have the option of passive income through ALGO staking that rewards you with extra ALGO tokens. ALGO holders who stake their tokens are allowed to generate passive income.

Income Supporting Network Security

DLT pertaining to Blockchain Security through proof of stake consensus mechanism is efficiently done with ALGO staking. This ensures the integrity and decentralization of the network. Security measures through automation guarantees Algorand blockchain security and integrity.

Flexible Low Investments

Certain complex prerequisites present in other cryptocurrencies do not apply to Algorand crypto currencies and is made easier. Algorand holders can stake with official wallets, hardware wallets as well as through certain popular platforms like Coinbase and Binance.

Passive Income Governance engagement ALGO holders

Voting and proposal submission pertaining to the future of Algorand blockchain can be executed through governance engagement with your ALGO tokens.

Green Technologies Staking with Sustainability focus.

In comparison to other mining based blockchain networks Algorand is far more efficient environmentally. Algorand heavily relies on Pure Proof-of-Stake (PPoS) method, making it easy to avoid energy waste.

Flexibility

Unlike other financial services, ALGO staking does not limit access to your funds for a long period of time. Staked funds remain available for use (depending on the platform).

Risks & Considerations for Staking Algorand (ALGO)

Risks

Market Risk – Price of ALGO can change randomly, which influences earnings.

Decreasing Rewards – Due to the timeSpan, the profits have diminished drastically.

Platform Risks – Staking platforms and exchanges are susceptible to hacking or crashing.

Liquidity Risk – Certain staking methods involve funds being constrained for prolonged periods.

Change In Policies – New rules can undermine staking prospects.

Considerations

Focus On Reliability – Employ secure wallets or trusted exchanges to stake.

Focus On Liquidity Preferences – If access to funds is paramount, select non-binding staking.

Focus On The Market’s Value For ALGO – Track price movement, and changes to rewards and inform yourself.

Focus On Other Staking Positions – In order to hedge against risk, do not stake all available ALGO.

Identify the Staking Conditions – Check platforms policies on rewards and telemetry data withdrawal.

Pros & Cons

| Pros ✅ | Cons ❌ |

|---|---|

| Earn Passive Rewards – Generate ALGO by participating in staking. | Declining Rewards – Staking returns have decreased over time. |

| Secure & Decentralized – Helps maintain the network’s security and efficiency. | Market Volatility – ALGO’s price fluctuations can impact earnings. |

| Eco-Friendly – Uses Pure Proof-of-Stake (PPoS), consuming minimal energy. | Platform Risks – Some exchanges or wallets may have security vulnerabilities. |

| Low Fees & Fast Transactions – Efficient blockchain with minimal transaction costs. | Liquidity Issues – Certain platforms may require a lock-up period. |

| No Expensive Equipment Needed – Unlike mining, staking requires only ALGO tokens. | Regulatory Uncertainty – Crypto regulations may affect staking policies. |

| Multiple Staking Options – Stake via wallets, exchanges, or DeFi platforms. | Limited Earnings Potential – Compared to other high-yield staking options. |

Conclusion

To sum things up, Staking Algorand (ALGO) is an effortless and environmentally friendly method of earning passive rewards while also helping secure the network.

Walets, exchanges, and DeFi platforms allow users to select the method that fits their needs. As much as ALGO staking affords low fees and attention to decentralization, the risks of market volatility and rewards decreasing over time poses a considerable threat.

Picking the right secure platform along with remaining up to date on information can make your staking with Algorand profitable for long term investors.