In this article, I will discuss the How to Stake Tokens on Avalanche and the steps required to earn rewards.

Earning rewards through staking not only helps strengthen the security of the AVAX blockchain network but also enables earning passive income with minimal effort involved.

This guide has been designed to support both new and seasoned users who wish to stake their tokens, so that they can approach the process with a clearer understanding.

What is Staking Tokens?

Staking tokens refer to setting aside a specified amount of cryptocurrency for the active functioning and safety protocols of blockchain security. Users assist in verifying transactions and keeping the entire system working seamlessly by staking. In exchange, they receive rewards which are most likely in the same token.

This activity is popular in Proof of Stake (PoS) and its variations where stakers function as verifiers or delegates. Staking promotes an active participation of the network as well as token holders while providing continuous income.

How to Stake Tokens on Avalanche

Staking tokens on Avalanche enables participants to secure the network and earn passive income simultaneously. Here is how you can stake AVAX on Avalanche.

Example: Staking AVAX on Avalanche

Setup An Avalanche Wallet

You need an Avalanche wallet and some available AVAX tokens.

Move AVAX to the P-Chain

Make sure you shift your AVAX from the X-Chain or C-Chain to the P-Chain within your wallet since staking occurs on the P-Chain.

Choose a Validator

Pick a reliable validator from the Avalanche network. Validators the blockchain and allocate staking rewards.

Delegate Your AVAX

Set the quantity of AVAX to stake and delegate it to the selected validator. The minimum staking amount is 25 AVAX.

Confirm & Stake

Check the staking specifics, execute the transaction, and begin receiving rewards.

Generate Rewards

Rewards will accrue to your AVAX balance relative to the validator’s efficiency and the duration of staking.

Unstake & Withdraw

Post the staking duration, you can withdraw your AVAX and the rewards confidently.

Other Place Where to Stake Tokens on Avalanche

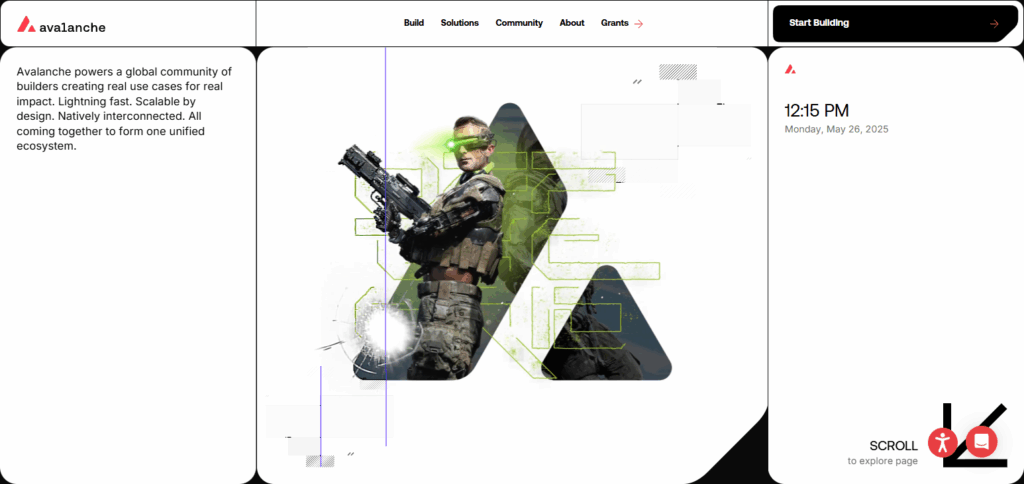

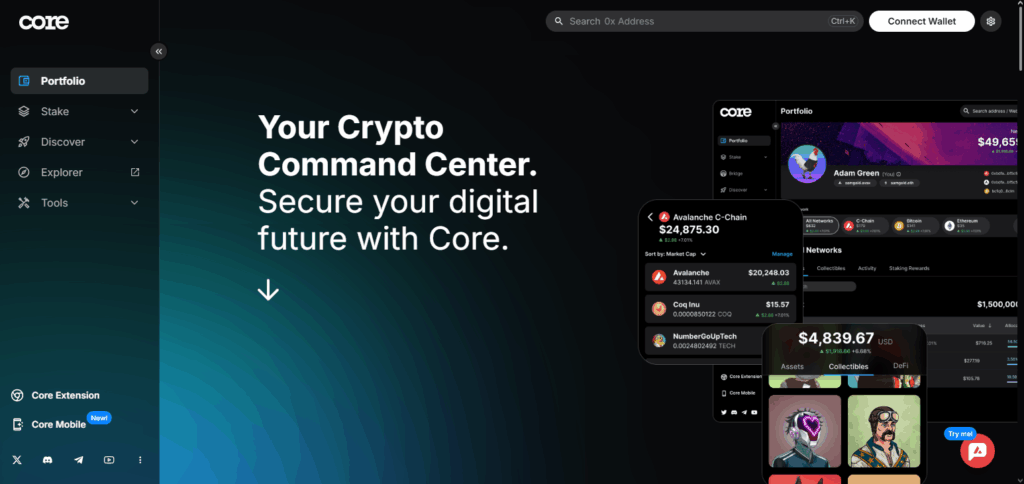

Core Wallet

The Avalance Core Wallet is now integrated with Avalanche, meaning users can delegate tokens to validators without any hassles, allowing effortless contribution to consensus. It is an official Avalanche wallet tailored for staking AVAX tokens.

The Core Wallet is unlike other wallets; it provides up-to-date staking stats, reward tracking, real-time information about validators, and much more, all from a single dashboard. Its ease-of-use designed specifically for staking makes it the perfect choice for blockchain Avalanche for novice and expert users alike.

Binance

Binance provides an easy and accessible way to stake Avalanche (AVAX) tokens without the hassle of a personal wallet or validator node. Users gain exposure from simplified delegation, automatic reward payout, and low technical hurdles by staking on Binance.

Added security and liquidity due to Binance’s user base and trust mark the platform as prudent for all levels of stakers. This Avalanche staker proposition comes with effortless participation in network growth and advancement.

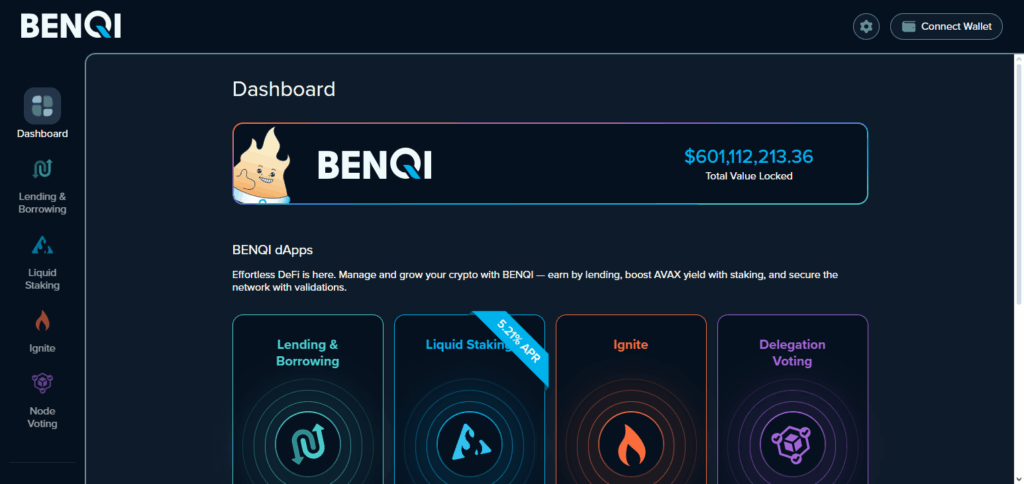

Benqi Finance

Through BENQI Finance, users can stake their AVAX on the Avalanche network and receive sAVAX in return, a liquid staking token that ensures straked AVAX bolsters the liquidity of the BENQI platform. sAVAX can thus be used for lending, borrowing, and yield farming in various DeFi ecosystems, increasing capital efficiency.

With integration to the Avalanche C-Chain, BENQI further automates the user experience by removing the complexity of transferring assets across chains to the P-Chain for easier staking. BYOD enables a sAVAX holder to vote on who will the maintainers of the protocol thus increasing the decentralization of the network.

Prerequisites for Staking AVAX Tokens

Minimum AVAX Amount: To become a validator, you need at least 25 AVAX. Else, a smaller quantity would suffice for delegating.

AVAX-Compatible Wallet: You must set up an Avalanche-supported wallet such as the Core Wallet or configure MetaMask to the Avalanche network.

AVAX Tokens: You must have AVAX tokens in your wallet available for staking or delegation.

Network Fees: Additional AVAX to spare for transaction fees during staking transactions.

Basic Understanding: Some comprehension of the Avalanche staking terminology, as well as knowledge of how to operate within the platform, is required.

Tips for Safe and Effective Staking

Choose Reliable Validators

Always check validator performance metrics, commission fees, and uptime to mitigate risks associated with slashing or loss of rewards.

Secure Your Wallet

Always store private keys in a safe bandwidth, preferably using hardware wallets or wallets with advanced security features.

Diversify Stakes

Explore the option of delegating to multiple validators in order to reduce risk.

Stay Updated

Monitor changes in the network alongside validator communications so as not to miss critical information.

Comprehend Lock-Up Periods

Understand the unstaking timelines so as not to be surprised by the inability to access tokens due to time delays.

Risk & Considerations

Validator Downtime

If a validator goes offline, rewards may be lost or penalties (slashing) may occur.

Slashing Risks

Any behavior of the active validators may result in a loss of some staked tokens.

Lock-Up Period

Some periods of staking imply no access or withdrawal capability which can hinder liquidity.

Market Cynamics

The price of AVAX tokens can change which will impact the overall yield from staking.

Security of the platform

Concerns relating to the security of wallets and vulnerability of the staking platform.

Selection of Validators

Unreliable validators may lower staking rewards or increase the risk and exposure.

Pros & Cons

| Pros | Cons |

|---|---|

| Earn passive income through staking rewards | Tokens are locked for a fixed period |

| Supports network security and decentralization | Risk of slashing if validator misbehaves |

| Low technical barrier when using platforms like Binance or Benqi | Potential loss if validator goes offline |

| Liquid staking options (e.g., Benqi’s sAVAX) allow flexible use of tokens | Market volatility affects token value |

| Easy delegation without running a full node | Transaction fees apply for staking actions |

Conclusion

In summary, staking tokens on Avalanche is an excellent method for network support while passively earning income. Accomplishing the outlined actions of obtaining wallet compatibility, acquiring AVAX, selecting a trustworthy validator, and delegation enables effortless engagement at Avalanche’s secure and scalable ecosystem.

Cavax, Core Wallet, Binance and even cutting edge Benqi Finance offers seamless user experiences for their investors while aiding network fortification through staking. Over time, these investments bear fruits, proving the foresightedness of strategic investment.