This article is about, How to Stake Tokens on Telegram Based Staking Pools is one of many trends emerging in the crypto world where convenience meets the ability to earn income with little effort.

Telegram staking pools give users the ability to custodiand stake, earn and manage their tokens without leaving the app. This makes staking far simpler and community-oriented, even for the most novice of users, as well as seasoned investors.

What is Staking Tokens?

Staking tokens involves blocking the use of a cryptocurrency of your choice on a blockchain system to help the network validate operations and defend the system and, in exchange, you earn rewards.

As opposed to trading, staking enables holders of a token to passively earn income by simply waiting for a period while committing the token.

The earnings in staking often come in the form of more tokens or interest, similar to dividends. Staking is common in Proof-of-Stake (PoS) and associated consensus systems, providing a more eco-friendly mining alternative.

For investors wanting constant growth while aiding the advancement of the blockchain, mining is one of the most appealing options.

How to Stake Tokens on Telegram-Based Staking Pools

Example: Staking USDT on a Telegram Staking Pool

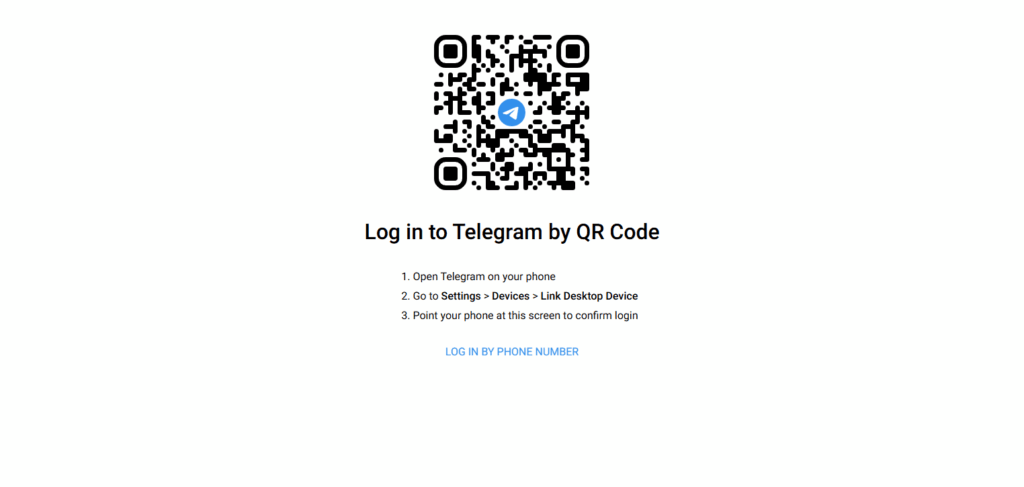

Step 1: Join the Official Telegram Bot/Group

Look for the Telegram bot or group of the project and click on Start to activate it ( for instance “XYZ Staking Bot”).

Step 2: Connect Your Wallet

In this step you will be prompted on how to connect a crypto wallet, to do this, you can either copy your wallet and paste or invoke a connect wallet feature, based on what the bot provides.

Step 3: Deposit Tokens

Always double check the wallet address. You have to send the bot the required tokens, or the USDT, USDC or if the project has a native coin you can send this as well.

Step 4: Select Staking Option

Each plan will show the amount of APY (annual percentage yield) the plan would earn. You can Select the 30 days, 90 days or the flexible staking offers.

Step 5: Confirm Transaction

The bot will send you a message when you confirm with the bot how many tokens you wish to stake and the plan you select.

Step 6: Track Rewards

In your Telegram bot under “My Stakes” or “Earnings” you are able to check what your rewards are. It will take time as they do not come instant with. Rewards update over a period of days or weeks.

Step 7: Withdraw or Compound

After the staking duration ends, you can opt to withdraw the staked tokens along with the rewards or choose to reinvest them for the purpose of compounding.

What for look Stake Tokens on Telegram-Based Staking Pools

Here are critical considerations to research prior to staking tokens on Telegram-based staking pools.

Verified Official Bot/Group – Check to confirm that the Telegram bot or channel has been corroborated and is associated with the project team.

Community Trust – Scrutinize user feedback, community discussions, and reviews to assess the reliability of the pools.

Security Measures – Prioritize pools with secure wallet connections and that do not request private keys.

Supported Tokens – Determine the tokens you are able to stake and check if they are in your possession.

APY & Rewards – Check the yearly percentage yields and the frequency of rewards across pools.

Lock-in Periods – Determine if the stake is flexible or if commitments to a fixed time are required.

Withdrawal Options – Check if there is a possibility of withdrawal and if there are any penalties imposed.

Transparency – Determine if there are reasonable staking rules that are backed by contracts and clearly define the terms.

Preparing to Stake Your Tokens

Select a Safe Wallet

Store your coins in a reliable wallet such as MetaMask, Trust Wallet, or a secure hardware wallet.

Confirm Token Compatibility

Verify that the tokens you intend to stake are accepted by the staking pool.

Sufficient Balance

Balance should cover the token amount and a small reserve of the native coin (e.g. ETH, BNB) for the network fees.

Terms of Staking

Take the time to understand the gas fees, staking configuration, and the predetermined time frames during which tokens cannot be unstaked.

Software Updates

To prevent potential technical issues, make sure your wallet app and Telegram are the latest versions.

Tracking and Managing Your Stakes

Here are main points for Tracking and Managing Your Stakes for Telegram-based staking pools.

Use the Bot Dashboard – Most Telegram staking bots provide commands like My Stakes or Earnings to track your staked amount and rewards in real-time.

Reward Frequency – Check whether the reward is paid daily, weekly, or if it is paid at the end of the staking period.

Multiple Stakes – If you join different pools, take note of each one like start date, APY, and duration to avoid confusion.

Withdraw or Compound – Decide whether you want to withdraw your earnings or reinvest for compounding purposes.

Set Reminders – Telegram and calendar alerts can be helpful in remembering lock-in expiry and date for claiming the rewards.

Security Tips for Staking on Telegram

Always Join Staking Pools From Credible Sources

Scoot your mouse over to the pins on the Telegram page that verifies using the official provided link to the project page or ponted to your page by the project page.

Don’t Give Away Your Private Keys

No staking bots that are legit will especially ask for your seed phrase or your private key.

Use Hardware Wallets

Store and stake tokens using wallets that have hardware support.

Watch Out for Scams and Phishing

Phishing bots are mostly found on Telegram and Discord. Reinforce your trail by checking user names, the spelling, and the pinned notices for the information details on the pages.

Set Up Two Factor Authentication (2FA)

Your wallet, as well as your Telegram, need to have 2FA for added security.

Review The Smart Contracts

If it’s possible to review the staking contract address, please check to confirm that the address is legitimate and that it has been audited.

Minimize The Amount Of Tokens Staked

Hold on to the proportion of the total shareholding to settle the risk of the loss of the pool.

Pros and Cons of Telegram-Based Staking Pools

| Pros | Cons |

|---|---|

| Easy to use through simple Telegram bots without complex setup | Higher risk of scams and fake staking bots |

| Instant updates and notifications directly in Telegram | Limited transparency compared to on-chain platforms |

| Community-driven engagement and quick support | Security risks if users connect wallets carelessly |

| Supports multiple tokens with flexible staking options | Often lacks detailed auditing or regulatory oversight |

| Convenient reward tracking within the Telegram interface | Withdrawal restrictions or penalties in some pools |

Future of Telegram Staking Pools

The future of Telegram staking pools is promising since more blockchain projects incorporate community features into Telegram. Due to Telegram’s popularity in the crypto community, staking bots have the potential to offer deeper automation, real-time analytics, and full wallet integrations.

With the growth of DeFi, more Telegram-based staking pools may integrate into larger ecosystems, giving users the ability to stake across multiple blockchains from one interface. Security, however, still remains the biggest obstacle, making the use of audited smart contracts and more granular verification the best option.

If optimizations like these continue, Telegram staking pools may become a mainstream tool for community engagement and passive income earning in crypto.

Conclusion

Staking tokens in staking pools based in Telegram enables the crypto users to earn income passively while they keep in touch with their preferred social groups. The staking procedure is very simple. One has to join the verified bot, deposit the tokens, choose a plan, and monitor the rewards. The whole process can be done from Telegram.

Though these pools do offer a good amount of flexibility, there are also a couple of downsides. Scams targeting Telegram users, lack of transparency, and security issues are all risks members might face.

Users have to choose the pools with the highest rewards and the strongest security to maximize benefits while minimizing risks. For clients, pools offer a good amount of convenience and social interaction, enabling investors to earn significantly on their crypto portfolios.

FAQ

What are Telegram-based staking pools?

They are crypto staking services managed through Telegram bots or groups, where users can stake tokens, earn rewards, and track performance directly inside Telegram.

Is staking on Telegram safe?

It can be safe if you use verified official bots and never share your private keys. However, scams are common, so research and caution are essential.

How do I track my rewards?

Most Telegram bots have commands like My Stakes or Earnings, allowing users to monitor staked amounts, APY, and rewards in real time.

Can I withdraw my tokens anytime?

Some pools offer flexible staking with instant withdrawals, while others have fixed lock-in periods with penalties for early exits.