In this article I will discuss the How to Trade Crypto on Margin, describing the concept, actions, tactics, risks, and suggestions for beginner traders.

Margin trading provides the opportunity to increase the expected return on investment, however the possibility of losses being incurred also increases. Be aware that this type of trading is highly risky and rewarding. Thus, knowing the basics is crucial for anyone who wants to dive into this type of trading.

What is Crypto Margin Trading?

Crypto margin trading allows participants in the market to utilize funds belonging to the exchange or broker to trading in virtual currencies, creating the opportunity to open larger positions than what is available in the account. Crypto margin trading has become a favorite in that it allows to leverage (2x, 5x, 10x, etc.) their investment.

This allows them to earn more, although losses may also be tremendous. Unlike spot trading, where you directly buy or sell an asset, margin trading requires you to keep a margin balance to not be liquidated. This type of trading is risky but can prove very profitable when approached with a proper strategy, a well-planned risk schedule, and a good approach to the market.

How to Trade Crypto on Margin

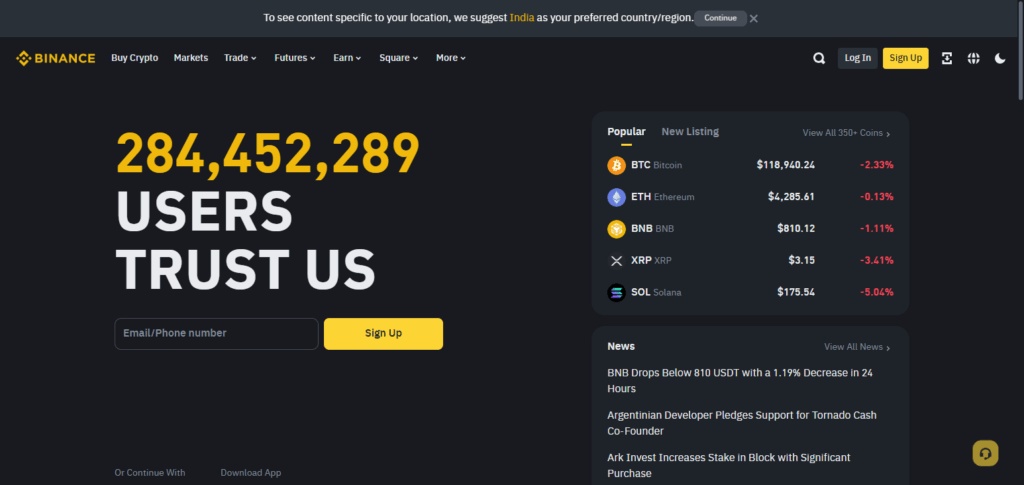

Example: How to Trade Crypto on Margin with Binance

Select a Margin Trading Platform

- Binance, Kraken, and Bybit are a few examples.

- Ensure your account has completed verification and margin trading is turned on.

Deposit Margin Funds

- Convert your 500 USDT to your margin wallet.

Fund Borrowing

- Binance has a 5x leverage limit.

- You now have a total of $2,000 of buying power after borrowing 1,500 USDT.

Execute a Trade

- Purchase one ETH at $2,000.

Track Trade Activity

- If ETH is now at $2,200, sell for that price.You’ve now earned a total of 4,600.Afterrepaying4,600.Afterrepaying1,500 with 10ininterest,yourprofitis10ininterest,yourprofitis3,100.

- Profit = 2,200−2,200−1,510 = $690

Risk Management

- If ETH price were to fall to $1,800:

- Current value of your position: $1,800.

- Outstanding debt: $1,500 + interest.

- Loss = 1,800−1,800−1,510 = $290

- Price drops a certain amount liquidation is a possibility.

How Crypto Margin Trading Works

Funding – Based on your deposited margin, the exchange will grant you additional funds and increase your margin, permitting you to trade on a larger scale.

Selecting Leverage – Based on what you want, you can select leverage of 2x; 5x; 10x, etc., to inflate the size of your position.

Position Execution – If you think prices will increase, you go long; if you expect prices to decrease, you go short.

Trade Management – Keep a close watch on profits and losses as well as the liquidation price.

Position Closing – Unused margin with profits can be kept, but losses incurred will be borne and the additional funds with interest will need to be settled.

Risks and consider

Market Volatility

The prices in the Cryptocurrency market are highly subject to sudden fluctuations.

Liquidation Risks

Your position will be forcibly closed if the funds in your margin account are lower than the maintenance margin.

Over-Leveraging

utilizes the increased risk associated with leverage making your funds highly vulnerable.

Interest Costs

Profits will be reduced as the associated interest with the amount borrowed will be charged.

Emotional Trading

Leverage encourages emotional and irrational decisions.

Common Mistakes Beginners Should Avoid

Overleveraging – Using over 20x leverage will simply destroy your account on a whim. Start off with low leverage for safety.

Ignoring Stop-Loss Orders – Not having a stop-loss will most likely lead to a trade with massive losses. Set stop-loss limits before executing a trade and you will mitigate a lot of risk.

Lack Of a Trading Plan – A trading plan or strategy acts as a safeguard to which a person can gravitate to. Failing to have one will lead to emotional decisions which can spiral out of control. Create and stick to a plan.

Chasing the Market – FOMO trading becomes a one way ticket to blowing your account. More often than not these trades lead to losses. Stop trying to chase the market and stick to your strategy instead.

Pros and Cons

| Pros | Cons |

|---|---|

| Higher Profit Potential – Leverage allows you to earn more from small price moves. | High Risk of Losses – Losses are magnified with leverage just like profits. |

| Short Selling Opportunities – You can profit when prices fall, not just rise. | Liquidation Risk – Your position can be closed automatically if the market moves against you. |

| Efficient Use of Capital – You can control larger positions with less initial investment. | Complex for Beginners – Requires strong market knowledge and risk management skills. |

Conclusion

Margin trading crypto can significantly increase potential profits, but the dangers involved are troubling. With reckless abandon, margin trading crypto can be done safely by beginners who care about their capital by using low leverage, strong risk management, and strong protections through stop-loss orders.

Minimally investing until the basic concepts, trading techniques, and key terms are mastered is a smarter and safer route. The range of tools available to margin traders can be effective, but a lack of control can decimate a trading balance due to poorly thought out decisions.

FAQ

What is crypto margin trading?

Crypto margin trading is a method of trading digital assets using borrowed funds, allowing you to open larger positions than your account balance.

Is margin trading suitable for beginners?

It’s risky for beginners due to volatility and liquidation risks. Start with low leverage and small amounts.

Can I lose more than my initial investment?

Yes, in some cases you can lose more than your deposit, especially with high leverage and extreme price moves.