In this article, I cover How To Trade Crypto Options, outlining the fundamentals, important tips, and items of interest to note in the trading process.

Regardless if you are just starting or you want to improve your skills further, this article will equip you with the necessary knowledge to comprehend the functionality of crypto options,

How to select the most suitable platform and effective trading maneuvers that shall allow you to handle the risks that come with trading in the extremely volatile crypto market.

What are Crypto Options?

Crypto options are contracts in which traders have the right, but not the obligation, to purchase or sell a cryptocurrency at a fixed price, known as the strike price, before or on a specified date.

Unlike in the buying and selling of cryptocurrencies, options trading has a level of risk which is lower as the maximum loss is only the premium paid for the option.

There are two main types: call options (betting prices will rise) and put options (betting prices will fall). There is great movement in the crypto market which allows for the implementation of different strategies with the use of crypto options.

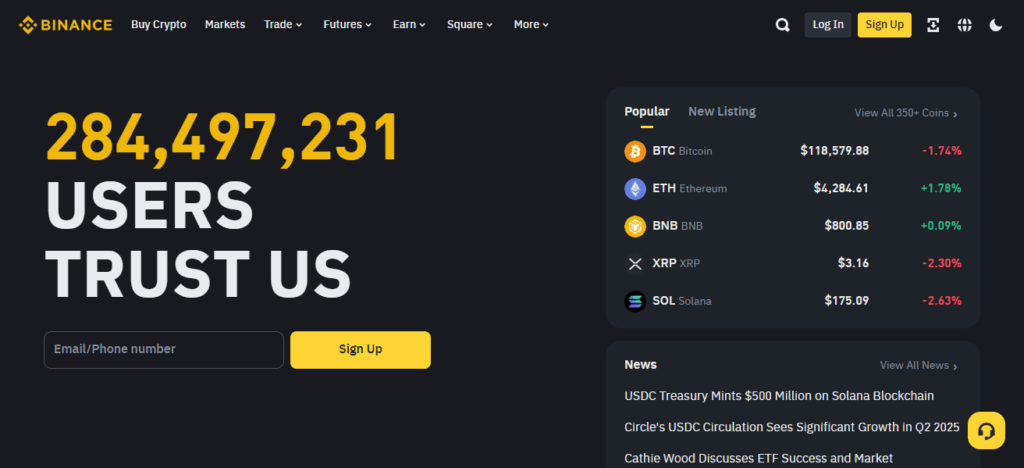

How To Trade Crypto Options With Binance Example

Step 1: Create and Verify Your Binance Account

Register on Binance and complete the identity verification to unlock all the options and features of trading on Binance.

Step 2: Fund Your Account

Transfer Bitcoin or USDT to your Binance crypto wallet for trading.

Step 3: Navigate to the Options Trading Section

Proceed to Options via Derivatives on your Binance homepage and the options trading interface will pop up where you can start trading.

Step 4: Choose Your Option Contract

Choose the base crypto for your options contract (ex. BTC). Pick either a call or put option. Set the desired strike and expiration date.

Step 5: Place Your Order

Decide on the number of contracts to purchase. Confirm the premium and place a buy or sell order as appropriate.

Step 6: Monitor and Manage Your Position

Check the option’s current valuation and decide whether to exercise, trade, or let it expire.

How Crypto Options Work

Crypto options are a form of contract that allow the buyer the right, but not the responsibility, to purchase or sell a cryptocurrency at a specific price, known as the strike price, on or before a certain date.

There are two primary categories: call options and put options. With a call option, you can purchase the cryptocurrency if its price rises, and with a put option, you can sell it if its price has fallen.

Acquiring an option entails purchasing a premium which is the price of the contract. In the scenario where the market shifts in your favor, for example, the price of crypto exceeds the strike price for a call option, you stand to buy the option for less than its value in the market.

In case the price does not favor you while exercising the option, you can choose to walk away not exercising your option and only losing the premium.

Option sellers, also known as writers, accept the risk that they might have to complete the contract if the buyer chooses to exercise it, which involves considerable risk. Traders enjoy strategic freedom while trading because they can cover their positions, speculate within a confined risk range, or earn income by collecting premiums.

Why Trade Crypto Options?

There are many reasons why trading in crypto options is advantageous for both investors and traders. Firstly, options are flexible. With different strategies, you can profit in a growing, stagnant, or declining market.

They let you hedge your crypto assets against price volatility, thereby reducing potential losses during market downturns. Additionally, options are leveraged, allowing for even greater potential profits. Furthermore, you can sell options to collect premiums, thereby generating income.

On the other hand, as with any other form of trading, there are inherent risks to be mindful of. Options trading is complicated, and if not carefully managed, can lead to losses. With crypto, options provide great tools for traders to manage risks and maximize profit potentials.

Tips for Successful Crypto Options Trading

Start Small and PracticeUtilize a demo account or a low stake to understand the use of options for trading in the market.

Understand the Basics ThoroughlyGrasp the essential concepts of strike price, expiration date, and option types to avoid trading losses.

Do Your Market ResearchMonitor the market and keep up to date with important news to make the right decisions for trading.

Use Risk Management ToolsReduce risks by applying stop-loss orders, limiting the size of positions, and spreading trades to safeguard your capital.

Choose the Right StrategyAlign your options trading strategy with your market perspective, for instance, signals from calls, puts, spreads and juxtapose with your risk intolerance.

Are crypto options legal and safe?

The legality of crypto options trading differs from country to country and so does the available trading platforms.

It is highly recommended that you use exchanges that are regulated and have passed due diligence as they comply with local financial regulations so that your money and personal information are secure.

Look up the rules that apply in your region to avoid unintentionally running into legal problems. In addition, practice good security hygiene, which includes, two-factor authentication, hardware wallets for crypto cold storage, and frequent password changes.

Being up to date with regulations and focusing on security helps to protect your assets while providing a less risky trading environment in the highly volatile crypto options trading scene.

Conclusion

In summary, trading cryptocurrency options provides a convenient method to earn money and control risk in turbulent markets.

In this form of trading, options, a simple and basic form of derivatives, can be benefitted through provided you comprehend the essentials of options trading and select a suitable trading platform.

Begin with the minimum and maintain a well-informed position, employing a systematic risk control approach to capitalize on opportunities and curtail potential losses. In crypto options trading, the key to success rests in trading responsibly.

FAQ

How do options differ from spot trading?

Options allow speculation without owning crypto and offer leverage.

What’s the difference between call and put options?

Call = right to buy; Put = right to sell.

Are crypto options risky?

Yes, risks include losing your premium and market volatility.