In this article, I will discuss the How to Trade MATIC Pairs for Day Trading. MATIC has established itself as an attractive layer-2 solution and has one of the most user-friendly ecosystems thanks to its low transaction fees.

Day traders, in particular, can capitalize on the volatility of MATIC, hence I will outline critical strategies to manage and mitigate risk, informing you of vital considerations to maximize profit potential when trading MATIC pairs.

What is MATIC ?

Polygon, previously known as MATIC, is a Layer 2 scaling solution for Ethereum that focuses on increasing transaction speed and decreasing costs.

Its goal is to increase the transaction throughput of Ethereum without compromising on security by enabling cheaper and quicker transactions. MATIC employs sidechains which execute transactions off the main Ethereum chain and then settle them later.

This is an ideal infrastructure for supporting decentralized applications (dApps), DeFi projects, and NFTs because it enhances the experience of developers and traders.

How to Trade MATIC Pairs for Day Trading

Day trading with MATIC pairs poses unique challenges, requiring a comprehensive approach towards strategy as well as risk management. Let us illustrate this using MATIC/USDT as a starting point:

Choose a Reliable Exchange

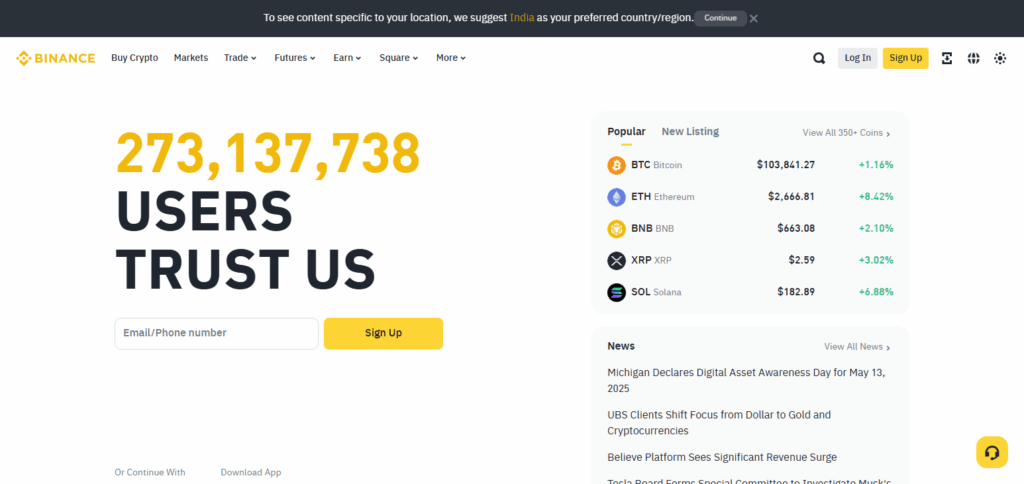

The best liquidity for MATIC/USDT trading can be found on Binance, Bybit, and Kraken.

Analyze Market Trends

Determine the psychological and technical aspects of the market with basic indicators, including RSI, MACD, and Bollinger Bands.

Set Up a Trading Plan

Outline the strategy for a trade, outlining risk tolerance, stop-loss, and target profitability.

Monitor Relevant Market Metrics

Identify areas with defined support and resistance that would indicate strong breakout or reversal expectations.

Execute Trades

For predetermined prices work with limit orders, for immediate action use market orders.

Manage Risk

Strategies should always focus on never exceeding 1-2% of the capital for the specific trade per risk, adjusting stop-loss proximity accordingly.

Review & Adjust

Trade analysis should be undertaken daily focusing on increasing strategy optimization and overall profitability.

Other Place Where to Trade MATIC Pairs for Day Trading

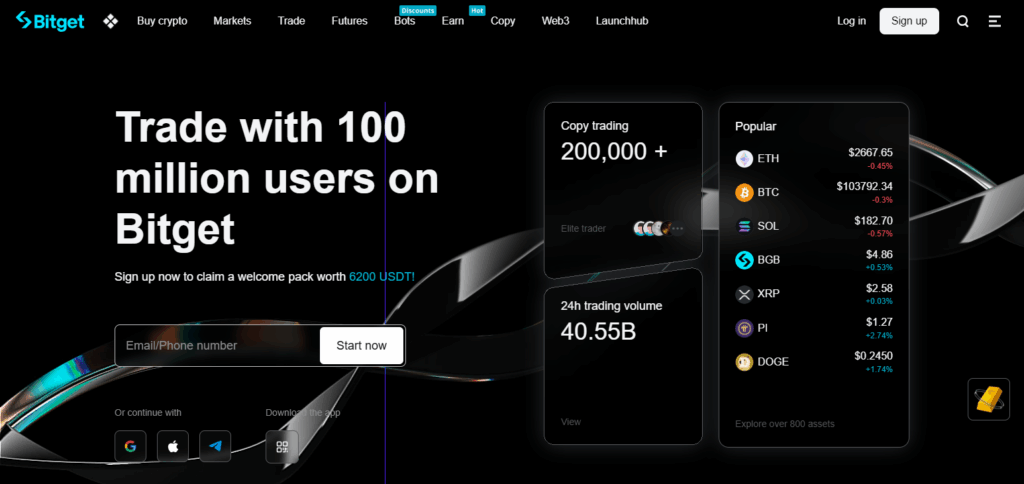

Bitget

Using Bitget for MATIC pair trading is ideal because of its high liquidity, low fees, and easy to navigate interface.

It provides high level trading features such as leverage, charting, and up to the second data streaming which day traders looking to profit on quick price movements absolutely require. Moreover, Bitget’s security and fast processing makes it reliable for MATIC pair traders to execute trades swiftly.

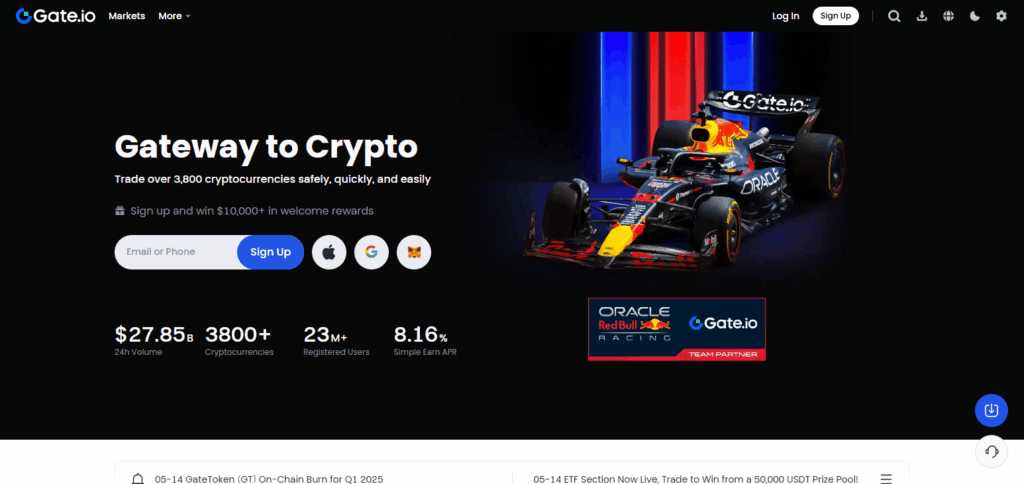

Gate.io

Gate.io stands out as an exchange for MATIC trading pairs because of its enormous array of other digital currencies and reasonably low fees. For day traders who want to leverage MATIC’s price swings, Gate.io’s advanced trading tools, including margin trading and spot markets, are useful.

Gate.io has also fast execution speeds and strong security policies in place which enable traders to make quick decisions with reduced exposure to risk.

Why Trade MATIC Pairs for Day Trading?

Ample Market Depth

MATIC pairs have active trading, ensuring sufficient liquidity for MATIC trading MATIC, with rapid entry and exit capabilities.

Profitability

If day traders hold positions for a very short period and MATIC’s price movements are volatile, this can result in significant profits.

Reduced Costs

Daily and frequent Polygon network transactions are cheaper due to its reduced fees.

Expanding Opportunities

MATIC’s wider use in DeFi, dApps, and NFTs increases the volume of trading pairs available.

Ethereum Layer

MATIC operates as an Ethereum Layer 2 solution which inherit security from Ethereum while enabling quicker transactions which inherently attracts more traders.

Risk Management in Day Trading MATIC Pairs

Determine Stop-Loss and Take-Profit Levels: Fix predetermined stop-loss cuts and profit thresholds which will limit losses for of each wagering and capturing earnings too when you hit a set target.

Weigh Position Size Correctly: Control the overexposure by managing every trade’s position and the proportion of the set sum which you are ready to lose into every wager.

Spread Portfolio Holdings: Avoid concentrating excessive funds in the MATIC pairs. Spread holdings into different classes of assets so that a bad outcome does not unduly bias the preferred outcome.

Avoid Excessive Trading: Avoid the excessive urge to trade due to anticipated profits. Follow the tactics conceived and enter the market only when necessary.

Risk Management with Risk-Reward Ratio: Make calculations to determine expected outcomes and confirm that the reward for optimal outcomes justifies the inputs or unfavorable conditions one has to satisfy in order access them.

Analyze Trends Market Movements: Absorb information about the evolvement in relations of enforceable terms and conditions, and MATIC news deemed important to relieve the surprise impact one may undesirably receive.

Control of Emotional Factors: Fix the volatile and apprehensive market mood swinging on the impulsive expenditures because attracted from high range bid.

Common Mistakes to Avoid When Trading MATIC Pairs

Overtrading

Trading on a frequent basis without defined signals can accumulate losses. It is best to stick to the strategy set and not follow every movement in prices.

Ignoring Market Trends and News

Not looking at news or events that could influence the price of MATIC or Etheream can lead to greater consequences.

Using Excessive Leverage

The possibility to make great amounts of profits with high leverage comes with increased risk of losing a significant amount of capital.

Lack of Proper Research

Making trades without having full understanding over the time inefficiency around them can lead to wrong positioned investments.

Ignoring Risk Management

Not applying any management of risks for loses by means of stop losses or wrong ratios can lead to unstable risk factors and greater loss.

Emotional Trading

Trading that is based off of irrational and impulsive decisions like greed or anger are elevated fatigue will drive make erratic trades.

Short-Term Focus

Doing everything possible to achieve quick wins eliminates detection of long trends that would otherwise benefit their approach. Balancing day trades with multiple market outlooks improves effectiveness.

Pros & Cons

| Pros | Cons |

|---|---|

| High Liquidity: Easy to enter and exit trades due to active market. | Volatility: High price fluctuations can lead to significant losses. |

| Low Transaction Fees: Reduced fees compared to Ethereum, making frequent trading more affordable. | Requires Expertise: Successful day trading demands a good understanding of market trends and technical analysis. |

| Scalability: Polygon’s ability to handle many transactions enhances trading efficiency. | Market Sentiment: MATIC’s price can be heavily influenced by external market news and trends. |

| Growing Ecosystem: Increasing adoption in DeFi, NFTs, and dApps offers more trading opportunities. | Risk of Overtrading: Traders may feel tempted to trade excessively due to MATIC’s price volatility. |

| Ethereum Compatibility: Benefits from Ethereum’s security while offering faster transactions. | Short-Term Focus: Day trading can result in missed long-term growth opportunities in MATIC. |

Conclusion

As a summary, we’ve covered the MATIC pairs day trading, strategies, risk control, and traps to watch for. With its rising ecosystem and low costs, MATIC provides sufficient opportunities for day traders seeking to exploit short-term price fluctuations.

However, attaining this goal necessitates discipline, extensive research, and proper risk management. With adequate preparation and strategies centered around information, traders can harness the volatility of MATIC pairs to their advantage, thereby improving their daytime trading experience.