In this article, I will discuss the How to Unwrap Tokens for Bridging. Unwrapping is an important action for cross-chain transfers because it involves changing wrapped assets to their original native form.

This procedure transforms the asset to make it suitable for different blockchains, minimizes costs, and increases liquidity. Knowing how to unwrap tokens in a safe and efficient way is important for proper and secure bridging transactions.

What is Unwrap Tokens?

Unwrapping a token involves the process of turning a wrapped token like WETH or WBTC into it’s original form.

Wrapped tokens are simpler to use than their native forms for the purposes of Cross-chain or DeFi activities.

The process of unwrapping involves using the 1:1 ratio of exchanged token to underlying asset.

This process becomes crucial when migrating tokens to their native blockchain and forfee reduction as well as compatibility with blockchain that do not support their native tokens.

How to Unwrap Tokens for Bridging

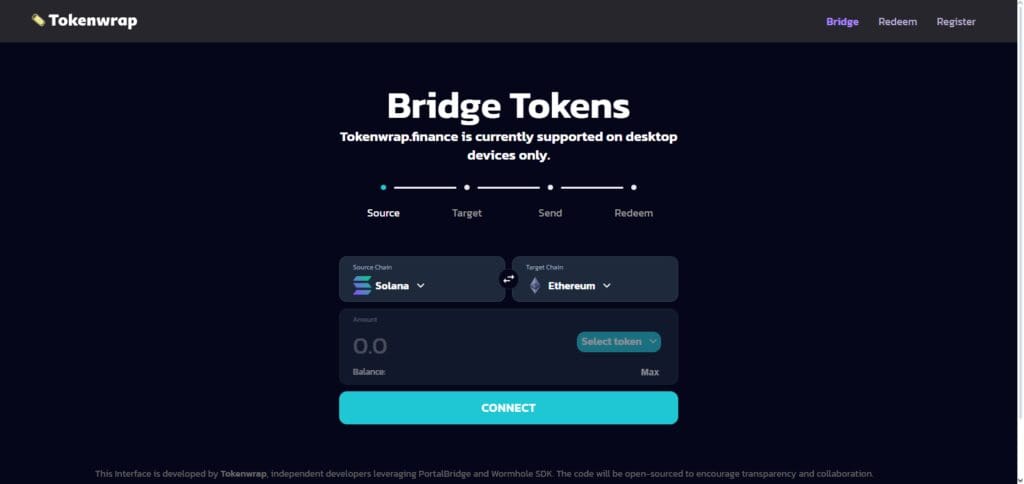

For explaining how to unwrap tokens for bridging purposes, let’s use Tokenwrap as the example platform. Tokenwrap is an innovative decentralized platform for cross-chain liquidity.

Process of Unwrapping Tokens using Tokenwrap

Login to the Platform

Go over to the Tokenwrap platform, and connect your wallet of choice be it MetaMask or any other compatible wallet.

Pick a Wrapped Token

Pick wrapped token that you would like to unwrap, tokens include wETH, wBTC, or wSOL.

Make Unwrap Request

Set the quantity of unwrapped tokens that you want to unwrap.

Review transaction details including confirming the destination blockchain.

Burn the Wrapped Token

Wrapped token on the current blockchain will get burned meaning it will no longer exist on that chain.

Releasing the Original Token

The specified amount of the original token is released from the smart contract and transferred to your wallet.

Confirm Transaction

Using a blockchain explorer, traced the transaction and confirm the original token has been transferred successfully to your wallet.

Other place where Unwrap Tokens for Bridging

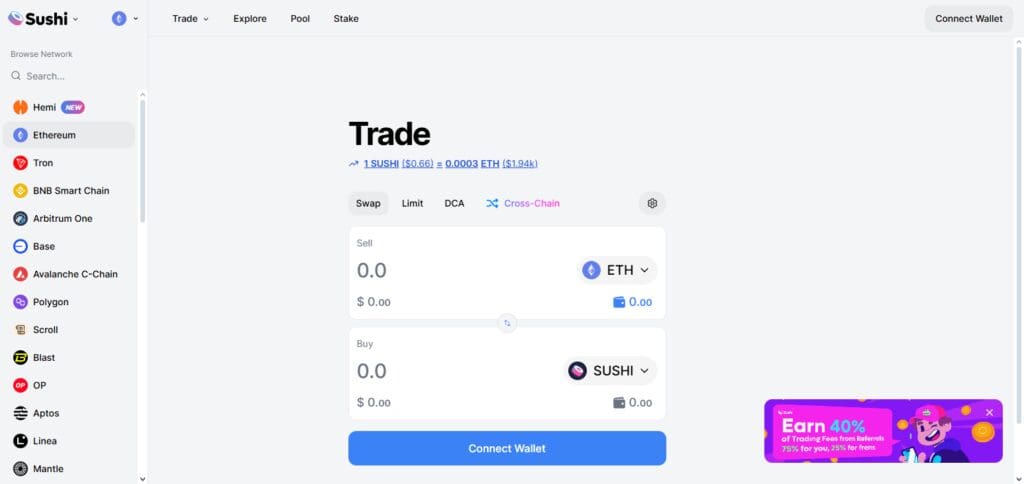

SushiSwap

SushiSwap is one of the most popular decentralized exchanges (DEXs) due to its simple interface and multi-chain support. It offers an exceptional way to unwrap tokens in preparation for bridging.

SushiSwap has low fees and supports many networks, enabling users to swap tokens efficiently.

The platform also seamlessly allows users to unwrap wrapped tokens and powerfully supports cross-chain transfers which makes it a reliable option for unwrapping tokens before bridging them across chains.

Curve Finance

Curve Finance is an market maker (AMM) style decentralized exchange (DEX) that offers an array of services including low-slippage stablecoin and token swaps.

This makes it a suitable candidate for unwrapping tokens prior to bridging. It allows users to wrap and unwrap their native assets and supports their liquidity pools allowing cross-chain token swaps.

Deep liquidity, low fees, and support for multiple networks makes Curve Finance a reliable choice for unwrapping that ensures and smoother, cost effective bridging transactions.

1inch

1inch is a sophisticated DEX aggregator whose core function is token unwrapping for bridging, which is done at the best rates available.

Users benefit from sophisticated smart routing technology that guarantees the most optimal unwrapping process.

1inch also enables the effortless conversion of wrapped tokens to their native counterparts, in preparation for cross-chain bridging. The process is effective due to low slippage and transaction fees combined with support of multiple blockchains.

Why Unwrap Tokens for Bridging?

Used Native Tokens of the Platform

Certain platforms and bridges only work with their specified native tokens, so wrapping is done to ensure successful transfers.

Gas Fees are Cheaper

Compared to wrapped tokens, gas fees on native tokens are normally lower.

Liquidity Increase

Many platforms accepting unwrapped tokens mean increased options for staking and trading.

Security Evaporation

Native tokens decrease the chances of encountering issues arising from failed compatibility or cross-chain errors.

Quicker Confirmation

On some networks, there is the possibility for faster transaction confirmations through the use of native tokens.

Tips for Safe and Efficient Bridging

Check Network Integration

Make sure the bridge is compatible with the source and target blockchains.

Review fees and slippage

Edit transaction fees and possible slippage for any unwanted financial outcomes.

Prefer Doubly-Checked Bridges

Use only well known audited bridges to avoid being scammed or losing funds.

Track gas prices

Use the bridge at low gas fee times.

Check token addresses again

Ensure the exact token being bridged is the intended token.

Make a small first transfer

To be more secure, begin with a smaller transfer before expanding.

Conclusion

In conclusion, changing back tokens for bridging is an integral part for effortless cross-chain transfers.

Getting access to lower fees, better liquidity, and high platform compatibility becomes possible when converted wrapped tokens are changed back to their native form.

Following thorough and secure unwrapping steps makes sure your tokens are primed for efficient bridging.

To avoid mistakes, always use trusted platforms, check network compatability, and keep an eye on transaction fees. By taking these steps, your tokens can be unwrapped and bridged, and cross-chain opportunities can be fully utilized.