In this essay, I will explore how token listings are priced on major crypto exchanges, addressing the primary elements that influence listing costs, including exchange reputation, project credibility, regulatory compliance, and market demand.

You’ll learn how pricing models operate, what hidden expenses to anticipate, and how cryptocurrency ventures can better position themselves for a profitable exchange listing.

What is Crypto Exchanges?

Crypto exchanges are platforms that either allow you to purchase/store cryptocurrencies or that allow you to trade crypto with other users. They act as marketplaces either through order books or liquidity providing systems through automation.

Exchanges offer services such as trading pairs, storage wallets, market analytics, two-factor authentication, and cold storage. There are two types of crypto exchanges; Decentralized exchanges (DEX) operate on blockchain and do not require a middle man for trading.

These are typically anonymous and do not require verification to trade. Centralized exchanges (CEX) have user verification, and are run by a company. These are the more friendly user and popular method for trade.

How Token Listings Are Priced on Major Crypto Exchanges

Example: Step by Step Process for Pricing Token Listings on a Major Crypto Exchange

Step 1: Submission of Project Application

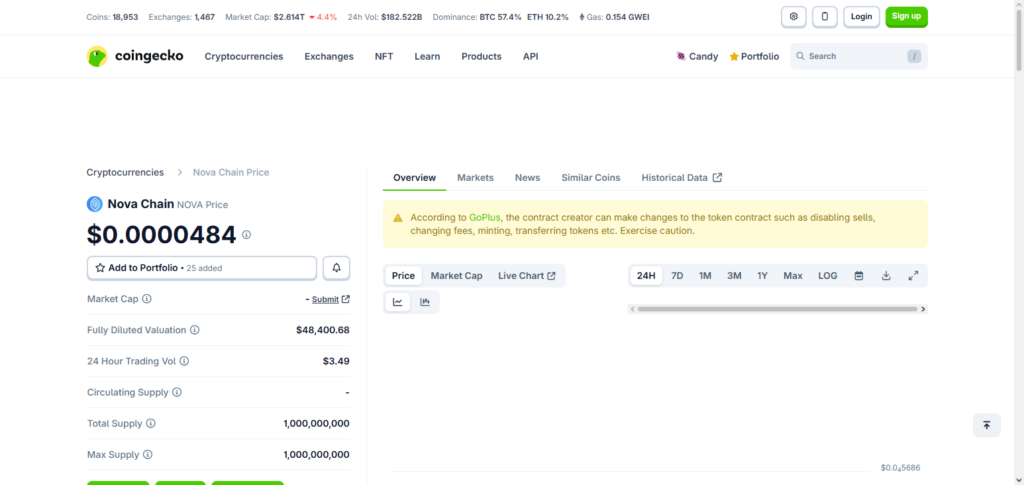

An example token project “NovaChain (NOVA)” submitts a listing application for a major exchange such as Binance, Coinbase, or OKX. Included in the submission are the project’s whitepaper, tokenomics, team info, details on the legal structure, and other compliance paperwork.

Step 2: Exchange’s Preliminary Review

As part of the preliminary review, exchanges analyze legitimacy of the project, use case, market opportunity, demand, and other factors related to the potential risk associated with the project. If a project fails the preliminary review, the project is rejected with no further opportunity to review pricing.

Step 3: Dual Track’s Legal & Technical DD

The technical team from the exchange reviews the project’s smart contract, confirms the blockchain and wallet integration is secure, etc. The legal team will review compliance for KYC/AML, for the laws of the jurisdiction, and what type of token it is (utility token, securty token, etc.).

Step 4: Exchange Risk and Value Scoring of the Token

Each exchange has their own proprietary methodology to determine an overall score for risk and value of an exchange based on the potential liquidity, potential trading volume, brand value, and regulated risk of the token. The valued score is the most significant driver in determining the range of the token listing fee.

Step 5: Pricing Proposal from the Exchange

After the Exchange completes its assessment, the Exchange proposes a listing package. For example, NOVA will get a quote for the listing fee of around $200,000–$500,000, depending on the inclusion of packages such as marketing, featured placement, and liquidity support.

Step 6: Negotiation and Package Selection

The project negotiates the terms of the listing fee. If NOVA is perceived as having a powerful community or holds strong strategic value, the Exchange will most likely adjust the fee downwards or even accept a portion of the payment in tokens rather than cash.

Step 7: Payment and Agreement Signing

Once the terms and conditions are finalized, the project is then required to sign a listing agreement and remit payment for the listing fee. This listing agreement contains a good number of legal disclaimers, conditions on delisting, and compliance terms and conditions.

Step 8: Technical Integration and Testing

The Exchange then incorporates the Project’s token into their systems, creating and configuring wallets, and then proceed to perform tests on deposits and withdrawals. Lastly, the Exchange will create and configure the trading pairs such as NOVA/USDT and NOVA/BTC.

Step 9: Marketing and Announcement Phase

If marketing is included in the listing package, the Exchange will initiate banners and advertisements as well as other social media platforms and email marketing to boost trading volume during the initial start of the listing.

Step 10: Official Listing and Monitoring

Trading of the token will then officially go live. The Exchange will actively check and assess liquidity and trade volumes to ensure compliance. If rules are broken or volume dies out, the token will receive listing warnings or the token may even get delisted.

Factors Affecting Token Listing Prices

Reputation and Tier of the Exchange: The biggest tier 1 exchanges with the most volume, security, and worldwide reach charge the most because they provide the best liquidity and brand name.

Credibility of the Project & History of the Team: Lowering the perceived risk with a strong, proven, and transparent leadership history can lower costs for a token listing.

Tokenomics & Usefulness: Tokens that are useful and have a good supply, great model, and strong value proposition can attract more positive attention resulting in better pricing.

Supply of the Market and Size of the Community: Strong social activity and large members of a community can provide listing services and lower costs to a token listing for a supply of volume to trade.

Legal and Regulatory Compliance: Projects for multiple jurisdictions are charged more due to the legal complications that can arise with risk management and compliance reviews.

Potential for Liquidity: The ability for a trade to happen with great volume and deep a order book can impact price for a listing.

Packages for Marketing & Promotion: Bundled with a premium package, featured listings, home page sponsorships, email blasts, and launch promotions, prices can sky rocket for a listing.

Operational Challenges: Building operational processes for an exchange can be costly if the support of custom blockchains, smart contract audits and wallets is required.

Fee Model: The payment of fees in cash, native tokens, or a combination of both can influence price and negotiation conditions.

Market and Jurisdictional Specifications: Pending listings to regulated jurisdictions, like the US or the EU, bring additional compliance costs, hence influencing the pricing.

Typical Pricing Models for Token Listings

Fixed Fee Model

The listing project pays a single initial listing fee. This is common with large centralized exchanges and usually incorporates some basic technical setup and standard assistance.

Revenue Share Model

The exchange takes a cut from trading fees or token distribution over a defined period, based on a token’s performance and volume instead of a large initial fee.

Hybrid Model

In this case, the exchange takes some upfront fee, and then there is a revenue share or a token ownership split. This tends to optimize the risk for both the exchange and the project.

Token Payment Model

The exchange takes some or all of the listing fee in the project\’s native tokens, usually with some locking or vesting stipulations.

Marketing Model

The base listing is offered at little or no charge, but listings come with add-ons that are priced to provide additional visibility, promotions, and featured slots.

Performance Model

There is no initial fee, but in exchange the project must meet post-listing liquidity, trading volume, or active user targets to avoid additional fees.

Free or Community Driven Listings (DEX Model)

With liquidity provision and transaction fees as the only costs, decentralized exchanges allow projects to list themselves for no charge, even though they can be considered as minimally contributing an initial liquidity themselves.

Why do top-tier exchanges charge higher fees?

Extensive Global Reach and Userbase: Global top-tier exchanges can provide access to millions and millions of active users and traders. This instant access can help to increase the visibility and demand for a token.

Greater Trading Volume and Liquidity: These exchanges can create an even more beneficial market condition for a token, because they can provide improved order books and better price discovery.

Brand Credibility and Reputation: This is the most essential reason why projects see the most credibility and investor interest – well-known exchanges create a greater proof of legitimacy for the listed projects.

Heightened Security Standards: User funds and digital assets (tokens) are protected using cold wallets, firewalls, and other protective measures.

Additional Compliance Cost on Regulation: The more regulatory compliance a project implements, the more it costs. Protocols like KYC and AML are justified for the additional cost, however, the price of compliance is also a concern of top-tier exchanges.

Costly Marketing and Promotions Services: These features and services are not always available on exchanges, but promotional marketing services can sometimes be included in advertising services and have a cost. These services promote the product in feature slots on the website, and can even promote it on social media.

Significant Technical Setup Services: Individual exchanges offer different wallets and APIs and provide ongoing support for trading, which adds to the costs of the service.

Market Abuse Prevention: Risk and operational costs are evaluated in the surveillance of market abuse. Ongoing checks for improper market activity, such as manipulation and wash trading, are included in these costs.

Tips for Projects Considering a Listing

Check the exchanges reputation

Make sure the exchange is aligned to your projects goals. Look at trading volume, safety, users, past delistings, etc.

Have strong documents ready

Documentation is critical for exchanges. If whitepapers are clear, tokenomics sound, smart contracts are audited, and the legal opinion is clear, the exchange will be able to move faster.

Invest in your community

A strong, vibrant community is key to driving up demand for the token and is invaluable in driving favorable terms for the token to be listed at the exchange.

Know the Total Costs

List fees are only the start. Marketing, legal, compliances, liqidity, and maintenance are all costs that will be incurred.

Listing Negotiation Packages

Don’t take the first offer for listing. Look for falling prices, token payments, and marketing payments for the first set of tokens.

Pre-allocate trading liquidity

Make sure your trading environment has plenty of value in it. Allot tokens for trading, or value in order to create trading.

Handle the legal stuff

There will be a lot of legal jargon and country mandated actions that will require delaying the listing. KYC and AML are the primary things to be done.

Define your goals

Before going to a larger trading venue, ensure you are focused on the goals. There will be a lot of volume, a lot of users, and a lot of uses for the token.

Evaluate Other Possibilities

Look into DEXs, regional exchanges, or launchpads as potentially lower cost or strategically more appropriate initial steps.

Future Trends in Token Listing Pricing

The future of token listing pricing will include more transparency, performance-based pricing, and innovative partnership models. Given the regulatory scrutiny, we can expect exchanges to offer a more compliance cost and a clearer breakdown of marketing and promotional spend.

We anticipate more projects paying a lower initial cost and more equity or token compensation and/or revenue share models based on trading volume and liquidity, coupled with revenue share models.

More decentralized exchanges and on-chain launch pads will also continue to push centralized exchanges to improve listing offers to be more competitive and provide long-term value to clients instead of charging a one-off listing fee.

Pros & Cons

| Pros | Cons |

|---|---|

| High visibility and global exposure on major exchanges | Listing fees can be very expensive for early-stage projects |

| Increased liquidity and trading volume | No guarantee of long-term trading activity after listing |

| Builds credibility and trust with investors | Strict compliance and legal requirements |

| Access to professional marketing and promotional support | Additional hidden costs (market-making, PR, audits, legal fees) |

| Technical integration and security support from exchanges | Risk of delisting if volume or compliance standards are not met |

| Potential partnerships and ecosystem growth | Negotiation process can be time-consuming and complex |

Conclusion

In conclusion, a number of factors, including exchange reputation, project legitimacy, regulatory requirements, and the degree of marketing and technical assistance provided in the listing package, influence token listing pricing on major cryptocurrency exchanges.

Most exchanges employ flexible pricing structures that take into account a project’s risk profile, market demand, and long-term value to the platform rather than a straightforward flat cost.

Understanding these elements, creating solid documentation, and carefully negotiating agreements can greatly lower expenses and increase the likelihood of a profitable, long-lasting market launch for cryptocurrency projects.

FAQ

How much do major crypto exchanges charge to list a token?

Listing fees can range from a few thousand dollars on smaller exchanges to hundreds of thousands of dollars on top-tier platforms. The final price depends on the exchange’s reputation, the project’s credibility, and the services included, such as marketing and liquidity support.

Are token listing fees negotiable?

Yes, many exchanges allow negotiation. Projects with strong communities, proven technology, or high trading potential can often secure discounts or alternative payment options.

Do all exchanges require an upfront listing fee?

No. Some decentralized exchanges and smaller centralized platforms offer free listings, but projects may still need to cover liquidity provision, marketing, or technical integration costs.

Can exchanges accept payment in the project’s native token?

Some exchanges allow partial or full payment in native tokens, often with lock-up or vesting conditions to reduce risk and align long-term incentives.

Why do top-tier exchanges charge higher fees?

Top exchanges provide higher liquidity, stronger security, global exposure, and a larger user base, which increases a token’s visibility and potential trading volume.