In this article, I will discuss Is Bitget Legal in India and whether Indian users can trade on the platform safely.

Cryptocurrency regulations in India remain unclear, and Bitget, a global exchange, operates without official registration in the country. I will explore its legal status, risks, and what Indian traders should consider before using Bitget.

About Bitget

Bitget was launched during tough times, but they greatly value unceasing effort. This founding team existed in traditional finance and first examined blockchain back in 2015 while a lot of people assumed it to be a bubble.

After spending time studying Bitcoin and Ethereum, in 2018, they understood that cryptocurrency has the power to transform finance for the unbanked population.

While many left, Bitget focused on user requirements and product development, aiming at sustainable growth that didn’t follow the market trends. Founded in a bear market, the company is constantly looking to make crypto trading easier and more approachable, step by step, while improving trading experiences for everyone.

Is Bitget Legal In India

Bitget does not have an official registration in India, but Indian users can still access their services. Trading in cryptocurrencies is not banned, however, India does not have set regulations for foreign exchanges like Bitget.

It is important for users to be mindful of potential risks such as change in governance, and the tax consequences of their actions.

Compliance to the dealings in cryptocurrency has been made strict by the Indian government, hence traders have the responsibility to be careful and informed on the changing legal boundaries concerning Bitget.

Can Indians Use Bitget?

Yes, Indians can use Bitget, but with certain considerations. Bitget is not officially registered in India, yet it remains accessible to Indian users. While cryptocurrency trading is not illegal, the Indian government has imposed strict tax policies and compliance requirements.

Users may face challenges related to banking restrictions, KYC verification, and potential regulatory changes. It’s essential for Indian traders to stay informed about evolving laws and use Bitget cautiously.

Alternatives Bitget

CoinDCX

CoinDCX is one of the leading Indian cryptocurrency exchanges, known for its security and user-friendly interface. Traders can deposit through UPI payments and bank transfers, simultaneously gaining access to spot and futures trading.

Due to its renowned strong compliance with Indian regulations, CoinDCX is able to provide high security and seamless transactions, making it the go-to platform for Indian traders looking to venture to the globally changing world of crypto.

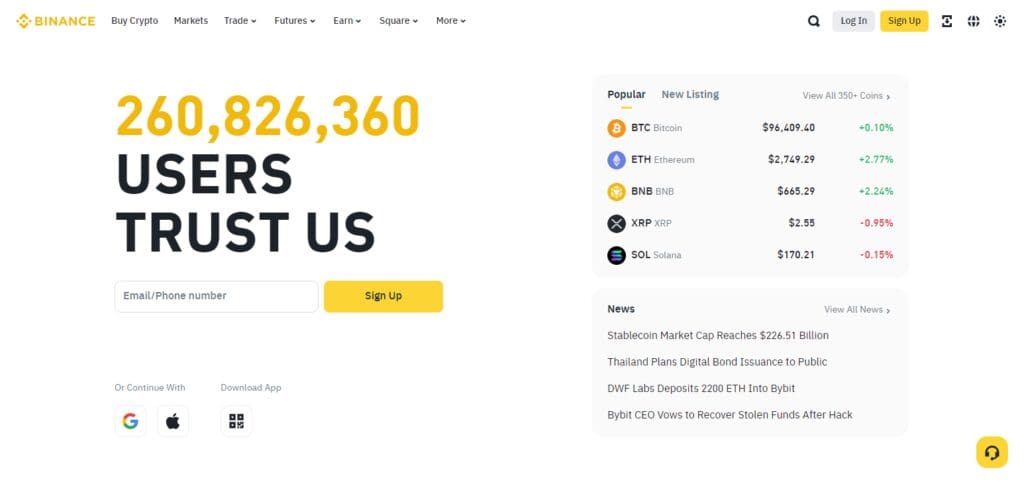

Binance

Binance is one of the biggest crypto trading platforms internationally. It is famous for its large trading volumes, affordable charges, and extensive variety of cryptocurrencies sold on the platform. Indian users can access Binance through INR deposits using P2P trading.

Even though Binance is not formally registered in India, it still remains a popular option because of it’s Indian features, security services, and infrastructure. But users need to be careful because of uncertain rules and restrictions.

KuCoin

KuCoin is an exchange that works globally and is known in the crypto world for its unique comprehensive range of supported currencies and advanced trading options . Indian users are able to trade through P2P for INR transactions without compulsory KYC for basic access.

While not registered in India, it can still be accessed. KuCoin offers other services, like spot and futures trading, as well as staking, but it is advisable to watch carefully for foreign exchange regulations that might come into force.

Pros And Cons Bitget

| Pros | Cons |

|---|---|

| User-Friendly Interface – Easy to navigate for beginners and advanced traders. | Not Registered in India – Operates without official regulatory approval in India. |

| Copy Trading Feature – Allows users to follow expert traders. | Regulatory Risks – Potential restrictions or bans in the future. |

| Low Trading Fees – Competitive fee structure compared to other exchanges. | Limited INR Support – No direct INR deposits; relies on P2P or crypto transfers. |

| High Liquidity – Supports large trade volumes with minimal slippage. | Withdrawal Restrictions – May face banking limitations for Indian users. |

| Strong Security Measures – Two-factor authentication (2FA) and cold storage for funds. | Limited Customer Support – Users report slow response times. |

| Futures and Spot Trading – Offers leverage trading and a variety of trading options. | Tax Compliance Issues – Indian users must manually report crypto taxes. |

| Mobile App Availability – Supports iOS and Android for trading on the go. | Occasional System Maintenance – Temporary downtime can disrupt trading. |

| Global Availability – Accessible in multiple countries, including India. | Learning Curve – Some features may be complex for beginners. |

| Innovative Features – Offers staking, DeFi, and yield farming options. | P2P Trading Risks – Users must be cautious of potential scams. |

Conclusion

In conclusion, Bitget’s official crypto exchange registration does not impact its users in India, as it is still accessible to them. India does not deem crypto trading as illegal, however there are no set laws surrounding foreign exchanges.

Users must be ready to embrace certain risks including regulations, taxes, and even banking limits. Given the constantly changing laws, utmost caution needs to be taken, even more so with Bitget.