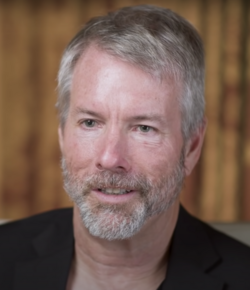

MicroStrategy’s Michael Saylor has diversified his Bitcoin Strategy, expanding his positions during what many analysts consider a tough period in which to make purchases. His MSTR stock has jumped, and Bitcoin has sharply reversed from earlier weakness to a strong uptrend, a positive development that has contributed to MicroStrategy’s stock outperformance.

MicroStrategy disclosed in an SEC filing that it purchased 10,624 BTC for an average price of $90,615 during the week. For that price, Saylor’s company purchased $962.7 million worth of Bitcoin, resulting in a YTD BTC yield of 24.7 percent.

MicroStrategy now holds 660,624 BTC that it purchased for an average price of $74,696 or $49.35 billion in total, further entrenching MicroStrategy’s dominance as the premier institutional owner of Bitcoin.

MicroStrategy has reported that the transaction was financed by equity sales. It sold $34.9 million of STRD stock and $928.1 million of MSTR stock. Since MicroStrategy has financed the transaction in this manner, it has done so without dipping into its Bitcoin reserves.

Saylor hinted the purchase was coming when he tweeted, “₿ack to Orange Dots?” to signal Saylor was once again burning the dollar to purchase more Bitcoin.

Scenario analysis indicated that Strategy would eventually need to sell their Bitcoin due to the mNAV and dividend obligations. Phong Le previously indicated the selling would need to happen when the firm has mNAV less than 1x.

With the new reserve Strategy built, Le indicated, should cover mDiv. Strategy built a $1.44 billion USD reserve which Le clarified should cover approximately 21 months of dividend and interest payments. With that buffer, Strategy expects not to need to sell any of their BTC for 3 years, and likely, to expand that buffer.

The purchase comes with Bitcoin’s recent price surge after surpassing the $90,000 price level. Strategy’s confidence seems to be well placed given BTC has been up, which has also been positive for their stock. Yahoo Finance has MSTR at $182, up from a $178 close last week, which means the stock is up 2% for the week.

Industry personalities have responded positively to this acquisition. One of them is *Anthony Scaramucci* who helped to establish SkyBridge and who pointed out this specific quality of Saylor to be extremely brilliant.

Scaramucci pointed out that Strategy first constructed a USD backstop and then went to the equity sell but to buy additional Bitcoin and he deemed that to be accretive in gaining and supportive of the Bitcoin market.

This is the most recent one being in Strategy’s most substantial acquisitions this year. The previous one being *836 million dollar buy made just three weeks prior*. The corporation’s most substantial purchase in 2025 is the *21,021 BTC obtained in July for 2.46 billion dollars*, this BTC purchase was financed from the firm’s STRC which was one of the largest IPOs in the year.