Bitget has publicised a decisive reorientation that places its proprietary utility token, BGB, centrally within the emerging Morph Chain environment. In a concurrent affirmation, the exchange clarified that BGB is designated as the gas and governance token for Morph Chain, a Layer 2 architecture devoted to payments and on-chain consumer finance.

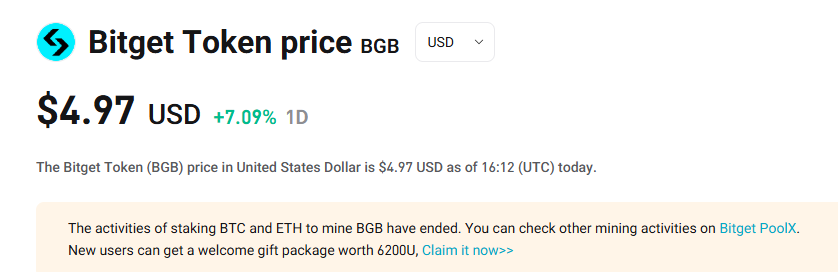

The announcement elicited an immediate upward price adjustment, with BGB appreciating by over 10%, a shift indicative of robust investor sentiment toward the strategic alignment.

To implement the migration, Bitget is transferring 440 million BGB to the Morph Foundation. A supplementary notice confirmed that 50% of the transferred volume, with a valuation approaching \$1 billion, is to be permanently burned.

This definitive action decreases the nominal supply of BGB and is intended to heighten the token’s scarcity, potentially enhancing its sustained price valuation. The residual 220 million BGB is to be effectively locked and incrementally released over a 50-month cadence, thereby securing liquidity, undergirding ecosystem expansion and iteratively delivering new utility layers.

The reconfiguration broadens BGB’s operational footprint beyond the Bitget centralized exchange environment, permitting adoption across decentralised exchange venues, Morph’s settlement stratum and the associated consumer-facing payments architecture.

The exchange’s material derivatives volume, recorded at a half-trillion US dollars per calendar month, reaffirms its capability to engender large-scale uptake across the Web3 ecosystem.

Bitget’s BGB token is set to establish its definitive on-chain residence within the Morph chain, anchoring its role within a highly scalable settlement network anticipated to engage more than 120 million end-users. Simultaneously, core components of the Bitget platform—alongside the Bitget Wallet—will be seamlessly woven into Morph, yielding a single, cohesive environment for value exchange, asset trading, and a comprehensive suite of network services.

Within this framework, BGB will serve a dual capacity, functioning as both the token of record for transaction costs and the mechanism for governance, thereby guiding network decisions.

Together with a basket of stablecoins, BGB will underwrite settlement and PayFi operations, all under the governance of the Morph Foundation, which will manage ongoing token emissions and initiate periodic buy-back reductions aimed at capping circulating supply at 100 million units.

Industry executives have underscored the landmark character of the initiative. Gracy Chen, Chief Executive of Bitget, qualified the migration as a definitive evolution of BGB, substantially extending its applicability into the realm of on-chain consumer financing.

Morph’s Chief Executive Colin Goltra reiterated that the protocol designation cements Morph’s role as the token’s official on-chain domicile, while framing the advance as a vital milestone along the trajectory of constructing a superior, globally interoperable ecosystem.

Both leaders have characterized the alliance as a deliberate equilibrium of operational scale and aspirational vision, thereby positioning BGB as the primary currency for Web3-based payment activity.

The recent decision has already exerted a measurable influence on BGB’s trading activity. According to TradingView, BGB is presently quoted at \$5.06, reflecting a daily increase of 8.66%. The token briefly exceeded \$5.30 before a shallow correction, a level surpassed on a closing-price basis on two trading occasions.

A broader examination reveals a 13% weekly advance and a 19% appreciation since the end of the prior month. The durability of the current upward trend is interpreted as investor conviction that integration across the Morph ecosystem will sustain elevated volumes and, consequently, persistent value appreciation.

Conclusion

In summary, Bitget’s establishment of BGB as the native gas and governance token of the Morph Chain constitutes a critical inflection point for the asset and the broader ecosystem.

The purposeful delegation of 440 million BGB—with a commitment to burn fifty per cent—shrinks the circulating supply, enhances the token’s scarcity profile, and entrench BGB as the preferred medium for transaction fees, smart contract execution, and decentralized governance.

By deploying the token within Morph’s Layer 2 architecture and bridging to Bitget’s comprehensive trading ecosystem, the mandate accelerates migration beyond centralized exchanges, thereby facilitating Web3-wide utility.

Peer evaluations acknowledge that the transaction judiciously reconciles operational scale with strategic vision, designating Morph Chain as the definitive on-chain domicile for the asset.

The subsequent, pronounced, and sustained price appreciation validates the market’s anticipatory appraisal of the transaction and affirms BGB’s prominence within the evolving architecture of on-chain consumer finance.