In this article , I will discuss the Multi-chain DeFi Gems, highlighting some great decentralized finance projects on various blockchains.

These gems have the capability to change the whole DeFi ecosystem for the better by offering more financial services through improved interoperability, liquidity, and wider access to services.

Be it an investor or a DeFi admirer, knowing these multi-chain projects have the potential to shine light on the advancement of DeFi.

Introduction Multi-Chain DeFi

The world of decentralized finance relies on Multi-Chain DeFi as a critical component. Multi-Chain DeFi can be defined as the operationalization of decentralized finance applications in different blockchain networks.

This approach attempts to address the problems associated with single-chain DeFi platforms by facilitating cross-chain transactions, improving liquidity, and enabling users to access a wide variety of services.

With Multi-Chain DeFi, Blockchain diversity is appreciated, which enhances interoperability, scalability, and innovation in the decentralized finance world.

How to Find Multi-Chain DeFi Gems?

Search For New Or Popular Defi Projects

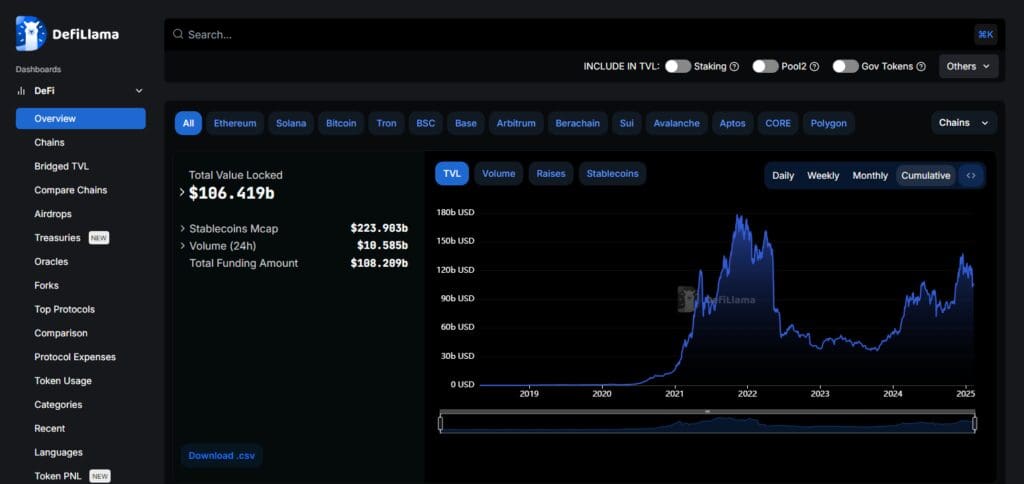

Head on over to DefiLlama and browse through “Chains” and “Projects” sections. Use the filter “New” or “Trending” to find up and coming DeFi protocols.

Examine the Growth of Their TVL Rate Over Time

Search for projects that show a pattern of growth in the TVL over time. Look at TVL per chain to look for growing ecosystems scattered around different chains.

Look For Yield Opportunities

Get high APY pools from DefiLlama’s “Yields” section. Ensure that the liquidity depth, risk factors, and sustainability all check out.

Watch Over Cross Chain Bridges

Follow liquidity within chains. Look for growing ecosystems that are supporting new DeFi protocols.

Look For Information On the Project

Select a particular protocol to see which chains it has deployed on. Remember to check the audits and team transparency as well as tokenomics of the project before you invest.

Evaluating Project Security & Risks

Your project’s risks and security challenges are fundamental to the management process as much as the individual components of the project. Pay attention to the following steps-

Identifying Assets: Outline all Crucial aspects, including systems, hardware, applications, and data associated with your project.

Identifying Threats And Vulnerabilities: Analyze your project to determine prospective threats as well as pinpoint security lapses.

Assess Risks: Realistically examine each risk, estimating the possibility of its impact along with a quick overview on its importance. Rank any obstacles regarding its set goals and purpose in relation to then prerequisites.

Develop Mitigation Strategies: Highlight an approach for managing the identified risk. These can include employing security controls, employee training, or even drafting an outline for contingency plans.

Monitor and Review: As new risks come up, keep scanning the scope of the project and measure how efficient the approaches to mitigate the risks are. As needed, enhance control to avoid security hazards.

Staying Updated with the Multi-Chain DeFi Space

To stay updated with the Multi-Chain DeFi realm, these tips should help:

Follow Industry News: Ensure that platforms such as The Block and Nextrope are consulted for any new articles or pieces, as these sites offer advanced information about the space.

Join DeFi Communities: Look for specific interest groups on Twitter, Reddit or Telegram. There are many influencers and members within the community who frequently post valuable information.

Use Analytics Tools: Platforms such as DeFi Pulse, DappRadar, and CoinGecko allow for the tracking of the popularity of various DeFi innovations across several blockchains.

Participate in Forums and Discussions: Websites and applications such as GitHub have many forums and discussion boards meant for sharing ideas, so work with those to learn more about important developments in the field.

Subscribe to Newsletters: Make your life easier by subscribing to newsletters from renowned platforms and prominent personalities in the DeFi community and take advantage of the updates sent straight to you.

Pros & Cons Of Multi-Chain DeFi Gems

✅ Pros

Higher Growth Potential – These multi-chain projects are capable of pulling different users and liquidity from various ecosystems.

Lower Gas Fees & Faster Transactions – Users can select the networks they want to operate in based on low fees and speedy transactions.

Better Risk Diversification – Users and investors who aren’t centralized can focus on risks that do not pertain to one blockchain.

Access to Multiple Communities – Users from various blockchains can adopt multi-chain projects due to their wide scope of functionalities.

Interoperability and Cross-Chain Utility – Moving of assets from one chain to another and DeFi composability and liquidity is enhanced.

❌ Cons

Security Risks – Cross-chain bridges, used by multi-chain protocols, are prone to being attacked which makes security a concern.

Complex User Experience – New users may find it confusing as they have to go through extra steps when managing assets on different chains.

Liquidity Fragmentation – Sharing across multiple chains dilutes the strength of individual pools leading to inefficient markets.

Smart Contract Vulnerabilities – Increasing the chances of vulnerabilities by having to deploy separate contracts for each individual chain.

Governance Challenges – The different blockchain communities may have opposing views towards governance causing issues.

Conclusion

Ultimately, finding Multi-Chain DeFi gems requires some form of dedication, participation in the crypto community, and the use of different tools for tracking and assessing projects.

By doing your research on Zerion, following analytic influencers, reading whitepapers, participating in DeFi forums, and many other activities listed above, the chances of coming across promising Multi-Chain DeFi gems increases.

Be alert – it will help you get the most from your investments in DeFi. Good luck! Let me know if there’s anything else I can help you with.