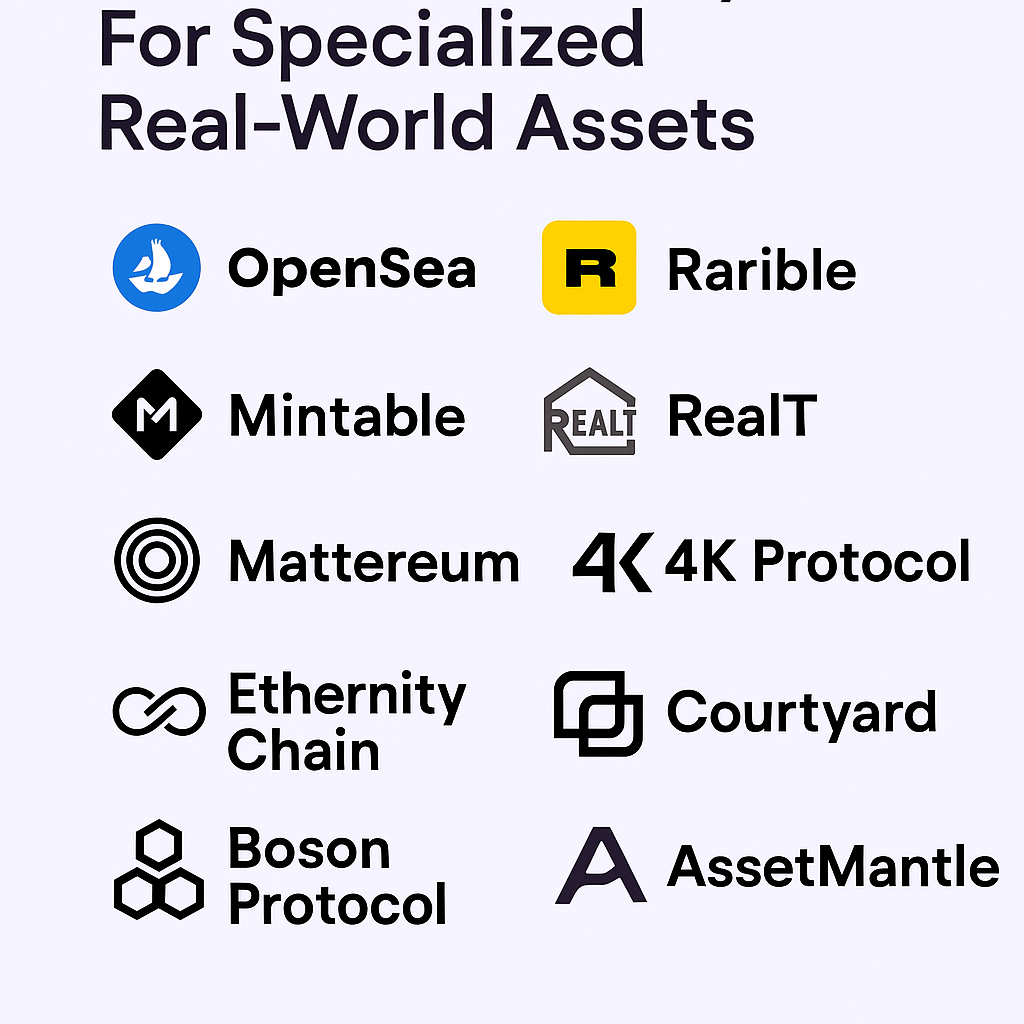

In this post, I will explore the NFT Aggregator For Specialized Real-World Assets, particularly the systems that link physical items such as real estate, high-end items, and various collectibles to the blockchain via NFTs.

These aggregators transform the management and exchange of real-world value in the digital economy by enabling secure, transparent, and tradable ownership of physical assets.

| Platform | Key Point |

|---|---|

| OpenSea | Largest and most popular NFT marketplace for a wide range of digital assets. |

| Rarible | Community-governed NFT platform allowing users to mint, buy, and sell NFTs. |

| Mintable | User-friendly NFT marketplace with easy minting for creators without coding. |

| RealT | Tokenizes real estate assets into fractional NFTs for passive income. |

| Mattereum | Bridges real-world physical assets with blockchain via legal-backed NFTs. |

| 4K Protocol | Offers NFT-backed physical luxury goods with insured storage and redemption. |

| Ethernity Chain | Focuses on authenticated NFTs (aNFTs) featuring celebrities and brands. |

| Courtyard | Specializes in tokenizing and vaulting physical collectibles like trading cards. |

| Boson Protocol | Enables decentralized commerce by linking NFTs to real-world redeemable items. |

| AssetMantle | Provides customizable NFT marketplace infrastructure for creators and enterprises. |

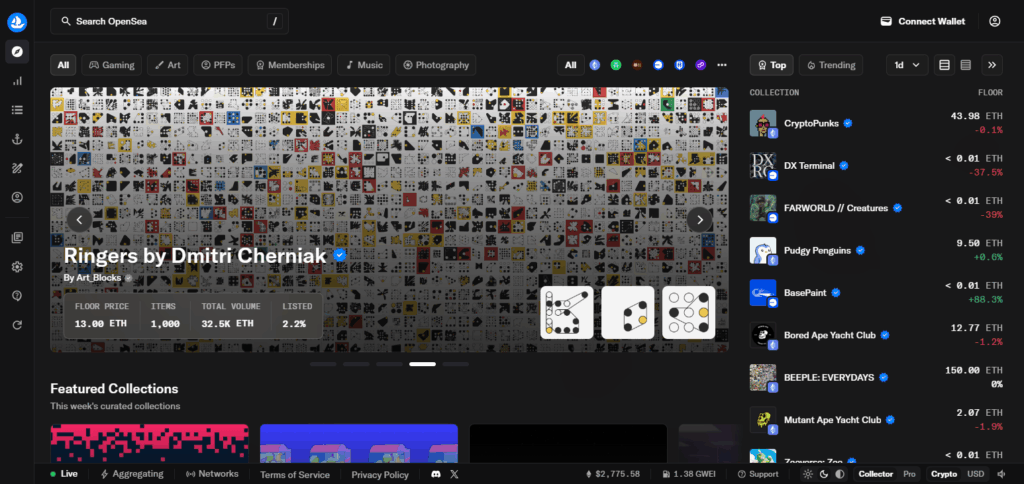

1. OpenSea

OpenSea remains the largest and most versatile NFT marketplace. It contains a wide range of digital assets such as art, music, domain names, and various collectibles. While it primarily focuses on digital NFTs, OpenSea is increasingly being used as an aggregator for real-world asset-backed NFTs.

Various projects and third-party integrations use OpenSea to list fractionalized or tokenized versions of physical assets like real estate, luxury items, or rare collectibles.

OpenSea operates on Ethereum and Polygon networks, allowing asset issuers to gain visibility and liquidity for tokenized real-world assets.

For creators or companies trying to reach both crypto and traditional asset investors, OpenSea offers invaluable exposure and high traffic.

OpenSea – Features

- Supports Ethereum, Polygon, and other major chains.

- Enables listing of real world asset backed NFTs.

- High liquidity and large user base.

- Integration with third party tokenized asset projects.

2. Rarible

Rarible is a community-driven NFT marketplace known for digital art. However, it also provides the means to tokenize real-world assets into NFTs. Rarible allows creators and businesses to mint custom smart contracts with metadata linked to physical items like property deeds, luxury watches, or fashion apparel.

With the addition of multi-chain interoperability like Ethereum, Flow, and Tezos, Rarible is slowly evolving into an aggregator of specialized real-world assets.The platform is flexible for novel asset-backed NFT projects due to users’ participation in decision-making and curation through DAO governance and the native \$RARI token.

New concepts for real-world asset NFTs can receive support and visibility through Rarible’s open-source community and voting system.

Rarible – Features

- Multi chain support Ethereum, Flow, Tezos.

- Allows the minting of NFTs that are tied to physical items.

- DAO governed with \$RARI token.

- Customizable smart contracts for real world applications.

3. Mintable

Mintable is easy to use and facilitates the creation of NFTs, including those for physical assets, which can be created by anyone. Its interface has gasless minting and is perfect for individuals and small businesses wanting to tokenize event tickets, certificates, and collectibles.

While still focusing on digital items, Mintable is increasingly being used for asset-backed NFTs because of its strong metadata capabilities and smart contract customization.

Through Ethereum, Mintable improves traceability and ownership proof which are important in real-world assets. It works with other projects on the convergence of physical and digital assets, thus making it useful for deploying real-world NFTs at a smaller scale.

Mintable – Features

- NFT minting with no code for creators.

- Supports metadata entries that are backed by assets.

- Gasless minting on some selected networks.

- Intuitive design for small scale tokenization.

4. RealT

RealT allows users to buy fractional shares of real estate assets via NFTs that legally represent a portion of them. The platform is a pioneer in the tokenization of real estate.

Every token comes with an Ethereum and Gnosis chain backed legal document and provides holders with rental income in stable coins. RealT has made it possible to trade and provide liquidity for previously illiquid assets.

Serving as an NFT aggregator for real estate, investors can now freely manage physical assets using blockchain technology. This enables the seamless and practical integration of physical real estate into decentralized finance (DeFi) systems.

RealT – Features

- Fractional NFTs of real estate properties.

- Token holders receive rental income.

- Legal documents associated with every NFT.

- Ethereum and Gnosis chains compatible.

5. Mattereum

Mattereum focuses on high-value physical assets like art pieces, instruments, and real estate by creating NFTs that link to legally enforceable contracts, a perfect solution for tokenization. Mattereum NFTs are embedded with smart legal contracts providing details on ownership, condition, and rights to transfer.

Their focus on asset trading friction allows for seamless proof-of-ownership and condition audits using blockchain technology. Mattereum acts as a trusted intermediary, enabling legal recourse and secured transactions while guaranteeing fraud-free exchanges.

Transactions involving Mattereum NFTs give buyers the assurance that their digital tokens represent true ownership of the asset and are legally accountable.

Mattereum – Features

- Smart contracts provide legal enforcement.

- Tokenization of high-value physical goods.

- Metadata and proof of ownership for assets is verifiable.

- Designed for cross border trade.

6. 4K Protocol

4K Protocol brings a revolution to the tokenization of real-world assets with NFTs backed by luxury goods like designer items, sneakers, and watches.

Before an item is minted into a redeemable NFT, it undergoes a process of authentication, insurance, and physical vault storage, which guarantees its security. Users have the freedom to trade the NFT and can redeem it at any time for the corresponding physical item.

This framework enhances liquidity in luxury markets that are typically illiquid. 4K Protocol integrates high-value, tangible assets into the blockchain system as an aggregator using a combination of DeFi principles and physical asset security.

From storage to token redemption, the protocol guarantees full transparency, making it safe for traders and collectors seeking to digitize their assets.

4K Protocol – Features

- Luxury items of a physical nature that are backed by NFTs.

- Redeemable with insured storage and redemption.

- Minting done prior to verification of authenticity.

- Luxury timepieces and footwear, for instance.

7. Ethernity Chain

Ethernity Chain is renowned for working with celebrities, athletes, and brands to produce authenticated NFTs (aNFTs). The platform offers the option to mint NFTs associated with physical items, memorabilia, and experiences.

Each aNFT not only offers authenticity and scarcity but also comes with real-world bonuses, such as signed merch or attending exclusive events. Ethernity Chain provides a marketplace for the endorsed assets allowing fans to engage with their favorites beyond the digital realm.

By featuring only verified listings, trust in the marketplace and its collectibles is strengthened. This strategy improves the value proposition for collectors by providing them with blockchain provenance and a physical asset.

Ethernity Chain – Features

- Authenticated NFTs (aNFTs) linked to celebrities.

- Associated merch and event access.

- Prominent brand collaborations.

- Assurance of scarcity and verification.

8. Courtyard

Courtyard is a blockchain based platform that aims to tokenize and vault high-value collectibles like trading cards and other pop culture memorabilia.

The ownership token is minted after an item is authenticated and secured in a vault. This enables collectors to trade buy, sell, or exchange their collectibles without needing to physically transport them.

By merging traditional collecting with the ease and liquidity of blockchain, Courtyard serves as a niche aggregator of NFTs for tangible collectibles.

Each NFT can be redeemed in full, and ownership is stored on-chain immutably. This allows Courtyard to securely trade physical items in a digital-first environment while maintaining pristine condition and value.

Courtyard – Features

- Tokenization of tangible collectibles such as trading cards.

- Secure vault storage with full redemption.

- On-chain tracking of ownership.

- Community-driven NFT exchange.

9. Boson Protocol

Boson Protocol aims to bridge the gap between real-world commerce and the decentralized world by enabling the tokenization of physical items’ NFTs which grants the right to redeem them. It allows brands to directly sell products through digital marketplaces, games, or even in the metaverse.

These NFTs are like vouchers that can be exchanged for physical items which are kept in partner logistics centers. Boson Protocol integrates the redemption of physical items into smart contracts which eliminates middlemen and automates fulfillment.

This serves the commerce of real-world assets in virtual space seamlessly. The unique design of the protocol facilitates programmable commerce which is perfect for tokenizing apparel, electronics, and branded goods in Web2 and Web3.

Boson Protocol – Features

- NFTs used as vouchers for tangible goods.

- Decentralized infrastructure for commerce.

- Fulfillment and redemption via smart contracts.

- Usable in the metaverse and games.

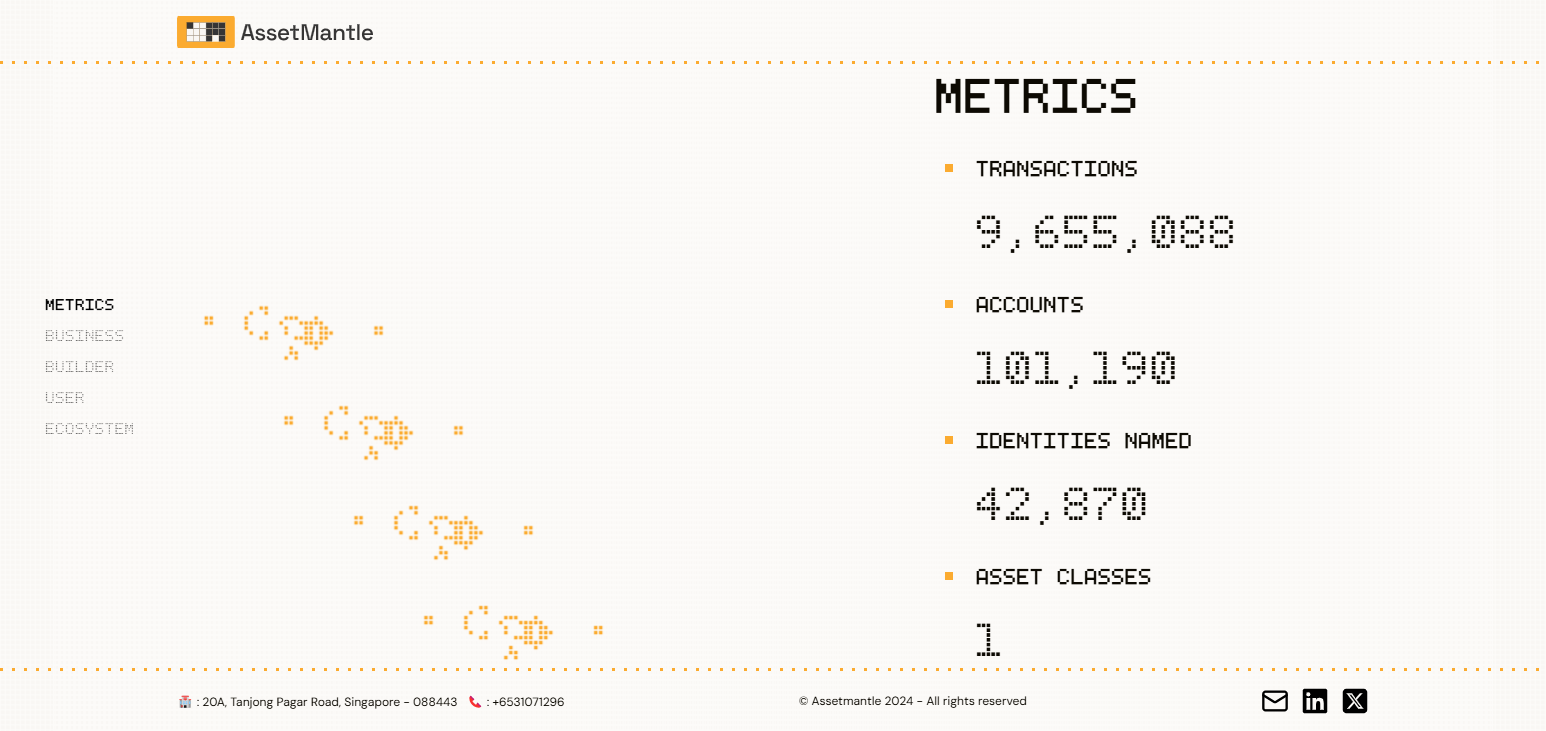

10. AssetMantle

AssetMantle focuses on helping creators and businesses establish tailored NFT marketplaces as an interoperable NFT ecosystem.

AssetMantle also provides the capability to tokenize real-world assets such as real estate documents, academic certifications, and supply chain items. Because of its multi-chain compatibility and modular, plug-and-play framework, AssetMantle functions as an aggregator by enabling users to curate and manage NFTs supported by real-world assets.

Development of Identity validation, control of relevant data, and connections to physical assets can be incorporated due to the system’s adaptable structure. Thus, businesses that seek to digitize and decentralize the ownership of physical assets through NFTs can leverage AssetMantle while retaining scalability and traceability.

AssetMantle – Features

- NFT marketplace template with modular architecture.

- Custom-made NFT asset classes, both digital and physical.

- Options for on-chain identity validation.

- Designed for enterprises and creators.

Conclusion

The way we buy, sell, and trade tangible items is changing with blockchain technology. RealT, Mattereum, and 4K Protocol are transforming the marketplace by issuing legally backed NFTs as verifiable ownership tokens for real estate and other luxury assets.

These aggregators collapse the gap between the physical and digital worlds by allowing formerly difficult to trade items to be traded with unparalleled transparency, liquidity, and access on a global scale.