In this article, i will discuss the Solana Protocols Set to Dominate. These protocols are pioneering new developments in the industry with rapid transaction speeds, minimal costs, and high-quality DeFi services.

Understanding the reasons that put them at the forefront of Solana’s expanding ecosystem and the decentralized finance (DeFi) innovation that lies ahead requires analyzing their distinct features and influence.

Key Point & Solana Protocols Set to Dominate List

| Protocol | Key Point |

|---|---|

| Marinade Finance | Leading liquid staking protocol that maximizes SOL yield. |

| Solend | Decentralized lending and borrowing platform with wide asset support. |

| Jupiter | Top DEX aggregator on Solana for finding the best token swap rates. |

| Orca | User-friendly AMM offering fast, low-fee swaps and concentrated liquidity. |

| Kamino Finance | Automated DeFi vaults optimizing yield across Solana’s ecosystem. |

| Drift Protocol | Advanced perpetual futures DEX with dynamic liquidity. |

| Raydium | AMM and liquidity provider integrated with Serum’s order book. |

| Meteora | Dynamic liquidity management platform improving capital efficiency. |

| Hubble Protocol | Borrowing platform offering zero-interest loans and USDH stablecoin. |

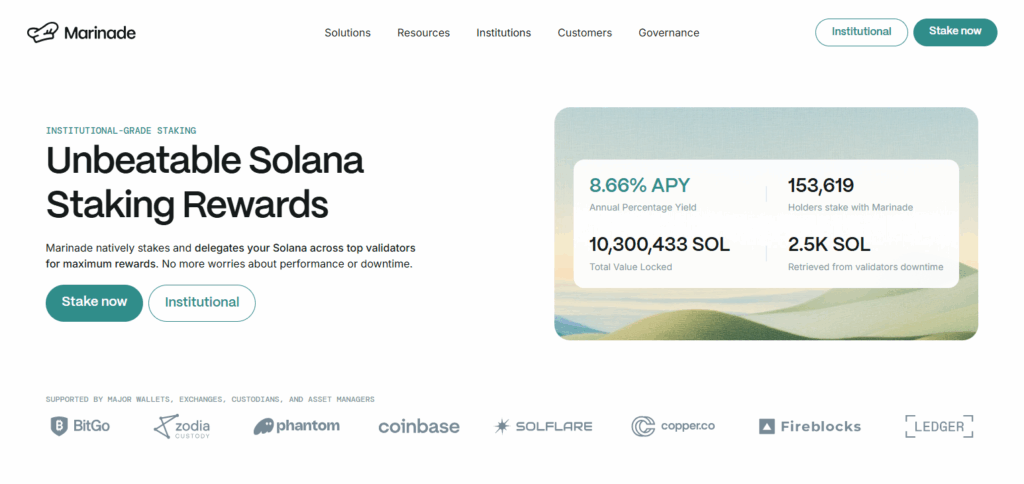

1.Marinade Finance

Marinade Finance is arguably one of the leading Solana protocols set to capture significant market share in 2025 because of its first mover advantage in liquid staking. Marinade enables users to stake SOL, but their capital remains liquid in the form of mSOL, which enhances capital efficiency and elevates participation in DeFi whilst maintaining staking rewards.

What stands out is its focus on decentralizing Solana’s validator set and network health. Marinade still functions as an infrastructure layer for sustainable growth, though, with increasing integrations throughout Solana’s ecosystem.

| Protocol | Marinade Finance |

|---|---|

| Function | Liquid staking protocol on Solana |

| KYC Requirement | Minimal to none for basic staking and withdrawals |

| Key Feature | Allows users to stake SOL and receive liquid mSOL |

| User Benefit | Earn staking rewards without locking assets or complex verification |

| Security | Non-custodial, decentralized validator selection |

| Integration | Widely supported across Solana DeFi platforms |

2.Solend

In 2025, Solend will most likely be the leader in Solana’s DeFi sector because it currently serves as the ecosystem’s primary decentralized lending and borrowing platform. It provides easy access to flash loans, leveraged strategies, and high-liquidity markets with low fees.

Solend’s adaptability is a key differentiating factor—able to accommodate diverse assets and introducing features such as isolated pools for risk control. Coupled with the speed and low cost of Solana, this makes Solend indispensable as a foundational protocol in the ecosystem’s finances.

| Protocol | Solend |

|---|---|

| Function | Decentralized lending and borrowing platform |

| KYC Requirement | Minimal or no KYC for basic borrowing and lending |

| Key Feature | Supports multiple assets with flexible collateral |

| User Benefit | Quick access to loans and leverage without heavy verification |

| Security | On-chain, non-custodial protocol with risk controls |

| Integration | Integrated with many Solana wallets and DeFi apps |

3.Jupiter

In 2025, Jupiter will be the best decentralized exchange aggregator in Solana’s DeFi ecosystem because of its unmatched price efficiency. It routes trades across multiple liquidity sources so users get the best swap rates on Solana.

Its most impressive attribute is the extensive trade handoff with other DeFi services that enables effortless token swaps with negligible slip. Because of the prevalence of DeFi services and ease of development on Solana, Jupiter is becoming a critical link in the chain for new Solana based DeFi systems.

| Protocol | Jupiter |

|---|---|

| Function | Decentralized exchange (DEX) aggregator on Solana |

| KYC Requirement | No KYC required for token swaps and trades |

| Key Feature | Routes trades across multiple liquidity sources for best rates |

| User Benefit | Fast, low-cost swaps without identity verification |

| Security | Non-custodial with on-chain execution |

| Integration | Compatible with major Solana wallets and DeFi tools |

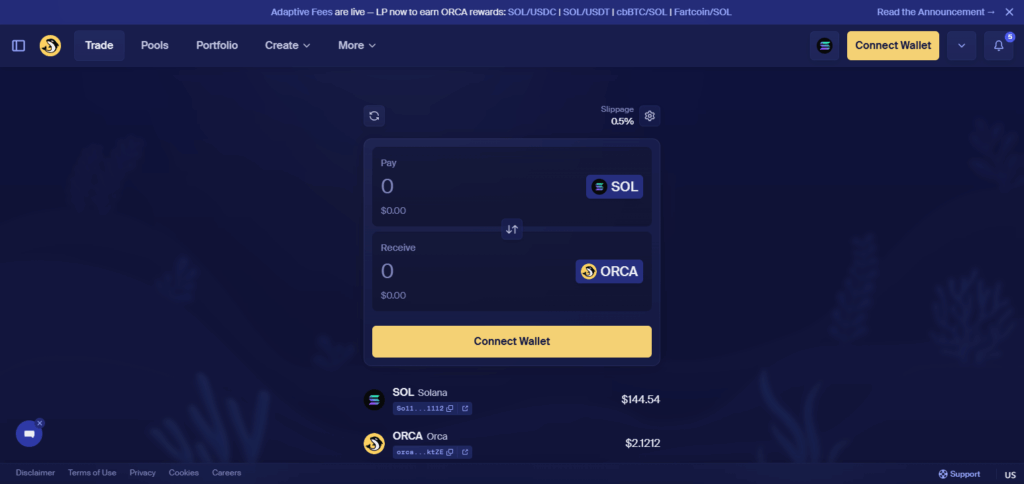

4.Orca

Orca looks to be the leading Solana protocol in 2025 because of its focus on user experience and automated market making. Its unique concentrated liquidity pools offer greater capital efficiency which is beneficial for both traders and liquidity providers.

Other than being a DEX, Orca also stands out for its simple interface, community driven features, and fast transaction speeds. Combining DeFi tools with user-friendly access, Orca is becoming crucial in advancing mainstream adoption in the Solana ecosystem.

| Protocol | Orca |

|---|---|

| Function | Automated Market Maker (AMM) on Solana |

| KYC Requirement | No KYC required for swapping and liquidity provision |

| Key Feature | User-friendly interface with concentrated liquidity pools |

| User Benefit | Easy, fast token swaps and yield farming without verification |

| Security | Non-custodial, fully on-chain protocol |

| Integration | Supported by major Solana wallets and DeFi platforms |

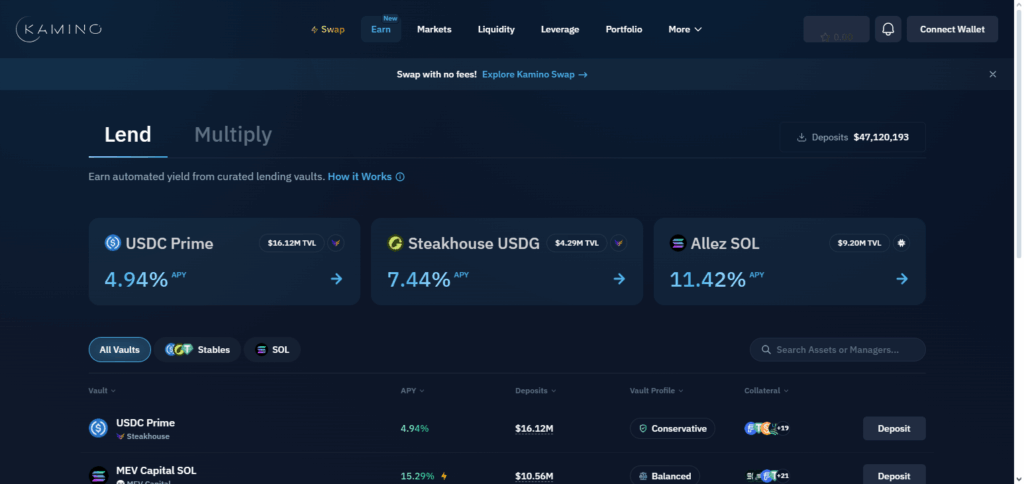

5.Kamino Finance

Forecasts suggest that Kamino Finance will become one of the top Solana protocols in 2025 as a result of its automated yield optimization strategies for liquidity providers. Kamino manages concentrated liquidity positions so that users do not have to rebalance constantly, thus simplifying complex DeFi operations and earning higher yields.

What sets Kamino apart are the Solana-native integrations and real-time optimization technologies. In Solana’s ecosystem, Kamino Finance removes barriers to sophisticated DeFi strategies, which boosts liquidity and participation across the network.

| Protocol | Kamino Finance |

|---|---|

| Function | Automated yield optimization for liquidity providers |

| KYC Requirement | No KYC required for using vault strategies |

| Key Feature | Manages concentrated liquidity positions automatically |

| User Benefit | Maximizes yields without manual management or verification |

| Security | Non-custodial and integrated with Solana DeFi protocols |

| Integration | Compatible with major Solana wallets and platforms |

6.Drift Protocol

By 2025, Drift Protocol anticipates changing the DeFi scene on Solana by offering a fully on-chain perpetual futures exchange. The most remarkable feature is dynamic liquidity which incorporates both order books and AMMs ensuring maximum efficiency.

Professional traders are also catered to with Drift’s tiered cross-margining and leverage systems. Focusing on speed and transparency, Drift aims to be the go-to platform for decentralized derivatives trading in Solana’s rapidly changing landscape.

| Protocol | Drift Protocol |

|---|---|

| Function | Decentralized perpetual futures exchange |

| KYC Requirement | No KYC required for trading on-chain |

| Key Feature | Combines order book and AMM for dynamic liquidity |

| User Benefit | Access to leveraged trading without identity checks |

| Security | Fully on-chain, non-custodial platform |

| Integration | Integrated with Solana wallets and DeFi ecosystem |

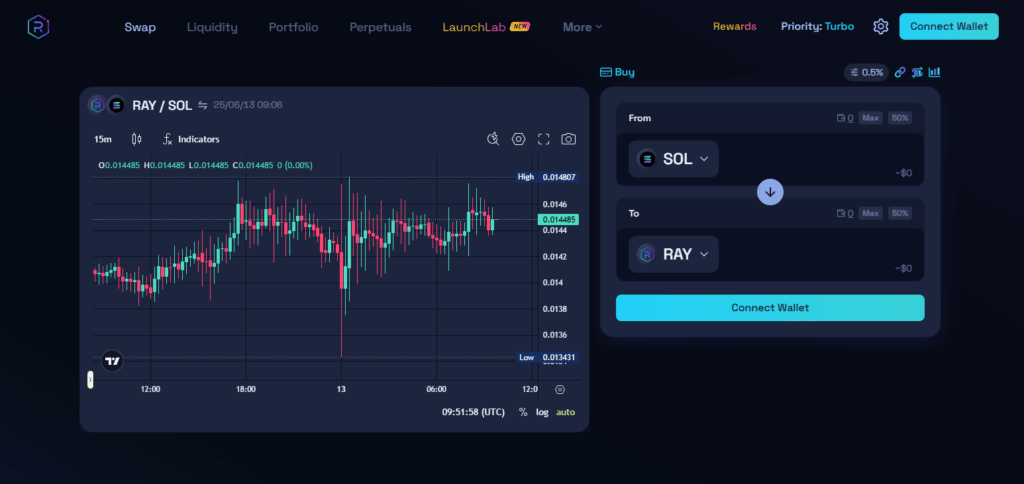

7.Raydium

Raydium will continue to stay a leading player on Solana in 2025 owing to its innovative hybrid liquidity model which merges the AMM functionality with Serum’s central limit order book.

This model not only enables Raydium to provide retail friendly swaps but also caters to all levels of traders with sophisticated trading features on a single interface.

It serves as a core hub for DeFi activity owing to its central liquidity, swift execution, and seamless token launches through AcceleRaytor. With the growth of Solana, Raydium’s flexibility makes it one of the core trading protocols in the ecosystem.

| Protocol | Raydium |

|---|---|

| Function | AMM and liquidity provider integrated with Serum |

| KYC Requirement | No KYC required for swapping and liquidity provision |

| Key Feature | Hybrid model combining AMM with order book liquidity |

| User Benefit | Fast, low-cost trading without identity verification |

| Security | Non-custodial, on-chain protocol |

| Integration | Widely supported by Solana wallets and DeFi apps |

8.Meteora

Meteora is expected to help Solana grow in 2025 by launching dynamic liquidity provisioning for contemporary DeFi ecosystems. Its most notable function is the automated adjustment of providing liquidity to match market demand, which optimally utilizes capital without utilizing resources from the user.

Solana users and developers benefit from smart automation and cross-application systems because liquidity management automation makes it easier. Thus far, meteora’s innovations place it as a crucial infrastructure layer which augments solana’s DeFi ecosystem responsiveness and agility.

| Protocol | Meteora |

|---|---|

| Function | Dynamic liquidity management platform |

| KYC Requirement | No KYC required for liquidity provisioning and management |

| Key Feature | Automated rebalancing of liquidity based on market conditions |

| User Benefit | Maximizes capital efficiency without manual intervention or verification |

| Security | Non-custodial, fully on-chain |

| Integration | Compatible with major Solana wallets and DeFi protocols |

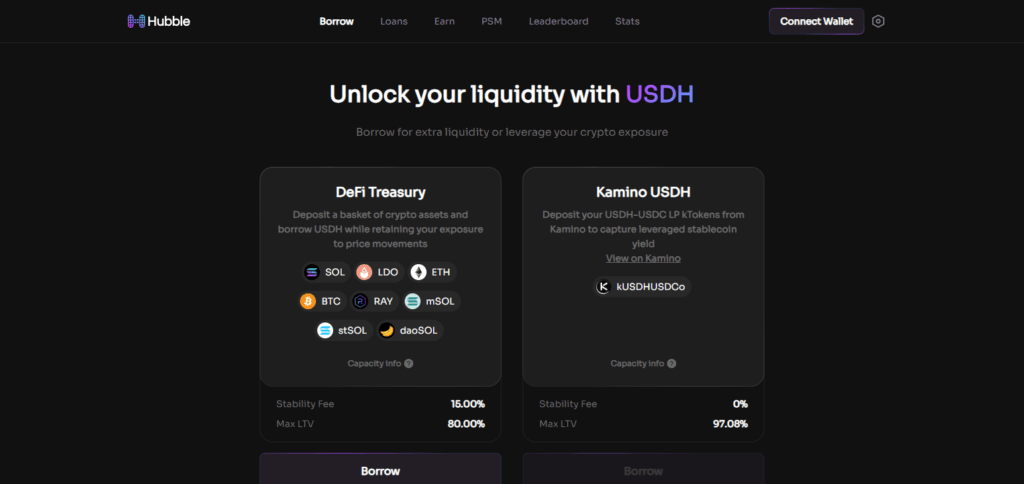

9.Hubble Protocol

In 2025, Hubble Protocol will lead Solana’s ecosystem by implementing new lending methods using its zero-interest loans and native stablecoin, USDH. Hubble Protocol aims to allow users to access liquidity without selling their assets which unlocks value in capital efficiency.

Users are able to trust and rely on the system due to Hubble’s focus on decentralized governance and risk management which enhances the trust and stability of the platform. Hubble is fortifying Solana’s DeFi ecosystem by providing competitive rates together with safety and ease of use, all in one platform.

| Protocol | Hubble Protocol |

|---|---|

| Function | Decentralized borrowing and stablecoin platform |

| KYC Requirement | Minimal to no KYC for borrowing and stablecoin minting |

| Key Feature | Zero-interest loans and USDH stablecoin issuance |

| User Benefit | Access liquidity without selling assets or heavy verification |

| Security | Non-custodial, on-chain risk management |

| Integration | Integrated with Solana wallets and DeFi ecosystem |

Conclusion

In summary, the Solana protocols poised to dominate in 2025 underline the ecosystem’s innovation, agility, and growth potential. The protocols are focused on liquid staking, DeFi lending, sophisticated trading, and agile liquidity provisioning; they solve critical user experience hurdles as well as core DeFi problems. Solana’s prominence in the blockchain industry is bolstered by its distinctive business model and effortless interoperability, projecting extensive adoption and long-term growth.