In 2025, Australia’s stock market continues to change, and investors seek out ETFs for diversified and inexpensive access to local and international markets.

Investors can select from a wide range of products on the ASX, from broad market products such as VAS and A200 to theme-based ETFs on technology, cybersecurity, and commodities.

These top 10 ETFs are a blend of stability and growth with the addition of specific sector attributes, thus forming a necessary part of a well-thought-out portfolio.

Key Point

| ETF | Key Point |

|---|---|

| Vanguard Australian Shares Index ETF (VAS) | Broad exposure to the top 300 Australian companies, including banks and miners. |

| Perth Mint Gold Structured Product (PMGOLD) | Provides direct exposure to physical gold as a hedge against inflation. |

| iShares S&P 500 ETF (IVV) | Access to 500 largest U.S. companies for global diversification. |

| BetaShares Australia 200 ETF (A200) | Tracks the top 200 Australian companies with a low-cost approach. |

| SPDR S&P/ASX 200 ETF (STW) | One of the most liquid ETFs on ASX, offering broad market exposure. |

| VanEck Australian Equal Weight ETF (MVW) | Equal-weight exposure reduces concentration risk in Australian equities. |

| BetaShares Global Cybersecurity ETF (HACK) | Targets fast-growing global cybersecurity companies amid rising digital threats. |

| BetaShares Asia Technology Tigers ETF (ASIA) | Focus on high-growth Asian tech companies in China, Korea, and Taiwan. |

| Betashares Global Defence ETF (DHHF) | Invests in leading global defense and aerospace companies. |

| BetaShares Global Silver ETF (SLVR) | Provides exposure to silver bullion, benefiting from surging prices. |

1. Vanguard Australian Shares Index ETF (VAS)

Vanguard Australian Shares Index ETF (VAS) passively tracks the performance of the S&P/ASX 300 Index, allowing investors to gain exposure to the performance of a broader range of Australian companies across the market.

With a Capital market value of 21.78 B Australian dollars, VAS is a perfect low-cost investment for anyone wanting to gain diversified exposure to the Australian VAS equity market.

VAS holds 303 Australian Shares, and VAS is needed for most Australian diversified equity portfolios since it has large, mid, and small-cap companies.

Vanguard Australian Shares Index ETF (VAS) Pros & Cons

Pros:

- Provides comprehensive coverage of the primary 300 Australian companies across multiple industries, including banks and block holders in the mining industry.

- Offers low management fees of 0.10% p.a.

- Extremely liquid as there are over A$21 billion in net assets.

- Excellent operating history, boasting a 9% increase in unit price over the past year. ([The Motley Fool Australia][1])

Cons:

- Performance is closely monitored relative to the Australian economy, which is affected by local issues like interest rates and commodity prices.

- No to little exposure to global markets and international trends.

- Overly concentrated in the financials and materials primary industries.

- Limited to no financial returns or dividends.

2. Perth Mint Gold Structured Product (PMGOLD)

Perth Mint Gold Structured Product (PMGOLD) was designed to simplify gold investments for Australians.

Currently, it is the best investment product for exposure to investment-grade gold bullion. With the assistance of the gold handling and security of the Australian government, it becomes a perfect investment for times of economic uncertainty and risk.

Perth Mint Gold Structured Product (PMGOLD)

Pros:

- 100% exposure to physical gold, directly subsidized by the Western Australian Government.

- Low management fees of 0.15% p.a.

- Gold is a reliable asset in times of economic downturns, covering unpredicted inflation and currency changes.

- Storage and insurance costs come bundled within the management fee, which makes the investment process even easier to manage. ([Perth Mint][2])

Cons:

- Gold prices are subject to volatility and are driven by global economic dynamics, which can, in turn, impact the performance of the ETF.

- Gold will always lack the capacity to generate any income, meaning it will never produce dividends or interest.

- Gold and ETFs that comprise gold will likely never possess the same levels of growth opportunity as equities or other asset classes.

- Holding gold provides to exposure to one commodity, meaning no diversification.

3. iShares S&P 500 ETF (IVV)

With an investment in the iShares S&P 500 ETF (IVV), one can access 500 of the biggest U.S. companies since the IVV tracks the S&P 500 Index. IVV is worth around A$11.64 billion, which offers investors easy access to the U.S. equity market.

The investment is also of low value. It is the ideal investment for people wanting to invest in U.S. equities due to its low value and extensive diversification across different sectors, as it provides a fair value range for all market exposures.

iShares S&P 500 ETF (IVV)

Pros:

- Access to 500 of the largest U.S. companies and diversification across different sectors.

- Minimal management fee of 0.03% p.a. provides value without added cost.

- Highly liquid with more than A$11 billion in assets under management.

- Follows the S&P 500 Index, which is the standard for U.S. equities. ([Yahoo Finance][3])

Cons:

- Depends on U.S. market performance, which can be impacted by interest rate and economic policy changes.

- Exposure to and affected by fluctuations of the U.S. dollar.

- Might be best to avoid this investment if willing to capture the growth of the Australian market as it has minimal exposure to Australian companies.

- Australian economy supporters will likely find this investment unattractive.

4. BetaShares Australia 200 ETF (A200)

The BetaShares Australia 200 ETF (A200) is designed to provide investment returns that track those of the Solactive Australia 200 Index; as such, it offers investment returns on 200 of the largest Australian companies.

With a management fee of A$0.04 p.a., it is one of the cheapest in the market. It is also one of the cheapest in the Australian market due to its extensive range. The combination of broad spectrum coverage and a low-cost fee structure is a strong value proposition to investors for the A200.

BetaShares Australia 200 ETF (A200)

Pros:

- Gives access to Australia’s top 200 companies and wide-ranging market coverage.

- One of the lowest management fees in the industry at 0.07% p.a.

- High liquidity due to considerable trading volume. ([The Motley Fool Australia][4])

Cons:

- Performance correlates with the Australian economy and its interest rates and commodity prices.

- There is low international market exposure which might reduce global growth access.

- High concentration and risk due to the over-weighting of the financial and material sectors.

- Other income-generating focused ETFs may provide higher dividend yields.

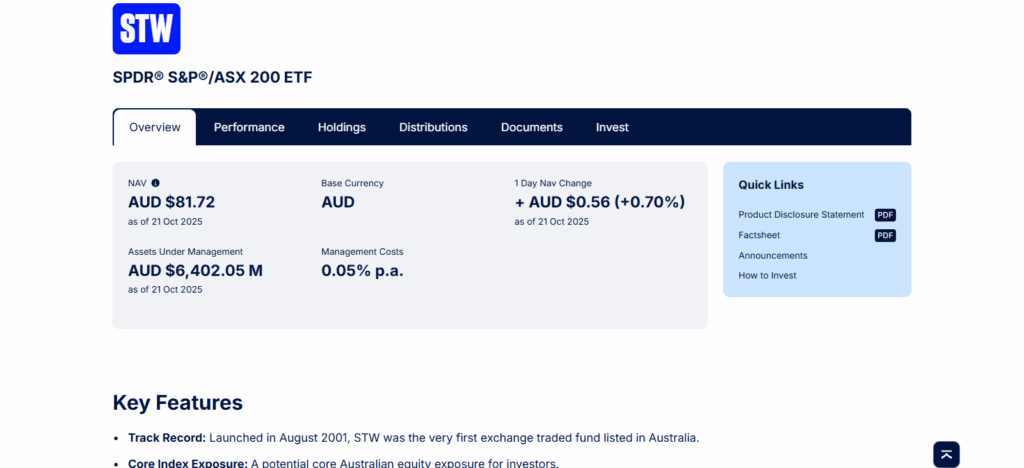

5. SPDR S&P/ASX 200 ETF (STW)

As one of the oldest and most liquid ETFs on the ASX, the SPDR S&P/ASX 200 ETF (STW) tracks the performance of the S&P/ASX 200 Index.

With a market capital of about A$13.3 billion, STW gives investors access to 200 of the largest Australian companies. Given STW’s long operational track record and high liquidity, it is a dependable option for investors looking for extensive market coverage.

SPDR S&P/ASX 200 ETF (STW)

Pros:

- Access to 200 major Australian companies providing extensive market coverage.

- Over A$13 billion in assets which contributes to the high liquidity.

- One of the oldest and most liquid ETFs on the ASX, providing an established track record.* Offers a dependable option for investors wanting to invest in the overall markets. ([Pearler][5])

Cons:

- Performance is dictated to a greater extent by the local economy, which is subject to changes in interest rates and commodity prices.

- Lack of international diversification, which means lack of global opportunities.

- Higher exposures to the financials and materials increase the risk of sector concentration.

- Potential for lower dividend yields relative to other income-focused ETFs.

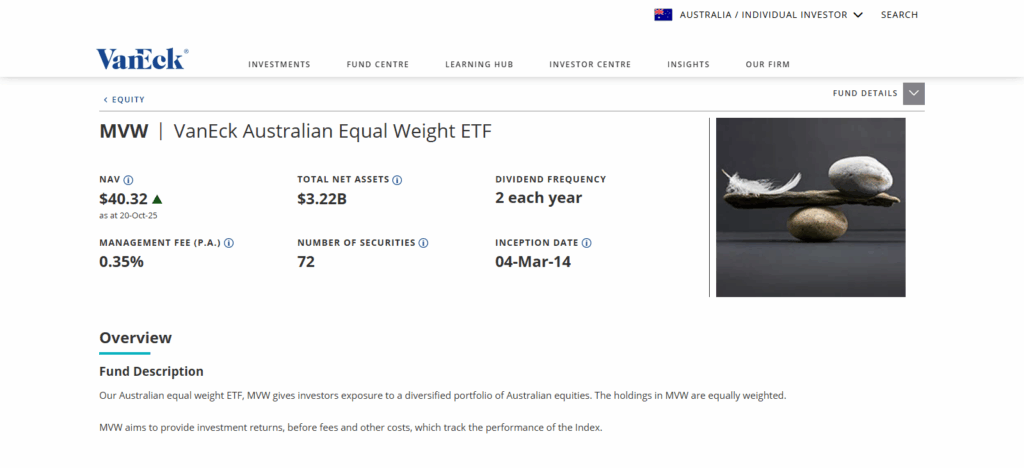

6. VanEck Australian Equal Weight ETF (MVW)

The VanEck Australian Equal Weight ETF (MVW) offers equal-weight exposure to Australian companies and, therefore, exposure to market concentration risk of market-cap-weighted indices.

With a market capital of about A$5.1 billion, MVW provides a diversified portfolio of Australian equities. MVW’s equal-weight strategy helps in providing exposure to a wider array of companies, which in turn helps in enhancing long-term potential returns.

VanEck Australian Equal Weight ETF (MVW)

Pros:

- Equal-weight approach means that concentration risk in large companies is lower.

- Can offer diversification across and within industries which can include smaller companies.

- Longer-term equal-weighted strategies can offer potential for outperformance.

- Highly liquid as evidenced by actively traded volume. ([Morningstar][6])

Cons:

- In periods dominated by the larger companies, relative to the market as a whole, these strategies tend to underperform.

- Higher turnover relative to market cap weighted indices may increase the cost of holding the ETF.

- Exposure to small caps can lead to greater price fluctuations.

- Potential for lower dividend yields relative to other income-focused ETFs.

7. BetaShares Global Cybersecurity ETF (HACK)

As digital threats expand, so does the demand for cybersecurity services. The BetaShares Global Cybersecurity ETF (HACK) invests in the most important companies in that field.

HACK has skilled marketers, capitalizing on the demand for cybersecurity services, with a market capitalization of A$1.21 billion. With the focus on protective services, it is a good choice for investors interested in thematic investments.

BetaShares Global Cybersecurity ETF (HACK)

Pros:

- Focuses on the large players in the global market of cybersecurity.

- Responds to increasing need for cybersecurity solutions due to heightened digital threats.

- Provides diversification across different companies in the cybersecurity field.

- High liquidity with significant trading volumes. ([Trackinsight][7])

Cons:

- 0.67% management fee is considerably high which may affect returns.

- 65% turnover ratio is high which may cause tax inefficiency.

- Volatility due to reliance on a single cybersecurity market.

- Concentration risk from investing in a niche market.

8. BetaShares Asia Technology Tigers ETF (ASIA)

The BetaShares Asia Technology Tigers ETF (ASIA) focuses on the transformational technology and high-growth companies, particularly in the major Asia-Pacific countries of China, Korea, and Taiwan.

With a market capitalization of A$1.2 billion, ASIA provides exposure to one of the most strategic technological areas for investors. Investing in high-growth technological companies in Asia makes it a great pick for emerging market investors.

BetaShares Asia Technology Tigers ETF (ASIA)

Pros:

- Invests in top technology firms in Asia, specifically in China, Korea, and Taiwan.

- Benefits from Asia’s ongoing technology revolution.

- Diversifies across different markets in Asia.

- Technology in Asia is growing rapidly which leads to high potential growth. ([Stockspot][8])

Cons:

- Emerging markets are volatile and become affected by geopolitical issues.

- Multiple Asian currencies increases currency risk.

- Concentration risk due to a focus on the technology sector.

- Countries with technology firms that are rapidly changing their policies may cause regulatory risks.

9. BetaShares Global Defence ETF (DHHF)

DHHF Global Defence is an ETF (Exchange Traded Funds) that provides exposure to key players in global defence and aerospace industries.

DHHF takes advantage of increases in global defence spending and is capitalized at roughly A$1.5 billion.

For DHHF, its exposure to a global security fundamental growth defence sector is an additional competitive advantage.

BetaShares Global Defence ETF (DHHF)

Pros:

- Provides exposure to leading global defence and aerospace companies.

- Benefits from the growth of global defence budgets.

- Allows investors to diversify across several defence companies.

- Returns could be stable because the defence industry will always be needed.

Cons:

- Niche sector focus translates to concentration risk.

- Government budgets, geopolitical volatility and cross-country relations affect performance.

- Some people will be concerned about the industry moral reasons.

- Countries that frequently change their policies regarding the sector have a higher risk of defence regulation.

10. BetaShares Global Silver ETF (SLVR)

BetaShares Global Silver ETF (SLVR) provides exposure to and gives investors silver bullion to own, a key addition to any precious metal portfolio.

As a testament to silver’s recent price increase, SLVR increased its silver bullion offering to investors.

As an alternative asset, SLVR’s focus on silver bullion makes it a compelling investment for fiscally 2025 diverse portfolios.

BetaShares Global Silver ETF (SLVR)

Pros:

- Allows investors to own silver bullion and use it to hedge against inflation and currency depreciations.

- Silver bulls have outperformed gold in 2025, which means a higher return.

- One of the lowest management fees in silver ETF’s market (0.49%).

- Offers a straightforward account to silver.

Cons:

- Silver ETF performance is exposed to silver price volatility and global economic conditions.

- Silver bullion does not generate cash flow as it is not a currency, so no interest is applied.

- No diversification opportunities because it is a silver ETF.

- Compared to other asset classes and equities, silver will have a lower growth potential.

Conclusion

As always, the ASX has an abundant range of ETFs that cater to all sorts of investor appetites, from those looking for broad-based investments to those interested in thematic and sector-based investments.

Even in 2025, VAS, A200, and STW are ideal for those looking for broad exposure to the Australian equity market. IVV still gives access to the Australian market for those looking to add U.S. equities for global diversification.

Thematic ETFs like HACK and ASIA focus on high-growth areas in cybersecurity and technology in Asia. On the other hand, PMGOLD and SLVR are good options if investors are looking for alternatives to inflation and to hedge their inflation exposures.

A well-diversified portfolio can still be built from these ETFs when properly combined to an investor’s personal risk and financial goal requirements.

For 2025, these ASX ETFs exemplify a good balance between stability, growth, and sector focus, which makes them good options for investors of all experience levels.

FAQ

What are ETFs?

ETFs (Exchange-Traded Funds) are investment funds traded on the stock exchange that track an index, sector, commodity, or other assets. They offer diversification, liquidity, and a low-cost way to invest in multiple securities simultaneously.

Why should I consider ASX ETFs in 2025?

ASX ETFs provide access to Australian and global markets, covering sectors like technology, finance, commodities, and defense. They are ideal for portfolio diversification, long-term growth, and thematic investing.

Which are the top ASX ETFs to watch in 2025?

Top ETFs include VAS, A200, STW, IVV, MVW, PMGOLD, SLVR, HACK, ASIA, and DHHF. These ETFs offer exposure to broad markets, high-growth sectors, and commodities, balancing stability and growth potential.

Are ASX ETFs suitable for beginner investors?

Yes. ETFs provide diversified exposure, reducing risk compared to individual stocks. Low management fees and the ability to buy and sell on the ASX make them beginner-friendly.

How can I choose the right ASX ETF?

Consider your investment goals, risk tolerance, and sector preferences. Broad market ETFs like VAS or A200 are ideal for conservative investors, while thematic ETFs like HACK or ASIA suit those seeking higher growth.