As the crypto market trend remains neutral, Ethereum price continues consolidation till now 4 September. At the moment, ETH is trading at almost $4,400, but various strong catalysts suggest a rebound toward the $5,000 mark is very likely. This has led to many analysts outlining four reasons which could help Ethereum’s price go up in near future.

1. Increase in Institutional Interest in Ethereum Assets

Institutional demand directly supports Ethereum’s growth. Just recently, Grayscale which is the largest crypto asset manager applied for the Ethereum Covered Call fund. This fund permits investors to receive passive income through ETH while simultaneously selling call options, premiums of which are paid as dividends.

Investors looking for decent yielding crypto ETFs would certainly back Ethereum, and Covered Call ETFs could bring in enough investors to Ethereum which would testify about Ethereum’s growth.

2. Whale Mentions Boosting Ethereum’s Upward Momentum

Further bullish signals come with continued whale accumulation. On Thursday an individual investor bought \$100 million of Ethereum which displays strong conviction belief in the asset.

Eth whale accumulation in the past is often thought of as bullish market signal because whales tend to be savvy, well-funded, and operate on market asymmetry. Ethereum whales tend to buy before general market upswings.

3. Ethereum Outshining Other Smart Contract Competitors

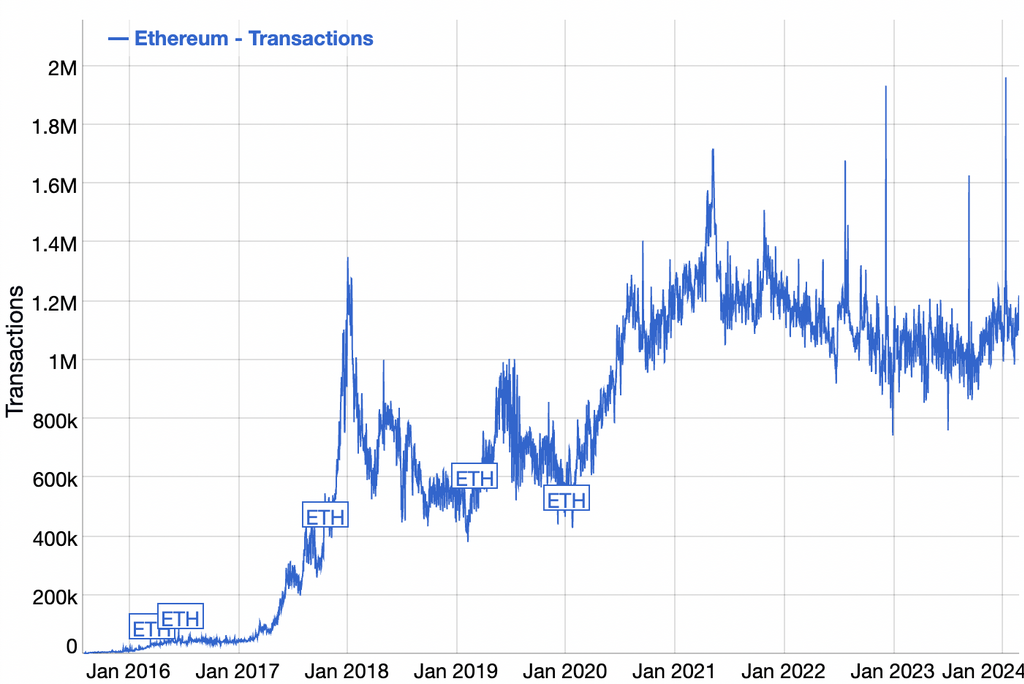

Compared and to other major blockchains like Solana, Tron, and BNB Smart Chain, Ethereum still ranks the highest in market share. Ethereum still dominates over 70% of the DeFi market with ethers DeFi platforms leading the transaction volume like Aave, Uniswap, and Lido.

On Aave alone, the past 24 hrs Ethereum-based DeFi earned over \$3.6 billion worth of tokens. Also, Ethereums network stablecoins rose to \$150 billion which strengthens ETH’s market position also.

4. Strong Technicals Indicating Further Upside

Ethereum and its technical indicators merge beautifully together which signifies a possible price increase. ETH on the 3-day chart shows that ETH is sitting on the weak stop and reverse point on the Murrey Math Lines which indicates ETH can move toward the extreme overshoot level of $6250.

More importantly, ETH is close to the $5000 level which increases the chances of hitting $5000 soon. ETH has conducted a retest of the $4100 support which has historically been a confirmation point for HR retests. That being said, dropping below $4100 loses that bullish argument and likely trails ETH back toward the major support pivot of $2500.

Conclusion

All of the above put together, pairing the ETH institutional interest as well as deep-pocket investor accumulation, DeFi, and the technicals suggests ETH is primed to surge to $5000. Investors are now keenly focused on these factors to determine the following phases for ETH.