I will talk about the Top Decentralized Exchanges (Dexs) In The Solana Ecosystem Earn, trade or exchange digital assets on these platforms that make DeFi trading much more efficient.

Every DEX offers unique tools that increase liquidity, decrease slippage, and lower costs, making them an integral part of Solana’s booming DeFi ecosystem.

These DEXs are changing the DeFi sector by providing speed and efficiency through reduced trading costs.

Key Point & Top Decentralized Exchanges (Dexs) In The Solana Ecosystem List

| Protocol | Keypoint |

|---|---|

| Bybit | |

| Bitrue | Bitrue is a cryptocurrency exchange that offers low fees, staking, and a wide selection of digital assets. |

| Raydium | AMM and liquidity provider on Solana, integrates with Serum for order book liquidity. |

| Orca | Solana-based AMM with a focus on user-friendly interface and low fees. |

| Saber | Focuses on stablecoin and wrapped asset swaps on Solana. |

| Drift Protocol | Decentralized perpetual exchange on Solana with leverage trading. |

| Lifinity | AMM optimized for concentrated liquidity, designed for low slippage. |

| Saros Finance | DeFi protocol on Solana focused on options trading and risk management. |

| Jupiter | Solana-based liquidity aggregator for seamless token swaps. |

| Atrix | Solana-based AMM with an emphasis on liquidity pools and farming. |

| Invariant Protocol | Protocol designed for cross-chain trading and liquidity aggregation. |

| Aldrin | AMM and DeFi platform offering token swaps, staking, and farming on Solana. |

1. Bybit

Founded in 2018, Bybit is a centralized exchange that continues to nurture the Solana ecosystem through its Web3 wallet and DeFi integrations. Even though Bybit is not a DEX by itself, it connects traders to the leading Solana DEXs Jupiter and Raydium through its Web3 interface.

It accepts all major digital assets including SOL, BTC, ETH and USDT. Through Banxa or MoonPay users can deposit both crypto and fiat, while withdrawing only crypto is easy. With secure wallet connection, DApp access and 24/7 customer support, Bybit stands as a bridge between CeFi and DeFi which unlocks the value of the Solana decentralized ecosystem.

2. Bitrue

Bitrue Crypto Exchange: Claim Your Share Of $12,000 Now!

Bitrue has shaken up the crypto market with their New Users Campaign, where they are giving away $12,000 just for making your first Futures Trade!

It’s as easy as it sounds—if you trade over $250 in Futures, you are rewarded by randomly being selected for a token airdrop worth anywhere from $5 – $20. For new or seasoned trades alike, this is a great opportunity to earn free crypto while utilizing Bitrue’s powerful trading platform.

? What to consider when Joining Bitrue:

✅ Welcome gifts for new Signups

✅ Zero hassle when it comes to security and Futures trading

✅ Great fee structure with high liquidity

What are you waiting for? Go grab your free airdrop today! If you haven’t yet signed up, do it with my link and start trading straight away:

3.Raydium

Raydium is one of the top decentralized exchanges (DEX) operating in the Solana ecosystem. Raydium’s key feature is its integration with Serum’s central order book, enabling users to trade efficiently by offering them deep liquidity and fast trades.

In addition to these, Raydium has low transaction costs, a great user interface, and is cross-platform compatible. All of these qualities set it apart as the go-to DEX for traders in the Solana network who require both AMM and order book liquidity.

| Feature | Details |

|---|---|

| Platform | Raydium |

| Blockchain | Solana |

| KYC Requirement | Minimal or none |

| Key Use Case | Decentralized exchange, liquidity provision, yield farming |

| Token Swaps | Supports swaps between Solana-based tokens |

| Liquidity Pools | Offers various liquidity pools with Solana tokens |

| Staking/Yield Farming | Provides options for staking and earning yield |

| Transaction Speed | Fast, due to Solana’s high throughput |

| Security | Non-custodial, user retains control of private keys |

| Supported Wallets | Phantom, Sollet, Solflare, and others |

4.Orca

Orca is one of the best decentralized exchange (DEX) in Solana’s ecosystem due to its stunning user interface which is focused on simplicity.

Orca sets itself apart from many other DEXs as its fully integrated AMM model features slippage sensitive priority and liquidity provision for small trades.

Coupled with fast transaction speeds and low fees, Orca’s user interface has provided a key position in Solana’s DeFi ecosystem.

| Feature | Details |

|---|---|

| Platform | Orca |

| Blockchain | Solana |

| KYC Requirement | Minimal or none |

| Key Use Case | Decentralized exchange, liquidity pools, token swaps |

| Token Swaps | Easy swaps between Solana-based tokens |

| Liquidity Pools | Offers automated market maker (AMM) liquidity pools |

| Staking/Yield Farming | Provides staking options and farming opportunities |

| Transaction Speed | Fast due to Solana’s high throughput |

| Security | Non-custodial, users control their private keys |

| Supported Wallets | Phantom, Sollet, Solflare, and others |

5.Saber

Saber has grown to become one of the top decentralized exchanges (DEX) operating within the Solana ecosystem. Saber deals primarily in the swapping of stablecoins and wrapped assets.

It’s unique algorithm slippage for stable coins making it one of the most efficient DEX’s, Also targeting low cost and high speed transactions. Because of this, users are provided and optimized trade experience turning Saber into one of the most preferred platforms within the Solana’s tight pegged assets ecosystem.

| Feature | Details |

|---|---|

| Platform | Saber |

| Blockchain | Solana |

| KYC Requirement | Minimal or none |

| Key Use Case | Cross-chain stablecoin swaps, liquidity provision |

| Token Swaps | Focuses on stablecoin-to-stablecoin swaps |

| Liquidity Pools | Provides liquidity pools for stablecoins and LP tokens |

| Staking/Yield Farming | Staking opportunities for liquidity providers |

| Transaction Speed | Fast transactions due to Solana’s high throughput |

| Security | Non-custodial, users maintain control of private keys |

| Supported Wallets | Phantom, Sollet, Solflare, and others |

6.Drift Protocol

Drift Protocol is known for being one of the most prominent decentralized exchanges or DEXs in Solana’s ecosystem because it specializes in decentralized perpetual futures trading. Drift makes it possible for traders to open bigger positions through a 20x leverage without having to rely on centralized exchanges.

After all, it is the only DEX that uses a hybrid AMM and order book model. In addition to this unique feature, Drift benefits from unprecedented liquidity and accurate pricing enabled by the Solana blockchain’s speed and low fees.

| Feature | Details |

|---|---|

| Platform | Drift Protocol |

| Blockchain | Solana |

| KYC Requirement | Minimal or none |

| Key Use Case | Perpetual swaps, margin trading, and decentralized futures |

| Token Swaps | Supports leveraged perpetual contracts and token swaps |

| Liquidity Pools | Offers liquidity for perpetual futures contracts |

| Staking/Yield Farming | Provides staking rewards for liquidity providers |

| Transaction Speed | High-speed transactions due to Solana’s network |

| Security | Non-custodial, users retain control over private keys |

| Supported Wallets | Phantom, Sollet, Solflare, and others |

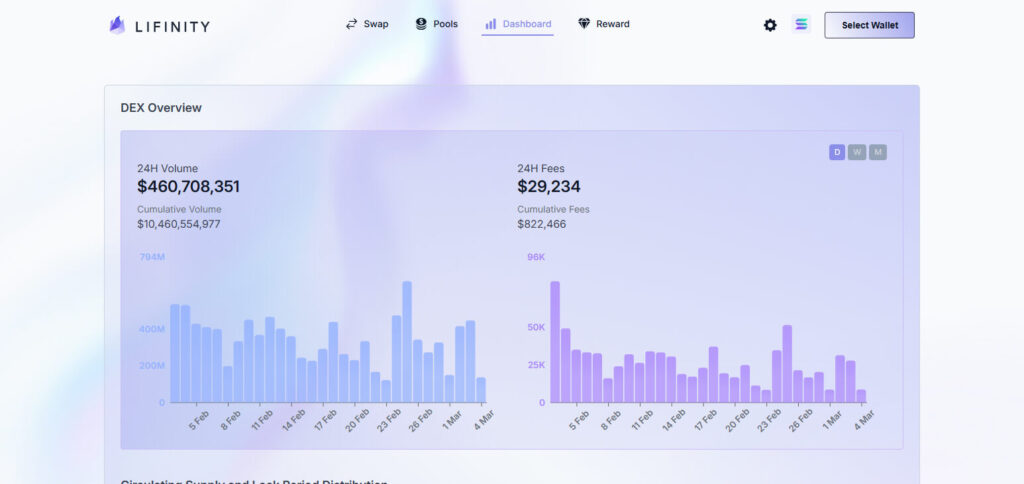

7.Lifinity

Lifinity is one of the leading decentralized exchanges (DEX) in the Solana ecosystem due to its concentrated liquidity model. Unlike regular AMMs, Lifinity’s algorithm lets liquidity providers concentrate their capital within certain price ranges.

This greatly improves trade efficiency and reduces slippage. This novel approach increases liquidity for low volume assets and minimizes fees, making Lifinity the go-to platform for traders that want slippage free and efficient trades within the bustling Solana network.

| Feature | Details |

|---|---|

| Platform | Lifinity |

| Blockchain | Solana |

| KYC Requirement | Minimal or none |

| Key Use Case | Automated market maker (AMM), liquidity provision for concentrated liquidity |

| Token Swaps | Focuses on efficient swaps with concentrated liquidity |

| Liquidity Pools | Offers innovative liquidity solutions with concentrated pools |

| Staking/Yield Farming | Provides staking opportunities for liquidity providers |

| Transaction Speed | Fast transactions due to Solana’s high throughput |

| Security | Non-custodial, users retain control of private keys |

| Supported Wallets | Phantom, Sollet, Solflare, and others |

8.Saros Finance

Saros Finance is a leading Decentralized Exchange (DEX) in Solana ecosystem that focuses on decentralized options trading. Its innovative business model enables users to trade on any option contracts on a fully peer-to-peer platform.

As a provider of fully on-chain decentralized options markets, Saros offers novel risk management tools to Solana’s DeFi scene. Such unique positioning makes Saros an important player in the ecosystem by giving traders additional tools and great freedom than what is afforded on other DEXs.

| Feature | Details |

|---|---|

| Platform | Saros Finance |

| Blockchain | Solana |

| KYC Requirement | Minimal or none |

| Key Use Case | Decentralized perpetual swaps and leveraged trading |

| Token Swaps | Focuses on token swaps and margin trading for various assets |

| Liquidity Pools | Offers liquidity pools for perpetual trading markets |

| Staking/Yield Farming | Staking opportunities for liquidity providers |

| Transaction Speed | Fast transactions thanks to Solana’s high throughput |

| Security | Non-custodial, users control their private keys |

| Supported Wallets | Phantom, Sollet, Solflare, and others |

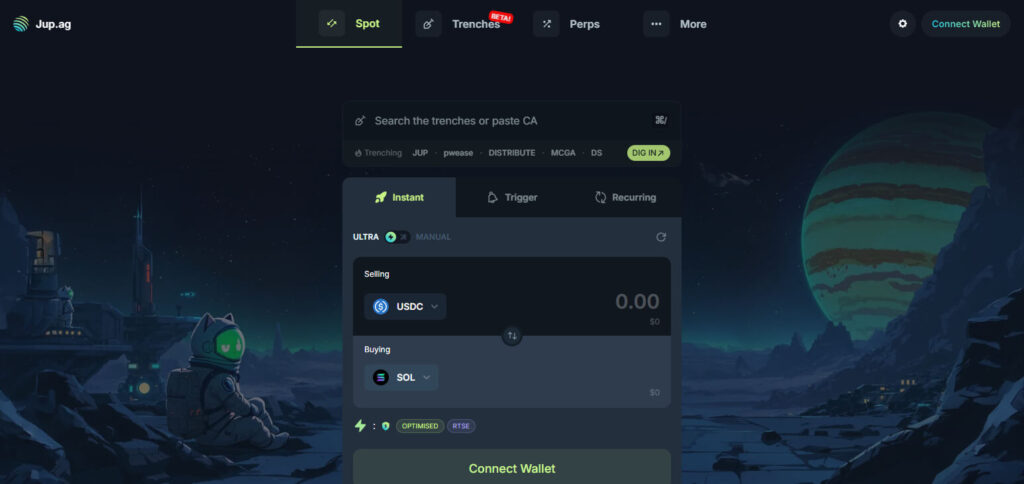

9.Jupiter

Jupiter is a pioneer in the field of decentralized exchanges (DEXs) operating in the Solana ecosystem. As a powerful liquidity aggregator, it optimizes token swaps by utilizing multiple DEXs, minimizing slippage for users.

This approach optimizes trading efficiency and reduces expenses, making Jupiter a top choice for users seeking effortless hyper-competitive swaps throughout the Solana network.

| Feature | Details |

|---|---|

| Platform | Jupiter |

| Blockchain | Solana |

| KYC Requirement | Minimal or none |

| Key Use Case | Aggregator for token swaps, routing trades across multiple DEXs |

| Token Swaps | Aggregates liquidity from various DEXs for efficient token swaps |

| Liquidity Pools | Sources liquidity from multiple decentralized exchanges |

| Staking/Yield Farming | Staking options available through integrated platforms |

| Transaction Speed | Fast transaction speeds due to Solana’s high throughput |

| Security | Non-custodial, users control their private keys |

| Supported Wallets | Phantom, Sollet, Solflare, and others |

10.Atrix

Atrix is a well known decentralized exchange (DEX) which operates within the Solana ecosystem and is known for liquidity farming. It differs from other DEXs in the Solana ecosystem by having single sided liquidity pools that enhance capital efficiency and reduces slippage.

Atrix aims to be the best DEX, in the Solana ecosystem by providing effortless swaps between tokens and highly efficient liquidity pools, all while having rapid transactions and minimal fees. It is clear that with lower fees and increased returns throughout the network, user’s trading experiences are enhanced.

| Feature | Details |

|---|---|

| Platform | Atrix |

| Blockchain | Solana |

| KYC Requirement | Minimal or none |

| Key Use Case | Decentralized token swaps, liquidity provision, and farming |

| Token Swaps | Supports efficient token swaps with low fees |

| Liquidity Pools | Provides liquidity for various Solana-based tokens |

| Staking/Yield Farming | Offers yield farming options for liquidity providers |

| Transaction Speed | Fast transactions powered by Solana’s high throughput |

| Security | Non-custodial, users retain control of private keys |

| Supported Wallets | Phantom, Sollet, Solflare, and others |

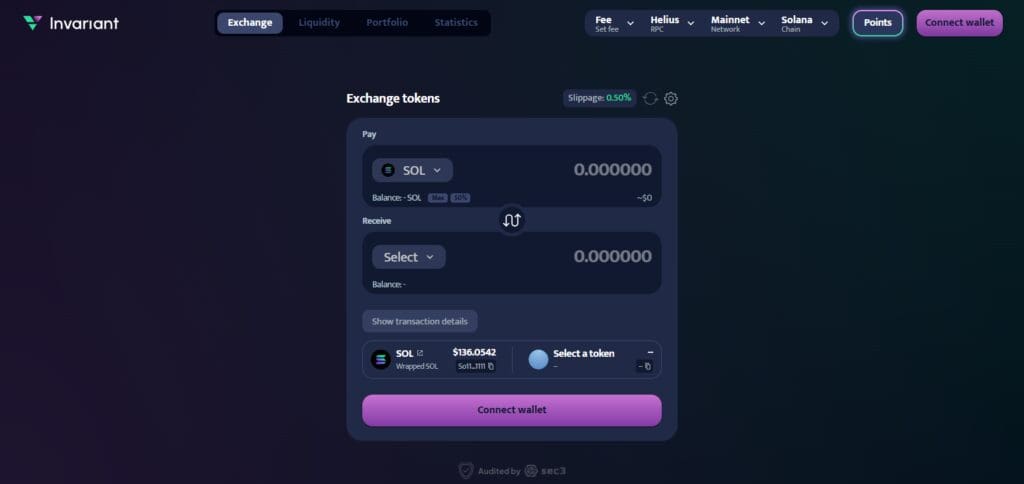

11.Invariant Protocol

Invariant Protocol stands out as one of the most prominent decentralized exchanges in Solana, unlike others, its speciality lies in invariant bonding curves for liquidity pools.

This model enables it to offer deep liquidity and efficient price discovery for countless assets. Invariant employs Cubefy’s assets optimization which translates in the Solana DeFi scene, as a “top slippage and fee” solutions. Users of the exchange gain the most value and find the most reliable services at the light speed Solana provides.

| Feature | Details |

|---|---|

| Platform | Invariant Protocol |

| Blockchain | Solana |

| KYC Requirement | Minimal or none |

| Key Use Case | Decentralized exchange for concentrated liquidity and token swaps |

| Token Swaps | Efficient token swaps with reduced slippage |

| Liquidity Pools | Concentrated liquidity pools for improved capital efficiency |

| Staking/Yield Farming | Staking opportunities for liquidity providers |

| Transaction Speed | Fast transactions due to Solana’s high throughput |

| Security | Non-custodial, users maintain control over private keys |

| Supported Wallets | Phantom, Sollet, Solflare, and others |

12.Aldrin

Aldrin is considered one of the best decentralized exchanges on Solana’s DEX. Aldrin stands out because of its rich Defi eco-system consisting of multi-faceted token swaps, staking, and yield farming.

With a user-focused approach, Aldrin’s clean and simple interface allows even novice traders to easily navigate the platform. Aldrin distinguishes itself with low-fee trades and fast execution of transactions within Solana’s DeFi ecosystem by taking advantage of Solana’s cheap and high-speed transactions.

| Feature | Details |

|---|---|

| Platform | Aldrin |

| Blockchain | Solana |

| KYC Requirement | Minimal or none |

| Key Use Case | Decentralized exchange for token swaps and liquidity provision |

| Token Swaps | Supports fast and low-cost token swaps on Solana |

| Liquidity Pools | Offers liquidity pools for various Solana-based tokens |

| Staking/Yield Farming | Staking and yield farming options available for liquidity providers |

| Transaction Speed | Fast transaction speeds due to Solana’s high throughput |

| Security | Non-custodial, users retain control of private keys |

| Supported Wallets | Phantom, Sollet, Solflare, and others |

Conclusion

To summarize, the best decentralized exchanges (DEXs) in the Solana ecosystem such as Raydium, Orca, Saber, Drift Protocol, Lifinity, Saros Finance, Jupiter, Atrix, Invariant Protocol, and Aldrin each have their own characteristics that propell the Solana ecosystem further.

With superior liquidity solutions, exceptional trading features and user friendly interfaces, these DEXs are fueling Solana’s growth and giving traders instant access to their resources at low cost while preserving decentralization’s primary tenets.