I will cover the Where Is Bitcoin Mined, subsequently analysing the principal sites that currently underpin worldwide mining operations.

The process entails the coordination of computational clusters and substantial electrical input, which renders both physical geography and the cost of electricity decisive factors.

Principal clusters—namely the United States, Kazakhstan, Russia, Canada, and, until late 2021, mainland China—secure a disproportionate share of network hashing capacity owing to tariffs on power, accommodating policy frameworks and well-developed logistical and digital infrastructure.

Together, these countries continue to exercise a formative influence over the architecture and security of the Bitcoin network.

What Is Bitcoin Mining?

Bitcoin mining validates and permanently inscribes transactions onto the Bitcoin blockchain. Miners employ high-performance computers to address cryptographic puzzles through proof-of-work, an effort that safeguards consensus and thwarts double-spending.

Rewards accrued by miners consist of both the subsidy of newly minted Bitcoin and the fees attached to processed transactions, thereby aligning economic motivation with network integrity.

The activity demands specialized application-specific integrated circuits (ASICs), occasions severe electrical consumption, and elevates considerations of regional suitability and marginal electricity cost to paramount importance.

In aggregate, mining employs a distributed architecture to preserve the ledger’s immutability while concurrently introducing Bitcoin to the circulating supply.

Factors Influencing Bitcoin Mining Locations

Electricity Expense: Given the enormous power consumption required, access to low-cost, consistently available electricity remains the single most influential determinant of economic viability.

Ambient Temperature: Jurisdictions characterized by naturally cooler temperatures permit reduced cooling burdens, translating directly into lower operational expenditures.

Legal Framework: Nations that adopt transparent, supportive cryptocurrency legislation attract sustained mining interest, whereas jurisdictions with punitive or ambiguous statutes experience significant capital flight.

Supporting Infrastructure: Continued operational integrity demands proximity to high-performance data networks, resilient power distribution grids, and modular data-center technologies.

Component Supply: Prompt and economical access to specialized mining hardware—particularly high-efficiency ASIC modules or high-density GPU units—shapes the feasibility landscape.

Fiscal Encouragement: Targeted tax abatements or direct capital subsidies provide decisive economic nudges, shifting the relative attractiveness of competing jurisdictions.

Top 5 Countries for Bitcoin Mining

1.China

China has long served as the pre-eminent center for Bitcoin mining, largely owing to its vast reservoirs of inexpensive, dispatchable power derived chiefly from coal and hydroelectric plants.

Gigantic mining operations proliferated in jurisdictions such as Sichuan and Inner Mongolia, where tariff concessions, established supply chains, and substantial grid capacity converged. Although the 2021 regulatory purges succeeded in curtailing onshore operations, the operational templates, cooling innovations, and firmware optimizations pioneered in these provinces continue to inform global best practices.

The Chinese episode to date has thus elevated electricity abundance and engineering economies of scale to canonical status in the design of Bitcoin networks, firmly embedding the region in the historiography of cryptocurrency evolution.

2.United States

The United States has positioned itself as a preeminent center for Bitcoin mining by leveraging extensive, low-carbon energy resources alongside a robust and contemporary infrastructure. Regions such as Texas and Kentucky present consistently low energy prices, pro-mining legislation, and a regulatory environment that favors capital investment, thereby enhancing the profit margins of large-scale mining enterprises.

Furthermore, the nation enjoys superior broadband penetration, enabling rapid data transfer, and the availability of state-of-the-art mining rigs, ensuring operational efficiency. Collectively, these factors—affordable and predominantly renewable electricity, advanced technological ecosystems, and strategic governmental endorsements—solidify the U.S. standing as a key contributor to the Bitcoin ecosystem, fostering both technological advancement and the system-wide pursuit of greater sustainability.

3.Kazakhstan

Kazakhstan has emerged as a prominent locus for Bitcoin mining, driven by exceptionally low electricity tariffs and an abundance of low-quality lignite coal generation.

The regulatory landscape remains permissive, supplemented by targeted state inducements, thereby enticing foreign mining corporations in pursuit of margin expansion. Extensive mining complexes have materialized, engineering Kazakhstan’s energy advantages and beneficial latitudinal location.

Although the concentration of mining capacity continues to implicate compelling greenhouse-gas externalities, the synergy of competitively-priced energy, expanding transactional and logistical infrastructure, and an advantageous central-continental position distinguishes the country as a vital node within the world’s cryptocurrency mining architecture.

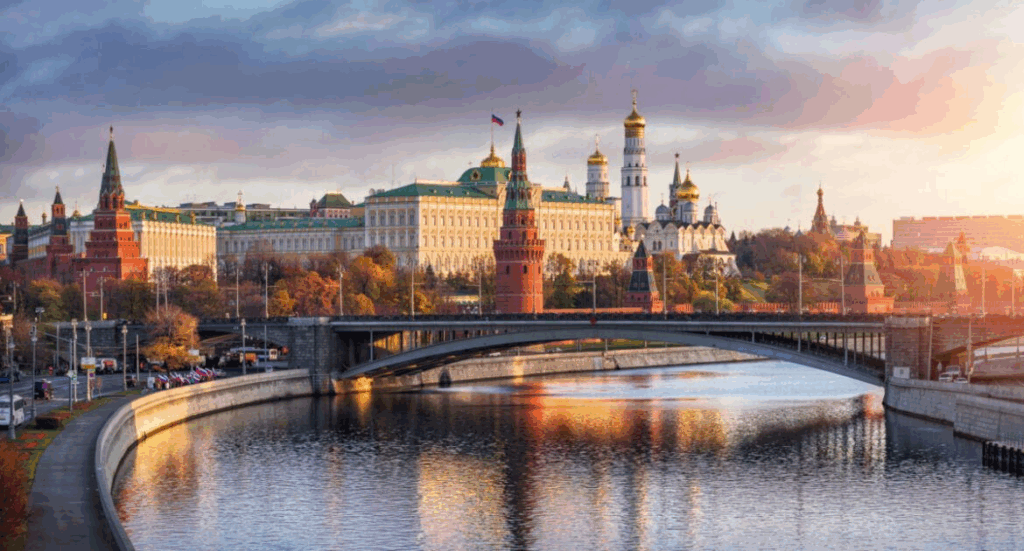

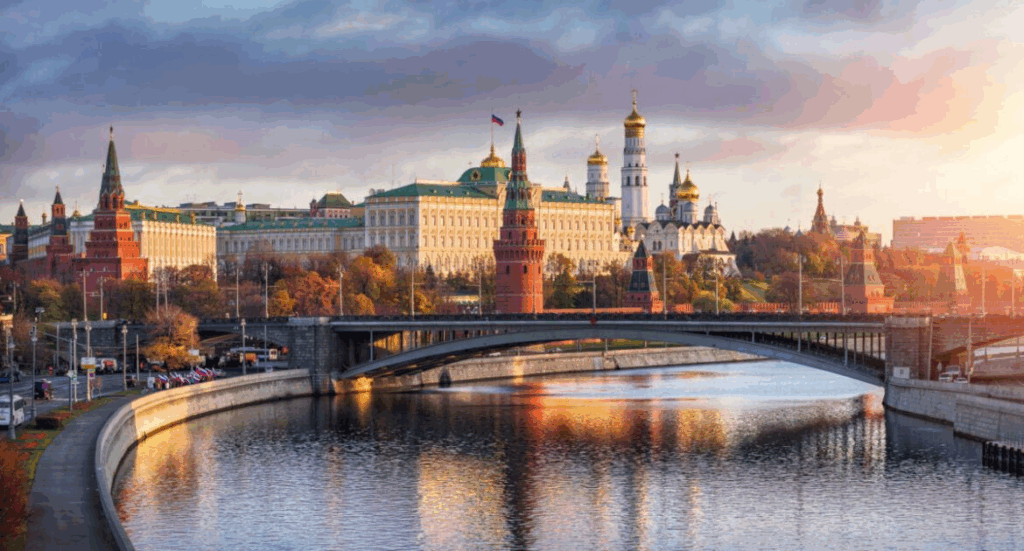

4.Russia

Russia has established itself as an influential centre of Bitcoin mining, leveraging its immense energy endowment and frigid climate, which collectively mitigate the thermal management costs central to the operation of mining rigs.

Provinces across Siberia furnish economical electricity, chiefly from hydroelectric and stranded natural gas resources, thereby drawing both local and foreign mining operations. Concurrently, the country’s expansive geographic surface permits the deployment of extensive mining complexes, insulated from hydrological and demographic pressures.

Taken together, these advantages, together with an accelerating domestic appetite for cryptocurrency, secure Russia’s role as an essential and competitively priced locus for large-scale Bitcoin production.

5.Canada

Canada has emerged as a focal point for Bitcoin mining, drawn primarily by extensive hydroelectric capacity that supplies low-cost, renewable power. Advantageous regional hydro basins deliver electricity that is sustainable, inexpensive, and readily expandable.

Complementing this, the nation’s chilly climate provides passive cooling for mining rigs, further decreasing energy expenditures and equipment wear. Quebec and British Columbia, in particular, feature robust, well-integrated power networks alongside a consistently favourable regulatory atmosphere, thereby attracting sizable, long-term mining projects.

By leveraging these characteristics, the country not only secures a growing share of the global hashrate but also shifts the cryptocurrency ecosystem toward comparatively lower-carbon production, thereby encouraging wider adoption of environmentally responsible operational standards.

Environmental Impact of Bitcoin Mining

Bitcoin mining exerts a considerable and distinct environmental toll, rooted chiefly in its persistent demand for electricity. The mining process draws an array of high-performance servers, perpetually active, which in many cases remain tethered to fossil-fuel power grids; consequently, elevated carbon emissions follow.

Areas that depend predominantly on coal-fired generation record especially acute effects. Alongside this, the accelerated replacement of mining hardware produces substantive volumes of e-waste, further straining environmental pathways.

Although a measurable segment of operators has begun to migrate toward renewable-energy feeds in an effort to dim the overall ecological imprint, investigations reveal that the cumulative burden—the product of persistent, distributed, and securitized computational effort—continues to warrant—hostile to carbon neutrality—robust policy discourse, the advancement of hardware efficiency, and the concerted adoption of reformulatory.

Future Trends in Bitcoin Mining

Emerging trajectories for Bitcoin mining are being recalibrated by interlinked factors of technological advancement, energy economics, and an evolving regulatory landscape. Operators are progressively migrating towards ultra-efficient ASICs and are strategically exploiting renewable energy supplies to lower marginal costs and mitigate ecological footprints.

Concurrently, firms are likely to relocate to jurisdictions characterised by accommodating legal frameworks and persistently low power tariffs. Innovations in immersion cooling, waste-heat recovery, and adaptive mining firmware will further amplify operational efficiencies and raise marginal profit margins.

Furthermore, the proliferation of geographically-distributed, permissionless mining pools, alongside the development of Layer-2 architectures, stands to redistribute hashing power in a manner that reinforces network security whilst entrenching the sustainability and scalability of Bitcoin’s underlying ledger.

Pros & Cons

| Pros | Cons |

|---|---|

| Earning Potential: Miners earn Bitcoin rewards and transaction fees. | High Energy Consumption: Mining requires large amounts of electricity, increasing costs and environmental impact. |

| Supports Network Security: Mining validates transactions and secures the blockchain. | Expensive Hardware: Specialized mining equipment like ASICs is costly. |

| Decentralization: Encourages a distributed network, reducing reliance on central authorities. | Technical Complexity: Mining requires technical knowledge and maintenance skills. |

| Potential for Appreciation: Mined Bitcoin may increase in value over time. | Regulatory Risks: Legal restrictions or government crackdowns can affect mining operations. |

| Innovation Driver: Promotes development of efficient technology and renewable energy solutions. | Hardware Depreciation: Mining equipment becomes obsolete quickly. |

Conclusion

In summary, Bitcoin mining functions as an international enterprise shaped by variations in power pricing, climatic conditions, technological infrastructure, and regulatory environments. Nations such as the United States, Kazakhstan, the Russian Federation, Canada, and, until recently, the People’s Republic of China, have emerged as preeminent centers because of their abundant energy and, in some instances, deliberately supportive policy frameworks.

Beyond its role in network security, mining contributes the creation of fresh supply into the Bitcoin economy. Future developments in digital extraction—fueled by technological refinement and increasing adoption of green energy solutions—will recalibrate the framework in which miners operate, striving to reconcile economic yield, process efficiency and ecological accountability.

FAQ

What is Bitcoin mining?

Bitcoin mining is the process of validating transactions on the blockchain using powerful computers, securing the network, and earning new Bitcoin as rewards.

Which countries mine the most Bitcoin?

Currently, major Bitcoin mining hubs include the United States, Kazakhstan, Russia, and Canada, while China previously dominated the industry.

Why are electricity costs important in Bitcoin mining?

Mining consumes huge amounts of energy, so cheap and reliable electricity is critical for profitability.