In this article, I will to talk about How to Buy BlackRock Bitcoin ETF while giving special attention to the iShares Bitcoin Trust (IBIT).

This particular investment could be made through any normal brokerage account without the need to own the actual Bitcoin.

Don’t worry, I will walk you through from how to set up a brokerage account to how to place an order, so you do not get lost while doing it.

About BlackRock Bitcoin ETF

The BlackRock Bitcoin ETF is a suggested exchange-traded fund (ETF) which targets direct investment into Bitcoin without the hassle of buying or storing the cryptocurrency.

Managed by BlackRock, the world’s largest asset management firm, this ETF would follow the movements of Bitcoin’s price, providing an easier way to invest in Bitcoin as compared to other options.

The approval of the ETF would greatly change the landscape of institutional adoption and investment in Bitcoin and other digital assets, as it would facilitate the merge of traditional finance and cryptocurrencies.

How to Buy BlackRock Bitcoin ETF

To purchase the Bitcoin ETF offered by Blackrock, here is a stepwise guide:

Open a Brokerage Account

Pick a brokerage firm that has ETFs on offer like Fidelity, Charles Schwab, or E*TRADE.

Locate ETF Ticker

If the ETF is granted approval and launched, do a search for its ticker symbol such as “BTCX” or other variations.

Deposit Cash

Be sure to add funds to your brokerage account so you will be ready to purchase the ETF shares.

Place a Trade

Look up the BlackRock Bitcoin ETF on the brokerage platform and pick out how many shares you would like to purchase. Place a buy order for the shares selected.

Monitor your investment

Keep an eye on how well the ETF is performing and modify your holdings when appropriate.

How do BlackRock Bitcoin ETF work

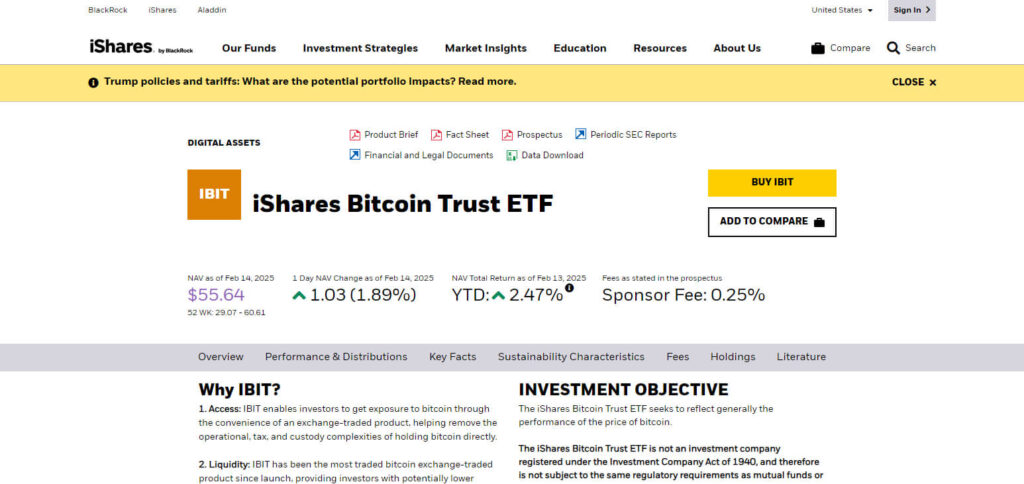

The iShares Bitcoin Trust (IBIT) is an ETF offered by BlackRock that facilitates investment in Bitcoin without having to own the coin directly. This is how it operates:

IBIT’s Fee Structure

BlackRock Implements an annual management fee of 0.12 percent which ranks IBIT as one of the cheapest Bitcoin ETFs around.

Ownership of Actual Bitcoin

The IBIT ETF owns physical Bitcoin, which means that the value of shares in the ETF track the price of Bitcoin.

Stocks Trading on Stock Exchanges

IBIT shares can be purchased or sold over stock markets which makes investing in Bitcoin accessible through regular brokerage accounts.

Storage and Protection

The custody of the Bitcoin is done by a regulated third party who takes care of the assets, lowering the issues that come with personal possession.

Price Fluctuations and Availability of a Commodity

IBIT is known to trade on the markets which leads to an increase or decrease in its price during the working hours based on the active buy and sell orders.

Top How to Buy BlackRock Bitcoin ETF

iShares Bitcoin Trust (IBIT)

BlackRock’s iShares Bitcoin Trust (IBIT) is a Bitcoin ETF that holds Bitcoin directly for issuers, giving investors unnecessary exposure without investing in Bitcoin directly.

Investors access it through brokerage accounts like stocks, because it is listed on conventional stock markets.

IBIT does not require complicated custody solutions, sophisticated security protocols, or multi-signature wallets which makes Bitcoin investing a lot easier.

Being a BlackRock product, it comes with institutional level security and compliance which makes it desirable for mainstream investors.

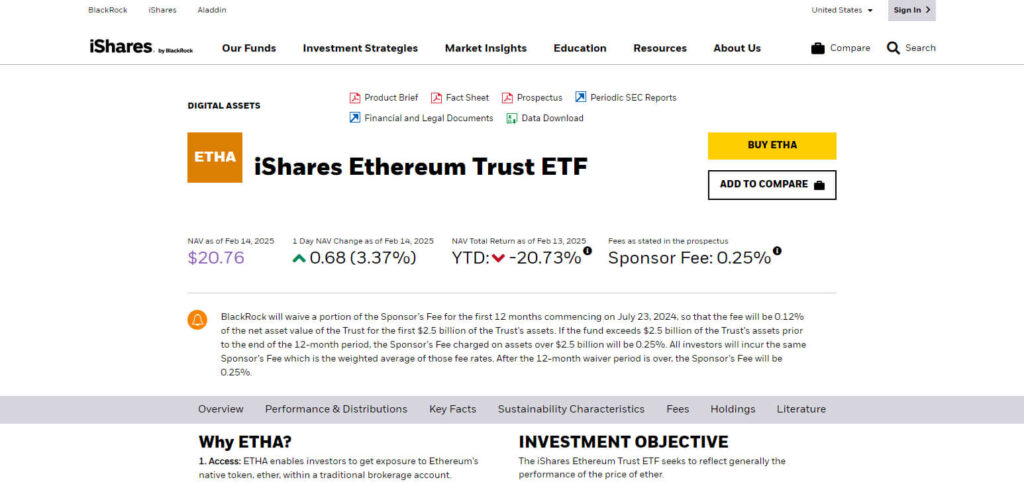

iShares Ethereum Trust (IETH)

Designed to offer direct exposure to Ethereum without requiring investors to hold the asset directly, the iShares Ethereum Trust (IETH) is BlackRock’s spot Ethereum ETF.

Similar to IBIT for Bitcoin, IETH is tradeable on stock exchanges and thus accessible through normal brokerage accounts. Its institutional-grade security, alongside regulatory scrutiny, forms the primary advantage over mainstream retail products by allowing investors to benefit from Ethereum’s growth without the risks associated with private key management and custody.

iShares Crypto Innovators ETF (ICRYPTO)

The iShares Crypto Innovators ETF (ICRYPTO) focuses on companies operating in the crypto sphere instead of investing in Bitcoin directly.

Differently than IBIT, which holds Bitcoin directly, ICRYPTO acquires shares of firms involved in crypto mining, exchange, and other blockchain technology related businesses.

Even though this ETF is invested in the broader crypto market, it helps in reducing the direct impacts of the market’s volatility. This strategy is better suited for investors looking for broad diversification in crypto assets under the institutional-level management and risk control from BlackRock.

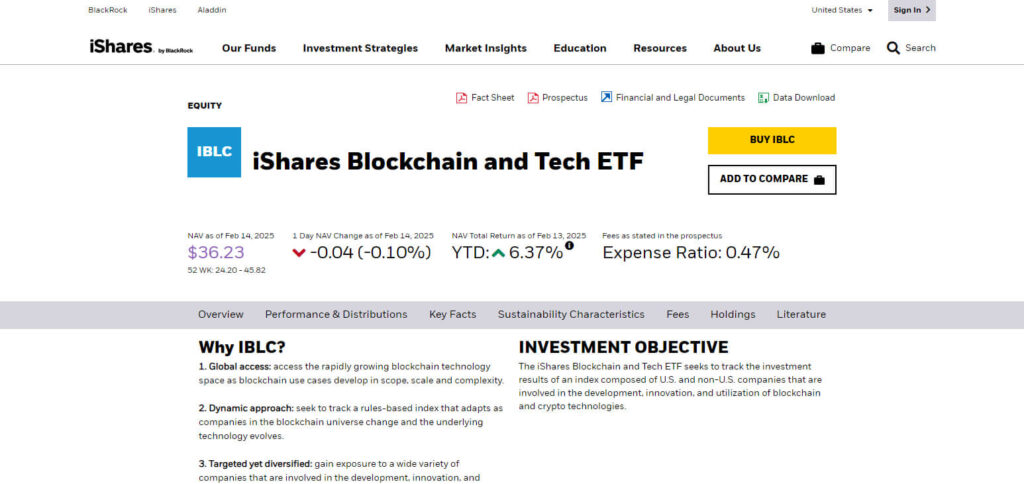

iShares Blockchain and Tech ETF (IBLOCK)

Rather than directly offering Bitcoin, the iShares Blockchain and Tech ETF (IBLOCK) invests in companies that have exposure to blockchain development and cryptocurrency inclusively.

IBLOCK, unlike IBIT, focuses on Bitcoin adjacent industries such as fintech, mining, and decentralized finance.

This ETF enables investors to access the broad blockchain ecosystem whilst utilizing BlackRock’s institutional knowledge and risk management expertise in the ever changing cryptocurrency environment.

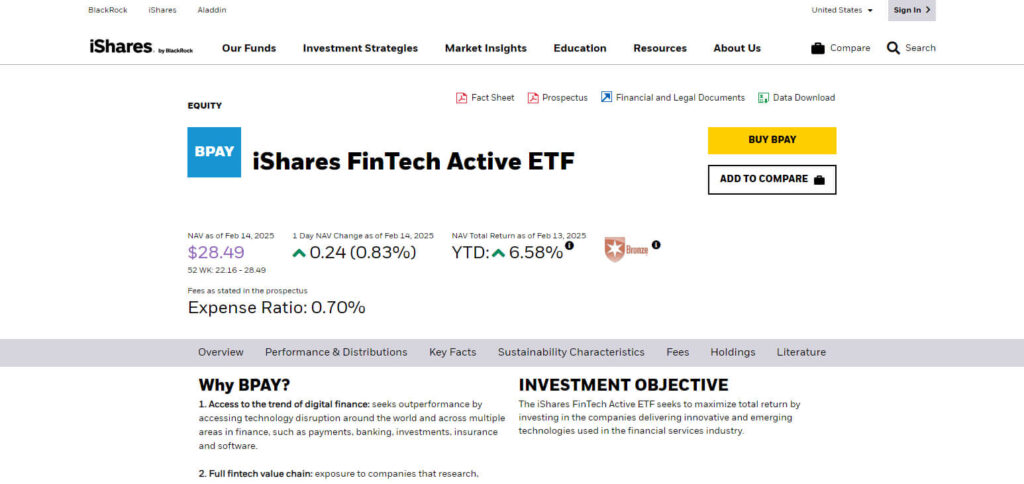

iShares Digital Assets and Fintech ETF (IDIGI)

IDIGI is designed to track companies involved in the proliferation of digital finance, blockchain technology, and cryptocurrency, which definitely makes for an interesting investment.

While IBIT holds Bitcoin directly, IDIGI’s investments are in the equity of fintech companies, payment processors, and blockchain-centric financial service firms.

This fund allows investors to take advantage of the growing digital economy while elevating BlackRock’s institutional level security, giving broad coverage to the technological revolution in finance that is transforming the world.

Conclusion

Before you buy the BlackRock Bitcoin ETF like the iShares Bitcoin Trust (IBIT), make sure to first open a brokerage account with a platform that provides the ETF option.

Once you add money to your account, look for the IBIT ticker symbol and order the dollop of shares that you wish to purchase.

The steps are identical to purchasing stocks, which provides a simple yet legal means on investing in Bitcoin. Not only is there no need for directly managing cryptocurrency, but also the protection and supervision of BlackRock’s deep-seated management is provided.