In this article, i will discuss the sources which provide the daily trading volume for micro-caps. Keeping track of trading volume is important to getting the activity of the market as well as investment decisions.

We will examine several reputable sites which specialize in providing current information on micro cap token volumes.

Where To Check Daily Trading Volume For Micro-cap Tokens

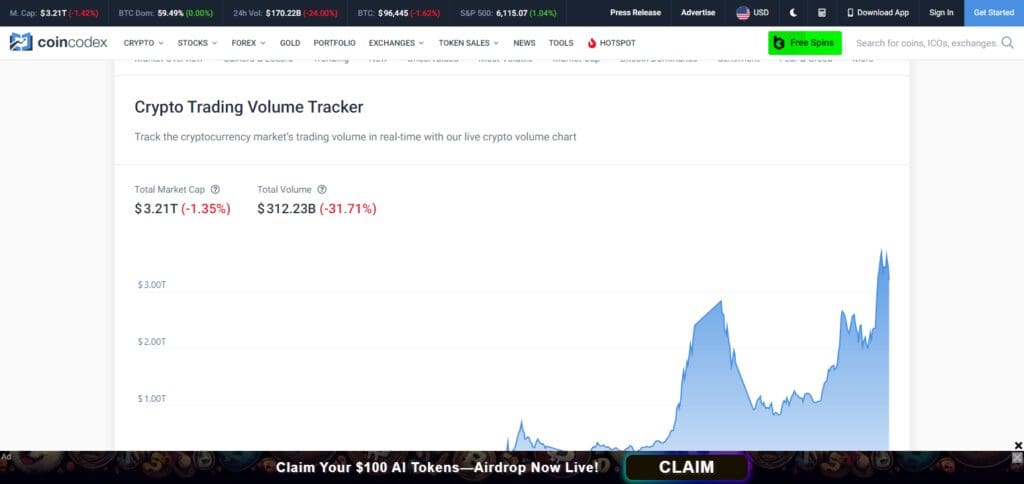

To keep track of the daily trading volume conducted on micro-cap tokens, there are numerous websites with comprehensive market data that can be used. For example, here is how to go about it on CoinCodex.

Step 1: Check out CoinCodex

Use the web browser of your choice to open the CoinCodex website.

Step 2: Go to Trading Volume

From the CoinCodex homepage, look out for the section dubbed “Trading Volume.” You can get it also under the “Market Overview” option or by using the link provided above.

Step 3: Look Up The Micro-Cap Token

In the search bar look up the name or the micro-cap’s token you wish to analyze. For instance, if you want to analyze the trading volume for “TokenX,” look up “TokenX.”

Step 4: Analyze Trading Volume Metrics

After locating “TokenX,” click on the name to get more in depth details about the token. Pay attention to “Volume(24h)” section. This represents the number of tokens traded in 24 hours. Normally, trading volume data is reported in USD or in the native currency of the token.

Step 5: Data Analysis

Drill down into the values obtained from the token in regards to Volume to know how active the token is in the market. Increased trading indicates increased market activity. Conversely, lower volume signals market inactivity.

Some Popular Platform Check Daily Trading Volume For Micro-cap Tokens

| Platform | Website |

|---|---|

| CoinMarketCap | coinmarketcap.com |

| CoinGecko | coingecko.com |

| LiveCoinWatch | livecoinwatch.com |

| CryptoCompare | cryptocompare.com |

| CoinPaprika | coinpaprika.com |

| CoinCheckup | coincheckup.com |

| CoinLib | coinlib.io |

Historical trading volume of crypto assets since 2013

The peak height of cryptocurrency trading witnessed in 2024 surged up to an astonishing $149.39 Trillion. Moreover, it was on the 17th of September of 2020 that the record for the most single trading day was set, with an approximate of $4.88 Trillion traded.

| Year | Yearly Trading Volume | Yearly Change |

|---|---|---|

| 2013 | $ 258.49M | – |

| 2014 | $ 13.04B | 4,945.30% |

| 2015 | $ 14.26B | 9.35% |

| 2016 | $ 43.09B | 202.19% |

| 2017 | $ 22.89T | 53,020.10% |

| 2018 | $ 4.94T | -78.42% |

| 2019 | $ 22.14T | 348.09% |

| 2020 | $ 44.42T | 100.69% |

| 2022 | $ 82.17T | 84.97% |

| 2023 | $ 76.75T | -6.59% |

| 2024 | $ 149.39T | 94.64% |

| 2025 | $ 17.83T | -88.07% |

These metrics tell a story of the past decade, showcasing the popularity and the volatility associated with the cryptocurrency market. The massive peaks and lows in traded volumes emphasize the dynamic and ever-evolving state of the market, affected by factors like regulations, technology, and the global economy as a whole.

Analyzing Trading Volume Data

For effective market trend analysis and making sound investment decisions, studying trading volume data is extremely important. The following steps will guide you in analyzing strategy volume data effectively.

Understand Trading Volume

The trading volume is the total number of shares or tokens traded within a particular duration which is mostly 24 hours for cryptocurrencies.

Identify Trends

Look for persistent patterns on the graph of trading volume over time. If the volume is higher than average in a period, it may suggest strong interest or liquidity. Low interest could suggest limited market activity.

Compare with Price Movements

Check the correlation between trading volume and price movements. Rising prices accompanied with an increase in volume indicates strong buying interest whereas an increase in volume and fall in prices indicates strong selling pressure.

Volume Spikes

Always be on the lookout for sudden spikes in volume, which may suggest notable events like news updates, new partnerships or changes in market sentiment.

Use Moving Averages

Although there can be volatility in trading volume data, moving averages can be used to identify long term trends. Common periods for moving averages include 20-day, 50-day and 200-day.

Analyze Relative Volume

Relative volume is a way to compare current trading volumes with the average volume of the past. A higher ratio indicates greater interest/activity than normal.

Monitor Volume Indicators

Track volume changes with On-Balance Volume (OBV) and the Volume Price Trend (VPT). These indicators will aid in confirming the price movements and possible reversal ranges.

Cross-Reference with News and Events

Relate the volume change with any news published, regulation changes, or any notable actions in the market. This will help explain the reason behind the volume variation.

Use Analytical Tools

Use TradingView, Token Terminal, or CoinGecko. These analytical tools give access to in-depth volume analysis features for better decision making.

Stay Updated:

Keeping an eye on trading volume is critical for understanding ever fluctuating market conditions and making proactive investment choices.

Best Practices for Monitoring Micro-Cap Token Volumes

Track Using Reliable Platforms

Make sure to track daily trading volumes using reputable platforms like CoinMarketCap, CoinGecko, and CoinCodex. They have extensive coverage across different currencies and provide correct and timely information.

Set Alerts

Set alerts on the platform of your choice for life changing spikes in trades, this will enable you to be kept up to date with any sudden increases or decreases.

Analyze Historical Data

Check historical records to trace changes in trading volume, this analysis can help you understand the token’s movements in the market over a period.

Cross-Reference Data

Cross-reference from different platforms to build a more accurate profile for the trading volume data. This reduces the chances of relying on false and outdated data.

Monitor Market Sentiment

Bear in mind social networks, forums, and news media as they constantly criticize or praise assets which can greatly affect the trading volume.

Stay Informed About Market Events

Be alert on anything that concerns the industry, such as new token listings, partnerships or even new regulations as they can greatly impact volume fluctuations. It helps to always be on alert to guess the movements of the market.

Use Analytical Tools

Use analytical tools and applications to help with the comprehension of trading volumes. TradingView and Token Terminal are perfect examples for advanced features of the volume analysis.

Expand your Sources:

Avoid focusing only on a particular tool or platform. To understand the market place better, ensure that you have various sources to gather information.

Conclusion

So, to wrap things up, it is crucial for investors to be diligent in tracking daily trading activity of micro-cap tokens. These websites’ designs makes it easy to get information, as these platforms provide accurate data on trading volumes; reliable sources like CoinMarketCap, CoinGecko and CoinCodex track volume information for their users.

Market surveillance will help investors in tracking activity in the market, spotting significant patterns or trends, and fine-tuning investments.

Knowing trading volumes assists investors in doing everything necessary to stay active in micro-cap tokens. If you have any further questions or issues, do not hesitate to reach out!