In this article I will explain the Why Are Binance Fees So High. Apart from being one of the largest crypto exchanges in the world, Binance provides a plethora of trading options which do come at a price.

Going through the Binance fee structure makes it easy for users to determine the likelihood of making a profit when using any of the trading options.

In the following paragraphs, we shall delve into issues like network congestion, advanced tools and operating costs that determine the cost matrices.

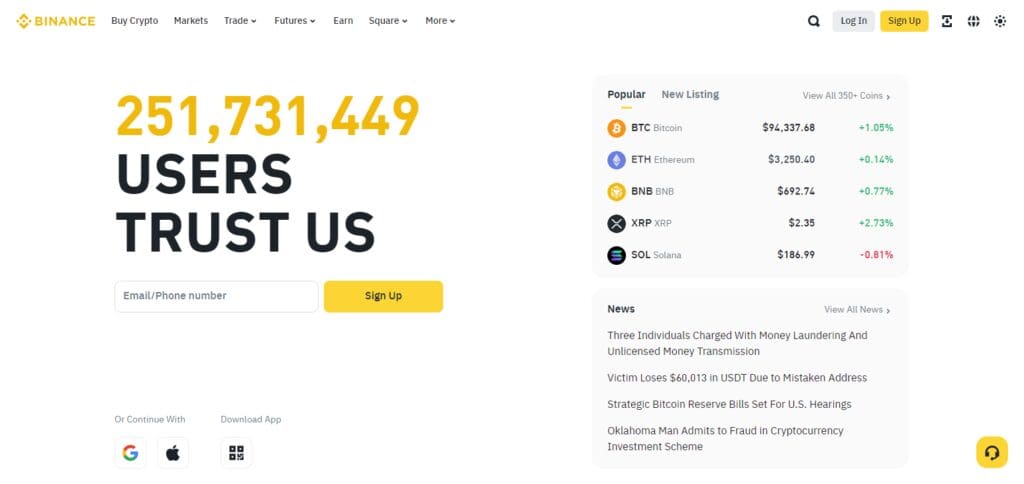

What Is Binance

Binance is an exchange that allows people to trade cryptocurrencies, and it is one of the biggest in terms of the volume that goes through it. Here, users get to trade with low fees, with a plethora of cryptocurrencies at their disposal, such as Bitcoin and Ethereum.

Alongside the low fees, this cryptocurrency exchange also has flexible features such as futures, staking, and a broad assortment of trading pairs, all while ensuring the interface remains secure. Overall, this exchange is simple, yet effective, targeting the needs of first-time and professional investors.

Why Are Binance Fees So High?

Trading Fees

Binance implements a consistent cost of 0.1 percent when it comes to spot trading. Moreover, if you own certain Binance coin (BNB), the costs are cut down by an impressive 25 percent.

Withdrawal fees

Binance account holders get charged approximately 0.0005 BTC for each Bitcoin withdrawal from the account. Keep in mind, this amount is always subject to change depending on the type of cryptocurrency withdrawn.

Market Spread

The market spread refers to the difference between the buy price and the selling price of an asset which in turn influences the overall cost associated with a single trade. Usually, the higher the market spread is, the more it will cost to complete a trade even when the fees associated with trading might be cheaper.

Liquidity

The relationships between large volumes of things with regard to markets that are thin usually have a greater spread therefore the cost to trade increases.

Revenue Generation

When the fees are raised, the intended purpose must be kept in mind. In this case a reason as to why the fees are raised is to generate higher revenue for the market which can then be used for growth and enhancing the services.

Encouraging Holdings

When customers are charged higher service fees put on them as a means to be encouraged to keep their funds in exchange for greater trading and therefore higher income.

Types of Fees on Binance

Trading Charges

- Spot Trading Fee – The cost of purchasing and selling digital coins on the spot market.

- Futures Trading Fee – The cost of trading futures contracts on the Binance platform.

- Margin Trading Fee – The fee charged for borrowing capital to trade in larger amounts in the margin market.

Fees for Withdrawal

You will pay a fee when you transfer your cryptocurrency or fiat currency from your account to an external wallet or bank account. The fee varies by type of cryptocurrency or fiat currency.

Fees for Deposit

As a rule, there are no fees charged for the deposit of cryptocurrencies, but a fee will apply for certain fiat deposit modes such as credit/debit card.

Fees for Funding (for Futures)

These are expenses incurred for holding a futures position overnight. This applies to both long and short positions..

Fees for Conversion

These are the expenses incurred when converting from one cryptocurrency to another on Binance’s exchange service.

Staking Fees

Binaries charge users when they stake certain coins based on the rules around the token and its staking period.

BNB Credit on Fees

Fees incurred for trading and withdrawal commissions on the Binance platform can be paid in Binance Coin (BNB) at discounted rates.

Factors Contributing To High Fees

Restrictions on Withdrawal

With the rise in Bitcoin’s price, in order for Binance to permit withdrawal, the network costs would rise thereby increasing the transaction fees.

Bitcoin Market Demand

Due to the current trend of Bitcoin, the market demand is high and the liquidity and circulation of Bitcoin rise which causes the fee structure to change.

Security Enhancements

As part of their operation, Binance offers a range of security measures which protect their users but also come at an extra cost which is likely to reflect in the fee.

Traders with more complex tools and security

Using features such as margin, leveraged and futures costs a lot in order to maintain them. Due to the risk and complexity involved, these features are likely to incur extra fees.

Enhanced Costs of Global Regulation Compliance

For regulations across the globe, Binance is required to maintain a high operational fee which ultimately increases the charges.

Fees User and Maker

Depending on the circumstances, market users and makers may end up paying different amounts for the services of a market and sometimes users may even pay more than the market makers.

Pros And Cons

Pros:

Security Ensured: With a robust 2FA authentication system in place, Binance’s fees are reasonable and match the security that Binance offers to their customers.

Best of the Best Features: The recent tools and features launched require a lot of development and resources. The tools launched are a wide range of advanced tools supported by the high fees match the development that took place.

Traders Always Have Options: The level of service Binance offers is unrivaled, and with all world class platforms, there is an associated cost that traders always have to incur. The cost that users pay reflects the quality of liquidity provided by the platform.

Everyone Can Access The Platform: The reason the fees are high is due to the fact that the operating areas are diverse and come with their own set of regulations, and ensuring that the platform is easily accessible to everyone requires high operational costs.

Cons:

Trading Might Get Expensive: If a user is a frequent trader then the fees can be an inconvenience as the trading costs can build up. High user fees around trading and withdrawing will have a negative impact.

Withdrawals May Cost More: Network congestion can lead to users facing higher withdrawal fees which may be an annoyance to users looking to frequently move their assets.

Binance Slows Down Beginners: With other platforms offering new traders little to no fees, the high fees can be discouraging for new users on Binance making the platform unattractive for new investors looking to join in.

Conclusion

All in all, Binance’s exorbitant fees look to be affected by elements such as, the congestion of networks, the requirement for high level protection and, the extensive packs of trading amenities provided.

Even though the fees contribute to the overall safety and liquidity of the space, as well as reach to a global audience, they may pose an issue to some small traders or people who would like to trade in small volumes.

On the other hand, advanced traders looking for a platform with ample features are often alright in paying high fees to Binance and see it more of an investment.