I will be analyzing the pros, risks, and profitability of Yield FarmingPolygon and BSC in this article. Polygon has low fees, fast transactions, and the security of Ethereum which is perfect for stable farming.

Whereas, BSC has higher APYs and a more developed DeFi ecosystem, but greater risks. Let’s ealuate which network is more suitable for your farming needs.

What Is Yield Farming?

Yield farming is defined as a subspecialization of Decentralized Finance (DeFi) that involves lending or staking one’s cryptocurrency in liquidity pools for earning rewards, often additional tokens.

The additional token rewards stem from the trading profits, interest earned, governance tokens, and other incentives offered by the DeFi platform. Yield farmers often borrow from one platform to increase their returns from another platform.

Some increase their returns further by compounding rewards on themselves. Although farming yields can provide good returns, it is highly risky as well due to impermanent loss, volatile markets, smart contract bugs, etc.

What is Polygon?

Polygon is a Layer-2 scaling solution for Ethereum that enhances transaction throughput, lowers costs, and maintains security. Polygon, previously Matic Network, further optimizes the blockchain by implementing sidechains and rollups which enable users to interact with dApps at a lower cost than Ethereum’s mainnet.

It is widely used across DeFi Aave, QuickSwap, and SushiSwap which makes it popular for yield farming, NFTs, and gaming. Polygon has emerged as a leader in the blockchain sector where they support the transfer of assets between Ethereum and other chains due to their interoperable, low fee, high transaction speed, and moderate decentralized infrastructure.

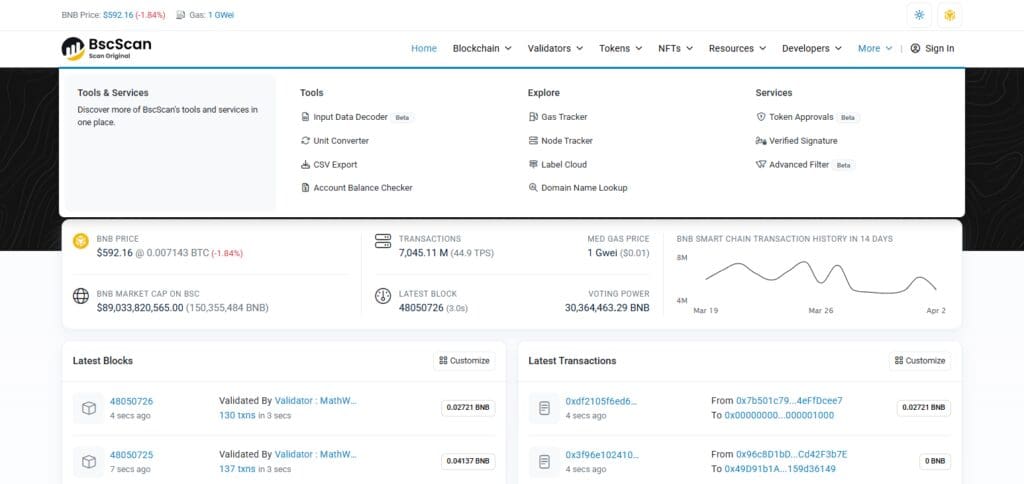

What is BSC?

The Binance Smart Chain (BSC) is a high-performance blockchain created by Binance to enable low-fee smart contracts and decentralized applications (dApps) with quick transactions. BSC was launched in 2020 alongside Binance Chain.

It supports EVM, meaning developers can effortlessly port Ethereum-based projects. BSC is mostly used for DeFi, yield farming, NFTs, and gaming; PancakeSwap, Venus, and Alpaca Finance are among the most prominent in the BSC ecosystem.

While BSC enables cost-effective and rapid transactions, it is more centralized than Ethereum since Binance controls most of the validators. Regardless, BSC is one of the most preferred blockchains for DeFi and high-yield farming opportunities.

Yield Farming on Polygon vs. BSC

Yield farming on Polygon and Binance Smart Chain (BSC) offers different advantages and trade-offs based on transaction costs, security, ecosystem, and potential rewards.

Polygon vs. BSC Yield Farming Comparison

| Feature | Polygon | BSC (BNB Chain) |

|---|---|---|

| Transaction Fees | Extremely low (fractions of a cent) | Low but higher than Polygon (few cents) |

| Transaction Speed | Fast (~2 seconds per block) | Fast (~3 seconds per block) |

| Ecosystem | Strong DeFi presence (Aave, QuickSwap, Balancer) | Larger ecosystem (PancakeSwap, Venus, Alpaca) |

| Security | More decentralized but some bridge vulnerabilities | Centralized with past exploits (bridge hacks) |

| Rewards & APY | Competitive yields, sometimes lower than BSC | Higher APYs but often riskier pools |

| Smart Contract Risk | Moderate risk (Ethereum-based security) | Higher risk due to more exploits/hacks |

How Yield Farming works on Polygon

The act of yield farming on Polygon (MATIC) entails earning rewards by staking or lending crypto assets in decentralized finance (DeFi) protocols. Polygon is an Ethereum Layer-2 scaling solution and it has positional advantages for farming yields on it because of its high transaction speeds and low cost.

How to Start Yield Farming on Polygon

Purchase MATIC and Link to Polygon:

You can get MATIC from exchanges like Binance and Coinbase. You can move assets from Ethereum to Polygon using Polygon Bridge. You can use Web3 wallets like MetaMask and Trust Wallet.

Select a Platform for Yield Farming

Aave – undertake lending of Cryptocurrency to earn Interest.

QuickSwap – Providing liquidity to earn LP rewards.

Balancer – Stake LP tokens that are comprised of multiple tokens.

SushiSwap – Use liquidity pools to yield farm and automatically compound rewards.

Add Liquidity

Add Tokens like MATIC/USDC to a liquidity pool (LP). Receive LP tokens which indicates ownership of the pool.

LP Tokens can be staked to earn yield rewards which are distributed via governance tokens. Some platforms enable auto-compounding that leads to earning.

Withdraw and reinvest

Earned rewards can be claimed and withdrawn as profits or reinvested.

Pros and Cons of farming on Polygon

Ultra-Low Fees — Its transaction costs are less than a cent which is cheaper than Ethereum and even BSC.

Fast Transactions — Block time is about ~2 seconds which allows fast deposits, staking, and withdrawals.

Ethereum Compatibility — Polygon is an Ethereum Layer-2 which means higher access to top DeFi apps like Aave, Curve, SushiSwap, and QuickSwap.

More Decentralized than BSC — Polygon has more validators than BSC making it less centralized and more decentralized.

Scalable & Sustainable — Being a Layer-2 for Ethereum means it has Ethereum’s security and ecosystem growth.

Cons

Smart Contract Risks — Just like any DeFi platform, Smart contracts can contain bugs, vulnerabilities, or be exploited.

Impermanent Loss — Drastic price movements of tokens may lead LPs to experience significant unrealized losses.

Lower Yields Than BSC — Though deemed safer, Polygon usually provides lower APYs than more risky BSC farms.

Bridging Complexity — The Polygon Bridge can be slow and costly when moving assets from Ethereum or other chains.

Security Concerns on Bridges — Past Cross chain security breaches such as the Ronin and Wormhole exploits show cross-chain security remains a significant risk.

How Yield Farming Works on BSC?

Yield farming on the Binance Smart Chain (BSC) basically requires staking or providing liquidity on some DeFi platforms for rewards. Due to the lower fees, quicker transactions, and the abundant farming opportunities, it is one of the most well-known blockchains for yield farming.

Steps to Start Yield Farming on BSC

Acquire BNB and Create a Wallet

- Purchase your BNB (Binance Coin) on an exchange like Binance.

- Create a Trust Wallet or MetaMask and link it to BSC.

Pick One Yield Farming Platform

PancakeSwap- The most known for staking and liquidity farming.

Venus- Lend crypto and earn interest.

Alpaca Finance- Leverage yield farming for even better returns.

Autofarm- Automatic yield compounding for optimal profits.

Offer liquidity to earn LP Tokens

Put two tokens like BNB/USDT into a liquidity pool (LP) for deposit. Get an LP token which shows your participation in the pool.

LP Token Staking for Rewards

LP tokens can be staked in farms for extra tokens (like CAKE on PancakeSwap). Multiple platforms provide automatic compounding for additional returns.

Compounding/Growing Funds and Profit Withdrawals:

Collect tokens and choose between compound (reinvest) or withdraw profits.

Pros and Cons of Farming on BSC

Pros

Lower Transaction Fees – BSC has significantly lower fees compared to Ethereum and usually charges between cents for each transaction.

Faster Transactions – Block processing occurs every ~3 seconds, which allows for fast deposits, withdrawals, and staking.

Abundant Yield Opportunity – Numerous DeFi platforms on BSC provide generous APYs, oftentimes over 100% for specific pools.

Broad Ecosystem – Farming platforms such as PancakeSwap, Venus, Autofarm, and Alpaca Finance are supported by BSC.

Support from Binance – The BSC is maintained by backbone accounts, which provide it with great liquidity and Binance exchange integration.

Cons

Threats to Security – The BSC has experienced numerous rug pulls, hacks, and other exploits on smart contracts, putting it at greater risk than Ethereum.

Impermanent Loss – A change in the price of a token may lead to liquidity providers incurring losses that are not crystallized.

High Competition – Many yield farmers are active in moving their funds around, resulting in lower long-term profits.

Concerns with Centralization – BSC is more centralized than Ethereum, with a smaller number of validators governing the network.

When to Choose Polygon for Yield Farming

Choose Polygon if

- You want to pay almost nothing in fees (gas fees are nearly zero).

- You like Ethereum DeFi protocols such as Aave, QuickSwap, and Curve.

- You prefer a less centralized and vulnerable network than BSC.

- You prefer long-term sustainable yield farming instead of risky fleeting profits.

- You want low scam risks (Polygon has fewer rug pulls than BSC).

Avoid Polygon if

- You expect those higher APYs because BSC does offer better short-term yields.

- You don’t want to risk slow and risky asset bridging.

- When to Choose BSC for Yield Farming

Choose BSC if

- You expect higher APYs and more farming instances.

- You want quick transactions for cheap.

- You like a more extensive DeFi ecosystem that includes PancakeSwap, Venus, and Autofarm.

- You are interested in higher risk for higher possible returns.

- You prefer short-term, high-reward farming strategies.

Avoid BSC if

- You are sensitive to security risks since BSC has more rug pulls and scams.

- You prefer a decentralized network (BSC is more centralized under Binance).

Conclusion

Yield farming on Polygon and Binance Smart Chain (BSC) offers distinct pros and cons which cater to differing investor types. Investors looking for Ethereum compatibility, low fees, and enduring stability within Polygon would have to endure lower yields, unlike BSC.

Polygon, as previously mentioned, is a safer but low-yielding option. Once again, BSC provides higher APYs, quicker transactions, and an expansive DeFi ecosystem, however, these benefits come at a cost of greater risk due to rug pulls, scams, and token inflation.

It all comes down to what one’s investment goals and risk appetite are—the steadfast and secure would prefer Polygon, whereas those seeking short-term, high-reward opportunities would lean towards BSC. For enhanced returns while minimizing risk, diversifying across both networks yields the most optimal results.