In this article, I will explore the Most Popular Nft Loan Services that allow asset owners to retain ownership of their NFTs while still providing liquidity through loans.

These platforms provide NFT collateralized loans with reasonable rates, secure deals, and flexible agreements.

Such services are becoming increasingly important for holders of digital assets in the ever-evolving NFT and decentralized finance (DeFi) sectors. ?

Key Features & Most Popular Nft Loan Services List

| Platform | Key Features |

|---|---|

| Nexo | Instant credit lines, institutional-grade security |

| Arcade | Asset Vault for bundling NFTs, smart contract-based |

| BlockFi | Crypto-backed loans, interest-bearing accounts |

| NFTfi | Flexible terms, no fees for borrowers |

| Dharma | Acquired by OpenSea, tech integrated into OpenSea |

| Compound | Smart contract-based, interest-earning deposits |

| Salt Lending | Fast processing, flexible repayment |

| Alchemy | Provides APIs & tools for NFT lending platforms |

1. Nexo

Nexo is a leading name in the crypto lending industry, in part because it has pioneered NFT-backed loans. It also provides NFT-backed lending services for institutional clients.

With Nexo, users gain access to instant crypto credit lines with competitive interest rates, as well as an LTV (Loan-to-Value) ratio of 20%.

The platform also offers secure vaults NFTs collateralized against loans and requires a minimum loan value of $500,000.

Currently, Nexo accepts well-established NFT collections, such as the Bored Ape Yacht Club, CryptoPunks, and numerous others, as collateral.

Nexo Features

- Crypto revolving lines of credit are available instantly, backed by NFTs.

- NFTs such as CryptoPunks and Bored Apes are accepted.

- Very low-interest rates from 1% APR.

- Top-notch security and custodial services.

2. Arcade

Arcade is a decentralized marketplace where users can borrow money by leveraging their Ethereum-based NFTs as collateral.

Arcade adresses garage lending by introducing the Asset Vault feature allowing users to combine multiple NFTs into one Vault, enabling larger loans.

The platform supports smarter, trustless transactions through smart contracts ensuring user security.

The platform operates on a peer-to-peer lending model offering competitive interest rates and other user-friendly loaning policies, with an extensive list of accepted NFT collections.

Arcade Features

- First NFT marketplace for lending NFTs in a peer-to-peer fashion.

- Allows users to bundle multiple NFTs into a single asset vault and take loans based on the amount.

- Uses Smart contracts for seamless payment transfers.

- Allows trying-out Ethereum based NFT collections.

3. Blockfi

BlockFi is a crypto lending platform with a diverse portfolio, allowing users to borrow funds against their crypto assets.

While BlockFi currently does not offer NFT-backed loans, it services clients with interest accounts, crypto, and other loaned funds.

Users can earn interest on their cryptocurrency holdings or even take out loans using these assets as collateral.

BlockFi remains a favorite among crypto investors due to its user-friendly interface, attention to regulatory requirements, and reputation in the market.

BlockFi Features

- Offers crypto-backed loans, does not support NFTs.

- Maintains crypto accounts that grow interest.

- Gives credit up to 50% of the asset value with loan limit ratio (LTV).

- Adheres to the law and shreds trust in secure lending.

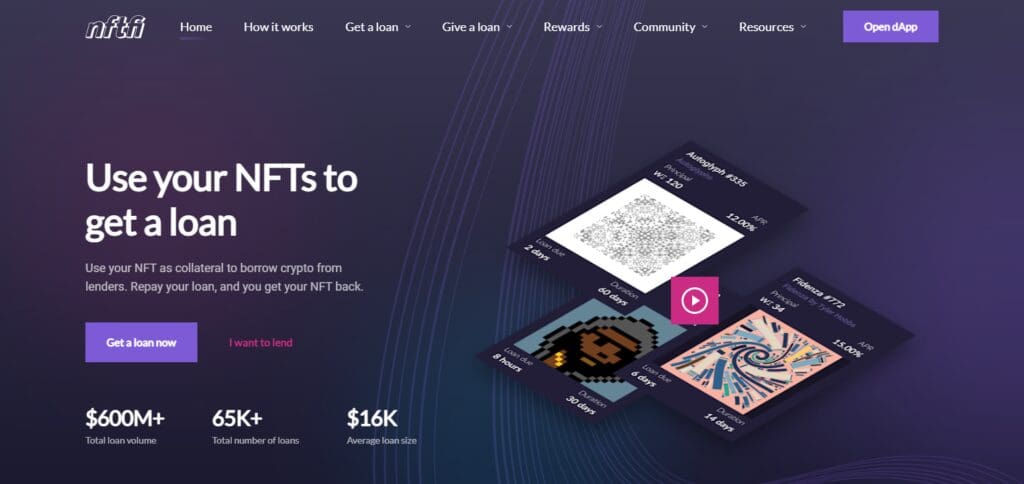

4. NFTfi

NFTfi is a decentralized, peer-to-peer marketplace that offers loans collateralized by NFTs.

Borrowers can put forth their NFTs to secure loans in cryptocurrencies like wETH or DAI.

This platform also accommodates various NFT collections, such as Bored Ape Yacht Club and CryptoPunks.

Borrowers have the advantage of relatively easy qualification requirements, while lenders can earn interest on their cryptocurrency holdings.

NFTfi takes a 5% cut of the interest earned by lenders, but there are no fees charged to borrowers.

NFTfi Features

- Facilitates NFT loans without any central authority.

- Accepts a wide range of NFTs.

- Zero fees for those who are borrowing.

- Repayment conditions are flexible depending on the lenders.

5. Dharma

Dharma was a decentralized lending protocol that allowed users to take loans against their crypto assets. The acquisition by OpenSea in January 2022, Dharma has made changes to its services.

The goal behind the acquisition was to use Dhamra’s technology in the Opensea’s marketplace to improve the overall experience.

Dharma Features

- Previously offered DeFi lending, now part of Open Sea.

- Allows borrowing against crypto assets without any restrictions.

- Improved marketplace functionality due to integration with Open Sea.

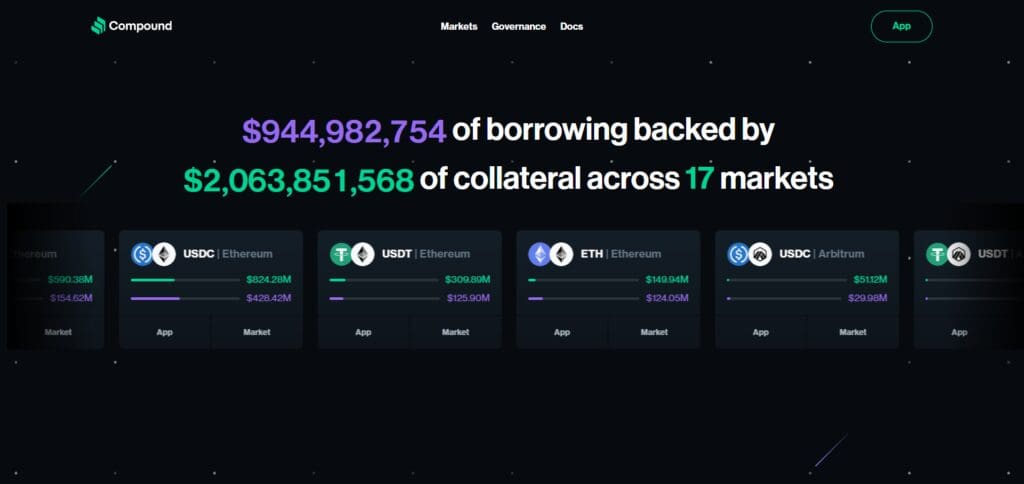

6. Compound

Compound is a decentralized finance (DeFi) lending and borrowing platform that allows users to lend out and borrow cryptocurrencies.

Even though it does not directly offer NFT-collateralized loans, it does allow users to borrow against digital assets and earn interest on deposited assets.

Some of the outstanding features offered by Compound include: flexible repayment, auto approval of loans, low fees, and many more.

It uses smart contracts that Compound executes on the blockchain offering security and transparency in the DeFi space.

Compound Features

- Peculiar NFT-less lending and borrowing services.

- Deposit earning interest.

- Lending pools with smart contracts.

- Support various crypto assets , but do not directly offer resources to purchase NFTs.

7. Salt Lending

Salt Lending is a digital lending service that allows borrowing against NFTs and other digital assets.

It has fast processing speeds, competitive interest, and flexible repayment options.

Salt’s goal is to give liquidity to NFT owners without requiring them to forfeit their assets.

The platform is also known to be easy to use with strong adherence to regulations which builds confidence for borrowers and lenders.

Salt Lending Features

- Allows users to borrow against their crypto assets or NFTs.

- Processes loans quickly and permits flexible repayment system.

- Less than 40% LTV secured against NFTs.

- Compliant to the regulations offering lending services within legal frameworks.

8. Alchemy

Alchemy is a blockchain tool for developing and building infrastructure to support building decentralized applications (dApps).

They do not directly offer NFT loans, but Alchemy services many NFT platforms through APIs and tools enhancing these services.

For example, NFTfi leverages Alchemy’s infrastructure to offer its NFT collateralized loan marketplace.

Alchemy’s range of developer tools is well recognized in the blockchain space; they help in the development of NFT platforms.

Alchemy Features

- Provides infrastructure for blockchains.

- Allows NFT lending platform developers access to APIs and other tools.

- Supports lending protocols like NFTfi.

- Helps scalable block chains sustain their applications.

Is NFT lending safe?

Like any new industry vertical, NFT lending has its risks. Even with the growing fraud cases in blockchain technology, lending mechanisms and frameworks in NFT space follow legal regulations. More platforms are entering the space and it looks like something is being done to regulate it.

My personal favorite benefit of investing in NFTs is the ease of earning passive income! I imagine it as: if one seeks to diversify their portfolio while earning passively, then this type of investment is recommended.

Conclusion

The ability to get NFTs as collateral loans gives NFT holders liquidity options without forcing them to sell their estates.

Nexo and Arcade offer services for high-value NFT lenders, whereas Salt Lending and NFTfi provide versatile peer-to-peer and institutional loan options.

Alchemy provides the lending infrastructure for NFT warrants, while BlockFi and Compound focus on blockchain-asset collateral financing. Dharma, which partnered with OpenSea, has also made strides in NFT warrant lending.

With the constant evolution of the marketplace, borrowed assets need to keep interest, security, and even their LTV ratio in mind before selecting a service.

Thanks to the NFT’s unique nature, these assets are continuously innovating the decentralized finance (DeFi) ecosystem.