Here, I will cover the Top Bridged-Tokens Coins By Market Cap with an emphasis on their significance in blockchain interoperability and decentralized finance (DeFi).

Bridged tokens allow for cost efficient asset transfers across multiple networks by minimising transactions costs and increasing scalability.

These tokens also offer users more sophisticated ways of engaging with DeFi applications as multi-chain ecosystems develop.

7 Top Bridged-Tokens Coins by Market Cap

1. Arbitrum Bridged

Arbitrum Bridged WBTC (Arbitrum One) is a layer 2 scaling solution that enables fast and low-cost transactions on the Ethereum blockchain. It works by allowing users to “deposit” assets from the Ethereum mainnet to Arbitrum

One, and then “withdraw” them back to the mainnet, using Arbitrum’s bridge. This process enables faster and cheaper transactions on Arbitrum One, while still maintaining the security of the Ethereum mainnet.

Arbitrum Bridged Features

- On Arbitrum, transactions are settled at a quicker pace, reducing the chances of blockage and improving speed.

- All tokens on ERC-20 can be used which allows easy migration for Ethereum users to Arbitrum.

- Allows easy transfer of assets between Ethereum and Arbitrum through the use of bridges.

2. L2 Standard Bridged WETH

Wrapped Ether (WETH) has no other than of token representing Ether (ETH) in an ERC-20 compliant format, which makes it easily usable in decentralized apps. The L2 Standard Bridged WETH is WETH that has been used on Layer 2 solutions, which increase speed and reduce costs.

According to the most recent figures available, L2 Standard Bridged WETH has a market cap of around $424.42 million and an estimated circulating supply of 128,100 WETH tokens.

L2 Standard Bridged WETH

- Wrapped Ether (WETH) is moved to Arbitrum network for speedy and less costly transactions.

- Entirely supports all Ethereum-powered DeFi services.

- Keeps a 1:1 ratio with native ETH.

- Helps decrease transaction gas price compared to Ethereum mainnet.

- Allows usage of Arbitrum liquidity pools and staking.

3. Avalanche Bridged BTC

The current trend is the migration of Bitcoin users from the Bitcoin network to the Avalanche networks, which is represented as BTC..

This allows holders of Bitcoin to spend their assets in the Avalanche ecosystem and enjoy quicker transaction speeds alongside cheaper fees than the Bitcoin network offers.

The market cap for Avalanche Bridged BTC is approximately $526.37 Million and the circulating supply is approximately 5,360 BTC.b tokens.

Avalanche Bridged BTC (BTC.b)

- Bitcoin moved to the Avalanche network for enhanced Defi services.

- Gives lower transaction prices and fast services compared to Bitcoin’s original blockchain.

- Gives the chance for BTC holders to join with the Dapps on the Avalanche.

- Protected through Avalanche’s interoperability and consensus mechanism.

4. Bridged USDC

USD Coin (USDC) is a stablecoin most commonly used within a myriad of blockchain protocols and applications. Bridged USDC means USDC tokens that have been moved to different networks for easier functionality within those systems.

For example, bridged USDC (USDC.E) on the Polygon PoS Bridge has a market cap of around $427.02 million and a circulating supply of about 426.96 million USDC.E tokens.

Bridged USDC

- A USD backed stable coin moved from Ethereu to Arbitrum.

- Provides assurance and high liquidity for DeFi trades.

- Lower transaction fee, and almost instant transfer compared to Ethereum.

- Applied in lending, borrowing, and trading activities in Arbitrum environment.

5. Mantle Bridged USDT

Another popular stablecoin closely associated with the US dollar is Tether (USDT). Mantle is a Layer 2 which uses the Bridged USDT Mantle representation.

This means USDT tokens are moved to the Mantle network enabling users to operate on this specific blockchain. Market Capitalization for mantle bridged USDT is around $235.69 million having Circulating Supply of 235.75 million USDT tokens.

Mantle Bridged USDT

- USDT stabledcoin is moved into the Mantle network.

- Allows users of DeFi and other blockchain applications to use USDT transactions without fearing fluctuation of price.

- Cuts costs while improving performance of the stablecoin users.

- Enables direct connection between various blockchains and Ethereum applications.

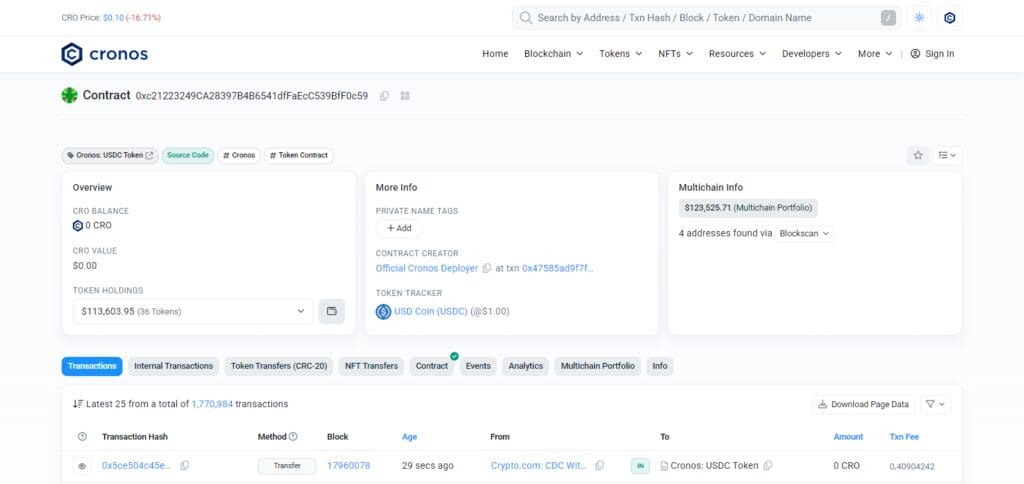

6. Cronos Bridged USDC

Cronos USDC has a market cap of about $88.61 million with a circulation of 87.82 million USDT tokens. CIRCULATING SUPPLY: 87.82M USDT CUSD TOKENALPHABET.COM Polygon POs bridged WETH.

The blockchain network Matic, or Polygon, is known for its scalability and low gas fees which allows it to attract a multitude of assets including WETH. Polygon PoS bridged WETH has a market cap of 479.60 million and a circulation of 144,750 WETH tokens.

Cronos Bridged USDC

- USDC stable coin migrated to the Cronos network.

- Allows reliable and effective transactions within the Cronos ecosystem.

- Enables inexpensive engagement with DeFi services such as loans and yield farming.

- Supports dApps via EVM compatibility.

7. Polygon PoS Bridged.

Polygon PoS Bridged WETH is a 1:1 pegged token on the Polygon blockchain, created by locking up the same amount of tokens on the Ethereum blockchain.

It’s a fully decentralized bridge for seamless asset transfers between Ethereum and Polygon networks. The Polygon Native Bridge employs a proof-of-stake sidechain for Ethereum, with high throughput and low costs.

Polygon PoS Bridged

- The assets WETH, USDC, and USDT have been bridged to the PoS networks of Polygon.

- Transactions fees are significantly cheaper and processing times are much quicker compared to Ethereum.

- Security is assured by Polygon’s validators and Ethereum’s checkpointing.

- General support for DeFi, gaming, and NFTs.

Conclusion

Bridged tokens are crucial for achieving cross-chain asset transfers between different blockchain ecosystems. L2 Standard Bridged WETH, Avalanche bridged BTC, bridged tokens USDC

Mantle Bridged USDT, Cronos Bridged USDC, and Polygon PoS bridged tokens are leading examples of bridged token that enhances liquidity, lowers transaction costs, and improves speeds for users.

With increased adoption, bridged tokens will continue to be critical DeFi assets and in gaming and Web3 applications making multi-chain environment even more interconnected and efficient.