In this article, I will discuss the Why Bridging Tokens Is Popular for Stablecoins in different blockchains.

Bridging works remarkably well for stablecoins as it provides network crossability, which enhances operating liquidity, decreases costs, and allows for DeFi application on different chains.

The growth of stablecoin adoption in the ecosystem is directly proportional to the increased demand for interoperability and bridging solutions.

What is Bridging Tokens?

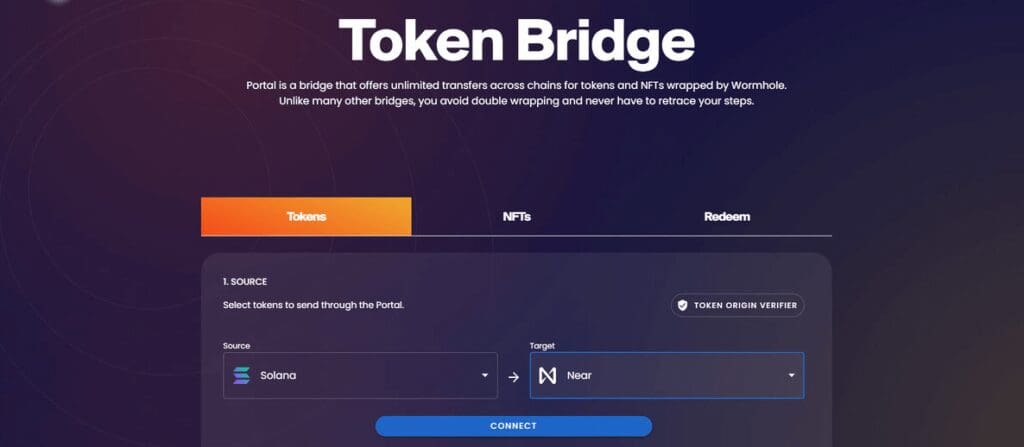

Bridging tokens is the process of moving assets like stablecoins from one blockchain to another using cross-chain bridges. These types of bridges allow one to lock tokens on the source chain and mint identical tokens on the alternate chain, thus enabling interoperability.

Users can access various decentralized finance (DeFi) applications, engage in multichain trading, and enjoy low fees with fast transactions.

Bridging tokens provides greater liquidity and market access while making the highly fragmented blockchain ecosystems more efficient, marking yet another major step in the world of cryptocurrency.

Why Bridging Tokens Is Popular for Stablecoins

Greater Utility

Stablecoins can be used more extensively for payments, trading and yield farming.

Cross-Chain Compatibility

Movement of stablecoins across different blockchains is more seamless.

Lower Transaction Fees

Cost efficient in comparison to on-chain transactions on already slumped networks.

Improved Liquidity

Growth of stablencoin’s market reach results in greater volume of tradeable tokens.

Interoperability in DeFi

Stablecoins can be used across different decentralized platforms without restrictions.

Faster Transactions

Transfer speed is higher than normal block chain transactions.

Benefits of Bridging Tokens for Stablecoins

Advantages of Bridging Tokens for Stablecoins

Wide Availability – Users are now able to transfer stablecoins across various blockchains, thus increasing their reach.

Reduced Fees – Transfer can be done on blockchains that have lower fees, thus helps reduce teh transaction fee.

Increased Liquidity – Allowing movement across various ecosystems increases liquidity of stablecoins.

Improved DeFi Functionality – Makes it easier to incorporate stablecoins into more decentralized finance (DeFi) applications.

Shortened Wait Times – Reduces the wait time of enabling transfers of stablecoins on faster networks.

Broader Applications – Allows for more applications in cross-chain payments, trading, staking, and yield farming.

Use Cases of Bridged Stablecoins

Cross-Chain Trade ARbs and Arbitrage

Using bridged stablecoins traders can seamlessly move them across blockchains to exploit prices variances.

Payments & Transfers

Allows quick and cheap payment processing alongside value transfers on a global scale.

Liquidity Supply on Defi

Enables fast transactions on Decentralized Exchanges (DEXs) and lending liquidity, which is essential for stable economy.

Yield Farming & Staking on Multichain

Allowing users to stake on multiple blockchains increases yields taking among stable clients.

Gaming and NFT Interoperability

Stablecoins allow seamless in-game purchases and NFTs across multiple chains.

Instituational and Enterprise Purpose

Allow efficient multi-chain bridged stable coins for financial settlements and operations.

Challenges and Risks

Inadequate Protection

Cross-chain bridges are proprietors of hacks which makes funds recovery impossible.

Risk of Over Trusting Centralized Bridges

The existence of centralised third parties in some bridges increases trust and counterparty risks.

Inefficient Virtual Asset Liquidation

The increase in the number of chains where stablecoins are issued may lead to decreased liquidity to these chains.

Exploitation of Bridges Smart Contracts

Manipulation or loss of bridge assets due to exploitation of bugs or other weaknesses in their smart contracts.

Over Charging Transaction Fee on Some Chains

Cost reduction due to use of bridges might be levelled by congestion fees on some highly frequented chains.

Unenforced Legal Framework

Imposed legal restrictions on cross-chain transactions can limit ease of use and compliance by various governments.

Pros & Cons

| Pros | Cons |

|---|---|

| Cross-Chain Compatibility – Enables stablecoins to move between different blockchains. | Security Risks – Bridges are common targets for hacks and exploits. |

| Lower Transaction Fees – Reduces costs compared to congested networks like Ethereum. | Centralization Concerns – Some bridges rely on centralized entities, reducing trust. |

| Improved Liquidity – Expands stablecoin access across multiple ecosystems. | Liquidity Fragmentation – Distributes liquidity across chains, impacting efficiency. |

| Faster Transactions – Transfers on optimized networks are quicker than traditional methods. | Smart Contract Risks – Bugs in bridge contracts can lead to asset loss. |

| Greater Utility – Enhances stablecoin use in DeFi, trading, and payments. | High Bridge Fees – Some cross-chain transfers still have high transaction costs. |

| Better DeFi Integration – Enables stablecoins to be used in lending, staking, and farming. | Regulatory Uncertainty – Changing regulations may affect cross-chain transactions. |

Conclusion

To sum up, bridging tokens has emerged an essential innovation for stablecoins as it enables effortless traversing across diverse blockchains. This enhances liquidity while lowering the costs of transactions, and expands the use of these tokens in DeFi, payments, and trading.

The adoption of stablecoins in the crypto ecosystem is intensified by increasing their accessibility and efficiency through enhanced cross-chain interoperability. On the other hand, overcoming security risks, fragmentation of liquidity, and regulation remain as issues to be fixed.

With the advancement of blockchain technology, crossing borders will keep changing for the better, allowing for a greater range of uses of stablecoins in DeFi.