In this article i will discuss the How to Open a Euro Bank Account in the US, including all the steps, requirements, and best available options.

If you’re a business owner, a freelancer, or someone who travels often, a Euro account can simplify international transactions.

What is a Euro Bank Account?

A Euro bank account is a financial account that permits the user to receive, send, and hold funds in Euros instead of US dollars.

It is very beneficial for international businesses, transactions, and for individuals that frequently visit Europe or European clients.

Unlike US dollar accounts, Euro accounts limit the impact of fluctuations in currency exchange rates and fees, as well a simplifying the withdrawals from these accounts.

Some selected US banks, international banks and certain fintech platforms offering multi currency banking solutions enable these accounts.

How to Open a Euro Bank Account in the US

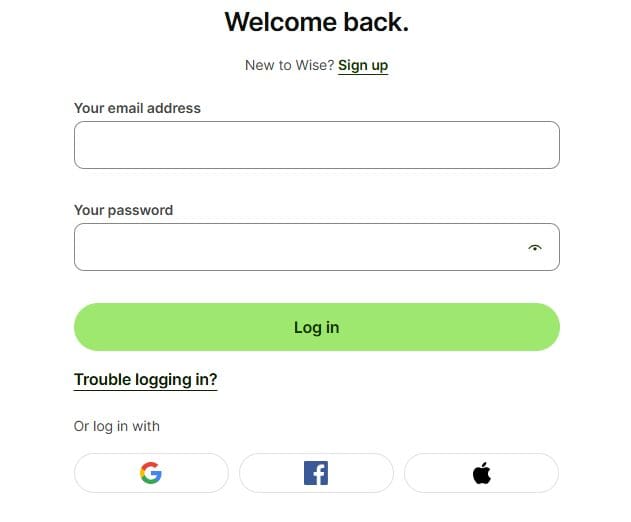

If you pick the perfect platform, opening a Euro bank account in the United States can be easy. Here is an example using Wise which is an online financial service

Sign Up

Go to Wise site or download Wise application.

Register by creating an account with your email and generating a strong password.

Verify Your Identity

Finish up KYC (Know Your Customer) by uploading a government document such as a passport or a drivers license.

Show proof of your address when necessary.

Set Up a Multi-Currency Account

After your account is verified, enable the multi-currency feature.

You can now hold, send, and receive Euros in addition to other currencies.

Obtain Local Euro Account Details

Wise gives you local Euro account details enabling you to receive payments like from the Eurozone.

Fund Deposit

Fund your account using bank transfer, debit card, or any other prefered method.

Start Using your Euro Account:

Payments can be made with your Euro balance and can also be sent internationally or withdrawn to a linked bank account.

Wise Debit Cards: You can ask for a Wise debit card to help you with transactions in Euros.

Why Choose Wise?

Best Rates: Get highly competitive rates and fees compared to other providers.

Convenience: Simple and fast access through web and mobile apps.

No Hidden Fees: Keep no balance like other banks require you to.

Global Access: Control your account from anywhere across the globe.

Benefits Of Euro Bank Account

Skip Fees Linked with Currency Conversion. – There is no need to exchange USD for EUR multiple times which reduces forex costs.

International Transactions – Less complicated for businesses, freelancers, and travelers who move around Europe.

Protection Against Exchange Rate Changes – Shields against how unstable USD-EUR currency pairs can be.

Having Funds in Different Currencies – Enhanced financial flexibility as funds can be placed in different currencies.

Investing or Conducting Business in the Eurozone – Handy for accessing and investing in Europe.

Alternatives to a Euro Bank Account

Multi-Currency Accounts

Accounts provided by Wise (formerly TransferWise), Revolut, and Payoneer allow users to hold and transact in multiple currencies, euros included.

Foreign Currency Accounts at International Banks

Not all banks, but some global banks like HSBS and Citi do provide foreign currency accounts. Be cautious; they may require high balances.

Prepaid Euro Cards

Services such as Wise and Revolut offer prepaid debit cards that hold euros. This helps users avoid prepaid exchange rate fees.

Forex Brokers and Money Transfer Services

These platforms, OFX, Wise, and PayPal, enable users to convert and transfer USD to EUR at competitive rates without needing a Euro bank account.

Cryptocurrency and Stablecoins

Digital transactions using euros may be easier with EUR pegged stablecoins like Tether EUR (EURT) or Circle (EUROC).

Pros & Cons

Pros:

No Need to Convert Currency – Avoid the hassle of converting USD to EUR, which saves money on exchange rates.

International Transactions – Great for businesses, freelancers, or individuals who have clients in Europe.

Reduced Risk of Exchange Rate Volatility – Helps safeguard against fluctuations in the USD to EUR exchange rate.

Send and Receive Payments in Euros Effortlessly – Send and receive euro transactions without incurring extra costs.

Investment Portfolio Diversification – Beneficial for those who are or hold funds in euros.

Cons:

Not Many Banks In the US Offer Euro Accounts – Very few banks have Euro accounts, thus limiting options for consumers.

Range of Expenses – May include account maintenance, outgoing wire transfer, and currency conversion fees.

High Balances Needed to Avoid Fees – Bank policies dictate that certain fees be rid of only if high balances are maintained.

Strenuous Application Procedure – More rigorous paperwork such as an income and international transaction history is required.

Multi Currency Accounts Offer More Flexibility – Accounts in Wise or Revolut typically come with more flexibility and lower fees.

Conclusion

In conlusion Opening a Euro account while living in the US can serve as an important asset for both individuals and businesses that work with euros.

Avoiding currency change fees and facilitating international transactions are some of the pros, while high fees and limited access constitute the cons.

Before opening an account, do consider checking through the options presented by banks and fintechs, including Wise or Revolut. If the account meets your defined financial goals, adhere to the steps provided to open it seamlessly and manage it effectively.