In this article, I focus on the Top Trending Tokens on Binance Smart Chain (BSC), explaining their specific characteristics and what makes them unique in the ever-changing landscape of cryptocurrency.

We will look at the infrastructure of the thriving BSC ecosystem alongside staple stablecoins like USDT and BUSD and utility tokens BNB and CAKE.

Key Point & Top Trending Tokens On Binance Smart Chain

| Token | Key Point |

|---|---|

| BNB | Native token of Binance used for trading fee discounts and gas on BSC. |

| USDT (Tether) | Popular stablecoin pegged to the US dollar for stable crypto trading. |

| CAKE (PancakeSwap) | Governance and reward token for the PancakeSwap DEX on BSC. |

| ETH (Ethereum BEP-20) | Wrapped Ethereum token for use on Binance Smart Chain. |

| XVS (Venus) | Governance token for Venus Protocol, a DeFi lending platform on BSC. |

| TWT (Trust Wallet Token) | Utility token for Trust Wallet users with governance and rewards features. |

| SFUND (Seedify.fund) | Token for accessing and investing in blockchain gaming IDOs. |

1. BNB

BNB is a pillar of Binance Smart Chain (BSC) owing to its sole deflationary purpose as the fuel to BSC’s dApps for paying transaction fees, staking, and governance, it surely dominates its competitors.

The token also enjoys trending status due to its universal case. If anything, one can say that the ecosystem is built around its demand, since every single thing that happens on BSC boils down to BNB being required as gas fee.

Moreover, Binance’s integration of the BNB token within the broader exchange ecosystem, as defi protocols also have a yield farming component, garners even more prominence.

Hence, as the de-facto flagship token of the BSC ecosystem, still BNB thrives rather well in terms of trading volume market cap and trading volume which all signals consensus on BSC’s health.

Workshops like CoinMarketCap provides the rankin in real time but regardless of that, his lower status on BSC keeps him in the spotlight.

BNB (Binance Coin)

- It is the original token of the Binance Smart Chain ecosystem.

- Functions include: payment of transaction fees, staking, governance.

- Subsidiary of DApps (decentralized applications) and smart contracts.

2. USDT (Tether)

USDT is a stablecoin that is tied to the value of the US dollar. It is increasingly gaining attention on BSC because of its significant adoption as a stable trading pair and liquidity provider in DeFi protocols.

USDT is favored by traders and investors because of its price stability which allows risk-averse transactions in turbulent markets.

On BSC, USDT serves as the backbone purpose of decentralized exchanges (DEXs) like PancakeSwap and lending platforms, seamlessly enabling swaps and yield farming.

Its trading volume and dominance in liquidity pools speak to USDT’s popularity. Positioning USDT as a tether between fiat and crypto, his practical use ensures his position as a top-trended token which can be tracked through BSC’s transaction data on BscScan.

USDT (Tether)

- Represents a stable coin whose value is always equal to the US Dollar.

- Provides liquidity and secondary market value for stability during volatile trading.

- Commonly accepted for trade and funds transfer.

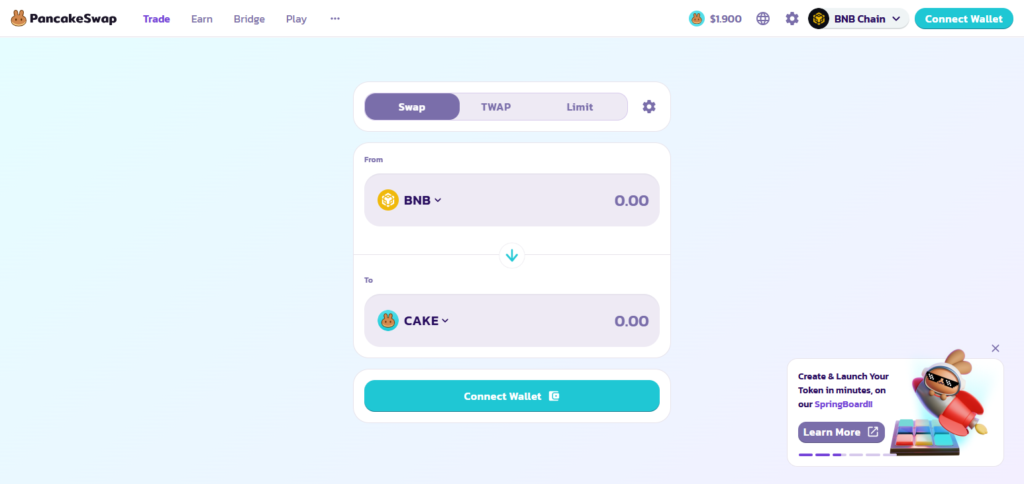

3. CAKE (PancakeSwap)

CAKE is the governance token for PancakeSwap, which is the leading DEX in the BSC ecosystem. Because it is tied to the second most utilized platform on the chain, CAKE tends to cut market trends.

Users stake CAKE to earn rewards, exercise governance, and vie in lotteries or NFT marketplaces, creating perpetual demand. Because of PancakeSwap’s low fees and high transactions per second, it serves as a breeding ground for traders, which increases CAKE’s popularity.

CAKE’s price is supported by the community and new features implemented such as AMM upgrades. On CAINW, CAKE’s low ranking on CoinMarketCap is in sharp contrast to BSC’s Blockchain Ecosystem where CAKE is heavily utilized, which explains the low ranking.

CAKE (PancakeSwap)

- Represents the native token of PancakeSwap, which is a decentralized exchange (DEX) built on BSC.

- Used for distribution by means of liquidity provision alongside spending votes by proxy, also referred to as governance.

- Allows participants to engage in yield farming and lotteries.

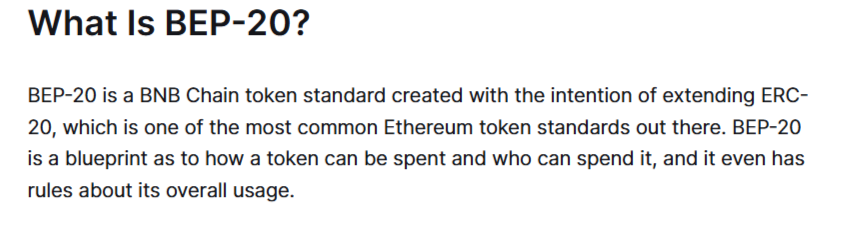

4. ETH (Ethereum BEP-20)

ETH or the BEP-20 tokenized version of Ethereum, is ETH not only trades on BSC, but also integrates with the unique features offered on the BSC ecosystem.

ETH tends to be a trending token on BSC because it enables Ethereum’s utility in a faster and cheaper environment overall. ETH is heavily utilized in BSC’s DeFi apps like yield farming and lending without the Ethereum gas fees.

Its integration into DEXs drives substantial cross-chain bridge transactions as investors move their assets between Ethereum and BSC, increasing activity and rising demand on BscScan and CoinMarketCap. The token’s trending status show that BSC is a budget-friendly alternative for Ethereum-based projects.

ETH

- Is a BEP-20 token that represents ethereum on the BSC network.

- Allows Ethereum Holders to participate in BSC DeFi ecosystems.

- Contains transactions which are cheaper and faster than ethereum transactions.

5. XVS (Venus)

The rise of XVS is associated with its use in governance of Venus, an esteemed DeFi lending and borrowing protocol on BSC.

Users stake XVS to receive rewards and vote on protocol upgrades as Venus’s stablecoin minting and yield farming opportunities pull in a variety of investors.

Its propensity to trend is linked to the ever-growing popularity of lending based platforms, especially with BSC offering low fees, making borrowing very cheap.

XVS is one of the top tokens on BSC because of observed market activity on CoinGecko, which provides insight into decentralised community engagement and adoption of theprotocol.

It showcases their support and adoption of the protocol which makes it one of the top tokens in BSC.

XVS

- Is the governance token of the Venus Protocol, which Is a DeFi on BSC.

- Used for voting on protocol decision and modifications, along with voting on changes the system uses.

- Loans, borrowing, and the minting of stable coins all take place.

6. TWT (Trust Wallet Token)

The participation rewards for staking, governance, and other roles incentivizing the use of the wallet make TWT and Trust wallet one of the most used wallets on BSC. TWT is trending because of its role in improving user interaction and integration with the ecosystem.

As the primary gateway to BSC dApps, Trust Wallet steadily increases the demand for TWT alongside the growth of the Chain. This is especially true for mobile-first users.

TWT is used and its promotional campaigns increase a user’s outdated with the wallet and periodic bolstered upgrade their programs. These users mark CoinMarketCap market data on TWT’s performance to catch onto the moving trend.

TWT (Trust Wallet Token)

- The Native Token of Trust Wallet Governs.

- Helps to lower the price of the wallet services and earns them a vote in the contract.

- Provides crypto users’ management towards security and ease of use.

7. SFUND (Seedify.fund)

The rise of interest in P2E games and metaverse projects drives the trading volume of Seedify’s gaming and NFT incubator token, SFUND, on the BSC network.

SFUND powers Seedify’s launchpad, which allows users to invest in early-stage blockchain games and receive rewards for staking.

His awareness demonstrates the growing gaming ecosystem on BSC as new projects are constantly being added to Seedify’s Seedify’s growing stock.

The meme status of the token is fueled by community enthusiasm and successful launches, trackable on CoinGecko for market traction and frequently discussed on X.

SFUND (Seedify.fund)

- Is the Token of embroiled and launched game title blockchanged gaming seedify.

- Used in addition to the blockchain gaming project for the theater stake registration and govornance.

- Advocates the rise of gaming ecosystems bas3d on blockchain technology.

Conclusion

To summarize, the Binance Smart Chain comprises an extensive selection of tokens suitable for trading, decentralized finance (DeFi), gaming as well as cross-chain functions.

Out of the trending tokens, BNB, USDT, BUSD, and CAKE take the lead because of their utility, tradable value, and popularity. XVS, TWT, and SFUND offer increasing value in lending services, wallet services, and blockchain gaming, respectively.

Investors and developers can take advantage of the growing possiblities this ecosystem has to offer. From looking into stablecoins for value retention, governance tokens for participating in DeFi, or even gaming tokens for creative engagement, Binance Smart Chain holds a significant position in the crypto world. Please tell me if you want a more detailed analysis or some useful strategies for any of these tokens.