In this article, I will cover the popular indices that give multi-faceted access to the world of cryptocurrency.

The most sophisticated indexes do not only track the market, they also help with risk mitigation and portfolio valuation enhancement.

From Crypto20 to the DeFi Pulse Index, these indexes contribute greatly to the ease of investing in cryptocurrency, as well as insight into its current state.

Key Points & Most Popular Crypto Indexes List

| Crypto Index | Key Points |

|---|---|

| Crypto20 | First tokenized crypto index fund, tracks top 20 cryptocurrencies by market cap. |

| Bitwise | Offers various crypto indexes including the Bitwise 10; focused on transparency. |

| Galaxy Crypto Index | Tracks performance of major digital assets traded in USD on major exchanges. |

| DeFi Pulse Index (DPI) | Measures performance of top DeFi tokens on Ethereum, weighted by market cap. |

| NFT Index (NFTI) | Tracks top NFT-related tokens; reflects the growth of NFT-based projects. |

| Grayscale Digital Large Cap Fund | Provides exposure to large-cap digital assets like BTC and ETH; SEC-reporting. |

| Bloomberg Galaxy Crypto Index | Institutional-grade index that tracks leading crypto assets across sectors. |

| FTSE Russell Crypto Index | Designed for institutional investors, it covers top crypto assets by liquidity. |

| S&P Cryptocurrency Broad Digital Market Index | Broad coverage of the digital asset market, includes over 240 cryptocurrencies. |

| CoinDesk DeFi Index | Benchmarks performance of leading DeFi tokens in a rules-based approach. |

10 Most Popular Crypto Indexes In 2025

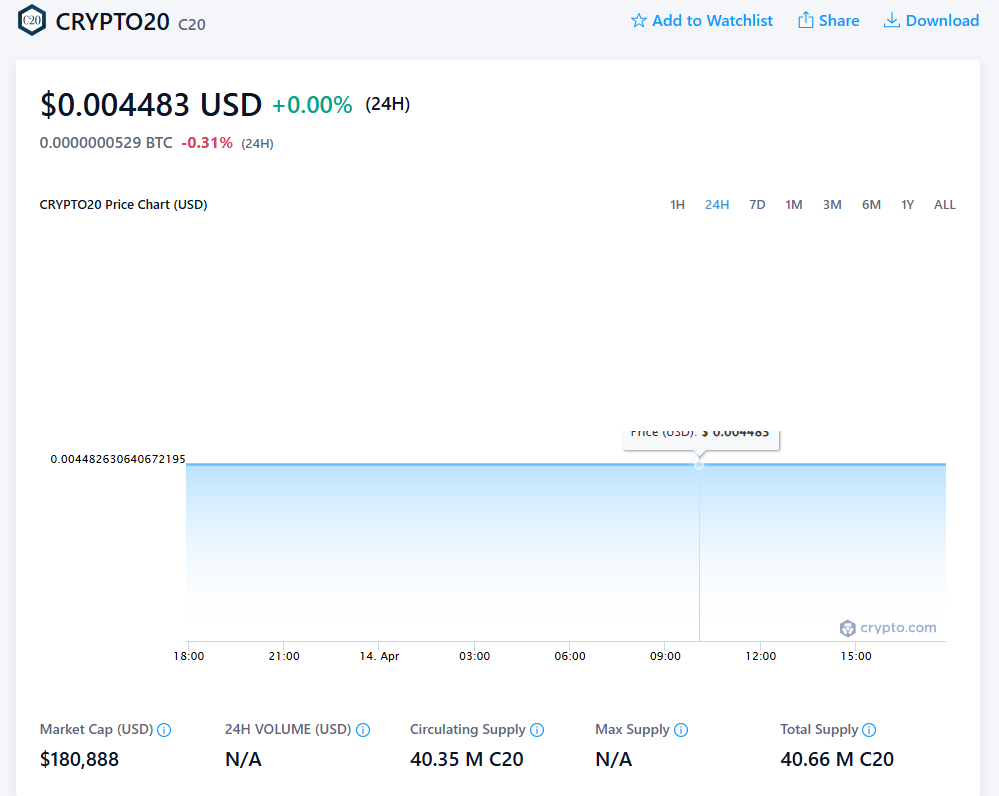

1.Crypto20

Crypto20 is one of the most popular indexes as it offers investors exposure to the top twenty cryptocurrencies by market capitalization through a single token (C20).

Crypto20 was the first tokenized crypto index fund, which aimed at simplifying diversified investment in digital assets. It is fully automated, rebalanced on a weekly basis, and provides transparent and data-based performance.

Crypto20 removes the requirement of multiple wallet management and helps in lowering the trading fees which are incurred while manually building a diversified crypto portfolio.

The structure ensures security and decentralized access using smart contracts, thus making it an appealing option for both new and experienced investors who want broad exposure to the crypto market.

| Feature | Details |

|---|---|

| Index Name | Crypto20 |

| Purpose | Tracks the top 20 cryptocurrencies by market capitalization. |

| Investment Strategy | Automated passive investment strategy. |

| Rebalancing Frequency | Weekly rebalancing to reflect market changes. |

| Diversification | Provides exposure to a wide range of digital assets. |

| Accessibility | Suitable for both new and experienced investors. |

| Key Benefits | Low risk due to diversification, easy entry for beginners, and passive management. |

2.Bitwise

Bitwise is one of the biggest providers of crypto index funds and their most selling product is the Bitwise 10 Crypto Index Fund.

This index measures the figures of the 10 largest cryptocurrencies by market capitalization, having Bitcoin and Ethereum which offers a diversified and balanced portfolio.

Bitwise emphasizes on transparency by routinely publishing holdings and methodologies. It helps both retail customers as well as institutions with secure custody and audited financials.

Audits are done regularly so it is easy to trust Bitwise. It is great for investors looking to gain comprehensive investment in the digital asset world.

| Feature | Details |

|---|---|

| Index Name | Bitwise 10 Crypto Index Fund |

| Purpose | Tracks the top 10 cryptocurrencies by market capitalization. |

| Investment Strategy | Diversified exposure to leading cryptocurrencies. |

| Rebalancing Frequency | Monthly rebalancing to reflect market changes. |

| Accessibility | Available as a publicly traded fund under the ticker “BITW.” |

| Key Benefits | Simplifies crypto investing, reduces risk through diversification, and offers professional management. |

3.Galaxy Crypto Index

The Galaxy Crypto Index is a popular benchmark that tracks the value of major digital assets traded in USD across leading exchanges.

It is managed by Galaxy Digital and in partnership with Bloomberg, providing institutional level access to the crypto market.

It features assets such as Bitcoin, Ethereum, and other high-value cryptocurrencies with the highest trading volume and market cap. It is adjusted every month and aimed at institutional investors requiring clear and unambiguous access to the cryptocurrency ecosystem.

Widely regarded as one of the most accurate indicators of the digital asset market, The Galaxy Crypto Index earns a reputation as the most relied upon benchmark for measuring trust in the cryptocurrency market.

| Feature | Details |

|---|---|

| Index Name | Galaxy Crypto Index |

| Purpose | Tracks the performance of the largest and most liquid digital assets. |

| Investment Strategy | Provides diversified exposure to digital stores of value, Web3, DeFi, and payments. |

| Rebalancing Frequency | Monthly rebalancing to reflect market changes. |

| Constituent Weighting | Market cap-weighted; no asset exceeds 35% or falls below 1%. |

| Accessibility | Designed for institutional and retail investors seeking broad crypto exposure. |

| Key Benefits | Transparent pricing, diversified portfolio, and dynamic market representation. |

4.DeFi Pulse Index (DPI)

The DPI (DeFi Pulse Index) is a well-known crypto index that measures the value of the most dynamic decentralized finance (DeFi) tokens of the Ethereum Network.

Index Coop and DeFi Pulse created DPI which encompasses assets such as Uniswap, Aave, and Compound which were selected based on their liquidity, market cap, and usage. It allows investors to hold a single token while having diversified exposure to the rapidly growing DeFi sector.

DPI undergoes recalculation every month to adapt to the dynamic shifts in the market and keep an accurate depiction of the ecosystem’s equilibrium.

DPI has served as a benchmark for deFi innovation and applied the most used methodology in deFi and focusing on the primary projects that the space has to offer.

| Feature | Details |

|---|---|

| Index Name | DeFi Pulse Index (DPI) |

| Purpose | Tracks the performance of the top 10 decentralized finance (DeFi) tokens. |

| Investment Strategy | Provides diversified exposure to DeFi projects through a single ERC-20 token. |

| Rebalancing Frequency | Quarterly rebalancing based on market capitalization. |

| Constituent Tokens | Includes tokens like Uniswap, Aave, Maker, Compound, and Synthetix. |

| Accessibility | Can be purchased on decentralized exchanges like Uniswap and SushiSwap. |

| Key Benefits | Simplifies DeFi investing, offers diversification, and reduces risk. |

5.NFT Index (NFTI)

In Index Coop’s effort to create thematically focused indices, they have released The NFT Index (NFTI). It is a specialized crypto index that tracks the performance of top NFT-related tokens.

Currently, NFTI includes projects such as ApeCoin, The Sandbox, and Decentraland, which are key players in NFT, gaming, and metaverse ecosystems.

NFTI is designed for investors who wish to attain diversified exposure to the NFT markets without the hassle of managing multiple assets.

It is rebalanced on a monthly basis, and adheres to a transparent, rules-based methodology. With such features, NFTI has gained popularity as a simple means of investing in the evolving landscape of NFTs.

| Feature | Details |

|---|---|

| Index Name | NFT Index (NFTI) |

| Purpose | Tracks the performance of NFT-related cryptocurrencies and metaverse tokens. |

| Investment Strategy | Provides diversified exposure to high-quality digital assets in the NFT ecosystem. |

| Rebalancing Frequency | Regular rebalancing based on token circulation and market performance. |

| Constituent Tokens | Includes NFT-related coins and metaverse tokens like MANA and AXS. |

| Accessibility | Available on decentralized platforms like Uniswap and CoinGecko. |

| Key Benefits | Simplifies NFT investing, offers diversification, and tracks emerging trends in the NFT space. |

6.Grayscale Digital Large Cap Fund

Grayscale Digital Large Cap Fund is a well-known crypto investment vehicle that provides diversified exposure to major digital assets by market capitalization. Bitcoin, Ethereum, and Solana are all included with asset weights rebalanced quarterly.

It is SEC-reporting and publicly traded, allowing conventional investors to access the crypto market through regulated channels.

Grayscale investments oversee the fund, and it simplifies direct cryptocurrency custody. With institutional-grade oversight, heavy grade long-term investors that wish to be compliant will have their needs met and participate in the growing digital assets market.

| Aspect | Details |

|---|---|

| Fund Name | Grayscale Digital Large Cap Fund |

| Purpose | Provides exposure to major cryptocurrencies, enabling portfolio diversification. |

| Top Cryptocurrencies | Bitcoin (BTC), Ethereum (ETH), Solana (SOL), XRP, Cardano (ADA)1. |

| Index Tracked | CoinDesk Large Cap Select Index (DLCS). |

| Market Price Per Share | $35.63 (as of March 12, 2025). |

| Assets Under Management | Over $600 million. |

| Investor Eligibility | Available to accredited investors. |

| Trading Platform | Shares can be traded via OTC Markets Group |

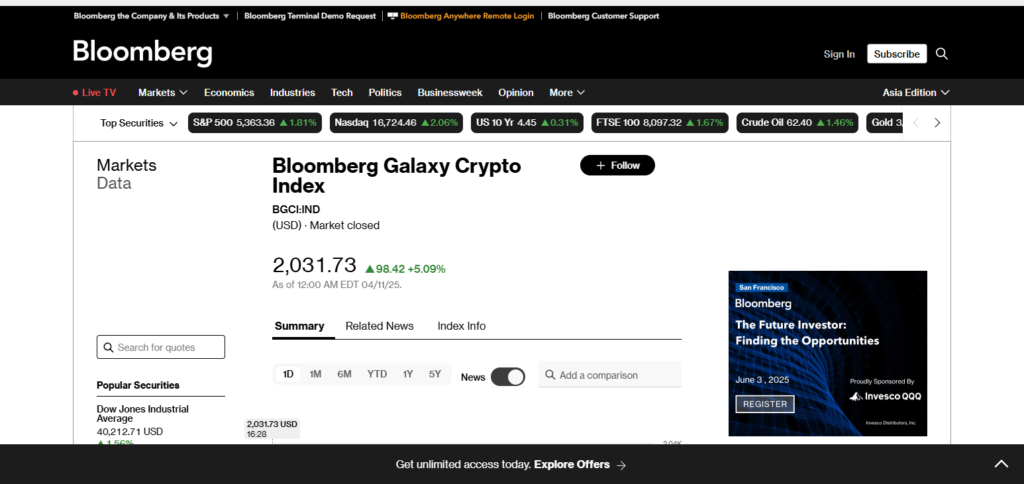

7.Bloomberg Galaxy Crypto Index

The Bloomberg Galaxy Crypto Index is one of the most reputed benchmarks as it monitors the largest and most liquid-supplied cryptocurrencies. It was created through a partnership between Bloomberg and Galaxy Digital, and it now comprises assets such as Bitcoin, Ethereum, and other digital currencies with large market capitalizations.

It employs a rules-based approach which relies coupled with market capitalization and liquidity asagnments, provides representative portrayal of the crypto market accuracy and transparency.

While it has a monthly rebalancing schedule, this index targets institutional clients and therefore provides a dependable, comprehensive and precise, sophisticated multi-dimensional analysis of monitored crypto assets’ movements.

The trusting nature of investors within Bloomberg Galaxy Crypto Index stems from their reliance on professional data sources as well as authoritative benchmarks and highly dynamic coverage of consistently evolving frameworks of digital assets.

| Aspect | Details |

|---|---|

| Index Name | Bloomberg Galaxy Crypto Index (BGCI) |

| Purpose | Measures the performance of the largest cryptocurrencies by market capitalization. |

| Top Cryptocurrencies | Bitcoin (BTC), Ethereum (ETH), Solana (SOL), XRP, Cardano (ADA). |

| Weighting Methodology | Based on market capitalization; constituents represent 1%-35% of the index value. |

| Rebalancing Frequency | Monthly, to ensure accurate representation of the crypto market. |

| Launch Year | 2018 |

| Market Data Source | Bloomberg Terminal and Galaxy Digital. |

8.FTSE Russell Crypto Index

The FTSE Russell Crypto Index is a comprehensive benchmark designed to evaluate the performance of leading cryptocurrencies.

It was established by FTSE Russell with Digital Asset Research and aims to provide an institutional-grade exposure to the digital assets market.

The index incorporates only certain cryptocurrencies and rigorously applies governance standards to maintain the integrity and reliability of the data.

It is ideal for fund managers and institutional investors who want transparent and criteria-based entry to the crypto industry. The index has a distinct focus on quality and compliance and is, therefore, widely accepted as the digital asset benchmark.

Here’s a concise table summarizing the key details about the FTSE Russell Crypto Index:

| Aspect | Details |

|---|---|

| Index Name | FTSE Russell Crypto Index |

| Purpose | Captures the performance of the expanding crypto universe across distinct sectors. |

| Weighting Methodology | Based on market capitalization and sector classification[_{{{CITATION{{{_1{FTSE Grayscale Crypto Sector Index Series |

| Rebalancing Frequency | Quarterly, to reflect the dynamic nature of the crypto market[_{{{CITATION{{{_1{FTSE Grayscale Crypto Sector Index Series |

| Governance Framework | Enhanced oversight and transparency to ensure robust index maintenance[_{{{CITATION{{{_1{FTSE Grayscale Crypto Sector Index Series |

| Launch Year | 2024. |

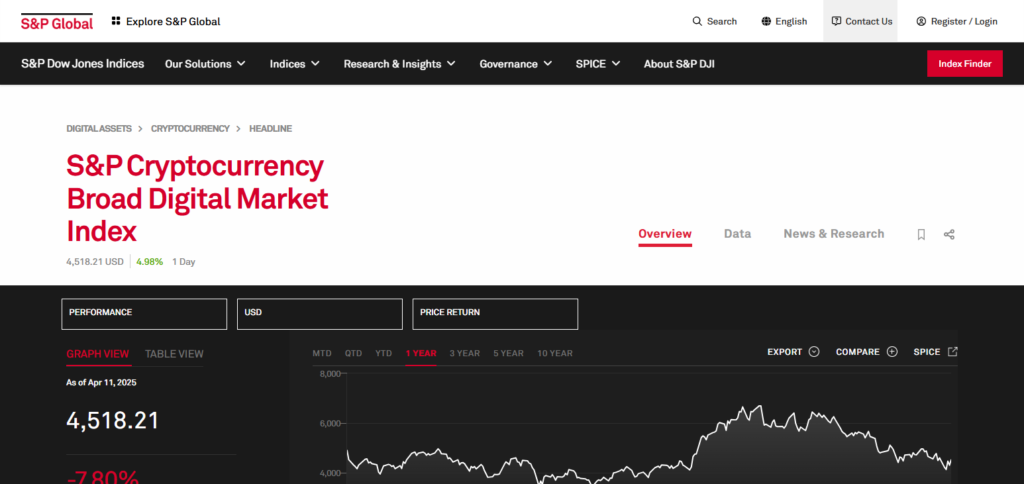

9.S&P Cryptocurrency Broad Digital Market Index

The S&P Cryptocurrency Broad Digital Market (BDM) Index tracks a comprehensive range of digital assets, providing full coverage of the cryptocurrency ecosystem.

The index, which was created by S&P Dow Jones Indices, includes more than 240 cryptocurrencies, capturing a wide variety of digital currencies. It aims to deliver a transparent, rule-based approach for evaluating crypto assets concerning liquidity and market cap.

The S&P BDM Index undergoes rebalancing on a monthly basis, enabling it to stay attuned to shifting market dynamics.

The index has earned a reputation for precision, making it popular among institutional investors who want to access the rapidly changing cryptocurrency market.

| Aspect | Details |

|---|---|

| Index Name | S&P Cryptocurrency Broad Digital Market Index |

| Purpose | Tracks the performance of digital assets listed on recognized open exchanges. |

| Top Cryptocurrencies | Includes Bitcoin (BTC), Ethereum (ETH), and other major digital assets. |

| Weighting Methodology | Based on market capitalization and liquidity criteria. |

| Rebalancing Frequency | Monthly, to ensure accurate market representation. |

| Launch Year | 2021 |

| Market Data Source | Sourced from Lukka, a leading crypto asset data provider. |

10.CoinDesk DeFi Index

The CoinDesk DeFi Index is an index meant to track the activity of prominent DeFi tokens. CoinDesk and CoinDesk Indices created it using well-known DeFi assets which include uniswap, Aave, and Maker based on market value, liquidity, and their relevance in the DeFi ecosystem.

The index is adjusted four times a year to capture the evolution of the DeFi landscape. It provides a clear and systematic framework for funds seeking diversified access to the developing DeFi industry.

The index has served sophisticated and public investors focusing on decentralized finance proportion.

| Aspect | Details |

|---|---|

| Index Name | CoinDesk DeFi Index (DFX) |

| Purpose | Measures the performance of the largest and most liquid digital assets in the DeFi sector. |

| Weighting Methodology | Market capitalization-weighted. |

| Rebalancing Frequency | Quarterly, to ensure accurate representation of the DeFi market. |

| Classification Standard | Based on the Digital Asset Classification Standard (DACS). |

| Launch Year | 2021 |

| Market Data Source | CoinDesk Indices platform. |

Conclusion

To summarize, the prominent crypto indexes like Crypto20, Bitwise, and DeFi Pulse provide investors with a more diversified exposure in the digital assets market.

The indexes provide adequate transparency and safety, along with professional monitoring of ranked cryptocurrencies, thus serving as fundamental resources for both retail and venture investors who intend to skillfully traverse the dynamics of crypto investment.