In this article, I will talk about the How to Buy Crypto with SEPA Transfer. For our users from Europe, SEPA transfers conveniently allow funding of crypto accounts in euros.

I will explain the steps, their benefits, and tips for ensuring a smooth, secure purchase. This guide will aid any user, beginner or seasoned, in crypto buying simplification.

What is SEPA Transfer?

SEPA (Single Euro Payments Area) transfers allow for easy and fast transactions throughout Europe. Considered as a one-stop shop, SEPA covers EU countries and several non-EU members which allows effortless monetary transactions between participating banks.

SEPA guarantees cross-border payment speed, security, and economic efficiency on par with domestic transfer, thus greatly aiding personal and business transactions.

For instance, it is very easy to purchase digital currencies in Europe since SEPA enables funding of crypto exchange accounts.

How to Buy Crypto with SEPA Transfer

Here is a simple step-by-step guide on buying crypto through SEPA:

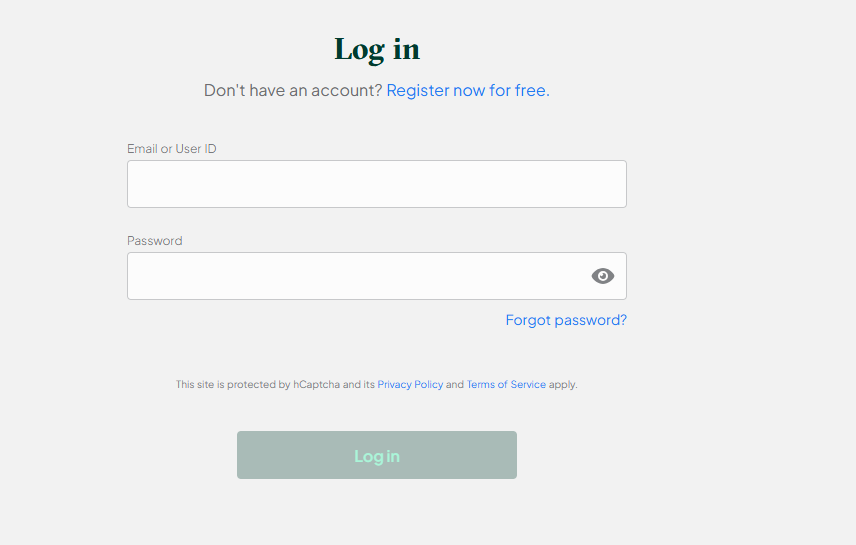

Buying Bitcoin with SEPA on Bitstamp

Step 1: Register and Verify Your Account

Create an account on Bitstamp which accepts crypto-to-SEPA transfers.

Go through KYC verification (ID and proof of address verification).

Enable 2FA security to secure your account.

Step 2: Deposit Funds via SEPA

Go to Deposit > Bank Transfer (SEPA).

Select EUR as the currency and enter the amount you want to deposit.

Bitstamp provides bank details (IBAN & BIC) necessary for the transfer.

Complete the SEPA transfer via your banking app or online banking.

Typically, the transfer is completed within 1-3 business days.

Step 3: Buy Bitcoin (BTC)

Once the deposit in EUR is available, navigate to Trade or Markets.

Select the trading pair BTC/EUR.

Select Market Order (buy instantly) or Limit Order (set a purchase price).

Specify the purchase amount in EUR and place the order.

The BTC purchased will be available in your Bitstamp wallet.

Step 4: Withdraw to Private Wallet (Optional)

Go to Withdraw > Crypto > Bitcoin.

Enter Bitcoin wallet address and confirm withdrawal to withdraw.

Expect blockchain confirmations to obtain your BTC.

Other Place Where to Buy Crypto with SEPA Transfer

Coinbase

Coinbase is among the easiest platforms for purchasing crypto through SEPA transfers, making it great for novices in Europe. Its primary benefit is the easy incorporation of SEPA deposits, which are usually completed within one business day.

Coinbase integrates compliance with regulations and user-friendly design, allowing effortless account funding in euros and trading free from convoluted steps or surprises.

Binance

With Binance, purchasing cryptocurrencies through SEPA transfers is convenient because of the low deposit costs and the variety of coins available. Binance stands out from other platforms because of its competitive pricing and high liquidity; traders receive more value during exchanges.

Though SEPA transfers are simple, they are often swift which aids European customers in rapidly accessing funds during trading lulls and alleviates unnecessary expenses.

Advantages of Using SEPA to Buy Crypto

Inexpensive Transaction Charges: Funding crypto purchases via SEPA Transfer usually incurs little to no fee.

Quick SEPA Transfer Completion: A majority of SEPA Transfers often complete between 1-2 business days, providing faster access to funds.

Strong Protective Measures: SEPAs are bound to European Regulations that guarantee safe and trustable ways to transfer money.

Many Exchanges Offer Support: A good number of Europe’s major crypto exchanges accept SEPA deposits.

Payments in Euro Accepted: Particularly good for users working in euros as it saves them from conversion fees.

Tips for a Smooth SEPA Crypto Purchase

Select a Suitable Exchange: Regulatory compliance and support for SEPA bank transfers makes this exchange a good option.

Do Complete KYC Verification Early: Identity verification is mandatory for SEPA deposits on most exchanges.

Take Care of Your Bank Details: Provide your IBAN and other relevant information accurately to avoid rejection or delays.

Stay Within Time Limits: SEPA transfers take 1–2 business days on average; plan accordingly.

Watch Out for Additional Charges: Investigate whether your bank or the exchange imposes additional (yet undisclosed) fees.

Security and Legal Considerations

Use Authorised Exchanges

Platforms certified comply with European Union regulations should be prioritized.

Enable Two Step Authentication

This provides additional security to the account protected.

Complete KYC Verification

To comply with anti-money laundering (AML) policies, most exchanges require identity verification.

Understand Tax Obligations:

Depending on the country, purportedly, cryptocurrency purchases and sales may need to reported.

Store Crypto Safely

After purchase, assets can be transferred to a private wallet which enhances security.

Pros & Cons

| Pros | Cons |

|---|---|

| Low transaction fees | Transfers may take 1–2 business days |

| Supported by major European exchanges | Not available outside SEPA region |

| High security and bank-level protection | Requires KYC verification |

| Simple euro-based payments | Limited to EUR; not ideal for other currencies |

| Easy to use for beginners | Bank errors can cause deposit delays |

Conclusion

To summarize, for users based in Europe, purchasing cryptocurrency through a SEPA transfer is simple and safe; moreover, it is inexpensive. With a trustworthy exchange, the required verification, and with the deposit procedure, your account can be euro-funded with ease.

This method is also streamlined for those who understand the advantages and security details, making SEPA transfers outstanding for Europeans who want to venture into the crypto world.