In this post, I Will discuss the Best Crypto ETFs in Europe. These funds give you safe, regulated access to Bitcoin, Ethereum, and Solana without the hassle of buying tokens on an exchange.

Backed by big institutions, they charge low fees and include solid security that large investors expect. Whether you want income from staking or prefer funds that hold the coins directly, these ETFs cover almost every strategy.

Key Point & Best crypto ETFs Europe

| Name | Key Point |

|---|---|

| CoinShares Physical Bitcoin (GB00BLD4ZL17) | A widely recognized Bitcoin ETF with $1.8 billion in assets under management. |

| Bitcoin Tracker Euro (SE0007525332) | A synthetic Bitcoin ETF tracking BTC with $1.5 billion AuM. |

| Bitwise Physical Bitcoin (DE000A27Z304) | A physically-backed Bitcoin ETF holding $1.35 billion in assets. |

| WisdomTree Physical Bitcoin (GB00BJYDH287) | A low-cost Bitcoin ETF managing $1.23 billion in assets. |

| 21Shares Bitcoin ETP (CH0454664001) | A popular and regulated Bitcoin ETP with $921 million AuM. |

| VanEck Bitcoin ETN (DE000A28M8D0) | A well-known Bitcoin ETN with $766 million under management. |

| 21Shares Solana Staking ETP (CH1114873776) | Offers Solana staking exposure with $909 million AuM. |

| iShares Bitcoin ETP (XS2940466316) | A Bitcoin ETP from iShares, holding $319 million in assets. |

| Fidelity Physical Bitcoin ETP (XS2434891219) | Backed by Fidelity, this ETP holds $297 million in Bitcoin assets. |

| CoinShares Physical Staked Ethereum (GB00BLD4ZM24) | An Ethereum staking ETF with $336 million AuM. |

1. CoinShares Physical Bitcoin (GB00BLD4ZL17)

CoinShares Physical Bitcoin ranks among Europes biggest Bitcoin ETFs, letting you gain BTC exposure without owning coins yourself. Each share is backed by real Bitcoin kept in cold wallets, the safest way to store digital coins offline.

The fund charges a slim 0.98% management fee, a plus for anyone planning to hold for years. Assets now top $1.8 billion, and many institutions pick it when they want a regulated entry to crypto. The firms long history in digital assets also lends extra trust to the product.

CoinShares Physical Bitcoin (GB00BLD4ZL17)

- Type: Physically backed Bitcoin ETF

- Issuer: CoinShares

- Management Fee: 0.98%

- Assets Under Management: $1.8 billion

- Security: Coins kept in cold storage

- Regulation: Meets EU crypto investment rules

- Listing: Trades on major European exchanges

2. Bitcoin Tracker Euro (SE0007525332)

Bitcoin Tracker Euro is an exchange-traded note (ETN) that lets investors ride Bitcoin price swings priced in euros. No coins are ever delivered because this synthetic product uses derivatives instead of a fund that buys and holds Bitcoin.

The note is managed by XBT Provider, part of CoinShares, and it now carries about $1.5 billion in assets across Europe, a clear sign of strong demand.

Its annual cost sits at 2.5%, and trading takes place on the Stockholm Nasdaq Nordic Exchange, making it simple for euro-area investors. High trading volume and backing from institutions place it among the top Bitcoin products on European markets.

Bitcoin Tracker Euro (SE0007525332)

- Type: Synthetic Bitcoin ETN

- Issuer: XBT Provider, a CoinShares part

- Management Fee: 2.5%

- AuM: $1.5 billion

- Tracking Method: Uses derivatives to mimic Bitcoin

- Listing: Available on Nasdaq Nordic in Stockholm

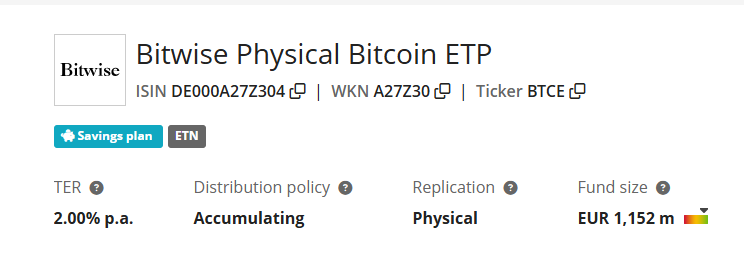

3. Bitwise Physical Bitcoin (DE000A27Z304)

The Bitwise Physical Bitcoin ETF offers a pathway that is backed by real coins stored in secure vaults. Known for solid digital-asset oversight, Bitwise applies strict security measures to protect those reserves from theft and loss.

The fund stands at roughly $1.35 billion in assets, ranking it among the largest crypto options on the continent. With a modest fee of 0.85%, it attracts investors who want exposure to Bitcoin without the sky-high costs common elsewhere.

Bitwise also prioritizes clear pricing and auditable proof of reserves, traits that institutions appreciate in regulated markets. Because this product holds physical Bitcoin rather than futures, each coin is regularly verified and stored under strict compliance.

Bitwise Physical Bitcoin (DE000A27Z304)

- Type: Physically backed Bitcoin ETF

- Issuer: Bitwise

- Management Fee: 0.85%

- AuM: $1.35 billion

- Security: Stored in institutional cold wallets

- Listing: Found on exchanges such as Deutsche Börse

4. WisdomTree Physical Bitcoin (GB00BJYDH287)

WisdomTrees Physical Bitcoin gives everyday investors a budget-friendly way to ride Bitcoin prices without owning coins themselves. The fund is physically backed, so real BTC sits in cold storage and stays out of hackers reach.

With about $1.23 billion in assets it is one of the larger options, and you can buy it on major European markets like the London Stock Exchange or Deutsche Brse Xetra. At a management fee of just 0.95% it costs less than many rival products.

Plus, WisdomTree still enjoys a solid reputation in traditional finance, so buyers feel better about security and transparency.

WisdomTree Physical Bitcoin (GB00BJYDH287)

- Type: Physically backed Bitcoin ETF

- Issuer: WisdomTree

- Management Fee: 0.95%

- AuM: $1.23 billion

- Security: Held in cold wallet storage

- Listing: Offered on the London Stock Exchange and Deutsche Börse

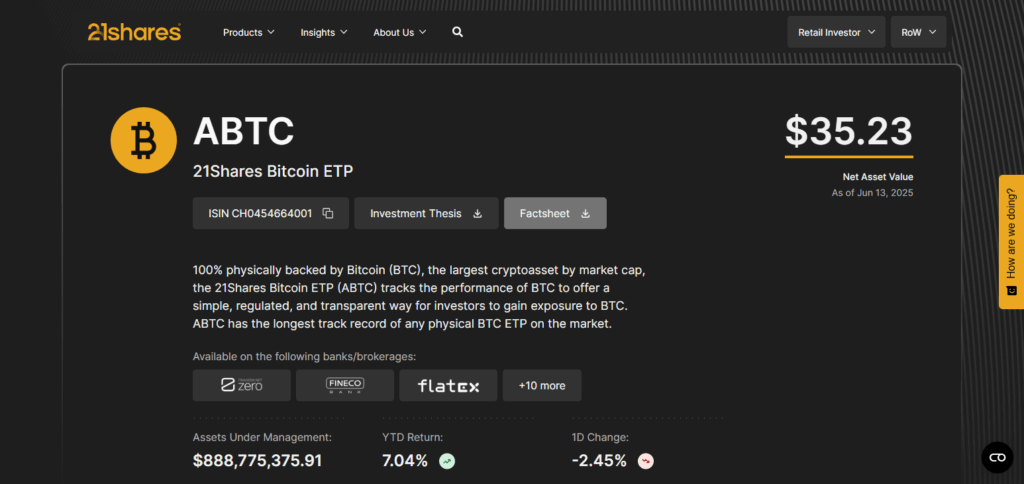

5. 21Shares Bitcoin ETP (CH0454664001)

The 21Shares Bitcoin ETP also holds real Bitcoin in cold storage, making it a fully backed exchange-traded product for serious investors. Founded in Switzerland, 21Shares helped launch the ETP craze and keeps the process institutional-grade.

Today the fund manages around $921 million and trades on Swiss and German exchanges, giving it wide reach.

Its 1.49% fee is a touch higher, yet many accept the cost for strong Swiss regulation and peace of mind. Because of this oversight, the ETP remains a top pick for European buyers after a secure Bitcoin play.

21Shares Bitcoin ETP (CH0454664001)

- Type: Physically backed Bitcoin ETP

- Issuer: 21Shares

- Management Fee: 1.49%

- AuM: $921 million

- Security: Coins secured in cold wallets

- Listing: Swiss and German exchanges

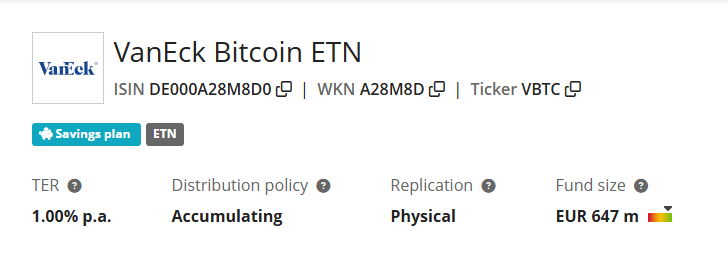

6. VanEck Bitcoin ETN (DE000A28M8D0)

The VanEck Bitcoin ETN is a physically backed exchange-traded note that gives you Bitcoin exposure without the hassle of keeping coins yourself. VanEck is a well-regarded global money manager that knows its way around both stock markets and digital assets.

The note holds about $766 million and trades on Deutsche Brse Xetra, so European investors can buy it with the same ease they buy blue-chip shares.

It charges a tidy 1.0% fee, placing it among the cheaper ways to get exposure to Bitcoin. For peace of mind, VanEck stores the underlying bitcoins with institutional-grade custody.

VanEck Bitcoin ETN (DE000A28M8D0)

- Type: Physically backed Bitcoin ETN

- Issuer: VanEck

- Management Fee: 1.0%

- AuM: $766 million

- Security: Institutional-grade custody solutions

- Listing: Deutsche Börse Xetra

7. 21Shares Solana Staking ETP (CH1114873776)

21Shares Solana Staking ETP is one of the very few special funds in Europe that gives you direct Solana (SOL) exposure and also stakes the tokens on your behalf.

Instead of sitting idle, the fund actively earns staking rewards, handing you a stream of passive income every reporting period.

With roughly $909 million under management, it has already crossed the popularity threshold for serious blockchain investors. The annual fee is 1.5%, yet that cost is often covered by the rewards, which makes the product especially appealing for buy-and-holders.

21Shares pairs its staking operation with top-notch cold storage, securing your assets while you sit back and collect yield.

21Shares Solana Staking ETP (CH1114873776)

- Type: Solana staking ETP

- Issuer: 21Shares

- Management Fee: 1.5%

- AuM: $909 million

- Staking Benefits: Passive income from SOL staking rewards

- Listing: Swiss and German markets

8. iShares Bitcoin ETP (XS2940466316)

The iShares Bitcoin ETP is run by BlackRock, one of the biggest names in finance. The fund gives direct exposure to Bitcoin and holds each coin in a secure, fully backed store.

With $319 million in assets under management, it clearly attracts serious institutional buyers. Because it trades on Euronext Amsterdam, European investors get regulated access to crypto without crossing borders.

The plan charges a slim 0.25% fee, ranking it among the cheapest Bitcoin ETPs out there. Backed by BlackRock, the product feels like a safe bridge between traditional finance and digital currency.

iShares Bitcoin ETP (XS2940466316)

- Type: Physically backed Bitcoin ETP

- Issuer: iShares (BlackRock)

- Management Fee: 0.25%

- AuM: $319 million

- Security: Cold-storage Bitcoin holdings

- Listing: Euronext Amsterdam

9. Fidelity Physical Bitcoin ETP (XS2434891219)

Fidelitys Physical Bitcoin ETP is backed by actual coins stored in institutional cold wallets that hackers find hard to reach. Fidelity itself is a global powerhouse in asset management, so the product comes with built-in trust.

The fund now holds $297 million and has a low cost of 0.75%, friendly for anyone saving long term. You can buy it on major European bourses like Euronext and Deutsche Brse Xetra, so liquidity is never an issue.

Its a go-to choice for institutions seeking regulated Bitcoin exposure while keeping counterparty risk as low as possible.

Fidelity Physical Bitcoin ETP (XS2434891219)

- Type: Physically backed Bitcoin ETP

- Issuer: Fidelity

- Management Fee: 0.75%

- AuM: $297 million

- Security: Institutional-grade cold storage

- Listing: Euronext, Deutsche Börse

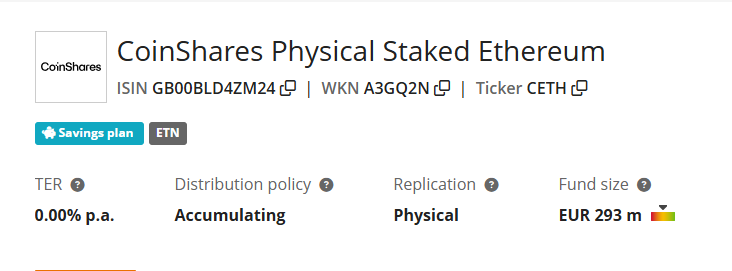

10. CoinShares Physical Staked Ethereum (GB00BLD4ZM24)

This exchange-traded fund gives you direct access to Ethereum (ETH) and adds staking rewards, so you collect passive income while holding the crypto. Run by CoinShares, the fund keeps assets in safe custody and uses Ethereums own staking setup to boost returns.

With about $336 million under management, it ranks among Europes top ETH-backed ETFs. Although the 1.25% fee sounds high, the added yield from staking often cancels it out, making the fund attractive for buy-and-hold investors.

Because it trades on Euronext and Deutsche Brse, you get a regulated ETH investment without the hassle of a crypto wallet.

CoinShares Physical Staked Ethereum (GB00BLD4ZM24)

- Type: Ethereum staking ETF

- Issuer: CoinShares

- Management Fee: 1.25%

- AuM: $336 million

- Staking Benefits: Passive income through Ethereum staking rewards

- Listing: Euronext, Deutsche Börse

Conclusion

Europe has rolled out a wide mix of crypto ETFs, ETNs, and ETPs, giving people a safe, rules-based way to own Bitcoin, Ethereum, and Solana. Crowd-pleasers such as CoinShares Physical Bitcoin, WisdomTree Bitcoin, and iShares Bitcoin ETP get nods for thin fees and the cold-storage safety big institutions demand, while 21Shares Solana Staking ETP and CoinShares Physical Staked Ethereum shine by throwing in easy staking income.

Those who want the coins sitting offline can turn to the Bitwise or Fidelity Physical Bitcoin ETPs, both backed by hardware wallets. If you dont mind a paper version, synthetic tools like Bitcoin Tracker Euro tap into derivatives markets without actually buying coins on-chain.

Whether low cost, staking profit, or iron-clad regulation tops your list, Europes crypto fund aisle has something for almost every play. Looking for a side-by-side comparison table? Just ask!