In this article, I will talk about the Top Polkadot Defi Apps which are changing the landscape of decentralized finance in the Polkadot ecosystem.

The apps provide advanced services such as cross-chain lending, trading, efficient staking, and more. Be it a developer or an investor, one can clearly see that these DeFi apps highlight the capabilities of Polkadot for creating seamless and flexible financial applications all around the world.

Key Point & Top Polkadot Defi Apps List

| Project Name | Key Point |

|---|---|

| Acala | DeFi hub on Polkadot offering a multi-functional stablecoin platform. |

| Hydration (HydraDX) | Cross-chain DEX using a shared liquidity pool for deep and efficient trading. |

| Bifrost | Provides liquid staking derivatives and multichain DeFi access. |

| Interlay | Enables Bitcoin bridging to Polkadot via a secure, trust-minimized protocol. |

| StellaSwap | Leading DEX on Moonbeam with integrated DeFi tools and cross-chain support. |

| Moonwell | Lending and borrowing protocol optimized for Moonbeam and Moonriver. |

| Parallel Finance | Offers staking, lending, and crowdloan derivatives with institutional-grade DeFi. |

| Beamswap | Moonbeam-native DEX and launchpad with yield farming and NFT tools. |

| Pendulum | Bridges fiat and DeFi, focusing on stablecoin forex and compliance-ready finance. |

| Polkadex | Combines CEX and DEX features for high-speed, non-custodial trading. |

1.Acala

Acala is one of the leading DeFi applications in Polkadot because it provides an entire ecosystem with a native stablecoin (aUSD), liquid staking, and an EVM-compatible L1 smart contract layer.

Acala’s competitive advantage lies in its liquid money market which allows for cross chain decentralized finance (DeFi) while maintaining low fees and deep liquidity through the built-in DEX. Its strong integration with Polkadot relay chain guarantees high scalability and security; hence, it can be considered as a multichain finance foundational protocol within the Polkadot ecosystem.

| Feature | Details |

|---|---|

| App Name | Acala |

| Network | Polkadot Parachain |

| Core Functions | Stablecoin (aUSD), DeX, Liquid Staking, Lending |

| Unique Feature | All-in-one DeFi hub with native stablecoin (aUSD) and micro gas fees |

| KYC Requirement | Minimal for most features; only needed for fiat on/off-ramp |

| Why It’s Top | Offers seamless DeFi experience with cross-chain support and efficiency |

| Target Users | DeFi users, developers, and liquidity providers |

2.Hydration (formerly HydraDX)

Hydration (formerly HydraDX) stands out in the Polkadot DeFi ecosystem by implementing a singular, multi-asset liquidity pool that allows for trading across an ultra-efficient range of tokens. Its innovative quotient-volume mitigating mechanism adjusts assets automatically, reducing slippage significantly while simplifying management of portfolios.

Built entirely on Substrate, Hydration offers fast, low-cost swaps as well as deep liquidity alongside decentralization. It leverages Polkadot’s cross-chain capabilities to streamline asset trading through a single pool which serves users with powerful exchange capabilities and unparalleled ease-of-use.

| Feature | Details |

|---|---|

| App Name | Hydration (formerly HydraDX) |

| Network | Polkadot Parachain (Substrate-based) |

| Core Functions | Omnipool DEX, single-sided liquidity, cross-chain swaps, DCA, lending/borrowing, stablecoin support |

| Unique Feature | Omnipool – unified liquidity pool enabling lower slippage, no pair requirements, and highly capital-efficient |

| KYC Requirement | Minimal – only required for fiat on/off-ramp; core DeFi features accessible without identity verification |

| Security Layers | Audits, bug bounties, liquidity caps, circuit breakers, dynamic fees |

| Why It’s Top | Innovative liquidity management, interoperability across parachains, seamless user experience with minimal entry barriers |

| Target Users | Traders, liquidity providers, yield seekers, and institutional users seeking efficient cross-chain DeFi operations |

3.Bifrost

Bifrost stands out as a top Polkadot DeFi app with liquid staking since it permits users to earn yield and maintain liquidity simultaneously. With Bifrost’s unique vToken approach, staked assets are converted into tradable derivatives which make capital access immediate.

Also, users can participate in other DeFi activities without going through traditional unstaking wait periods. Bifrost also caters to other ecosystems like Kusama and others which guarantees seamless cross-chain transactions. This combination of usability, flexibility, and yield advancement makes Bifrost one of the leaders in DeFi on Polkadot.

| Feature | Details |

|---|---|

| Name | Bifrost |

| Category | Liquid Staking & Cross-Chain DeFi |

| Network | Polkadot Parachain |

| Minimal KYC | Yes – Non-custodial & DeFi-native; no mandatory KYC for regular use |

| Core Use Case | Enables liquid staking of DOT and other tokens via vToken derivatives |

| Unique Value | Provides staking liquidity without locking assets |

| Integration | Supports Polkadot, Kusama, Moonriver, and more |

| Governance | Community-driven via BNC token |

| Website | https://bifrost.finance |

4.Interlay

As a leading Polkadot DeFi application, Interlay offers the only secure and trustless bridge to bring Bitcoin into the Polkadot ecosystem. Its prominence is marked by BTC-backed “iBTC” token which allows users to utilize their Bitcoin for trade, lend, or stake in a decentralized manner without losing exposure to Bitcoin.

Through stringent collateralization, decentralized governance, and interoperability, Interlay makes it possible for Bitcoin holders to fully participate in DeFi—ushering cross-chain innovation and increasing Polkadot’s relevance in the crypto sphere.

| Feature | Details |

|---|---|

| Name | Interlay |

| Category | Bitcoin DeFi on Polkadot |

| Network | Polkadot Parachain |

| Minimal KYC | Yes – No KYC needed for using vaults or DeFi functions |

| Core Use Case | Brings Bitcoin to Polkadot via iBTC, a trustless BTC-backed asset |

| Unique Value | Fully decentralized Bitcoin bridge with collateralized security |

| Integration | Connects Bitcoin with Polkadot DeFi ecosystem |

| Governance | Managed via INTR token and community proposals |

| Website | https://interlay.io |

5.StellaSwap

As a leading Polkadot DeFi application, StellaSwap is known for its streamlined and effective decentralized exchange located on Moonbeam’s parachain. Its unique innovation of EVM integration fused with the native Moonbeam structure enables effortless Ethereum asset cross-chain swaps while keeping Polkadot security and performance standards.

Due to its in-depth yield farming options paired with intuitive platform design, StellaSwap enhances liquidity provider and trader participation within multichain DeFi seamlessly—offering polished speed, flexibility, and unprecedented depth.

| Feature | Details |

|---|---|

| Name | StellaSwap |

| Category | DEX & DeFi Hub on Moonbeam |

| Network | Moonbeam (Polkadot Parachain) |

| Minimal KYC | Yes – Non-custodial, permissionless access; no KYC for DeFi use |

| Core Use Case | Swap, stake, farm, and bridge tokens within Polkadot and EVM chains |

| Unique Value | EVM-compatible DEX with integrated multichain bridging |

| Integration | Supports cross-chain assets via Axelar, Wormhole, Multichain |

| Governance | Community voting powered by STELLA token |

| Website | https://app.stellaswap.com |

6.Moonwell

Moonwell distinguishes itself as one of the leading Polkadot DeFi applications because of its integrated functionalities on Moonbeam and Moonriver that allow for multi-chain lending and borrowing. The focus on security and decentralization makes the real-time risk assessment a unique feature of within crypto governance systems .

Users can earn yield on their deposits while gaining access to liquidity without having to sell their assets. Its EVM compatibility guarantees developer flexibility, making it a foundational liquidity layer in the Polkadot ecosystem.

| Feature | Details |

|---|---|

| Name | Moonwell |

| Category | Lending & Borrowing Platform |

| Network | Moonbeam & Moonriver (Polkadot Ecosystem) |

| Minimal KYC | Yes – Fully non-custodial; no KYC required for lending or borrowing |

| Core Use Case | Supply and borrow crypto assets with on-chain liquidity and rewards |

| Unique Value | Real-time risk management and seamless EVM compatibility |

| Integration | Supports assets across Polkadot, Ethereum-compatible chains |

| Governance | Community-led via WELL & MFAM tokens |

| Website | https://moonwell.fi |

7.Parallel Finance

For its decentralized lending, staking, and crowdloan participation services, Parallel Finance is ranked as one of the top Polkadot DeFi apps. With regard to capital efficiency, it enables users to both stake and use the same assets as collateral.

This model offers dual utility without reducing security. Parallel has been built using Substrate which allows for deep integration with Polkadot’s parachain ecosystem and, therefore providing quick, scalable and cross-platform financial services on a retail and wholesale level.

| Feature | Details |

|---|---|

| Name | Parallel Finance |

| Category | DeFi Super App (Lending, Staking, Trading) |

| Network | Polkadot Parachain |

| Minimal KYC | Yes – No KYC needed for using core DeFi functions |

| Core Use Case | Offers liquid staking, decentralized lending, and yield farming |

| Unique Value | Multi-functional DeFi suite with high capital efficiency |

| Integration | Supports DOT, KSM, and native assets on Polkadot |

| Governance | Decentralized via PARA token |

| Website | https://parallel.fi |

8.Beamswap

Beamswap currently leads in the DeFi sector on Polkadot as it is the first decentralized exchange and automated market maker (AMM) on Moonbeam’s network. Its most distinguishing feature is its integrated launchpad and yield farm which permits users to access high-yield farming while projects can get directly deployed within its ecosystem.

Beamswap also stands out because of its native support for EVM-compatible assets, cross-chain capabilities and seamless operations which make it an indispensable liquidity hub in Polkadot’s growing multi-chain DeFi economy.

| Feature | Details |

|---|---|

| Name | Beamswap |

| Category | DEX & Yield Farming Platform |

| Network | Moonbeam (Polkadot Parachain) |

| Minimal KYC | Yes – Permissionless and non-custodial; no KYC required |

| Core Use Case | Token swaps, staking, yield farming, and launchpad services |

| Unique Value | First DEX with a launchpad on Moonbeam |

| Integration | EVM-compatible; supports multichain assets and wallets |

| Governance | Community-governed via GLINT token |

| Website | https://beamswap.io |

9.Pendulum

Pendulum is one of the leading DeFi apps on Polkadot as it allows for seamless integration of fiat currencies with DeFi protocols through stablecoins. Pendulum’s smart contracts are its most innovative feature and are designed to meet regulatory compliance, making Pendulum attractive to TradFi institutions that have to operate within certain regulations.

Offering foreign exchange trading and payment automation, Pendulum tackles real-world financial use cases by offering forex trading, payment automation, yield generation and many other services on a Polkadot parachain while focusing on interoperability and scalability.

| Feature | Details |

|---|---|

| Name | Pendulum |

| Category | Forex-Optimized DeFi Network |

| Network | Polkadot Parachain |

| Minimal KYC | Yes – Open access; KYC not required for core DeFi participation |

| Core Use Case | Bridges traditional forex with DeFi using stable assets and smart contracts |

| Unique Value | Connects fiat on/off-ramps to the Polkadot ecosystem |

| Integration | Integrates with Stellar and fiat-pegged stablecoins |

| Governance | Community-driven via PEN token |

| Website | https://pendulumchain.org |

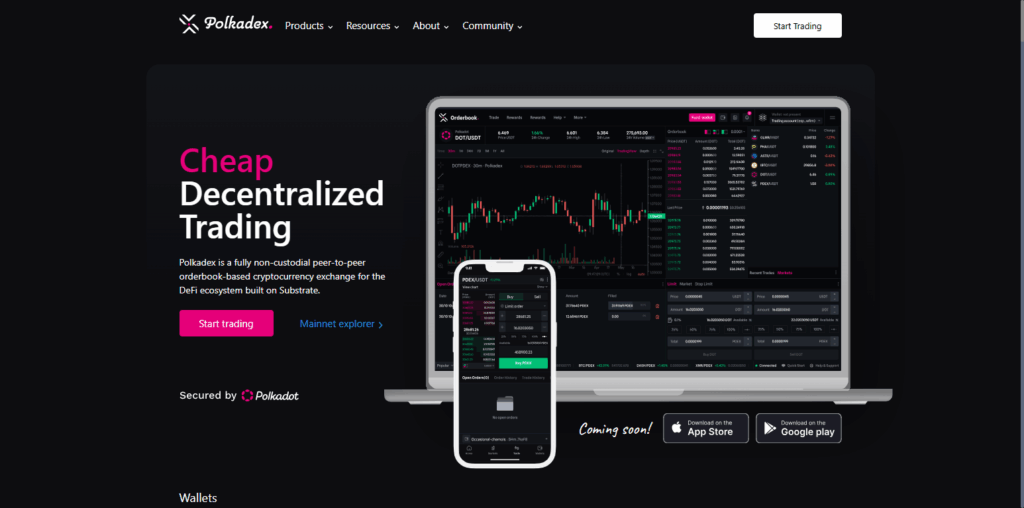

10.Polkadex

Polkadex deserves recognition as one of the top DeFi applications on Polkadot for melding the capabilities of a centralized exchange with the security of a decentralized polygonal order-book-based DEX. Polkadex is not another AMM; it allows sophisticated trading like high-frequency trading, low slippage, and custodian-free user control trade-offs.

Its most notable competitive differentiation is TEEs or trusted execution environments which provide front-running protection and privacy. Built on Substrate, Polkadex offers speed, scalability, and interoperability which positions it favorably compared to other professional traders in the Polkadot ecosystem.

| Feature | Details |

|---|---|

| Name | Polkadex |

| Category | Decentralized Orderbook Exchange |

| Network | Polkadot Parachain |

| Minimal KYC | Yes – No KYC for decentralized trading via Polkadex Orderbook |

| Core Use Case | Non-custodial trading with high-speed order matching |

| Unique Value | Combines CEX-like performance with DEX-level decentralization |

| Integration | Bridges with Ethereum; supports DOT ecosystem assets |

| Governance | Powered by PDEX token for upgrades and decision-making |

| Website | https://polkadex.trade |

Conclusion

To summarize, the leading DeFi applications of Polkadot including Moonwell, Parallel Finance, Beamswap, Pendulum and Polkadex show how much power and versatility the entire Polkadot ecosystem has.

From cross-chain lending to dual-utility staking, compliant TradFi interfacing to sophisticated trading infrastructure—each platform brings unique innovations. These features all together withstand the test of complexity while exhibiting great elegance.