In this article, I will discuss the How to Buy Fractional Shares on Schwab, helping anyone get started with investing for as low as a few dollars.

You’ll understand Schwab Stock Slices™, the purchasing process of fractional shares, as well as tips for managing your investments. This guide will be helpful for novices who wish to invest in great companies at a low cost.

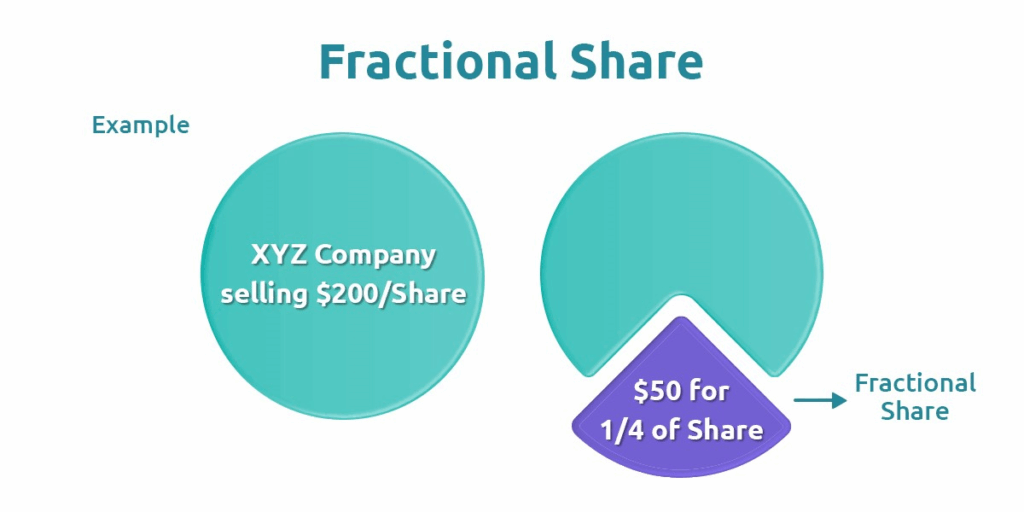

What Are Fractional Shares?

A fractional share is a division of a share of stock which allows an investor to purchase less than a full share of a particular companies stock. Rather than acquiring an entire share which may be highly priced, you have the option to spend a certain fixed amount of money, for example $5 or $10.

This is helpful for newcomers or people with limited resources to invest in companies with higher stocks such as Amazon and Apple. Fractional shares also aid in investment diversification by reducing the capital needed to invest across different companies.

How to Buy Fractional Shares on Schwab

Example: Schwab’s Fractional Share Purchase of Apple

Step-by-Step Process

Open a Schwab Brokerage Account

- Go to Schwab’s homepage and click on “Open an Account.”

- Pick a standard brokerage account type, and fill out the app with personal and financial info.

Deposit Money Into Your Account

- Set up an external bank account and transfer money (minimum $5 to utilize Stock Slices feature).

- ACH transfer, wire, and mobile check deposit are all accepted.

Navigate to Schwab Stock Slices

- Once logged in, click on “Trade” and choose “Schwab Stock Slices.”

- A list with all S&P 500 companies eligible for fractional investing will appear.

Select Stock(s) of Your Choice

- Choose Apple (AAPL) and also pick additional 30 other stocks if you want.

- Input the total you wish to invest (for example, $50).

Submit Your Order

- Check the summary of your order for accuracy and approve the transaction.

- Schwab will compute the fractional share at a share price of 200e.g.200e.g.50 would equate to 0.25 shares.

Monitoring your Shareholding

- Your fractional shares will be visible in your portfolio just like any other stock.

- Dividends will be paid in proportion to your holding, and you can sell your piece at any time without incurring any commission fees.

Why Choose Charles Schwab for Fractional Investing

Schwab Stock Slices™ Program: You can acquire fractional shares of S&P 500 companies starting at just $5 with Schwab.

No Commission Fees: Buying fractional shares is completely free at Schwab, which is great for new investors.

Trusted Brokerage Platform: Schwab provides excellent customer service and equipment for safe investing as a long-time regulated broker.

User-Friendly Interface: Managing and buying mobile and web shares through the mobile and web platforms is straightforward.

AutomaticDividend Reinvestment: With your fractional shares, you can earn dividends which are automatically reinvested enhancing compounding.

Tips for Choosing Stocks

Start With Famous Companies: It’s advisable to start with reputable companies especially those included in the S\&P 500, for relatively lower risk and sustainable growth in the future.

Spread Investments Across Different Sectors: Avoid putting all your eggs in one basket. Invest in different sectors such as technology, health care, and consumer goods to mitigate risk.

Take Schwab’s Research Recommendations: Make use of Schwab’s available stock evaluations, research, rating systems, and notifications to simplify stock choice.

Look at Dividend Paying Stocks: Look for stocks that are known to pay dividends regularly to gradually build up passive income.

Your Financial Targets: make stock selections based on personal objectives set out whether they are about growth, income, or wealth accumulation over time.

Managing Your Fractional Shares

After acquiring fractional shares via Schwab, managing them is simple. Their performance can be monitored from your Schwab account dashboard alongside full shares. Any dividends earned will be automatically credited to your account with an option for portfolio reinvestment.

You can sell fractional shares anytime during trading hours, but only market orders are accepted. Staying informed about company updates, regularly reviewing your holdings, and rebalancing your portfolio are all great ways to help stay on track with your investment objectives.

Limitations and Considerations

Restricted to S&P Stocks: It is not possible to purchase any public stock, Schwab Stock Slices™ only allows fractional purchases of stocks within the S&P 500 index.

No Stop Limit Orders: Buying fractional shares is restricted to market orders only, where you purchase the share at the current market price without setting a defined price.

No Immediate Execution of Orders: Orders for fractional shares are executed only once a day for that trading day’s session, leading to possible discrepancies in price.

Restrictions on Fractional Shares: It may be impossible to transfer fractional shares to another brokerage. Therefore, one may need to sell them to transfer.

Record Keeping For Taxes: Even with minor amounts, capital gains and dividend taxation will incur, leading to addional record keeping.

Conclusion

Purchasing fractional shares on Schwab is quick and cost-efficient. Starting with just $5, you can invest in leading S&P 500 companies through Schwab Stock Slices™.

You also don’t have to worry about commission fees. Schwab allows you to steadily build a diversified portfolio over time. Whether you’re a beginner or want to increase your investment, Schwab provides a safe and simple platform to help you build wealth over time.

FAQ

What is the minimum amount required to buy fractional shares on Schwab?

You can start investing with as little as $5 per stock through Schwab Stock Slices™.

Which stocks are eligible for fractional investing on Schwab?

Only companies listed in the S&P 500 index are eligible for Schwab’s fractional share program.

Are there any fees for buying fractional shares on Schwab?

No. Schwab does not charge any commission or transaction fees for buying fractional shares.