In this post, I will explain how to legally double your Bitcoin. With how popular cryptocurrency has become, a lot of investors are looking for safe ways to grow their assets without falling for a scam, illegal activity, or fraud.

By committing to well-established techniques like HODLing, dollar-cost averaging (DCA), or trend-following trading, it is possible to increase your Bitcoin steadily over time.

Key Points & Best Bitcoin Trading Strategy for Consistent Gains List

| Trading Strategy | Key Point |

|---|---|

| Trend Following | Follows the direction of market trends, aiming to profit from sustained moves. |

| Swing Trading | Targets short- to medium-term price swings, holding positions for days/weeks. |

| Scalping | Focuses on small, quick profits from minor price movements, often minutes. |

| Arbitrage Trading | Exploits price differences of the same asset across markets for risk-free gains. |

| Momentum Trading | Buys assets showing upward momentum and sells those with downward momentum. |

| Grid Trading | Places buy and sell orders at regular intervals to profit from market fluctuations. |

| Dollar-Cost Averaging (DCA) | Invests a fixed amount regularly, reducing impact of market volatility. |

| HODLing | Long-term holding of assets regardless of short-term market movements. |

| Options Trading | Uses derivative contracts to speculate or hedge with leverage and defined risk. |

| Event-Driven Trading | Trades based on market-moving events like earnings, mergers, or announcements. |

10 Best Bitcoin Trading Strategy for Consistent Gains

1.Trend Following

Trend following for Bitcoin trading means determining the direction of the market: either upward or downward—and trading accordingly. Moving averages, trendlines, and the MACD all serve to confirm trends.

This strategy limits the risk of counter-trend trades, so it’s easier to capture larger trade movements over time. It is effective in strongly sustained markets, but it struggles in sideways or choppy markets.

Adequate risk management, including stop-losses, and patience is key for consistency. Rather than predicting market reversals, following trends allows for consistent profits while minimizing risk of sudden market shifts.

Features Trend Following

- Spot and adhere to the current market direction (uptrend or downtrend).

- A technical approach will be employed in the use of moving averages, MACD, and trendlines.

- Contain spikes and let it rest for extended periods to capitalize on trends.

- Strict risk management and a well-planned strategy in place is crucial to avoid making counter-trend trades.

2.Swing Trading

Swing trading aims at medium-term price shifts in Bitcoin, holding positions for a few days to two weeks. Traders look at technical signs, where to buy and sell, and momentum indicators to find the best buy and sell opportunities.

This approach seeks to capitalize on both upward and downward changes without the need for close monitoring. Swing trading offers a balanced approach to risk and reward. It avoids the frenzy of day trading and does not get stuck in a stagnant market for extended periods.

It does, however, require careful risk management and proper stop-loss measures. Swing traders are able to capitalize on market and sentiment cycles, entering trades during the beginning of a move and selling near intended reversal points.

Features Swing Trading

- Focus on making profits from the price changes in the space of a few days to weeks.

- Make use of technical patterns and support and resistance levels for entry and exit points.

- A good risk-reward balance offers a decent opportunity to capture profits.

- Since timing the market is key, moderate market surveillance and fast trade are ideal.

3.Scalping

Scalping is a form of high-frequency trading in Bitcoin that aims to take advantage of small price movements. Scalping Bitcoin requires a trader to have technical indicators, an order book, and a means to execute trades in just a few seconds.

Success in this Bitcoin trading approach hinges on one’s discipline, the availability of the trading platform, and the management of stop-loss systems. Each of the trades done in Scalping Bitcoin results in very small profits, but the overall profits in the long run is huge.

Scalping works in active and volatile trading environments. Success hinges on repeatable processes, active control of risks, and a trader’s ability to manage emotions and avoid make snap decisions.

Features Scalping

- A focus on the market’s minute price changes with the hope of acquiring small gains quickly.

- Fast trading and trading on pseudonymous virtual platforms will be crucial.

- Control measures such as stop-loss and risk management are mandatory.

- Ideally, this strategy works best during periods of him demand.

4.Arbitrage Trading

Bitcoin arbitrage trading evenly exploits the difference in the Bitcoin price in various markets. Traders will purchase a Bitcoin on one platform for a lesser price and will proceed to sell it on another for a higher price. Making a profit that is virtually without risk.

This method depends on transaction costs, spreads, and execution. As with any other Cryptocurrency, Bitcoin prices are extremely volatile, and the difference in price might cease. This situation typically demands the use of automated tools or bots.

Arbitrage is especially helpful for achieving steady profits, as it is independent of the general trend. Liquidity, withdrawal limits, and transaction congestion are the most crucial things to focus on. If other traders closely follow this method, they will be able to achieve consistent profits especially when the market is heavily trading.

Features Arbitrage Trading

- Trading between Bitcoin platforms and market sites for different pricing to gain a profit.

- Purchase on one platform and offload on sell a higher rate platform for easy money.

- Fast paced trading, automated tracking, and low trading fees to qualify transactions.

- Effective when market price is stagnant or in periods of low trading volume.

5.Momentum Trading

As for momentum trading, it is more about focusing on certain Bitcoin assets, often termed as “hottest assets”, and “surfing” on them till they start to go out of favor. In order to mitigate “fire and loss”, they use RSI, MACD and Volume indicators to make precise moves.

The goal of all momentum traders is to “catch the wave” as early as possible and get out before it “swells too high”, exploiting the market.

Momentum Trading works best during market extreme movements or during the release of certain news, although it poses great danger of risk estimation errors.

In order to maximize profits, momentum traders utilize market technical indicators as well as news events.

It is prudent to note, however, that breaches of momentum trading rules will force the trader to lose more. Strict following of rules and boundaries of in and out vastly improve the effectiveness in momentum trading.

Features Momentum Trading

- Focus on Bitcoin trades with direction based on the price action of the instrument.

- For making decisions, uses RSI, MACD, and volume indicators.

- Enters positions early and exits before changes occur.

- Requires constant market surveillance and methodical action.

6.Grid Trading

Grid trading, multiple buy and sell orders are placed at fixed intervals, creating a grid and utilizing Bitcoin’s natural price movements. This method is profitable in sideways and ranging markets, as every price increase to a grid level results in profit.

Traders set upper and lower bounds, changing distance between levels based on market choppiness. Order management is often done using automated bots. Effective risk management is critical, especially during periods when trends are strongly one-way.

Relative to other strategies, grid trading Bitcoin makes Bitcoin grid trading more profitable and consistent, as market prediction is a secondary concern. With disciplined consistency, availability patience, and automation, long-term growth is achievable.

Features Grid Trading

- Sells and buys assets at scheduled intervals to maximize gains from price fluctuations.

- Works well in sideways or ranging markets.

- Commonly facilitated by trading bots to maximize efficiency.

- Profits add up with market oscillations without needing to anticipate trends.

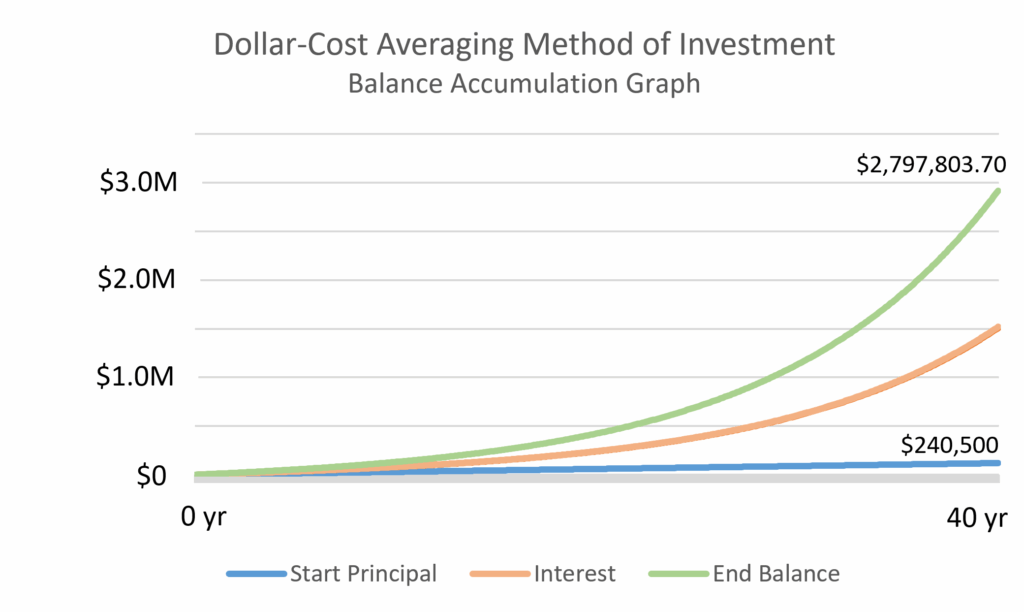

7.Dollar-Cost Averaging (DCA)

DCA is the practice of investing a specific and fixed amount for Bitcoin at set intervals, irrespective of its price. This method helps mitigate the impact of market volatility and the risk of timing the market poorly.

Over time, the average cost of holdings smoothens the peaks and troughs of the market, allowing consistent accumulation. DCA is best for long-term Bitcoin investors who prefer a more hands-off method. It minimizes emotional trading and market timing errors.

For steady DCA profits, these strategies need to be paired with a well-defined, steady discipline to trigger plan framework. With DCA, Bitcoin is a dip purchase asset that leads to the compounding of wealth over time alongside price appreciation.

Features Dollar-Cost Averaging (DCA)

- Makes regular fixed purchases of Bitcoin, regardless of its current price.

- Diminishes the effect of short-term fluctuations.

- Promotes disciplined, low-maintenance investing.

- Eases the ability to manage investments while minimizing overall risk exposure.

8.HODLing

HODLing is a long-term strategy for Bitcoin which involves purchasing and holding the asset until its value appreciates, irrespective of market volatility.

This strategy is based on the assumption that Bitcoin will always trend upward over a multi-year horizon, despite sharp corrections that may follow.

HODLing reduces exorbitant trading fees while reducing emotional stress and taking advantage of compound growth and declining Bitcoin market volatility. It requires patience and a pronouncing conviction.

For steady profits, risk management, securing holdings, and portfolio diversification are critical. HODLing tends to work best during a bull market or a phase of mainstream adoption. HODL is designed for long-term wealth builders who trade resilience for timing volatility.

Features HODLing

- A strategy focused on the long-term ignores short-term market changes.

- Reduces the overall trading frequency and emotional trading.

- Benefits from Bitcoin’s long-term historical price trend.

- Works well for patient investors who want growth over an extended period.

9.Options Trading

Traders are able to buy and sell contracts to trade Bitcoin up to a specified price by a certain date through Bitcoin options trading. Options provide opportunities for leverage, hedging, and speculation. Traders profit on directional moves, changes in volatility, or time decay.

There are several strategies such as calls, puts, spreads, and straddles which can be tailored to bullish, bearish, or neutral markets. Understanding option pricing, the Greeks, and risk exposure are necessary for consistent profits.

In contrast to spot trading, losses are capped to the premiums paid for buyers, while all sellers are exposed to more risk. With disciplined strategy, Bitcoin options trading can greatly increase profit potential while enhancing exposure to risk in a disciplined manner.

Features Options Trading

- Trades in Bitcoin options giving the right to buy or sell at a predetermined price before a set date.

- Offers additional risk and asset management options.

- Allows implementation of diverse investment strategies: calls, puts, spreads, and straddles.

- Demands familiarity with options, Greeks, and risk management.

10.Event-Driven Trading

Significant news, regulatory shifts, or a company’s technological advancements can all trigger price movements in Bitcoin and event-driven trading seeks to take advantage of that. Analyzing market sentiment, timing, and prior market reactions enables traders to time their trades perfectly.

Major hard forks, currency adoption, and other economic events in the crypto world can be very influential. Speed and thorough research are vital to the success of this strategy.

Although this approach can be very profitable, it tends to be accompanied with chaotic price swings and requires rigorously planned trades and disciplined stopping points.

To be successful, a trader must integrate the fundamentals, rather than buy into the hype. Event-driven trading captures the shifts in market sentiment that surround Bitcoin, turning chaotic moments into calculated opportunities.

Features Event-Driven Trading

- Trading triggered from news, market shifts, forks, or regulations.

- Requires sentiment analysis and study of past responses.

- Gains from short-term price fluctuations around the event.

- Requires fast execution, in-depth research, and strict exit discipline.

Conclsuion

in conclsuion Practicing patience through legal and risk-averse methods like long term HODLing, dollar cost averaging (DCA), and trend-following trading are proven ways to grow your Bitcoin.

Practicing these methods hand-in-hand with risk management unlocks steady accumulation and minimal loss. Shortcuts and high-risk schemes lead to failure; investing strategically, consistently, and over time is the best way to double your Bitcoin securely and legally.

FAQ

Can I double my Bitcoin quickly?

Quick doubling is high-risk. Legal growth relies on disciplined strategies, not shortcuts.

What’s the safest strategy?

HODLing and Dollar-Cost Averaging (DCA) reduce risk while steadily increasing holdings.

Can trading help?

Yes—trend following, swing, and momentum trading can grow Bitcoin with proper risk management.