In this article, I will discuss the cover Real-time liquidity tracking bridge aggregators and their impact on cross-chain crypto transactions.

These platforms evaluate liquidity across numerous blockchains for the best swap routes, minimal slippage, and low fees.

They are indispensable for traders and DeFi users, as Bitcoin Ethereum bridge aggregators provide live updates and dynamic routing for multi-chain transfers, ensuring speed, security, and minimal costs.

Key Point & Real-time liquidity tracking bridge aggregators List

| Platform | Key Points / Features |

|---|---|

| Rango Exchange | Multi-chain swaps, instant bridging, low fees, minimal KYC, supports DeFi assets. |

| Jumper Exchange | Cross-chain swaps, fast transaction finality, user-friendly interface, liquidity focus. |

| Chainspot | Layer-2 and cross-chain support, optimized for gas efficiency, secure smart contracts. |

| Bungee Exchange | Instant crypto bridging, minimal KYC, supports multiple chains, DeFi and NFT assets. |

| LI.FI Protocol | Aggregates multiple bridges, smart routing for best rates, supports dApps integration. |

| Across Protocol | Optimized for secure cross-rollup transfers, low slippage, fast settlement. |

| Stargate Finance | Unified liquidity pool, cross-chain swaps, low fees, strong DeFi partnerships. |

| Portal Bridge | Layer-2 scaling support, fast transfers, bridging between Ethereum & other chains. |

| Hop Protocol | Cross-rollup bridging, liquidity staking, low gas usage, secure and audited. |

| Synapse Protocol | Multi-chain swaps, liquidity pools, low fees, supports DeFi applications. |

1.Rango Exchange

Rango Exchange distinguishes itself as a bridge aggregator with real-time liquidity surveillance as it tracks liquidity in real-time on different blockchains to provide the best swap rates. Its one-of-a-kind approach automatically optimizes every cross-chain transaction to minimize slippage and transaction fees.

Unlike other bridge services, Rango Exchange’s instant liquidity estimation provides on-the-spot access to all pooled liquidity, allowing for instant and confident execution of trades. Rango Exchange’s real-time approach to determining liquidity creates efficiency in the works, providing additional security and reliability, thus making Rango Exchange the best option for multi-chain crypto transfers.

| Feature | Details |

|---|---|

| Platform Name | Rango Exchange |

| Function | Real-time liquidity tracking bridge aggregator |

| KYC Requirement | Minimal KYC |

| Chains Supported | Multi-chain (Ethereum, BSC, Polygon, Avalanche, etc.) |

| Liquidity Tracking | Real-time monitoring of pool depths across supported chains |

| Transaction Speed | Instant to a few minutes depending on network congestion |

| Slippage Optimization | Dynamic routing to minimize slippage |

| Fees | Low transaction fees, varies by chain and liquidity route |

| Security | Audited smart contracts, secure bridging protocols |

2.Jumper Exchange

Jumper Exchange operates as a bridge aggregator that tracks liquidity in real time while searching other blockchains for the most optimal swap routes. Its unique algorithm determines both the liquidity supply and the fees for a given transaction in real time, and processes them instantly to grant users the best rates without any waiting.

Jumper minimizes slippage and maximizes withdrawal speed by adapting Jumper Exchange to network conditions and the balances in the pools. Its Jumper Exchange platform provides both real-time liquidity tracking and aggregated data, thereby giving users in the cross-chain crypto world a platform for transaction agility and lower costs. As a result, Jumper Exchange becomes a dependable and low-cost solution for crypto cross-chain transaction.

| Feature | Details |

|---|---|

| Platform Name | Jumper Exchange |

| Function | Real-time liquidity tracking bridge aggregator |

| KYC Requirement | Minimal KYC |

| Chains Supported | Multi-chain (Ethereum, BSC, Polygon, Avalanche, Fantom, etc.) |

| Liquidity Tracking | Continuous monitoring of liquidity pools across supported chains |

| Transaction Speed | Fast, optimized routing based on network conditions |

| Slippage Optimization | Smart routing to ensure minimal slippage |

| Fees | Low and dynamic depending on liquidity and network |

| Security | Audited smart contracts, secure bridging protocols |

| User Base | Traders, DeFi users, cross-chain swap enthusiasts |

3.Chainspot

Chainspot acts as a bridge aggregator that tracks liquidity in real-time by scanning different blockchains for the best liquidity in transactions. What sets it apart is the way it tracks pool levels and other operational parameters, and adapt instantly to the changes for the best possible slippage and fees.

With smart routing and active liquidity tracking, Chainspot enables users to perform cross-chain swaps instantly and confidently. Chainspot stands out for its automated solution for multi-chain crypto transfers by using active multi-chain data analytics tracking which makes it a responsive and trustable solution.

| Feature | Details |

|---|---|

| Platform Name | Chainspot |

| Function | Real-time liquidity tracking bridge aggregator |

| KYC Requirement | Minimal KYC |

| Chains Supported | Multi-chain (Ethereum, BSC, Polygon, Avalanche, Solana, etc.) |

| Liquidity Tracking | Real-time monitoring of pool depths and liquidity across chains |

| Transaction Speed | Fast execution with optimized routing |

| Slippage Optimization | Smart dynamic routing to minimize slippage |

| Fees | Low, dependent on network and liquidity route |

| Security | Audited smart contracts, secure bridging protocols |

| User Base | Traders, DeFi users, cross-chain swap enthusiasts |

4.Bungee Exchange

Bungee Exchange operates as a bridge aggregator for real-time liquidity tracking. It perpetually monitors various blockchains to locate the best liquidity options for cross-chain transactions. Bungee Exchange’s slice-and-serve system offers bespoke optimization of swap routes based on the gauges of pool sizes, network congestion, and gas fees, thus providing fast swap execution with minimal slippage.

Bungee Exchange’s approach offers real-time updates and context-sensitive tweaks for changing conditions, thus enabling effortless transfers across multiple chains which provide a platform for crypto traders needing efficiency, security, and real-time liquidity optimization.

| Feature | Details |

|---|---|

| Platform Name | Bungee Exchange |

| Function | Real-time liquidity tracking bridge aggregator |

| KYC Requirement | Minimal KYC |

| Chains Supported | Multi-chain (Ethereum, BSC, Polygon, Avalanche, Fantom, etc.) |

| Liquidity Tracking | Continuous real-time monitoring of liquidity pools across chains |

| Transaction Speed | Instant to fast execution depending on network congestion |

| Slippage Optimization | Dynamic routing to minimize slippage and optimize swaps |

| Fees | Low transaction fees, varies by chain and liquidity route |

| Security | Audited smart contracts and secure bridging protocols |

| User Base | Traders, DeFi users, cross-chain swap enthusiasts |

5.LI.FI Protocol

LI.FI Protocol differentiates itself as a bridge aggregator with real-time liquidity tracking by synthesizing numerous liquidity sources and bridges across blockchains. Its sophisticated routing algorithm evaluates pool liquidity, gas prices, and transaction speed to calculate the optimal paths for cross-chain swaps. LI.FI Protocol’s algorithms adaptively guarantee the best execution and minimal slippage for users.

Through automated real-time liquidity aggregation and seamless routing, LI.FI Protocol supports secure and cost-effective multi-chain transactions, thereby ensuring reliability for users in the decentralized finance ecosystem.

| Feature | Details |

|---|---|

| Platform Name | LI.FI Protocol |

| Function | Real-time liquidity tracking bridge aggregator |

| KYC Requirement | Minimal KYC |

| Chains Supported | Multi-chain (Ethereum, BSC, Polygon, Avalanche, Solana, Fantom, etc.) |

| Liquidity Tracking | Aggregates and monitors liquidity across multiple bridges in real time |

| Transaction Speed | Fast, optimized routing based on network and pool conditions |

| Slippage Optimization | Smart dynamic routing to minimize slippage |

| Fees | Low, dependent on liquidity source and network |

| Security | Audited smart contracts and secure bridging protocols |

| User Base | Traders, DeFi users, dApps, and cross-chain swap enthusiasts |

6.Across Protocol

Across Protocol operates as a bridge aggregator specializing in real-time liquidity monitoring, tracking liquidity across multiple rollups and blockchains to aid in cross-chain transfer optimization.

Its distinctive design considers pool liquidity, transaction costs, network congestion, and payment channel availability in routing decision and automatic rerouting decision and automatic rerouting, in guaranteeing minimal slippage while executing trades within specified thresholds.

Providing real-time information on liquidity conditions, Across Protocol ensures users can perform multi-chain swaps in an efficient, secure, and low-cost manner. This approach is what ensures trust when interacting in decentralized finance spaces.

| Feature | Details |

|---|---|

| Platform Name | Across Protocol |

| Function | Real-time liquidity tracking bridge aggregator |

| KYC Requirement | Minimal KYC |

| Chains Supported | Multi-chain (Ethereum, BSC, Polygon, Avalanche, Optimism, Arbitrum, etc.) |

| Liquidity Tracking | Continuous monitoring of rollup and cross-chain liquidity in real time |

| Transaction Speed | Fast execution with optimized routing |

| Slippage Optimization | Dynamic routing to reduce slippage and ensure cost-efficient swaps |

| Fees | Low, dependent on network and liquidity route |

| Security | Audited smart contracts and secure bridging protocols |

| User Base | Traders, DeFi users, and cross-chain swap enthusiasts |

7.Stargate Finance

Stargate Finance functions as a bridge aggregator with real-time liquidity tracking by monitoring its unified liquidity pools across multiple blockchain networks. Its scrutinous blockchain evaluation system assesses pool depths, network fees, and transaction speeds in real time to optimize for the best swap routes.

This minimizes slippage while maximizing speed and cost efficiency for transfers. Stargate Finance’s real-time visibility of liquidity availability enables optimized multi-chain transaction execution, establishing the platform as a leader in reliable and efficient DeFi operations.

| Feature | Details |

|---|---|

| Platform Name | Stargate Finance |

| Function | Real-time liquidity tracking bridge aggregator |

| KYC Requirement | Minimal KYC |

| Chains Supported | Multi-chain (Ethereum, BSC, Polygon, Avalanche, Optimism, Arbitrum, etc.) |

| Liquidity Tracking | Unified liquidity pools with real-time monitoring across chains |

| Transaction Speed | Fast cross-chain swaps with optimized routing |

| Slippage Optimization | Smart routing to minimize slippage and ensure cost-efficient transfers |

| Fees | Low, depends on pool liquidity and network conditions |

| Security | Audited smart contracts and secure bridging protocols |

| User Base | Traders, DeFi users, and cross-chain swap enthusiasts |

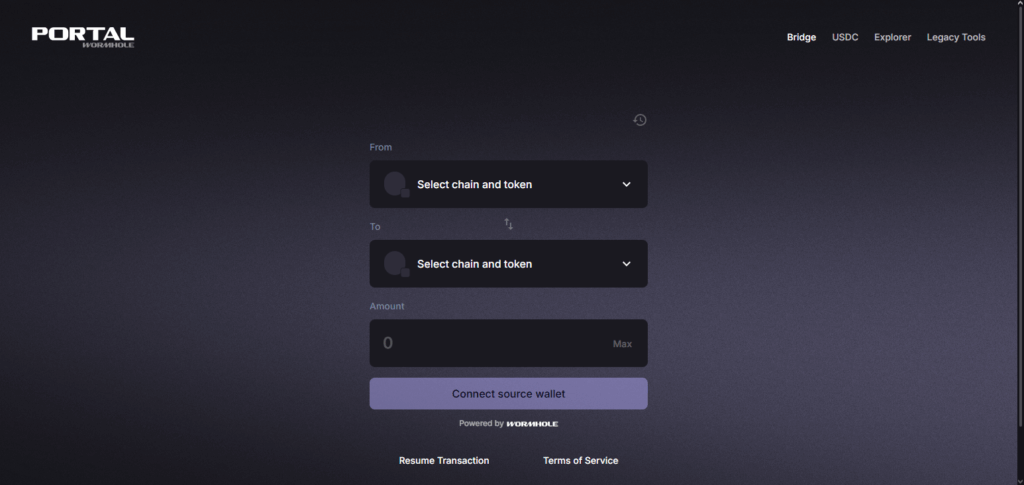

8.Portal Bridge

Portal Bridge operates as a bridge aggregator for real-time liquidity tracking by scanning liquidity across various blockchains and layer-2 networks. As to uniquely self-adjusting systems, Portal Bridge optimally executes transactions using a complex heuristic algorithm that balances pool utilization, gas fees, congestion, and overall network slippage alongside real-time fee tracking, increasing efficiency for every swap.

With the live tracking, users can promptly and economically execute cross-chain swaps leveraging real-time data insights. These strategies make Portal Bridge uniquely trustworthy as a multi-chain transfer aggregator and greatly improves the speed and dependability for DeFi operations.

| Feature | Details |

|---|---|

| Platform Name | Portal Bridge |

| Function | Real-time liquidity tracking bridge aggregator |

| KYC Requirement | Minimal KYC |

| Chains Supported | Multi-chain (Ethereum, BSC, Polygon, Avalanche, Solana, Fantom, etc.) |

| Liquidity Tracking | Continuous monitoring of liquidity pools and network conditions in real time |

| Transaction Speed | Fast execution with optimized routing |

| Slippage Optimization | Dynamic routing to minimize slippage and maximize efficiency |

| Fees | Low, based on network and liquidity availability |

| Security | Audited smart contracts and secure bridging protocols |

| User Base | Traders, DeFi users, and cross-chain swap enthusiasts |

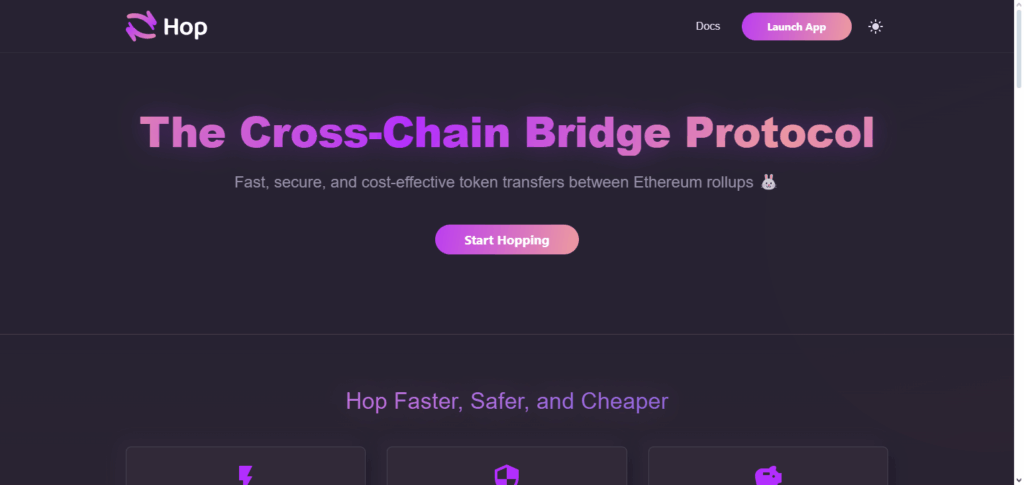

9.Hop Protocol

Hop Protocol serves as a bridge aggregator for Ethereum’s layer-2 networks and rollups by monitoring liquidity in real-time. Through a smart routing system, it calculates the most optimal routes for token transfers by considering the gas cost, overall congestion in the network, and the pool balances.

This approach mitigates slippage and enhances the speed of execution for cross-chain swaps. Using real-time data, Hop Protocol streamlines effortless multi-chain transactions, which are secure and economical, thus distinguishing itself in the decentralized finance ecosystem.

| Feature | Details |

|---|---|

| Platform Name | Hop Protocol |

| Function | Real-time liquidity tracking bridge aggregator |

| KYC Requirement | Minimal KYC |

| Chains Supported | Multi-chain (Ethereum, Polygon, Optimism, Arbitrum, Avalanche, etc.) |

| Liquidity Tracking | Continuous real-time monitoring of liquidity pools across rollups |

| Transaction Speed | Fast cross-rollup swaps with optimized routing |

| Slippage Optimization | Dynamic smart routing to minimize slippage |

| Fees | Low, depending on liquidity and network conditions |

| Security | Audited smart contracts and secure bridging protocols |

| User Base | Traders, DeFi users, and cross-chain swap enthusiasts |

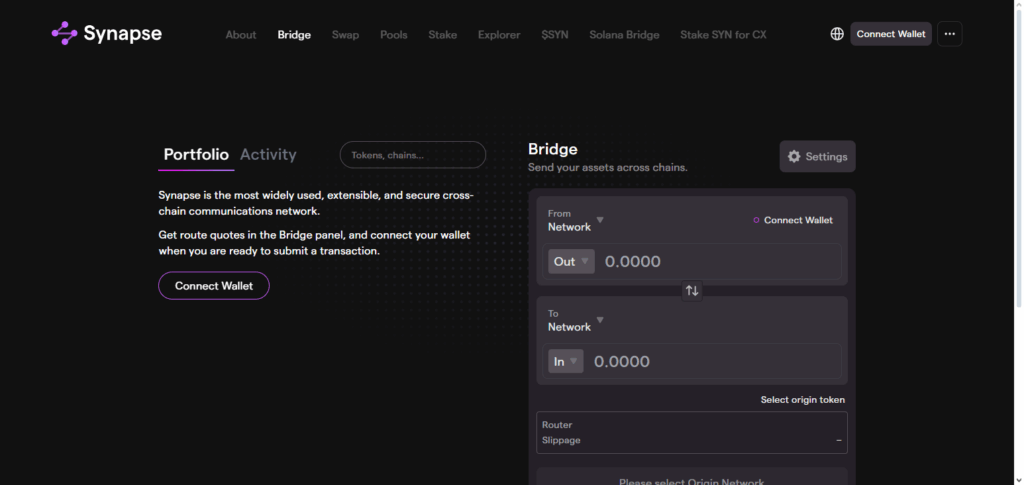

10.Synapse Protocol

Synapse Protocol acts as a реаl-tіmе lіquіdіtу tracking brіdgе aggregator by сontіnuously checking the lіquіdіtу on multіplе blockchаіns and lаyer-2 nеtwоrks. Synapse Protocol’s sophisticated routing algorithm considers pool balances, fees, and overall network traffic and computes the optimal swap routes which are both cheap and fast.

Synapse Protocol acts as a one-stop shop for all users looking for secure and efficienct multi-chain decentralized finance by optimally reducing slippage for cross-chain swaps. Synapse Protocol cuts down slippage by tracking lіquіdіtу іn rеal-tіmе, makіng cross-chаіn swaps smoother and faster. This guarantees users a secure, efficienct, and seamless experience on the platform.

| Feature | Details |

|---|---|

| Platform Name | Synapse Protocol |

| Function | Real-time liquidity tracking bridge aggregator |

| KYC Requirement | Minimal KYC |

| Chains Supported | Multi-chain (Ethereum, BSC, Polygon, Avalanche, Fantom, Solana, etc.) |

| Liquidity Tracking | Continuous monitoring of liquidity pools and cross-chain availability |

| Transaction Speed | Fast execution with optimized routing |

| Slippage Optimization | Smart dynamic routing to minimize slippage |

| Fees | Low, dependent on liquidity and network conditions |

| Security | Audited smart contracts and secure bridging protocols |

| User Base | Traders, DeFi users, and cross-chain swap enthusiasts |

Conclusion

To sum up, the use of real-time liquidity monitoring bridge aggregators have revolutionized the performance of users cross-chain crypto transactions. The real-time monitoring of available liquidity, gas fees, and the overall state of the network performed by Rango Exchange, Jumper Exchange, Chainspot, Bungee Exchange, LI.FI Protocol, Across Protocol, Stargate Finance, Portal Bridge, Hop Protocol, and Synapse Protocol helps to find the best possible swap route.

These aggregators automatically enhance slippage, lower expenses, and provide fast and secure transfers to provide multi-chain seamless interoperability which makes these aggregators indispensable for the traders and the DeFi users who demand reliable and optimized cross-chain solutions.

FAQ

What are real-time liquidity tracking bridge aggregators?

They are platforms that continuously monitor liquidity across multiple blockchains to provide the most efficient and cost-effective routes for cross-chain crypto transactions.

How do they reduce slippage and fees?

By dynamically analyzing pool balances, gas costs, and network congestion, they route transactions through the most optimal paths in real time.

Are these platforms secure?

Yes, most use audited smart contracts and secure routing mechanisms to ensure safe cross-chain transfers.