This article will explain How to Stake Tether (USDT) for High Returns while walking you through the process one step at a time.

You will discover the top platforms for staking USDT, various staking opportunities, strategies to increase your profits, and the major risks you should be aware of. At the end, you will know how to grow your USDT holdings efficiently and, most importantly, safely.

What is USDT Staking?

USDT staking involves earning passive income through crypto platforms or decentralized finance (DeFi) staking protocols by lending or locking tethered stablecoin (USDT) crypto assets. Since USDT is directly tethered to the US dollar, it is not as volatile as high-risk cryptocurrencies.

USDT is also much safer than other cryptocurrencies, as the low USDT staking interest rates coupled with risk-averse investments lend to steady returns. USDT staking is carried out on centralized exchanges or decentralized platforms.

Centralized staking exchanges manage the funds while interest is distributed through smart contracts on decentralized platforms. In decentralized exchanges, you can lend USDT to borrowers, provide liquidity to pools or protocols, and enter yield-earning strategies.

Safety risks on USDT staking are significantly lower than other coins, as platform exit, modified market interest rates, and volatile “withdraw” or staking limits can be instituted without fair warning and market liquidity can shift on the platform. In summary, available steady coins provide USDT staking to gain interest on low risk devoid of on cryptocurrencies fluctuations.

How to Stake Tether (USDT) for High Returns

Example: Staking Tether (USDT) for High Returns – Step by Step

Step 1: Create and Verify Your Binance Account

- For registering choose to use your email or phone number.

- KYC for identity verification is required to use the stake and earn functions.

Step 2: Deposit USDT

- Access your Binance wallet and choose Deposit.

- Move USDT from another wallet or exchange to your Binance wallet.

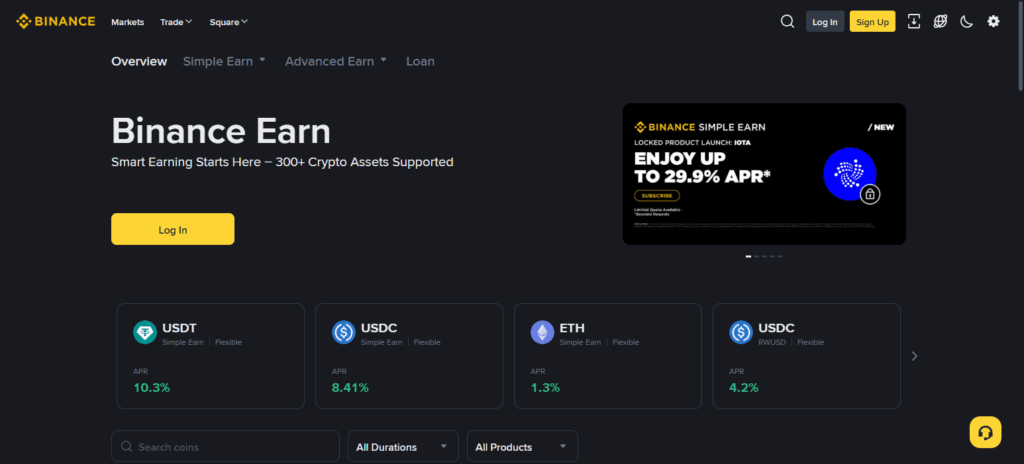

Step 3: Access Binance Earn

- Select Earn and then go to Savings or Staking.

- Locate USDT from the available coins dropdown.

Step 4: Select a Staking Choice

- The Flexible Staking option allows you to withdraw anytime although the APY is slightly lower (about 4 to 6 percent range).

- For the Locked Staking option, your USDT cannot be withdrawn for a predetermined amount of time. You choose the length (30, 60, or 90 days) and the higher APY is from 6 percent to 12 percent.

Step 5: Enter Amount and Wait for Profits

- Enter the amount of USDT you wish to stake.

- Check and confirm your expected returns and terms.

- Click Confirm.

Step 6: Monitor and Collect Rewards

- The Earn Dashboard has everything you need to predictive your staking.

- Flexible staking offers daily reward credits while locked staking pays out rewards only at the end of the term.

Benefits of Staking Tether (USDT)

Stable Returns: Being a stablecoin, Tether (USDT) will always be equal to 1 US dollar, unlike most cryptocurrencies that have a lot of volatility, constant earnings will always be predictable with low returns.

Passive Income: Staking USDT will allow you to earn interest that is not affected by trading activity.

Flexible Staking & Fixed Options: Different platforms, in addition to different liquidity, will let you choose for flexible (withdraw any time) or fixed-term staking.

Lower Risk Exposure: Staking highly volatile coins carries a higher risk. With USDT being a stablecoin, your principal is much safer for this low volatility reserve.

Compounding Opportunities: Using your staking USDT earnings to reinvest will hugely benefit you over time by implementing compound interest.

Accessible for Beginners: USDT staking is very simple and requires no crypto experience or knowledge.

Tips for Maximizing Returns

Examine APY Differences

Select the exchange or DeFi protocol that offers the highest interest rate.

Flexible Staking Addresses Liquidity Needs

Choose flexible staking if you need to access your money quickly as it is un-penalized.

Choose Longer Lock Periods (If Okay with It)

Higher APYs are usually given in fixed-term staking which guarantees the principal is staked.

Compound Staking Rewards

Your principal grows if you restake your USDT rewards earned.

Use Multiple Trusted Platforms

This way you mitigate risk in case one of the platforms goes under.

Look Out for Promotions

Go for exchanges that are giving promotions with bonus APYs, and seasonal offers.

Consider Fees and Terms

Look for hidden fees, minimum staking requirements, and penalties associated with withdrawals to ensure you are not left with a loss.

Risks & Considerations Before Staking

Platform Risk

Centralized exchanges might get hacked or become insolvent or poorly managed over time, putting your assets at risk.

Smart Contract Risk (DeFi)

Each decentralized protocol depends on computer code, which might have bugs or flawed logic that puts your assets at risk.

Liquidity Risk

In an emergency, you might face difficulty with funds if locked staking is configured to keep funds locked and inaccessible for long intervals.

Interest Rate Risk

Your expected returns might be impacted since APYs are variable and are subject to change over time.

Regulatory Risk

The crypto ecosystem is evolving, and so are the regulations that may change the way staking, and withdrawals may be done in the future.

Withdrawal & Transaction Fees

Each platform might have withdrawal and transaction fees that cut into your profits.

Market & Counterparty Risk

Staking USDT is low risk, however, the platform or borrower can default and your rewards might get severely impacted.

Pros & Cons

| Pros | Cons |

|---|---|

| Stable returns due to USDT being pegged to USD | Platform risk if the exchange or protocol fails |

| Earn passive income without active trading | Locked staking reduces liquidity for a fixed period |

| Flexible and fixed-term staking options | Interest rates (APY) may fluctuate over time |

| Low volatility compared to other cryptocurrencies | Fees and withdrawal charges can reduce net earnings |

| Supports DeFi and lending ecosystems | Smart contract vulnerabilities in DeFi platforms |

| Opportunity to compound rewards for higher returns | Regulatory changes may affect staking operations |

| Accessible for beginners and easy to use | Counterparty risks if lending protocols default |

Conclusion

Staking Tether (USDT) allows you to earn passive income and greatly reduces the risk associated with investing in other cryptocurrencies. Depending on your needs, you can choose between flexible and fixed staking options on trusted centralized exchanges and DeFi protocols. There are a few simple steps you can take to get started.

However, you should be cautious regarding a few risks, including exposure to platform security, shifting interest rates, and liquidating your staking position.

Regularly checking your profit margins, dividing and consolidating your earnings, and changing staking positions to take advantage of varying APYs will improve your profit margins quite a lot. Overall, staking USDT is strategic and provides great peace of mind in time and risk management.

FAQ

How much can I earn from staking USDT?

Returns vary by platform and staking type. Flexible staking usually offers 4–6% APY, while locked staking can offer 6–12% or more.

Can I unstake USDT anytime?

It depends on the staking option. Flexible staking allows withdrawals anytime, while fixed-term staking requires you to lock funds for a set period.

What is USDT staking?

USDT staking is the process of locking or lending your Tether (USDT) on crypto platforms or DeFi protocols to earn interest or rewards over time.

Can I reinvest my staking rewards?

Yes, many platforms allow you to compound your rewards, which can significantly increase your overall returns over time.