I will explain the step-by-step procedure for trading Perps on MetaMask in this article. Perpetual contracts, or Perps, enable traders to forecast cryptocurrency prices without the headache of owning the underlying asset.

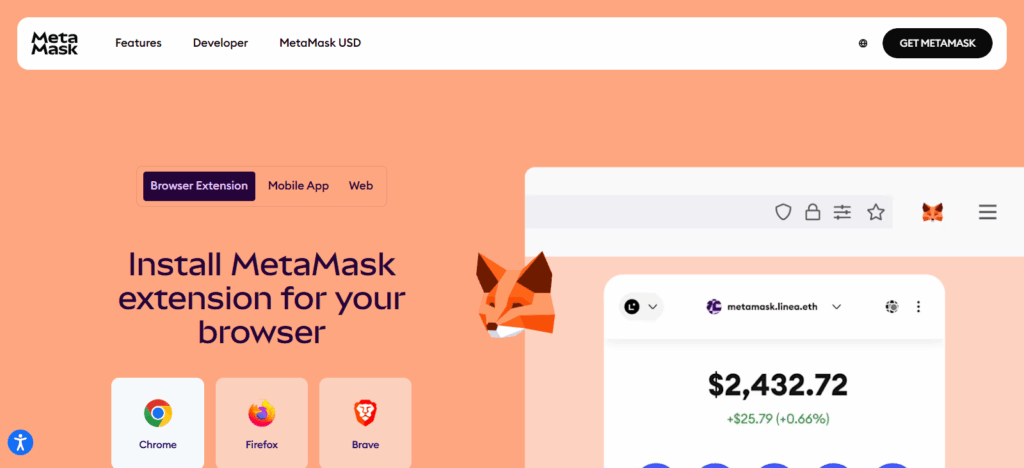

MetaMask enables users to easily and securely manage their wallets and interact with decentralized platforms. If you would like to begin trading Perps, follow the instructions in this guide.

What Are Perpetual Contracts (Perps)?

Perpetual contracts or ‘Perps’ are derivative instruments in the crypto space that enable traders to speculate on price changes without owning the underlying asset. Unlike traditional futures contracts that have a specific expiry date, perpetual contracts have no expiry date, allowing traders to hold position for as long as they like, provided the necessary margin is maintained.

While perpetual contracts do not expire, they can be traded with leverage, which magnifies the potential returns and risk associated with each position, as traders control a position that is much larger than their actual capital.

A vital aspect of Perps is the funding rate mechanism which ensures the contract price does not drift too far from the asset’s underlying spot price. Funding rates are constantly recalibrated and are the periodic payments made to long and short position holders to keep the buy and sell sides in equilibrium.

Perpetual contracts trade with a high degree of liquidity and offer flexibility and numerous long or short opportunities, which adds to their popularity.

On the other hand, the risk of liquidation on leveraged positions that are set in the opposite direction of the market movement is a fundamental risk that traders face, and thus risk management techniques should always be incorporated while trading Perps.

How to Trade Perps on MetaMask

Example: Ether Perpetual Contracts on MetaMask

Step 1: Complete Setting Up MetaMask

- Make sure that MetaMask is downloaded, created, and that a MetaMask wallet has been created properly, and then funded with enough ETH (or a given interchangeable token need to acquire ETH on that trading platform) for executing trades and gas transactions.

Step 2: Link MetaMask with a Perpetual Contracts Trading Platform

- Go to a platform that has Perpetual Contracts like dYdX and Perpetual Protocol and is a decentralized exchange (DEX).

- Select the wallet option, click “Connect Wallet,” then click on MetaMask to connect and approve the action from the wallet pop-up.

Step 3: Pick the Perpetual Contract

- Select the trading options, and for this example, we will use the Ether Perpetual Contract.

- Decide if you want to go long (predict the price will go up) or go short (predict the price will go down).

Step 4: Set Position Size and Leverage

- Input the Ether amount and the desired ETH you want to trade.

- Choose the positions of leverage like 5x or 10x, but remember the higher the leverage, the more profit you stand to make.

Step 5: Check Funding Rates and Fees

- Review the trading rates and funding rates to ensure they align with your trading plan and are reasonable.* Learn that the funding rates are paid at intervals for the purpose of keeping the contract price near the spot price.

Step 6: Execute the Trade.

- To enter the trade, select “Open Position” and a relevant icon.

- The transaction will be active once MetaMask receives your confirmation.

Step 7: Monitor the Position

- Primary focus is on funding rates and price changes.

- Employ available risk control features on the platform, such as stop-loss and take-profit.

Step 8: Closure of the Position.

- To realize your profit or loss, click on “Close Position” when you are ready.

- Your account will be credited and a transaction on MetaMask will need to be verified to access your funds, or losses, that include profit.

Why Use MetaMask for Trading Perps

Complete Ownership of Your Funds

MetaMask is a non-custodial wallet, which means the keys and the crypto assets are in your sole possession.

Easy Access to Other DeFi Apps

Smooth integration with decentralized exchanges (DEXs) and Perps trading apps like dYdX, Perpetual Protocol, etc.

Works on Various Networks

Compatible with Ethereum, Binance Smart Chain, and Polygon, and other networks, enabling cross-chain Perps trading.

Improved Protection

Compared to centralized exchanges, MetaMask’s encryption of private keys and passwords minimizes the chances of hacking.

Easy to Organize Transactions

Wallets can look at, sign, or deny trades and gas fees without third-party help.

Simple for Beginners

A straightforward layout allows novices to connect, trade, and check on their positions without complex configurations.

Allows Trading of Leverage Perps

Users can leverage Perps trading on selected platforms, while the funds remain in a self-custody wallet.

Limited Regulations and Full Control

There are full, private, and transparent records of transactions, as they are stored on-chain.

Tips for Safe and Effective Perps Trading

Start Small

- While you are still a beginner, even a small amount of capital can help mitigate risk as you learn how Perps operate.

Use Proper Risk Management

- A single trade should not risk more than a small percentage of your capital.

- Make sure you have stop-loss limits in place.

Be Mindful of Leverage

- The profit and the risk of liquidation increase with greater leverage.

- Use leverage in line with your industry experience and risk appetite.

Monitor Funding Rates

- The funding rate mechanism can either make you a long or a short position for a given period of time.

Pay Attention To Market Volatility

- The crypto market moves quickly in both directions, so you should keep your ear to the ground about news and price spikes.

Use Stop-Loss and Take-Profit Orders

- Take proactive measures to control potential losses and secure profits so you don’t have to watch the market 24/7.

Diversify Your Trades

- Don’t allocate all your capital to a single trade or position as diversification can help in these situations.

Set Trade Alerts

- Use external or internal triggers to monitor risk and manage exposure, so you can be sure you are protected with a reasonable cushion to adjust your position quickly.

Stay Updated on Platform Fees

- Trading fees and gas costs can also bare on profitability.

Keep Security in Mind

- Use a complex password and enable 2fa for your MetaMask wallet to avoid phishing attempts on your wallet.

Troubleshooting Common Issues

MetaMask is not connecting to the Platform

- Update your mobile app or browser, clear your app cache, or try a new browser.

- If the platform asks you to switch to a different network (e.g., Ethereum Mainnet), you may have to.

- If the platform prompts you to switch to a different network, you may need to clear your mobile app cache or try a different browser.

The transaction is stuck or fails.

- If you don’t have sufficient funds for gas fees, check your wallet balance.

- Increase the gas price if you want near instant confirmation.

- If Ethereum gas fees are incredibly high, you may have to wait until congestion decreases.

Gas fees are incredibly high.

- The trading platform offers unused hours and L2 networks such as Arbitrum or Polygon, which are great for trading.

You have the incorrect network selected.

- If you have added custom RPC networks and the Perps or DEX platform does not have a default network, you may also need to do that.

Position liquidation without warning/unexpected.

- Setting a stop-loss to close high-risk trades automatically is one way to prevent liquidations.

- Keep an eye on your margin and leverage, as they contribute heavily to sudden liquidations.

Errors on Platform Interface

- Update your mobile app or browser, clear your app cache, or try a new browser.

- Check the official channels for platform outages or maintenance.

Tokens Not Visible in Wallets

- Manually paste the token’s contract address in the MetaMask wallet.

- Check if the token is listed on the network you are currently using.

Safety Issues

- Do not disclose your seed phrase or private keys.

- Do not approve any transaction unless you trust the source. Always confirm the validity of the individual or platform.

Pros & Cons

| Pros | Cons |

|---|---|

| Full control over your funds with a non-custodial wallet | High risk due to leverage; potential for liquidation |

| Seamless integration with DeFi platforms and DEXs | Requires understanding of crypto derivatives and funding rates |

| Supports multiple networks for cross-chain trading | Gas fees can be high on certain networks like Ethereum |

| Enhanced security with private key encryption | Mistakes (e.g., wrong network, wrong token) can lead to loss of funds |

| User-friendly interface for beginners | Market volatility can cause sudden losses |

| Transparency and on-chain transactions | Learning curve for risk management and position monitoring |

| Supports leveraged trading | Dependence on platform stability; outages can affect trades |

Conclusion

For cryptocurrency fans who wish to retain their financial autonomy, using MetaMask to trade perpetual contracts (Perps) provides a unique and versatile solution. Traders who connect MetaMask to a supported platform, fund the wallet, exercise care in managing leverage, and manage their positions appropriately can, along with short and long positions, manage other positions across multiple assets.

The essentials of Perps trading hinges on mastery on the instrumental aspects of the market like funding rates, market risks, and volatility. Even though beginners will have no problem, MetaMask offers high levels of security, total transparency, and frictionless integration with DeFi systems which will greatly assist experienced traders.

Carefully monitoring positions, and applying a minimal risk strategy, users should start small. With appropriate measures and practice, Perps trading on MetaMask can provide a user with access to the more exhilarating area of crypto derivatives¼

FAQ

Can I trade Perps directly from MetaMask?

MetaMask itself does not offer trading, but you can connect it to decentralized exchanges (DEXs) or Perps trading platforms like dYdX or Perpetual Protocol to trade securely.

What are perpetual contracts (Perps)?

Perps are derivative contracts that let you speculate on the price of a cryptocurrency without owning it. Unlike traditional futures, they have no expiration date.

How can I avoid liquidation?

Use proper risk management, monitor your positions regularly, and set stop-loss orders to prevent losses from exceeding your margin.

Are there fees for trading Perps on MetaMask?

Yes. You pay trading fees on the platform and gas fees for blockchain transactions via MetaMask. Fees vary depending on network congestion and the platform.