In this article, I will talk about the Best Stablecoin Interest Rates & Yields in DeFi and CeFi platforms.

With stablecoins, you can passively earn interest with little risk when compared to other cryptocurrencies, and they help you earn interest while minimizing risk depending on the platform you choose.

I will examine Aave, Curve, Yearn Finance, and Celsius to identify the best ways with which you can earn interest on your stablecoins.

Key Points & Best Stablecoin Interest Rates & Yields

| Platform / Protocol | Key Highlights |

|---|---|

| Aave | Best for risk-adjusted yields; supports multiple stablecoins |

| Curve Finance | Leading platform for stablecoin swaps and liquidity pools |

| Pendle | Top choice for tokenized yield management and fixed income strategies |

| Convex Finance | Optimizes Curve liquidity for higher returns |

| Morpho Blue | Efficient lending protocol with low slippage and high yield potential |

| Yearn Finance | Aggregates DeFi strategies for automated yield optimization |

| Anchor Protocol | Known for high yields on UST (Terra stablecoin); caution due to past volatility |

| Compound | Established DeFi lending protocol with stable returns |

| Celsius Network | CeFi platform with variable rates; regulatory concerns may affect reliability |

| Clave | CeFi platform offering up to 4.22% APY on stablecoins |

10 Best Stablecoin Interest Rates & Yields

1. Aave

Aave is a prominent DeFi lending protocol and one of the first apps that provided real yield lending, making it a go-to option for those seeking secure and risk-adjusted yields.

With an interest rate of 4.67% APY on USDC and USDC minting, it is a perfect app for conservative investors because of the guaranteed yield.

Aave V3 is available on multiple chains and, like all Aave versions, it has a unique and dynamic interest rate system.

Aave has one of the highest safety ratings in DeFi, which allows users to lend and borrow without intermediaries.

Aave has also incorporated advanced user functions, such as flash loans and collateral swaps, while still keeping an easy-to-use interface for users seeking passive income.

Features Aave

- Dynamic Interest Rates: Applies an algorithm that adjusts the rates on the supply side and the borrowing side, according to prevailing market conditions.

- Multi-Chain Support: Ethereum, Arbitrum, Optimism, and many more.

- Governance: Community-driven, AAVE token holders vote on decisions.

- Collateral Options: Takes a diverse amount of different assets.

- Security: Comprehensive risk management and frequent audits.

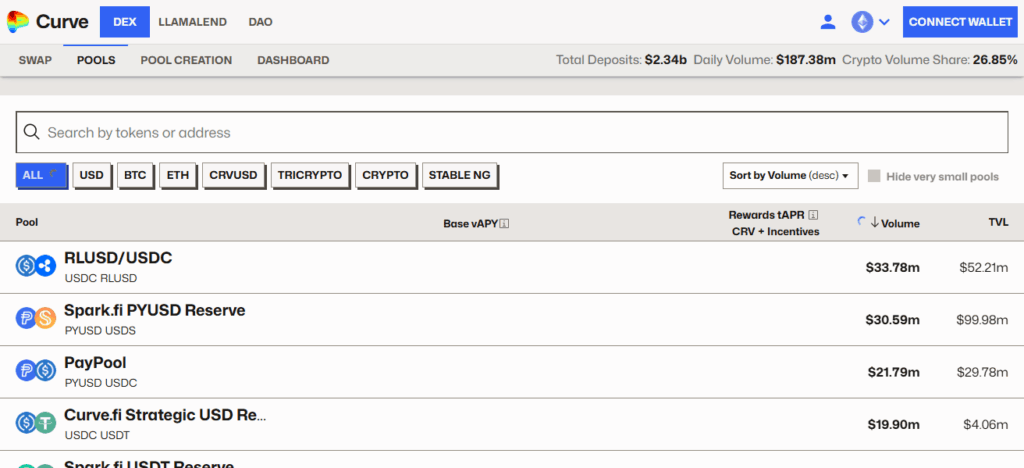

2. Curve Finance

Curve Finance focuses on liquidity pools for stablecoins and provides niche pools with variable yields of up to 16.24% APY.

It caters to low-slippage trades on closely valued pairs like USDC, DAI, and USDT. Curve’s yield varies with the composition of the pools and their respective trading volumes; the latter is usually augmented by CRV tokens.

Users deposit stablecoins in pools to receive fee earnings and reward boosts. Curve is integrated with multiple chains and partnered with yield optimizers like Convex and Yearn.

It is ideal for individuals seeking aggressive liquidity returns who have good practical DeFi knowledge.

Features Curve Finance

- Stablecoin Optimization: Low-slippage stablecoin swaps.

- Yield Distribution: Liquidity provision, governance token rewards.

- Multi-Asset Pools: Variety of stablecoins and wrapped assets.

- Governance: Decision-making governance through CRV tokens.

- Integration: Other DeFi systems work synergistically for additional yield.

3. Pendle

Pendle Finance allows users to fix yields or speculate on future interest rates with innovative yield tokenization. It is provides Annual Percentage Yield or APY of 13.58% on sUSDe PT tokens.

Pendle separates yield-bearing assets into principal and yield segments to facilitate more complex strategies including fixed-income investing and yield farming.

This is highly beneficial for users seeking certainty with their returns or intending to protect themselves against volatile interest rates.

Pendle services are audited and it operates mainly on Ethereum and it most of unique operating requires on Ethereum based services .

Pendle is preferred by more complex DeFi users seeking to optimize yield with advanced token management.

Features Pendle

- Yield Tokenization: For better flexibility and management of yield, assets are separated into ownership tokens and yield tokens.

- Fixed Yield Options: Tokenized assets provide fixed-rate yield.

- Market Liquidity: Allows yield-bearing tokens to be traded on secondary markets.

- DeFi Composability: Intentional synergy with other protocols to enhance the strategy.

- Risk Management: Yield exposure hedging.

4. Convex Finance

Convex Finance improves yield generation on Curve Finance by combining automated CRV stake and boost reward aggregation.

Users gain more APY on Curve LP tokens deployed on Convex, reaching over 20% on optimized pools.

Convex is a yield maximizing service on Curve with no active CRV stake CVX on the Curve ecosystem, making it a perfect candidate for passive investors wanting limited engagement with Curve liquidity reward.

Convex is a powerful stablecoin yield farming tool, primarily for those already employing the yield farming pools on Curve. Convex also issues CVX tokens to users as extra incentive rewards.

Features Convex Finance

- Increased Rewards: Curve liquidity provider rewards are enhanced without needing to stake the tokens directly.

- Rewards Compounding: Compounds the rewards of users automatically.

- Liquidity Pools: Supports different liquidity pools on Curve to provide users with different exposures.

- Governance: Participants of the governance process are CVX holders.

- Ease of Use: Makes engaging with your countless yield farming techniques simple.

5. Morpho Blue

Morpho Blue positions itself as an efficient and composable next-gen lending protocol. By facilitating direct peer-to-peer matchmaking between lenders and borrowers, it eliminates the inefficiencies associated with traditional pooled systems, all the while offering superior yields on stablecoins.

While the APYs are variable, borrowers and lenders alike appreciate the low-risk and optimally priced stablecoin lending during market downturns.

Developers and power users who appreciate custom modular lending markets will also appreciate the custom, risk-adjustable architecture of Morpho Blue lending markets. Morpho Blue Blue provides effective and safe stablecoin lending.

Features Morpho Blue

- Lending Optimized: Finds and connects lenders and borrowers to the best rates.

- Variable Yield: Market conditions determine the yield which varies between 2.5% to above 22% yielding.

- Decentralized: Trustless interactions are guaranteed on a decentralized network and system.

- Worldwide Liquidity: You gain access to numerous lending and borrowing opportunities worldwide.

- Corporate Soluions: Lending functionalities are integrated and lending solution tools are offered to corporates.

6. Yearn Finance

Yearn Finance automates stablecoin strategies across DeFi protocols as a yield aggregator. Users can deposit USDC or DAI into managed vaults where assets yield returns.

Annual yields for vaults can yield returns of 4% – 12% APY, but depends on strategies selected. For passive investors, Yearn provides simplification of DeFi strategies such as Curve staking and Convex boosting.

Yearn Finance vaults contain transparency and regular audits, and existing performance fees are only charged on the yield generated.

Thanks to community governance, controls, and integrations with the foremost DeFi protocols, yield farming with stablecoins on Yearn Finance becomes a low effort passive farming DeFi strategy.

Features Yearn Finance

- Auto Strategy: Uses vaults with self adjusting strategies to maximize yield.

- Yield farming: Includes a diverse collection of assets and stablecoins in yield farming.

- Decentralized Governance: Protocol decisions are made by governance of YFI token holders.

- Absorb Risk: Strategies to reduce impermanent loss and other risks are deployed.

- Seamless: Other DeFi platforms are used to increase yield opportunities.

7. Anchor Protocol

Anchor Protocol offered savings options on Terra and 20% APY on UST stablecoins. Provided fixed-rate returns and reward staking on bonded assets.

Collapse in May 2022 with the Terra crash. Losses were enormous. Triggered high yield savings potential, also highlighted the risk of unsustainable incentives and algorithmic stablecoins.

Discussions about DeFi, safety and yield sustainability. Anchor Protocol remains a cautionary relic of DeFi and risk management. Investors must prioritize unsustainable risk management.

Features Anchor Protocol

- Stable Yield – Minimal variability in monthly earnings on stablecoin deposits.

- Proof of Stake – Earns yield through staking rewards of major blockchains.

- Decentralization – Governance by the community through the holders of the ANC token.

- Earning Made Easy – Earning yields has been simplified.

- Security First – Providing a safe environment for user’s funds.

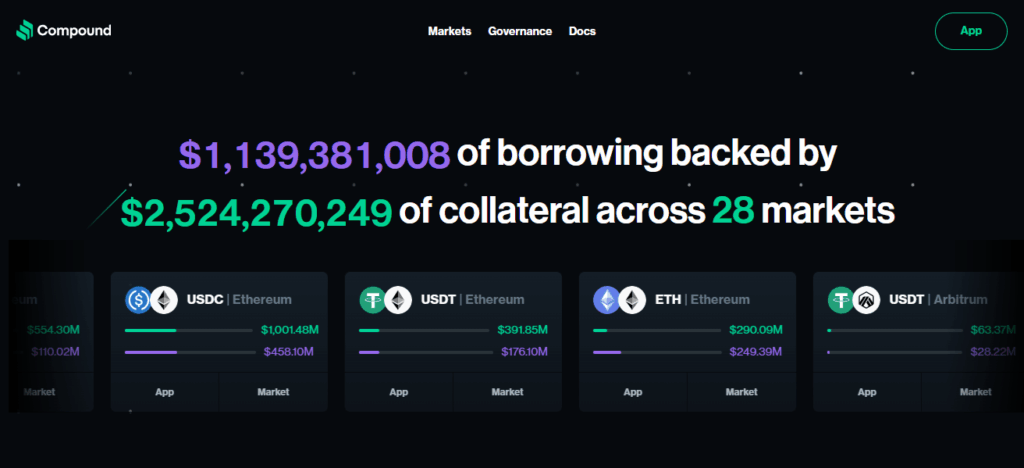

8. Compound

Compound’s decentralized lending platform enables users to earn interest by providing liquidity with stablecoins like DAI, USDC, and USDT.

Interest earns depends on market conditions but stays within 2- 5%APY. Compound promotes transparent governance, and protection of user funds is guaranteed through secure smart contracts.

Every user deposit earns interest and is represented by cTokens. Compound allows users to borrow against collateral, providing even greater flexibility.

Wide DeFi integration means users can readily access reliable stablecoin interest with minimal risk. Compound’s governance and reliable contracts ensure user funds remain safe.

Features Compound

- Algorithmic – Supply and borrow rates are set algorithmically according to market conditions.

- Asset Variety – A wide array of assets are supported for lending and borrowing.

- Governance – Participants in the governance of the protocol through the COMP token.

- Security – Regular audits and a comprehensive risk management plan.

- Integrations – Used in combination with other DeFi tools for more complex strategies.

9. Celsius Network

Celsius Network was a centralized crypto lending platform offering up to 10% APY on stablecoins such as USDC and USDT. Weekly payouts and no minimum deposits enticed customers.

However, Celsius had liquidity problems and mismanagement, and subsequently filed for bankruptcy in 2022, freezing user assets. After this, the risks that custodians pose to users in crypto became apparent.

Although it was a source of yield, it is now a warning. Users looking for returns on stablecoins should use platforms that are decentralized and exposed, and should never trust their money to systems that are not properly regulated, that have no transparency, and that lack proof of reserves.

Features Celsius Network

- High Yield Accounts – Competitive rates on stablecoin deposits.

- Security – Used industry standard measures to protect user funds.

- Earning Made Easy – Earning yields has been simplified.

- User Engagement – Through community initiatives and feedback.

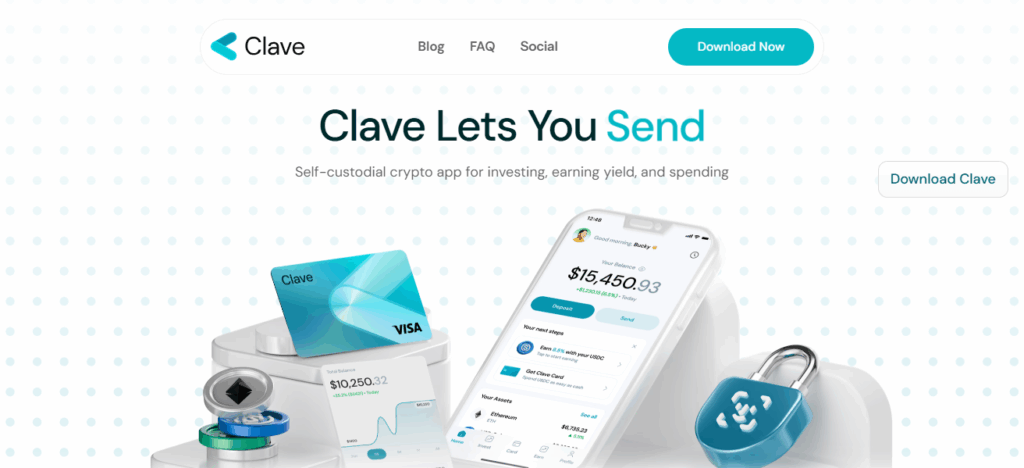

10. Clave

Clave is a new decentralized finance protocol building simple and safe yield strategies for stablecoins.

Clave integrates with Aave, Curve, and Yearn, and abstracts complexity for users while delivering market leading APYs.

Clave is also focused on building smart wallet infrastructure with programmable yield flows and automated yield strategies.

Clave will deliver optimized yield outcomes while smart yield flows are running in the background, with rates varying depending on market conditions.

Clave’s focus on UI/UX and DeFi composability will serve retail and institutional users. Stability, safety, and simplicity in yield generation will make Clave a favourite in the target market as the protocol gains traction.

Features Clave

- Innovative – In the DeFi space introducing new yield generating ideas.

- User Empowerment: Supplies methods for users to handle their optimization and management of yields.

- Community Governance: All decisions are made through votes from the community.

- Security: Prioritizes the protection of users and their funds.

- Integration: Offers advanced yield opportunities through partnerships with other DeFi platforms.

Conclsuion

To sum up, leading platforms for stablecoin interest and yield such as Aave, Curve, Pendle, and Yearn Finance, provide varied options, spanning from automated yield strategies to fixed-rate tokenized assets.

Options in both DeFi and CeFi, such as Celsius and Anchor, offer attractive yields while maintaining a balance between risk, liquidity, and safety.

The appropriate platform is a function of the user’s risk appetite, yield expectations, and the degree of decentralization they seek.

FAQ

What are stablecoins?

Stablecoins are cryptocurrencies pegged to stable assets like the USD, providing low volatility and predictable value.

How do I earn interest on stablecoins?

By depositing them into DeFi or CeFi platforms that lend, stake, or provide liquidity.

Which platforms offer the highest stablecoin yields?

Aave, Curve Finance, Pendle, Yearn Finance, Anchor, Compound, Morpho Blue, Celsius, Convex Finance, and Clave.

Are stablecoin yields safe?

Yields depend on platform security and market conditions; DeFi carries smart contract risk, while CeFi has counterparty risk.

Can yields fluctuate?

Yes, DeFi yields are variable, while some platforms like Pendle or Anchor offer more stable/fixed returns.