In this article, I will cover the Tools for Tracking Live Movements in the Crypto and Forex Markets. Such Tools assist traders in tracking and assessing current price changes as well as market trends.

This enables them to make rational trading decisions in the rapidly changing landscape of crypto and forex markets. Whether it is sophisticated graphical analysis, on-chain analytics, or insights from social trading, having the appropriate resources enables traders to complete their tasks in a precise, prompt, and well-planned manner.

Why Use Tools to Monitor Real-Time Crypto and Forex Market Movements

Instant Market Updates – Get real-time updates anytime to track and gain insights of any possible market opportunities.

Informed Decision-Making – Accurate and quick analyses of the market allow for the optimal choice of the time to make a trade.

Trend Analysis – Spot trends early to maximize profits.

Risk Management – Monitor the market and control the stop-loss and take profit parameters.

Automated Alerts – Alerts of market activity and large news are critical in making split-second trading decisions.

Comprehensive Market Insights – A complete set of tools such as market charts, analytical indicators, and real-time data.

Time Efficiency – Save yourself manual graphing and computations.

Competitive Advantage – Trade with the edge of real-time data against competitors.

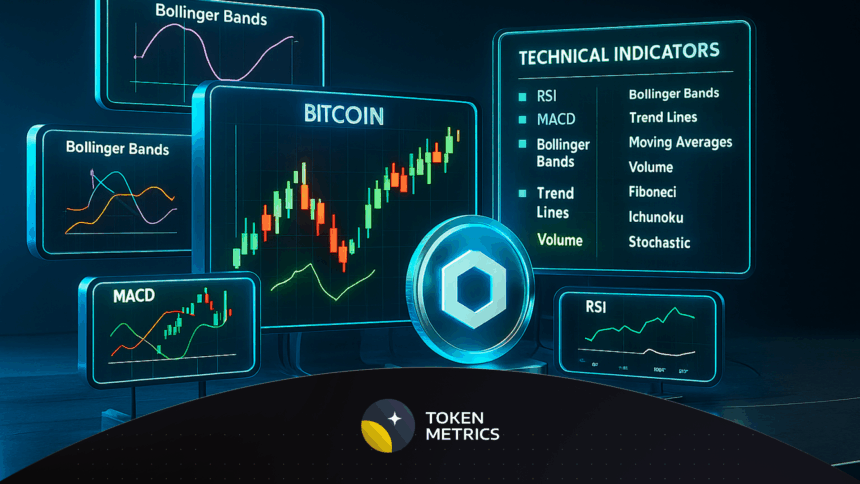

Key Point & Tools to Monitor Real-Time Crypto and Forex Market Movements

| Tool | Key Point / Feature |

|---|---|

| TradingView | Advanced charting and technical analysis with customizable indicators. |

| MetaTrader 5 (MT5) | Professional trading platform for forex and crypto with automated trading features. |

| CoinMarketCap | Real-time crypto market data, rankings, and historical charts. |

| CryptoQuant | On-chain analytics and market insights for informed crypto trading. |

| CoinGecko | Comprehensive crypto tracking with price alerts, market cap, and trends. |

| ForexFactory | Forex news, economic calendar, and real-time market updates for traders. |

| Glassnode Studio | On-chain metrics and analytics for deep cryptocurrency market insights. |

| Santiment Terminal | Market sentiment and analytics platform for crypto traders. |

| Myfxbook | Forex trading analytics, performance tracking, and community-driven insights. |

| Coin360 | Visual crypto market heatmaps for tracking price changes and trends. |

| Alpha Impact | Social trading platform with real-time trader insights and market performance tracking. |

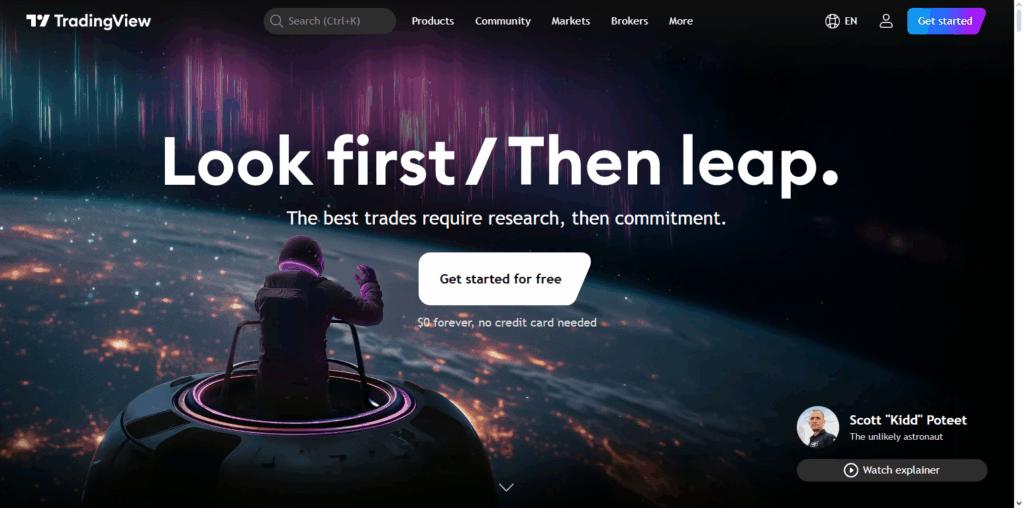

1. TradingView

Along with the rest of the tools to monitor real-time crypto and forex market movements, TradingView functions well in providing valuable charting capabilities.

In addition to advanced charting tools, users can also access and leverage a multitude of technical indicators and drawing tools to enhance one’s trading. Alerts can be customized and set to market events, enabling traders to act on market opportunities as they become available.

TradingView fosters a trader community where users can share insights. The interface is simple yet powerful, catering to both novices and experienced traders, providing opportunities that the crypto and forex markets offer.

TradingView Features

- Real-Time Charts – Offers one of the most customizable charting systems that lets you use multiple indicators, overlays, and drawing tools for technical analysis.

- Market Alerts – Set price, indicator, or strategy alerts for crypto and forex so that traders can catch price movements.

- Social Community – Share and discuss trading ideas, strategies, and scripts with a world of millions of traders.

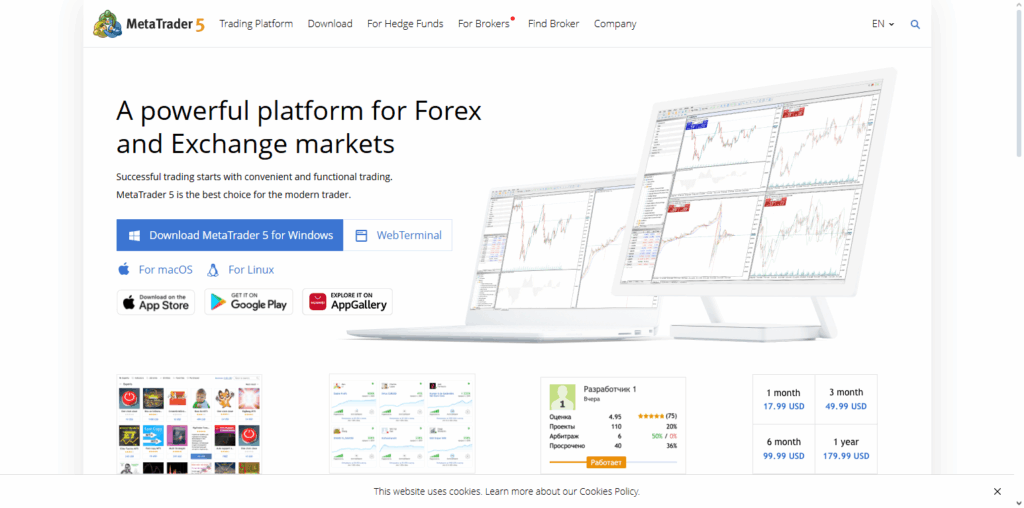

2. MetaTrader 5 (MT5)

MetaTrader 5 (MT5) functions as a multi-featured professional trading application that is instrumental for traders around the globe for monitoring the crypto as well as the forex market in real-time. MT5 comes with automated trading options through expert advisors (EAs), multi-order capabilities for sophisticated trading, and advanced charting features.

MT5 supports trading strategy formulation through historical data analysis, and simultaneous monitoring of various instruments with live news streams.

With its exceptional flexibility, MT5 accommodates user pernission for broker integration, advanced forex, and crypto trading. With a customizable trading interface, MT5 helps traders maintain an accurate and comprehensive overview of dynamic market conditions. This facilitates quick and accurate strategy implementation.

MetaTrader 5 (MT5) Features

- Multi-Asset Trading – Trade forex, crypto, stocks and futures in one place with real-time price streaming.

- Advanced Analytical Tools – Features more than 80 built-in indicators, automated trading (Expert Advisors) and backtesting.

- Customizable Interface – Allows traders to configure charts and layouts as well as trading workflows to align with personal strategies.

3. CoinMarketCap

CoinMarketCap is a serious tool for tracking real-time market movements in crypto and forex and provides access to a plethora of information on thousands of cryptocurrencies.

It covers real-time pricing, market cap, volume, circulation, historical data, and several other key metrics and charts. Investors and traders can track coins, analyze market patterns, and set price trigger alerts.

It also offers DeFi tracking, emphasizes trending tokens, and integrates news for users to be informed of key daily market changes.

For both beginners and advanced users, CoinMarketCap is the most comprehensive source of crypto information for making trading decisions in a highly volatile environment.

CoinMarketCap Features

- Live Market Data – Monitors real-time data on price, market cap, volume, and supply for thousands of cryptocurrencies.

- Comprehensive Metrics – Historical data, rankings, and coin comparisons for data-driven investment decisions.

- News & Insights – Market event insights to help traders and keep them informed with analyses on the news.

4. CryptoQuant

Offering on-chain analytics, CryptoQuant is a sophisticated instrument to track movements in the crypto and forex market in real-time. It assists in market prediction with in-depth analytics on exchange flows, crypto miners’ movements, and liquidity changes.

The service is equipped with charts, signals, and personalized alerts, all dedicated to price and network activity, which assists in anticipating changes in the market. CryptoQuant is invaluable in interpreting the dynamics of blockchain activity and market activity.

Using CryptoQuant, traders are equipped with advanced analytics that assists in price trend analytics, proactive risk management, and in estimating profitable opportunities for crypto trading.

CryptoQuant Features

- On-Chain Analytics: Analyzes blockchain data and insights, examination of data inflow and outflow into exchanges, miner activities, and other activities in the blockchain network.

- Market Sentiment Indicators: Tracks the trends and phases of the market to determine whether the market is being accumulated or distributed.

- Custom Alerts: Blockchain specific events or pre-determined figures and metrics can be used to create alerts.

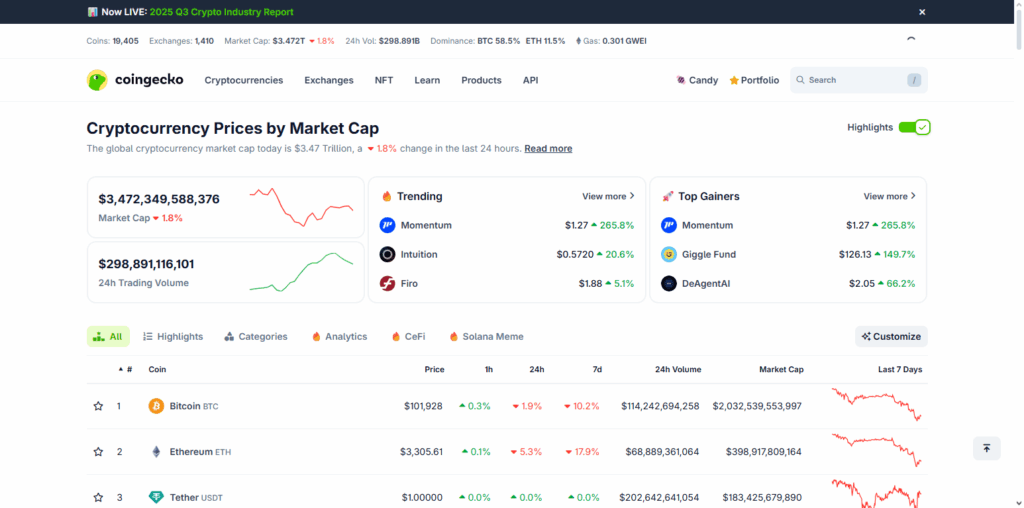

5. CoinGecko

CoinGecko is an all-encompassing instrument for tracking crypto and forex market movements. It provides a very wide range of information around a cryptocurrency such as price, market cap, volume, and even blockchain developer activity.

It gives users historical price charts, tools to track DeFi projects, and real-time market updates. CoinGecko analyzes and presents data on social activity around a cryptocurrency, listing activities, and fundamentals of a project which assists in assessing market sentiment and health of the project.

CoinGecko offers price alerts and portfolio tracking for users, to ensure that they are able to act on recent market changes. It is very reliable, easy to use, and provides data that is essential to all active participants in the crypto market, which is why it is popular among users.

CoinGecko Features

- Market Overview: Displays live prices, market caps, volumes, and rankings of thousands of crypto assets.

- DeFi and NFT Tracking: Analytics for decentralized finance tokens and NFT marketplaces.

- Historical Data & API: Historical price charts and analysis can be done using provided developer friendly APIs.

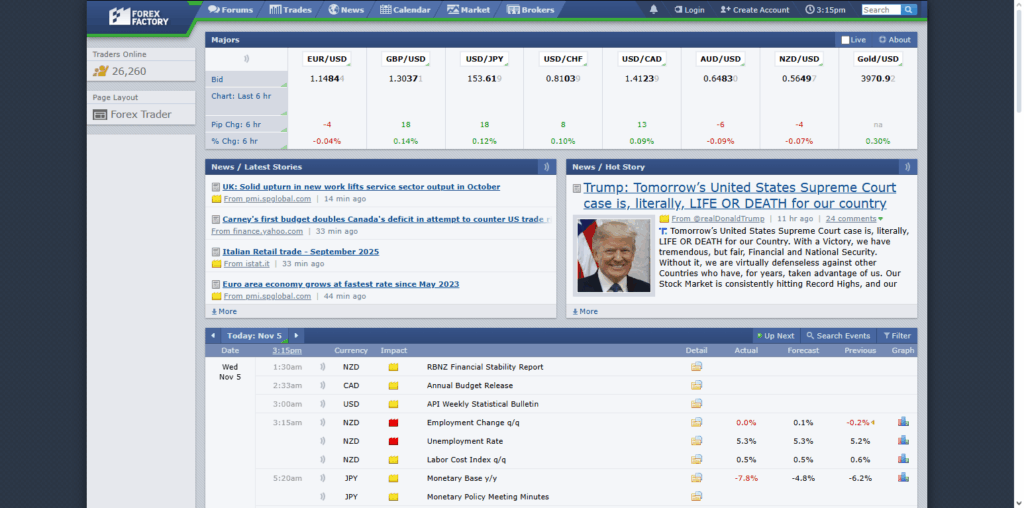

6. ForexFactory

ForexFactory is important for tracking the real-time movements of the crypto and forex markets. It focuses primarily on the forex sector. It hosts an economic calendar with real-time updates, breaking news, and analytical reviews, helping traders forecast potential market volatility.

ForexFactory also has a forum and various trading tools where traders collaborate and share strategies. It is useful in tracking the global economic events that affect the forex pairs and the crypto markets.

It’s live charts and news alerts enable traders to make decisions in real time. Making ForexFactory a part of your daily trading activities will provide a deeper insight into the market and its motivators, thus, enhancing the accuracy of your trades.

ForexFactory Features

- Economic Calendar: Provides real-time updates of global economic events and news impacting forex markets.

- Market Forum: Community driven discussion on strategies, news, and market trends.

- Trade Tools: Provides a set of tools such as volatility charts, session timing, broker reviews, and other trade instruments to streamline the decision making.

7. Glassnode Studio

On-chain data analytics is a specialization of Glassnode Studio. It is a professional tool for tracking real-time movements of the crypto and forex markets. It shows network activity, exchange balances, transaction volumes, and market sentiment indicators.

Traders rely on Glassnode to determine market accumulation, potential sell-offs, and overall health. It has customizable dashboards that provide real-time alerts and visualizations, making decision-making easier.

Glassnode Studio is especially useful for crypto traders, as it provides advanced analytical tools that go far beyond price charts. It blends market movement and on-chain data, allowing traders to forecast trends, control risks, and optimize their trading potential in high volatility crypto markets.

Glassnode Studio Features

- On-Chain Intelligence: Monitors on-chain network activities, behavior of network participants, balances on exchanges, and other blockchain metrics.

- Market Insights: Exposes analytics on market cycle behavior, supply distribution, and holder behavior.

- Customizable Dashboards: Enables real-time monitoring of specific assets or metrics using configured dashboards.

8. Santiment Terminal

Santiment Terminal is a leading tool for real-time monitoring of the crypto and forex markets. Santiment provides sentiment analysis and market intelligence.

It analyses social media data, on-chain metrics, and project developments to measure market sentiment. Traders get real-time dashboards, notifications, and other insights to foresee price movements and market shifts. Santiment Terminal is great for spotting new opportunities and comprehending the psychology of the markets.

Sentiment data and technical analysis together provide precision for traders on market entry and exit points. Sentiment analytics provide a simplified explanation of complex market dynamics, making Santiment Terminal an indispensable tool for crypto and forex traders.

Santiment Terminal Features

- Behavioral Analytics: Social media activity, developer activity, sentiment analysis and other factors that help anticipate trends in various crypto markets.

- On-Chain Metrics: Coin supply, exchange inflows and outflows, and other network stats fall under this category.

- Market Signals: Predictive alerts that help in making informed trading decisions.

9. Myfxbook

Myfxbook offers real-time market monitoring and is best known for its forex market analysis, which seamlessly integrates crypto markets through brokers.

With Myfxbook, traders gauge their performance, analyze their trading strategies, and assess their results against community standards.

Members benefit from live account monitoring, automated analysis, risk, profit, trade analytics, and other comprehensive reports.

Users can track social performance and share trade secrets to stimulate community insights. Myfxbook’s detailed analysis, risk and performance transparency, and social features assist traders in market response, risk management, and strategy refinement.

Myfxbook Features

- Portfolio Tracking: This feature tracks and analyzes the performance of forex trading accounts and displays the results in real-time.

- Community Strategies: Provides access to shared strategies, trading signals, and auto-trading setups which the community uses.

- Detailed Analytics: Optimizing strategy performance by analyzing the win loss ratio, drawdowns and trading history is facilitated by this feature.

10. Coin360

Coin360 is a useful instrument for tracking real time crypto and forex market trends. It is equipped with useful heatmaps that show the user how the market is performing at a glance. Coin360 is also equipped with the ability to show real time updates for thousands of cryptocurrencies and displays the price, the volume of trade and market cap.

Coin360 facilitates the quick recognition of the market’s most valuable and least valuable assets. The platform also analyzes and incorporates historical data and news streams. Coin360 takes the guesswork out of market tracking for traders looking for quick answers.

It displays trends, increases, decreases, and broader market changes to assist traders in decision making. Coin360 improves trader performance in crypto and forex markets through quick and accurate market assessments.

Coin360 Features

- Heatmap Visualization: Provides an interactive heatmap of the market which makes it easier to quickly see price movements and trends.

- Live Market Data: Provides data in real time concerning price, volume and market cap of various crypto assets.

- Trend Analysis: Provides visualized data on top gainers, losers and trends in various sectors.

11. Alpha Impact

Alpha Impact is first and foremost a social trading platform. Beyond that, Alpha Impact allows users to track the live movements of the crypto and forex markets. The platform provides clients with insights on top traders, market trends, and clients’ portfolios.

Users can follow traders and strategies, get notified on traders’ movements, and trade prompted strategies. Alpha Impact offers a custom analytics dashboard where users can monitor performance and track risk.

Social tools combined with analytics gives rookies the ability to study experienced traders to formulate a trading plan. New traders and experienced traders alike will improve their trading in the crypto and forex markets with actionable insights and market intelligence provided by Alpha Impact.

Alpha Impact Features

- Social Trading Insights: Provides data on professional traders’ real time trades and positions for comparison.

- Analytics & Alerts: Signals and alerts are provided to follow expert strategies and preserve or mimic funds.

- Performance Metrics: Risk levels and trading patterns of traders are analyzed to inform decision-making.

Conclusion

Traders of all experience levels need dependable tools to track live movement with crypto and forex markets. In a fast-moving trading landscape, real-time data, sophisticated charts, and notifications enable traders to create sound decisions using services such as CoinMarketCap, CryptoQuant, and MetaTrader 5.

More profound analysis of market movement is possible with on-chain analytical services such as Glassnode Studio and Santiment Terminal.

Strategy monitoring and education are further enhanced on social and performance platforms such as Myfxbook and Alpha Impact. Integration of these services improves decision-making speed, improves risk controlling, and provides a unique advantage in the highly unpredictable crypto and forex trading markets.

FAQ

Why are these tools important for traders?

Real-time monitoring tools allow traders to react quickly to price fluctuations, manage risks, and identify trading opportunities. They save time, provide market insights, and help implement strategies efficiently in highly volatile markets.

What are tools to monitor real-time crypto and forex market movements?

These are platforms or software that provide live updates, charts, technical indicators, and analytics for cryptocurrencies and forex pairs. They help traders track market trends, analyze price movements, and make informed trading decisions. Examples include TradingView, MetaTrader 5, CoinMarketCap, and CryptoQuant.

Which tool is best for technical analysis?

TradingView is widely regarded as the best tool for technical analysis due to its advanced charting, customizable indicators, and real-time alerts. MetaTrader 5 also provides robust analysis tools suitable for both crypto and forex trading.

Are these tools free or paid?

Many tools offer both free and premium versions. Free versions provide basic data and alerts, while premium subscriptions offer advanced analytics, additional indicators, and priority support. Examples: TradingView and CoinGecko have free tiers with optional paid upgrades.

Do these tools provide alerts for price changes?

Yes. Tools like TradingView, CryptoQuant, CoinMarketCap, and Alpha Impact allow traders to set customized alerts for price levels, market events, or technical indicator triggers, helping them act instantly.