These exchanges serve US users without KYC, but navigating the legal landscape requires careful consideration of federal and state regulations.

The allure of buy crypto with no kyc options remains strong among privacy-conscious traders, yet the regulatory environment in 2025 presents complex challenges. While platforms operating as crypto exchange platform services without identity verification exist, US traders must understand that most centralized exchanges face increasing scrutiny from FinCEN, the SEC, and CFTC.

The grey area lies in distinguishing between decentralized protocols (generally legal), non-custodial services, and offshore platforms that may suddenly restrict US access. This guide examines nine exchanges that currently serve American users without mandatory KYC, detailing their features, risks, and compliance considerations to help you make informed decisions about anonymous crypto trading.

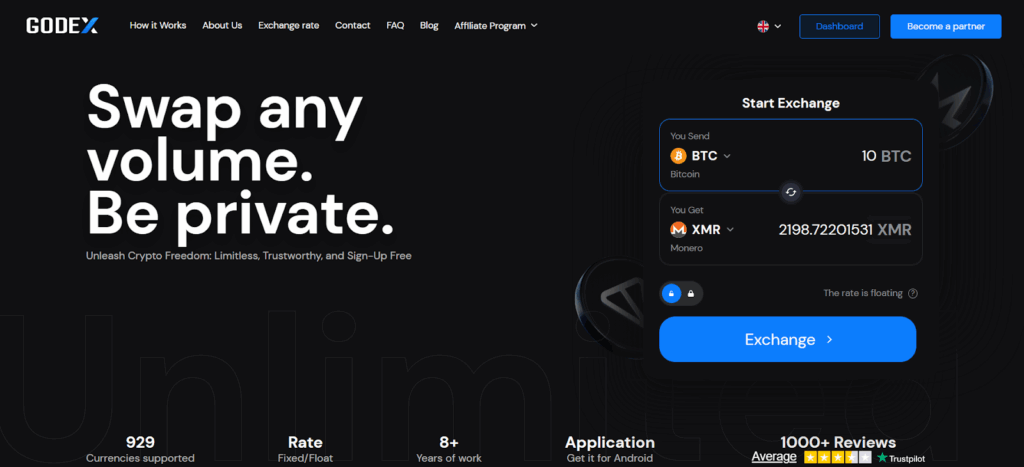

1. GODEX – Premium No-KYC Crypto Exchange Platform

GODEX crypto exchange platform homepage displaying 929 cryptocurrencies available for no-KYC instant swaps

GODEX leads the no-KYC exchange market with comprehensive privacy features and professional infrastructure designed for serious traders.

Since launching in 2018 and operating from Seychelles, GODEX has established itself as a reliable crypto exchange platform supporting over 929 cryptocurrencies. The platform’s standout feature is its complete absence of identity requirements, allowing users to execute trades without registration or KYC procedures while maintaining complete transactional privacy.

Key Features:

GODEX offers unlimited exchange volume without imposed thresholds or restrictions, making it ideal for both small and large transactions. The platform provides fixed-rate swaps that lock in prices for a defined time window, protecting users from market volatility during transactions. With 99.9% operational continuity and responsive technical support infrastructure, GODEX ensures reliable service around the clock.

The non-custodial model means users hold coins in their own wallet before and after trades, with funds only briefly passing through during the swap window. This approach significantly reduces custodial risks associated with centralized platforms. For US traders seeking to buy crypto with no kyc, GODEX represents a professional solution, though users should note it may be considered a grey-area service under current FinCEN guidelines due to its offshore registration.

| Pros | Cons |

|---|---|

| Zero KYC requirements, complete anonymity | Limited to crypto-to-crypto only (no fiat) |

| 929+ cryptocurrencies supported | Higher spreads on some pairs compared to CEX |

| Fixed-rate protection against volatility | Offshore registration may concern compliance-focused users |

| Unlimited transaction volumes | Limited regulatory recourse if issues arise |

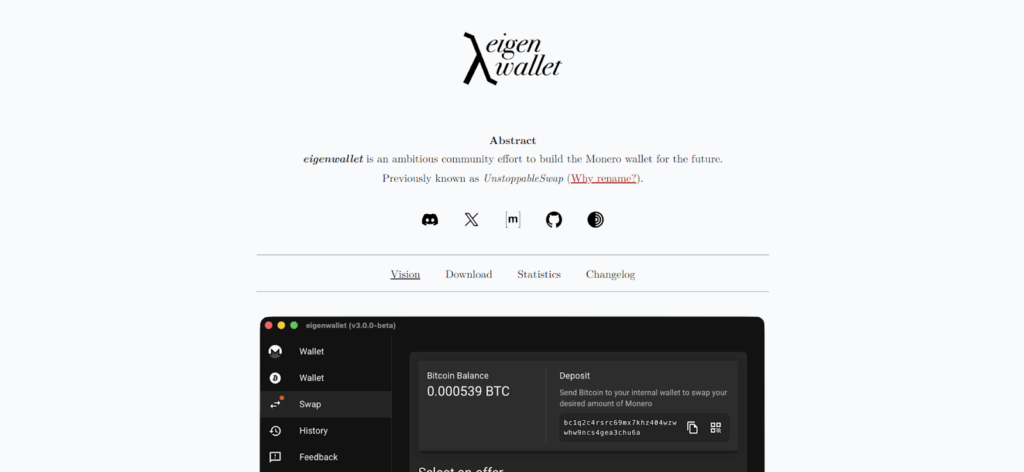

2. eigenwallet – Bitcoin-to-Monero Atomic Swaps

Alt text: eigenwallet interface showing Bitcoin to Monero atomic swap feature for anonymous crypto trading

eigenwallet specializes in trustless BTC-XMR exchanges using cutting-edge atomic swap technology without any KYC requirements.

This platform facilitates Bitcoin to Monero atomic swaps securely in a decentralized manner using state-of-the-art cryptographic protocols and open-source desktop software. Previously known as UnstoppableSwap, eigenwallet operates with a strict no-middleman philosophy, ensuring users remain in sole possession of cryptographic keys required to spend coins, ensuring self-sovereignty.

Technical Implementation:

The service uses atomic swap protocol that is cryptographically secured, meaning users cannot be cheated out of money as long as they follow the protocol. All transactions occur through the Tor network for complete privacy, and the entire codebase is open source and available on GitHub for audit and verification.

For US traders, eigenwallet represents a best changenow alternative usa for privacy-focused BTC-XMR swaps, though user reviews indicate mixed experiences with swap speeds and occasional failures, though refunds work reliably. The platform requires maintaining a stable internet connection during swaps, with successful swaps typically completing within an hour.

| Pros | Cons |

|---|---|

| Trustless atomic swaps, zero counterparty risk | Only supports BTC↔XMR pair |

| Complete privacy via Tor network | Slower processing (often 1+ hours) |

| Open-source code for transparency | Success rate around 33-50% per user reports |

| Guaranteed refunds on failed swaps | Requires technical knowledge of wallets |

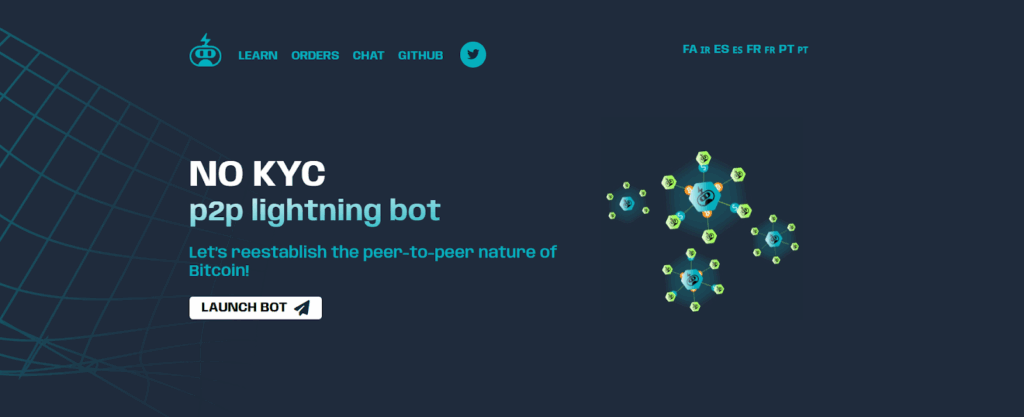

3. lnp2pbot – Lightning Network Telegram Trading

Alt text: lnp2pbot Telegram bot interface enabling Lightning Network peer-to-peer bitcoin trading without KYC verification

lnp2pbot enables peer-to-peer Bitcoin trading directly within Telegram using Lightning Network for instant, KYC-free transactions.

This Telegram bot facilitates buying and selling bitcoin on the Lightning Network in a peer-to-peer manner, using local currency without requiring KYC or providing personal data. The platform emphasizes Bitcoin as a censorship-resistant medium of exchange while keeping user privacy paramount.

How It Works:

The bot uses hold invoices on Lightning Network to temporarily hold payments similar to escrow, with receivers not getting funds immediately until specific conditions are met. The platform charges a flat fee of 0.6% which includes network fees, paid only by sellers, and there are no limits to transaction volume from the bot itself.

For US traders, lnp2pbot offers a unique opportunity to trade Bitcoin with local payment methods while maintaining privacy. The platform operates as a peer-to-peer marketplace directly in Telegram with end-to-end encrypted communications. While not technically a traditional crypto exchange platform, it provides excellent community support and reliable transaction processing, making it an innovative best changenow alternative usa for small-to-medium Lightning Network trades.

| Pros | Cons |

|---|---|

| Instant Lightning Network settlements | Bitcoin-only platform |

| 0.6% flat fee, no hidden charges | Requires Telegram account |

| 58 fiat currencies supported | Limited liquidity compared to major CEX |

| No transaction limits | Community-based support only (no company backing) |

4. Infinity Exchanger – Tor-Only Privacy Exchange

Alt text: Infinity Exchanger Tor-based homepage offering private cryptocurrency swaps with no registration required

Infinity Exchanger operates exclusively on the Tor network, providing maximum privacy for crypto swaps without accounts or KYC.

This Tor-only exchange takes one cryptocurrency and outputs one or more cryptocurrencies with no user accounts, allowing quick exchange of multiple assets. The service explicitly states KYC will never be requested and maintains a strict no-log policy, making it one of the most privacy-focused options available.

Features and Limitations:

Infinity Exchanger operates in Bitcoin, Bitcoin Cash, Litecoin, and Monero, with work underway to add new coins. The platform offers a flat 4% fee on all conversions with payouts processed after just 1 confirmation for BTC, BCH, and LTC, or 2 confirmations for Monero.

User experiences vary significantly. Successful swaps report completion in 6-7 minutes with funds arriving under 30 seconds after confirmation, but negative feedback highlights high 10% fees on some transactions, invalid transactions, poor UI leading to fund losses, and unresponsive support. For US traders seeking maximum privacy to buy crypto with no kyc, Infinity Exchanger provides deep anonymity but comes with higher risk factors and limited asset support.

| Pros | Cons |

|---|---|

| Maximum privacy via Tor-only access | Very limited coin selection (4 cryptocurrencies) |

| No accounts or registration required | Fee reports vary widely (4-10%) |

| Multiple output addresses supported | Mixed reliability and support responsiveness |

| Can function as crypto mixer | Clearnet access unavailable (Tor required) |

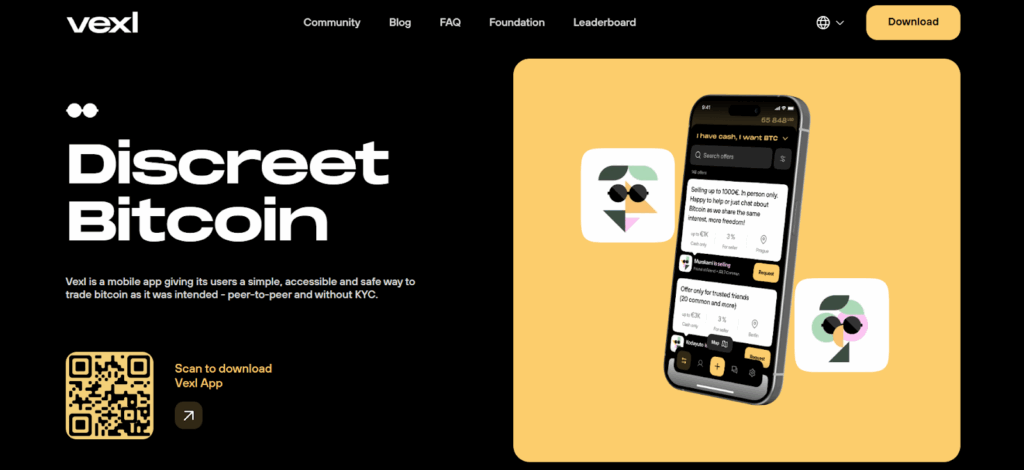

5. Vexl – Social Network P2P Bitcoin Trading

Alt text: Vexl mobile app interface connecting US traders for peer-to-peer bitcoin exchange through trusted contacts

Vexl creates a trusted trading network by connecting users with their contacts for peer-to-peer Bitcoin exchanges without KYC.

This mobile app enables peer-to-peer Bitcoin trading without KYC verification by connecting users through their phone contacts and friends of friends. Vexl doesn’t have access to users’ activities or identities as contacts remain encrypted and transmitted in unreadable form.

Unique Trust Model:

Unlike traditional P2P platforms connecting users worldwide, Vexl exclusively connects traders with acquaintances of their acquaintances, ensuring some level of connection between parties. Users browse anonymized offers within their real world social bubble, with identities remaining hidden until both parties choose to reveal them. The platform includes end-to-end encrypted chat where nobody but the two traders can see messages.

Vexl charges zero fees for using the platform or taking a cut from trades, with the Vexl Foundation operating as a non-profit supported by SatoshiLabs. For US traders, Vexl provides a best changenow alternative usa that leverages social trust rather than escrow services, though it requires building a network of Bitcoin contacts to be effective.

| Pros | Cons |

|---|---|

| Zero platform fees | Bitcoin-only (no altcoins) |

| Social trust model reduces scam risk | Requires phone number registration |

| No escrow needed, direct P2P | Network effect dependent (need Bitcoin contacts) |

| Open-source mobile apps (iOS/Android) | No escrow protection increases P2P risk |

6. HodlHodl – Multisig P2P Bitcoin Exchange

Alt text: HodlHodl non-custodial crypto exchange platform featuring multisig escrow for buy crypto without KYC transactions

HodlHodl operates as a non-custodial P2P platform using multisig escrow for secure Bitcoin trades without KYC requirements.

This non-custodial Bitcoin trading solution allows users to trade directly with each other without holding user funds. Every contract creates a unique multisig escrow Bitcoin address, with sellers depositing directly from their wallets.

Trading Mechanism:

The seller deposits Bitcoin into multisig escrow, the buyer pays the seller via agreed payment method, then the seller releases locked Bitcoin using their payment password directly to the buyer’s wallet. Because HodlHodl doesn’t hold any funds, it circumvents complex compliance procedures and never asks for personal information.

The platform supports over 370 different deposit and withdrawal methods including bank transfers, PayPal, and Skrill, with trading fees of 0.50% for standard users and 0.45% for referral code registrations. There are no withdrawal limits but restrictions exist on the number of contracts, active offers, and volume allowed for single trades. For US traders, HodlHodl represents a solid crypto exchange platform option, though the service currently isn’t available to US customers due to regulatory uncertainty.

| Pros | Cons |

|---|---|

| Non-custodial multisig security | Currently unavailable for US users |

| 370+ payment methods supported | Bitcoin-only platform |

| 0.45-0.50% competitive fees | Contract limits may restrict large traders |

| Global P2P trading | Email registration required (not fully anonymous) |

7. PegasusSwap – Fast Anonymous Swaps

Alt text: PegasusSwap homepage showcasing 1000 plus cryptocurrencies available for anonymous instant swaps

PegasusSwap delivers instant cryptocurrency swaps supporting 1000+ assets with no registration or KYC verification required.

The platform enables swapping any amount of crypto at any time without restrictions or delays while providing best market rates. PegasusSwap operates without requiring JavaScript, offers good UI design, and processes swaps quickly.

Service Quality:

User feedback highlights fast transactions with most swaps completing in 3-15 minutes, good customer service responding within minutes, and low fees. The platform accepts Monero as a payment option, providing enhanced anonymity for privacy-conscious traders.

However, some users report issues including stuck funds, receiving less than expected, high fees on small amounts, buggy status updates, and slow UI. The service may use centralized exchanges as intermediaries for routing but never exposes users to KYC or account risks. For US traders seeking to buy crypto with no kyc, PegasusSwap offers swaps for over 1000 assets including BTC, ETH, XMR, stablecoins, and many altcoins with non-custodial operations providing destination address control.

| Pros | Cons |

|---|---|

| 1000+ cryptocurrencies supported | Some user reports of stuck transactions |

| No JavaScript required (privacy-focused) | Network fees can be high on small swaps |

| Fast processing (3-15 minutes average) | May route through CEX intermediaries |

| No registration or account creation | Variable fee structure not always transparent |

8. Quickex – Instant Crypto Swaps Since 2018

Alt text: Quickex instant crypto exchange interface supporting 200 digital assets for no-KYC US traders

Quickex has operated since 2018 providing instant cryptocurrency exchanges for 200+ digital assets without KYC requirements.

The platform enables exchanging Bitcoin, Ethereum, USDT and 100+ cryptocurrencies instantly at best rates with no registration. Quickex launched in 2018 as a reliable and secure cryptocurrency exchange platform offering transparent terms of service and fast transactions.

Trading Experience:

Users report Quickex offers low fees, no hidden costs, with smooth transactions and an easy-to-navigate interface. The platform specializes in instant, non-custodial swaps where funds never linger on someone else’s account, with no KYC required for limits up to approximately $900.

However, user experiences show complexity. Some exchanges experience delays or blocks, particularly with coinjoined BTC treated as high-risk. Support responds quickly when issues arise, though resolution can take hours. For US traders, Quickex operates in a grey area as it may require KYC in case of suspicious transactions and is not available for US residents according to some listings. Despite this, it remains accessible as a crypto exchange platform alternative.

| Pros | Cons |

|---|---|

| Operating since 2018 (established track record) | May block coinjoined/mixed funds |

| 200+ cryptocurrencies available | KYC can be triggered on suspicious activity |

| Fast 5-15 minute average completion | Geographic restrictions (unclear US status) |

| Non-custodial swap model | Some reports of funds held pending verification |

9. Swapter – 1200+ Coins with Zero Limits

Alt text: Swapter platform displaying 1200 cryptocurrency pairs with zero volume limits for anonymous trading

Swapter supports over 1200 cryptocurrencies with no exchange volume limits or KYC requirements for maximum flexibility.

Established in 2022, Swapter operates as a fully automated cryptocurrency exchange platform allowing users to exchange without registration or providing personal information. The platform supports over 1,200 different cryptocurrencies including Bitcoin, Ethereum, and privacy coins such as Monero, Dash, and Zcash.

Platform Characteristics:

Swapter provides instant and secure transactions typically completed within 5 minutes with no limits on exchange volume. The platform operates as a non-custodial exchange where users retain control over their funds throughout the process, with 24/7 customer support to assist users with any questions or issues.

Recent strategic partnerships with platforms like CoinEasy demonstrate serious plans for expanding market presence. However, user reviews are mixed with a 3.2/5 SwapSpace rating and 3.8/5 Trustpilot rating, showing issues including undelivered crypto on completed swaps and fixed-rate changes after deposits. For US traders, Swapter provides broad asset access to buy crypto with no kyc, though its newer establishment (2022) means less proven track record compared to older platforms.

| Pros | Cons |

|---|---|

| 1200+ cryptocurrencies (widest selection) | Newer platform (2022) with less track record |

| Zero volume limits on transactions | Mixed user reviews (3.2-3.8/5 ratings) |

| 5-minute average swap time | Reports of failed transactions and support delays |

| Non-custodial with 24/7 support | Some fixed-rate integrity concerns |

Legal Status: Understanding US Compliance Risks

No-KYC exchanges exist in regulatory grey areas where federal and state enforcement actions remain unpredictable for US traders.

Federal Regulatory Framework

Virtual Asset Service Providers must register with FinCEN as Money Services Businesses and implement comprehensive AML/CFT programs, conduct KYC procedures, submit Suspicious Activity Reports, and comply with the Travel Rule. The challenge for US traders using no-KYC platforms is that entities engaged in cryptocurrency exchange, transfer, or custody are typically classified as MSBs requiring FinCEN registration.

No KYC crypto exchanges that US users can still access typically fall into the decentralized category, with DEX platforms like Uniswap remaining legal because they operate as protocols rather than traditional exchanges. However, the Department of Justice announced in 2025 it would no longer target exchanges, mixing services, or wallets for user actions or unintentional regulatory breaches, creating some breathing room.

Risk Factors for Traders

Crypto companies paid over $5.80 billion in fines during 2023 because compliance programs fell short. For individual traders, risks include:

- Platform shutdowns without warning

- Frozen funds during investigations

- Tax compliance obligations regardless of KYC status

- Potential money laundering accusations for large volumes

The IRS and tax offices globally are cracking down on crypto with dedicated operations to match wallet addresses with identities, making tax avoidance inevitable to catch. US traders should understand that using no-KYC exchanges doesn’t eliminate legal obligations – cryptocurrency transactions remain taxable as property under IRS rules.

State-Level Variations:

New York requires BitLicense with comprehensive KYC protocols, while California’s Digital Financial Assets Law effective July 2026 will impose strict requirements with $100,000 daily penalties for unlicensed activity. This patchwork creates confusion where a platform legal in Texas may violate New York law.

How to Safely Use No-KYC Exchanges: 5 Essential Steps

Protecting your privacy and funds on no-KYC platforms requires strategic security measures beyond what the exchanges themselves provide.

Step 1: Use Dedicated Wallets

Never trade directly from your main storage wallet. Create dedicated wallets for exchange interactions to compartmentalize risk. Use different addresses for each exchange to prevent linking transactions.

Step 2: Verify Addresses Multiple Times

Non-custodial exchanges provide no recourse for wrong addresses. Always verify wallet addresses carefully as typing errors can result in permanent loss of funds. Copy-paste addresses and verify the first and last characters before sending.

Step 3: Start With Small Test Transactions

Before moving large amounts, send a small test transaction. This $20-50 test confirms the exchange processes correctly and your receiving address works properly. The small fee is worth avoiding catastrophic losses.

Step 4: Use VPN with Tor When Possible

A VPN doesn’t change your legal status but can provide additional privacy layers. For Tor-only exchanges like Infinity Exchanger, this is mandatory. For others, VPN usage helps mask your IP from exchange logs.

Step 5: Document Everything for Taxes

Even if you use no KYC exchanges, most tax offices have released clear guidance that crypto is subject to tax. Maintain detailed records of:

- Transaction IDs and timestamps

- Exchange rates at transaction time

- Wallet addresses used

- Purpose of each transaction

This documentation protects you during IRS inquiries while allowing you to accurately calculate capital gains and losses. Remember: privacy from exchanges doesn’t mean privacy from tax authorities.

Conclusion

No-KYC exchanges offer privacy but require careful navigation of legal grey areas and security best practices for US traders.

The landscape of cryptocurrency exchanges without KYC verification continues evolving as regulatory pressure intensifies. While platforms like GODEX, eigenwallet, and HodlHodl provide legitimate alternatives for privacy-conscious traders, US users must acknowledge the inherent risks. Federal agencies have made clear that MSB registration and AML compliance remain mandatory for centralized services, yet decentralized protocols and offshore platforms persist in grey areas. Your best approach combines using reputable non-custodial services, maintaining meticulous tax records, starting with small transactions, and understanding that buy crypto with no kyc options may disappear or restrict access suddenly. The nine crypto exchange platform options detailed here represent current best choices, but diversification across multiple services and maintaining self-custody wallets remains essential for long-term success in anonymous crypto trading.

Disclaimer: This article provides information only and does not constitute legal or financial advice. Cryptocurrency regulations vary by jurisdiction. US traders should consult legal professionals regarding compliance obligations. Using no-KYC exchanges does not eliminate tax reporting requirements.