With an increasing focus on transparency, Best Crypto Exchanges with Proof-of-Reserves has become a standard metric for assessing crypto exchanges.

Today’s traders want evidence they can verify, not just a pledge, that a platform has, and continues to, hold the assets it claims. The top crypto exchanges that offer Proof-of-Reserves are able to provide measurable accountability by combining on-chain wallet disclosures, cryptographic proof, and third-party audits.

This guide analyzes top tier providers that utilize the visibility of funds to compete for the business of investors who are security oriented and navigating an ever more driven data digital age.

What is Proof Of Reserves On Crypto Exchanges?

The cryptocurrency company reserves enough cash to cover what they owe to customers. A proof of reserves audit is when a third-party auditor is contracted to check the audit proof and the proof reserves and cover what they owe to customers.

The auditor covers what they must firm to ensure that the firm reserves the total amount owed to customers. This is whether the firm has sufficient cash at hand to facilitate the customers withdrawing their cash.

However, the proof of reserves audit is only looking where the customer, i.e. the crypto exchange, directs them. Furthermore, the audit does not capture the firm’s current liabilities, hence the audit is not complete.

Key Point

Proof-of-Reserves Comparison Table

| Exchange | Key Point |

|---|---|

| Binance | Publishes regular PoR snapshots showing 100%+ collateralization; reserves often exceed liabilities; assets verifiable on-chain via cryptographic audits. |

| Kraken | Uses independent cryptographic audits; reserve ratios consistently above 100% (e.g., BTC 114.9%, ETH 101.2%); users can verify balances via Merkle Tree proofs. |

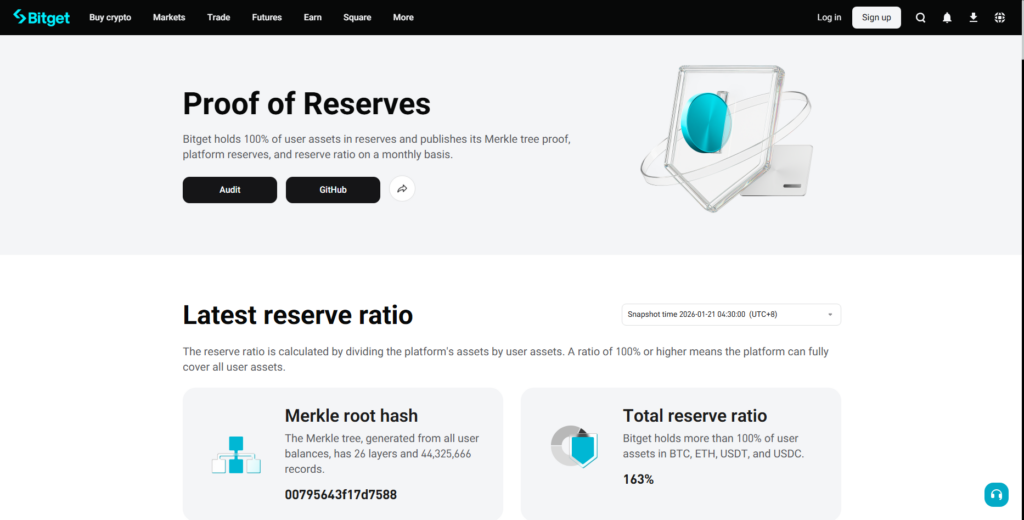

| Bitget (Statistics) | January 2026 PoR shows BTC 254%, ETH 161%, USDT 100%, USDC 113%; maintains a 163% overall reserve ratio; offers MerkleValidator for user verification. |

| MEXC | Maintains 1:1 reserves or higher; January 2026 snapshot: BTC 158%, ETH 107%, USDT 127%, USDC 140%; audits conducted with Hacken for transparency. |

| Indodax | Publishes PoR feature showing Rp 18 trillion (~$1B) reserves; fully collateralized 1:1; wallet addresses publicly verifiable on-chain; voluntary transparency initiative. |

| BingX | Uses Merkle Tree verification; monthly reports; reserve ratios: BTC 133%, ETH 126%, USDT 142%, USDC 122%; verified by Mazars audit firm. |

| Bitfinex | Publishes public wallet addresses on GitHub; reserves include ~204,338 BTC; emphasizes transparency and resilience; no exposure to FTX collapse. |

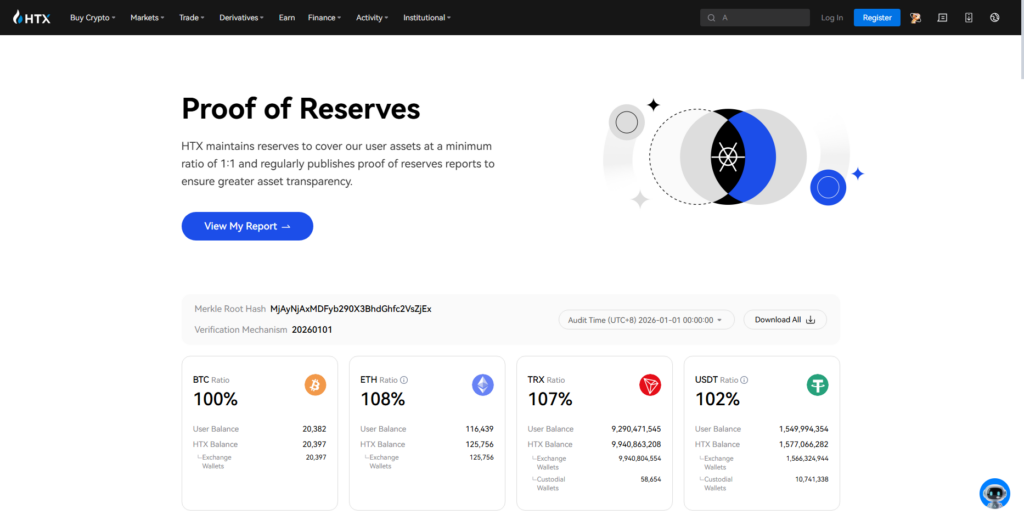

| Huobi (HTX) | Implements Merkle Tree PoR; consistently maintains 100%+ reserves for 34+ months; assets like BTC, ETH, USDT, TRX all fully backed. |

| Bitget (System) | Robust Merkle Tree-based audits; 163% average reserve ratio; BTC reserves at 254%; liabilities tracked by 0xScope; open-source verification tools on GitHub. |

| BitMEX | Conducts Proof of Reserves & Liabilities (PoRL) twice weekly; open-source tools on GitHub; users can verify balances privately; combines reserves with liabilities for solvency checks. |

1. Binance’s Proof Of Reserve

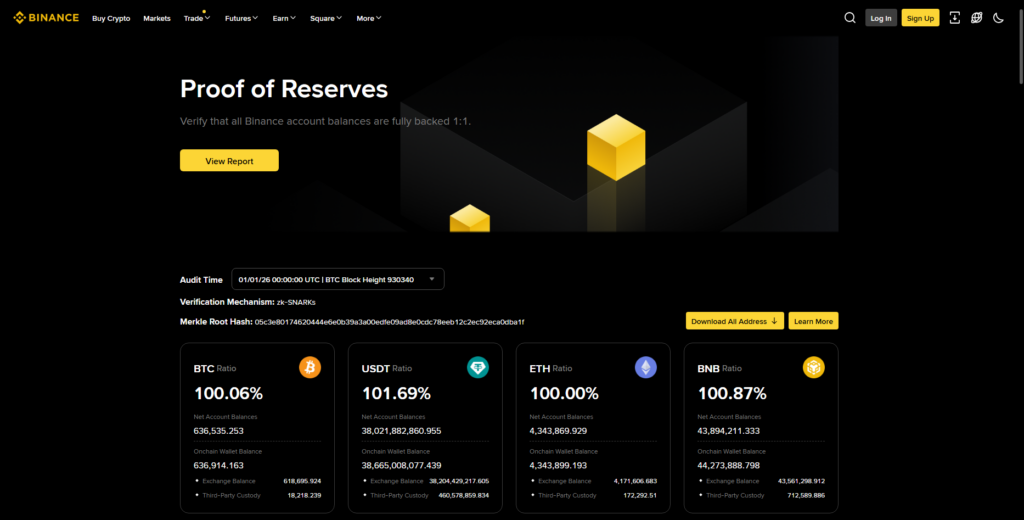

To show Proof of Reserve for all customer funds, Binance implemented its first system in 2022 which ensured that all customer assets were backed 1:1 or more. Users were able to verify their balances through on-chain Merkle trees, and also through published and user-verifiable on-chain data.

To enhance privacy in 2023, Binance altered its system to include zk-SNARKs, allowing for Proof of Reserve without disclosing customer data. By the end of 2023, the system had verified user assets of $63 billion across 24 tokens.

Binance has become one of the leading global crypto exchanges due to their consistent updates and publicly accessible verification dashboard.

Binance’s Proof-Of-Reserve

- Wallet Type: Custodial Exchange Wallets (Hot and Cold Storage)

- Restricted Countries: USA (Binance.com), UK (Limited), Ontario (Canada), some parts of Europe

- Languages: More than 40 languages

- Supported Cryptocurrencies: 350+

- Customer Support: 24/7 live chat and email. Help Center

Proof-Of-Reserve of Binance

Pros:

- Binance can verify total liabilities using zk-SNARKs, which means they can protect individual account information.

- Users can check their own Merkle tree snapshot inclusion on the Binance public dashboard.

- Users can verify proof of reserve for multiple high liquidity tokens.

- Reporting on reserves during market fluctuations boosts users’ confidence.

Cons:

- Each snapshot does not always contain the same assets and liabilities.

- Attestations are relied on for some portions rather than full continuous audits.

- Non-technical users may not understand the complexity of the proof of reserve system.

2. Proof-of-Reserve System of Kraken

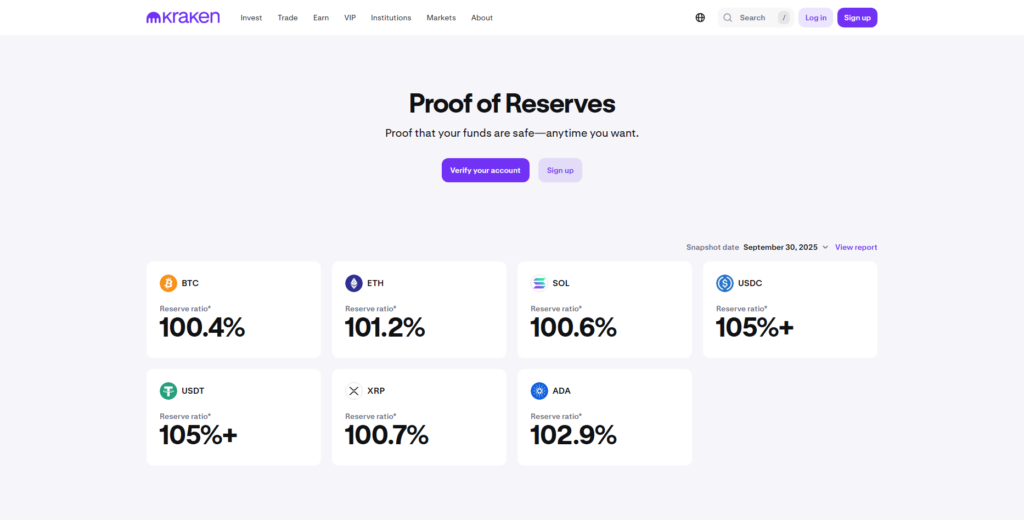

Kraken was the first to go the extra mile in cryptographically verifiable Proof of Reserves audits and created a mark in the industry for transparency. The exchange performs bi-annual and unannounced audits for both assets and liabilities.

These audits provide a comprehensive overview of Kraken’s financial status. The audits go through Armanino and are reviewed through a cryptographic system. At first, Kraken only supported covered Bitcoin and Ethereum, Kraken later expanded the services to include 5 more major cryptocurrencies.

By the start of 2024, these cryptocurrencies constituted ~63% of total user funds on the exchange. Kraken maintained the reputation of being the most trust-centric and compliance-driven exchange by being the first to provide third-party verification and user-level proof tools.

Kraken’s Proof-Of-Reserve System

- Wallet Type: Custodial Wallets (Mostly Cold Storage)

- Restricted Countries: New York (USA), Some Sanctioned Areas

- Languages: English, Spanish, French, German, and Japanese

- Supported Cryptocurrencies: 200+

- Customer Support: 24/7 live chat and email. Phone support in some areas

Proof-of-Reserve System of Kraken

Pros:

- Unscheded bi-annual audits by a 3rd party for assets and liabilities.

- Users can obtain a proof of reserve statement based on their own cryptographic validation.

- The Proof of Reserve program is the oldest of the major exchanges.

- Kraken covers the most jurisdictions in the world and is highly compliant.

Cons:

- Kraken audits do not encompass all the assets.

- PoR systems that are more frequently updated are more desirable than Kraken.

- Users do not have access to a proof of reserve system that has more reporting visualization.

3. Bitget Proof-of-Reserve Statistics

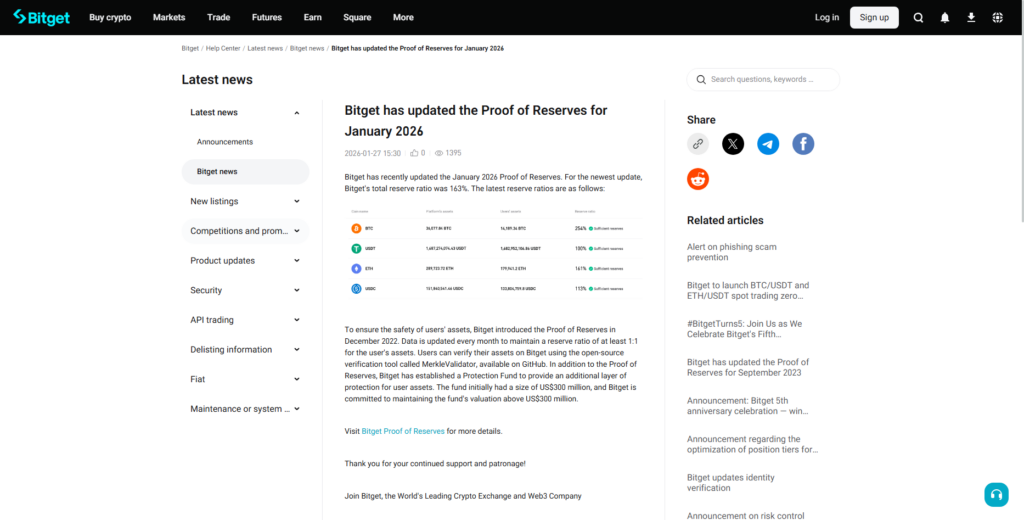

Bitget started its Proof of Reserves Initiative in 2022 for its first PoR report using the Merkle tree approach to transparently and verifiably track its reserves. The exchange publishes monthly PoR reports and keeps a 1:1 reserve ratio for all supported assets.

With the Bitget MerkleValidator tool on GitHub, users can verify their balances. As of April 2024, Bitget maintains a total reserve ratio of 176%, which means it is over-collateralized.

The exchange has a partnership with auditors to provide attestations about its asset holdings and liabilities. Frequent updates, public verification mechanisms, and over-collateralization make Bitget stand out in the market.

Bitget Proof-of-Reserve Statistics

- Wallet Type: Custodial Wallets (Hot and Cold Storage)

- Restricted Countries: USA, China, Singapore, and some other areas

- Languages: More than 15 Languages

- Supported Cryptocurrencies: 500+

- Customer Support: 24/7 live chat, email, and ticketing system

Bitget Proof-of-Reserve Statistics

Pros:

- Published the total reserve ratios demonstrating significant over-collateralization.

- Community members can verify using the MerkleValidator that is open source.

- Transparency is ensured by the monthly snapshots.

- Active monthly management for major stablecoins and high-volume assets.

Cons:

- Smaller tokens may not be fully represented.

- There is no easy way to find contact information for audit partners.

- Beginning verifications can find the interface challenging.

4. Initiatives by Crypto.com to Prove Its Reserves

The proof of reserves system crypto.com started in 2022, using a simple Merkle tree verification, so customers can check their balances and compare them to the company’s on-chain published reserves.

Crypto.com has been auditing its reserves (and publishing its liabilities to be fully backed) with the Mazars Group. Crypto.com has been publishing its reserves on BTC, ETH, USDC, USDT, XRP, and DOGE.

These assets have been updated with their reserves, and the proof of these reserves have been published periodically. Crypto.com combines proof of reserves with on-chain transparency and user verification to comply with the regulations and offers asset proof, reserve proof, and user level verification to customers, be it retail or institutional.

Crypto.com – Proof of Reserves (PoR) Key Details

- Wallet Type: Custodial exchange wallet (hot wallets for liquidity + majority cold storage for security)

- Restricted Countries: USA (Crypto.com Exchange limited), China, select sanctioned and high-risk jurisdictions

- Languages: 20+ including English, Spanish, French, German, Italian, Portuguese, Korean, Japanese, Chinese

- Cryptocurrencies Supported: 250+ across BTC, ETH, USDT, USDC, XRP, CRO, and major altcoins

- Customer Support: 24/7 in-app live chat, email support, help center, social media support channels

Crypto.com

Pros:

- Due to PoR audits by Mazars, additional trust and regulatory proof is gained.

- With Merkle tree, users can independently verify their balances.

- Users can expect proper coverage of major coins, as well as many of the more popular altcoins.

- Enhanced and increased transparency is gained via their published reserve reporting.

Cons:

- Audits are done periodically and not in real time.

- Audits done periodically will limit certain parts of the globe from being able to use the features of the full exchange.

- The verification process and tools used can be more complicated than what a novice user may expect.

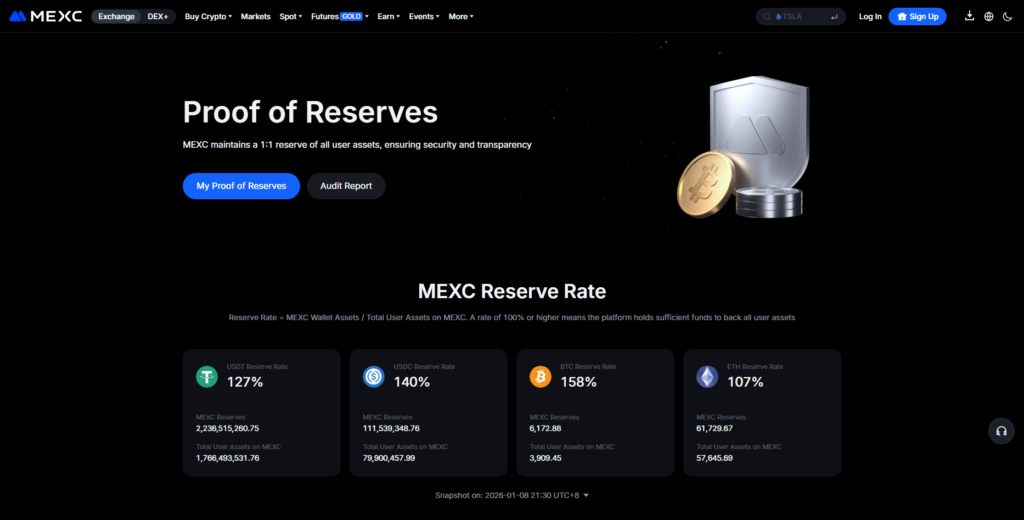

5. MEXC Proof Of Reserves

Customers can now use MEXC’s Proof Of Reserves (PoR) system since the company started implementing it in 2023. Users can use the PoR system to assess the exchange’s PoR concerning its customer liabilities.

MEXC processed customer liabilities with the use of Merkle tree structures to preserve proofs of account ownership. MEXC PoR covers spot, fiat, and futures accounts with BTC, ETH, USDT, and USDC.

MEXC PoR proves solvency by assessing if the on-chain balance is greater than or equal to the total customer liabilities. MEXC aims to gain customer confidence by providing regular updates and a verification system. MEXC’s verification is focused on retail and institutional traders.

MEXC Proof of Reserve

- Wallet Type: Custodial wallets (hot wallets and cold wallets)

- Countries served: USA, China, Canada (limited), and other countries

- Cookies: More than 20

- Cryptos: More than 1,600

- Services: Email, live chat 24/7, and help center

MEXC

Pros:

- Accounts of scope, fiat, and future all hold PoR responsibility.

- Supported by a really wide scope of cryptocurrencies.

- Balance verification can be done through the Merkle tree and is user friendly.

- Various snapshots are transparent with their constant updates.

Cons:

- Limited description of third party audits that are independent.

- Little PoR history for collecting long-term data.

- Mainly uses internal reserve audits.

6. Indodax Proof Of Reserves System

In 2023, Indodax was among the first Indonesian exchanges to implement a formally verified transparency system, which is part of their Proof of Reserve system.

One of the first exchanges in Indonesia to implement a formal Proof of Reserve was Indodax, whose system was reviewed by Kreston Indonesia, an accounting firm that published an Agreed-Upon Procedures report on April 18, 2023.

The audit verified that Indodax’s cash, receivables, and crypto assets were greater than all user claims. This verification audit considered both the fiat payment channels and the crypto wallet.

With the combination of traditional accounting precision and on-chain balance verification, Indodax offers its regional users a solid proof of being fully compliant and solvent, enhancing trust in the crypto ecosystem in the Southeast Asia region.

Proof of Reserves by Indodax

- Wallet Type: Custodial (local exchange wallets)

- Countries served: Mainly focused in Indonesia, limited access to other countries

- Cookies: English and Indonesian

- Cryptos: More than 200

- Services: Helpdesk (in-person), ticketing systems, and email

Indodax Proof Of Reserves Feature

Pros:

- There is a public verdict from the recognized accounting company which certified him using AUP standards.

- Covers both fiat payment gateways and crypto holdings.

- Compliance focused on the region increases the trust of local users.

- The publication of audit reports in the public domain increases credibility.

Cons:

- Coverage of assets is less than that of global exchanges.

- A less frequent than monthly PoR programs update.

- The tools for user verification are primitive.

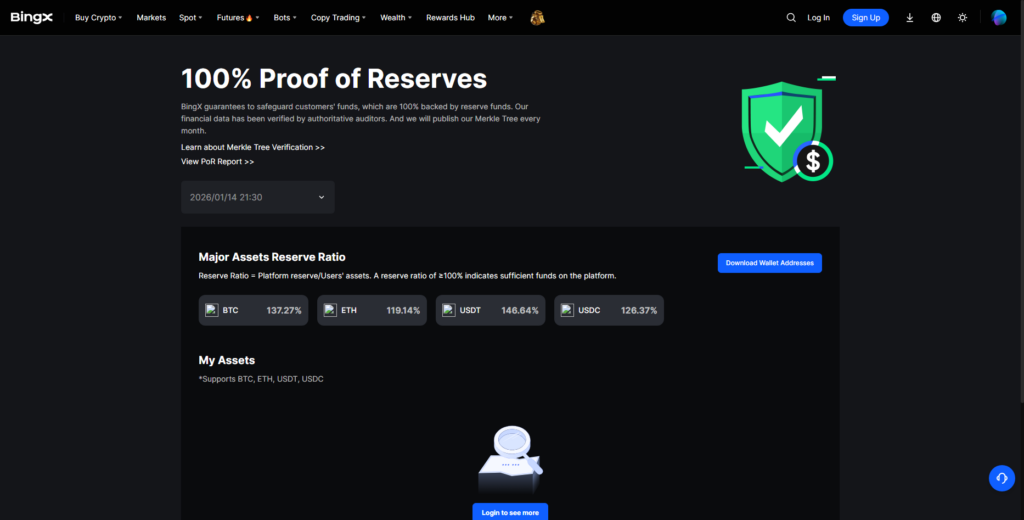

7. BingX Proof Of Reserves System

Users can independently verify BingX’s Proof of Reserves system based on Merkle tree architecture. The exchange records reserves on the 1st and 15th of every month to maintain transparency.

Since user funds are audited and partnered with Mazars, this documentation confirms user funds are fully backed. Audited data have shown the following collateralization ratios: 102.27% for BTC, 111.56% for ETH, 119.73% for USDC, and 166.25% for USDT.

These reserve ratios reflect over-reserving on BingX’s key assets. Traders seeking transparency on their finances would benefit from BingX’s consistent reporting and real-time verification.

Proof Of Reserves of BingX

- Type of Wallet: Custodial wallet (hot + cold storage)

- Countries with restrictions: USA, Canada, Singapore, some Europe regions

- Number of Languages Supported: 10+

- Number of Cryptocurrencies Supported: 300+

- Type of Customer Support: Live chat, email, help center (24/7)

BingX Proof Of Reserves System

Pros:

- There is real-time transparency, with two updates a month.

- Detailed asset by asset breakdown collateralization ratios is published.

- The credibility of independent audits from Mazars.

- There is a simple and user friendly interface for Merkle verification.

Cons:

- Compared to larger platforms, fewer PoR supported tokens.

- Ratio of collateral is subject to possible changes during each update.

- The reports archive is historical and limited.

8. Proof of Reserves from Bitfinex

Following the FTX collapse in 2022, Bitfinex adopted a Proof of Reserves system to build trust with users and add transparency. In the beginning, $5.06 billion in reserves was reported, with $3.36 billion in bitcoin, $1.49 billion in ethereum, and smaller amounts in USDT and USDC.

These assets were distributed over 135 hot and cold wallet addresses. Bitfinex and BitGo created a wallet system that allows users to verify their bitcoin proof of reserves in real time, and they publish wallet addresses to the public.

Users have the tools to check the on-chain balances with the liability of the platform. The exchange intends to increase the scope of its open-source custody system, which will improve the reporting in the future on its long-term solvency.

Bitfinex proof of reserves

- Type of Wallet: Custodial wallet (cold storage with multi-signature)

- Countries with restrictions: USA, some sanctioned countries

- Number of Languages Supported: English, Chinese, Russian, Spanish

- Number of Cryptocurrencies Supported: 170+

- Type of Customer Support: Email, ticket support

Bitfinex Proof of Reserves

Pros:

- An external source can verify public blockchain addresses.

- Reserves in Bitcoin can be tracked in real-time from their partnership with BitGo.

- Asset distribution by type and currency is disclosed.

- Cold storage security is good.

Cons:

- Liability reports are incomplete and irregular.

- There is more focus on Bitcoin in PoR than on smaller assets.

- For most users, the process is technical and complex.

9. Huobi Proof Of Reserves Initiative

Huobi implements a Proof of Reserves initiative using a Merkle tree system to show that user assets are locked on a 1:1 ratio. Users are able to confirm their balances through the on-chain wallet and Huobi publishes these reports monthly.

The system works with major assets such as BTC, ETH, USDT, HT, and TRX. Recently, reserve disclosures show ratios of 100% for BTC and USDT, and 101% for ETH, which demonstrates full coverage.

Huobi also enforces a 100% withdrawal policy, so there are always enough assets on hand to accommodate user demands. This consistent reporting maintains user confidence in more regulated market environments.

Huobi (HTX) proof of reserves initiative

- Type of Wallet: Custodial wallet (hot + cold storage)

- Countries with restrictions: USA, China, some regions

- Number of Languages Supported: 15+

- Number of Cryptocurrencies Supported: 600+

- Type of Customer Support: Live chat, email, help center (24/7)

Huobi Proof of Reserves

Pros:

- Single, short, and clear monthly reports on reserve ratios of key assets.

- Formalized and documented 100% withdrawal policy.

- High-volume cryptocurrencies are collateralized within PoR.

- Users can verify on an easy-to-use page.

Cons:

- Third-party audit process is too briefly covered.

- Accessibility is limited primarily due to geo-blocking.

- There is little distribution of cold and hot wallets.

10. Bitget Proof Of Reserves System

Bitget manages all user assets with a 100% reserve and Proof of Reserves since 2022. On the exchange, users can verify data without disclosing any private information.

From 2025, Bitget’s Merkle tree boasts 20 million+ balance entries in 26 tiers, representing the liabilities of the entire platform. Users can view monthly snapshots of the wallets and usage data.

Bitget claims to have over 168% total reserve ratio with overcollateralization recorded in BTC, ETH, USDT, and USDC. The combination of surplus reserves with high scale and high frequency further boosts Bitget’s transparency measures.

Bitget proof of reserves system

- Type of Wallet: Custodial wallet (hot + cold storage)

- Countries with restrictions: USA, China, Singapore, some regions

- Number of Languages Supported: 15+

- Number of Cryptocurrencies Supported: 500+

- Type of Customer Support: Live chat, email, ticket support (24/7)

Bitget Proof of Reserves

Pros:

- Merkle tree with millions of entries is a useful large-scale asset.

- Traceability increases with public monthly updates of wallet balances.

- Plenty of reserve ratio leaves a healthy solvency buffer.

- Individual users can verify their balances without revealing their identity.

Cons:

- Documentation is under technical.

- Major tokens are prioritized in asset coverage.

- There is no real-time visibility in snapshot-based reporting.

Common Red Flags in Proof-of-Reserves Claims

No Financial Responsibility Disclosure: In addition to hiding total user liabilities, the exchange states total wallet balances, making it impossible to verify whether reserves cover user deposits.

No Independent Audit: This will be the proof, which will be the internal audit without a third party, and will be subject to the audit.

Updates are Rare: Users are unable to assess the activity reserves because they do not approach the updating transparency reserves in a timely manner.

Limited Coverage of Assets: User balances and proof systems are less than whole because reports cover major cryptocurrencies and ignore plenty of smaller coins and derivatives.

No Tools for Users to Check: Users have no way to verify that their balances are in the Merkle trees or proofs, and no way to confirm their account.

Hidden Wallet Addresses: It is not easy to do so. It is quite hard to do so.

Unclear Reserve Ratio: There is no way to explain what they mean or what time frame they mean to not be able to edit.

Conclusion

By replacing marketing claims with verifiable on-chain and audited data, Proof-of-Reserves has emerged as a quantifiable standard for exchange transparency. Stronger solvency indicators are routinely shown by platforms that incorporate frequent reserve updates, user-level Merkle tree verification, and third-party audits.

Exchanges disclosing over-collateralization ratios above 100% and giving historical snapshots provide clearer financial visibility. PoR, however, works best when assets and liabilities are properly stated.

According to data, traders looking for long-term platform stability are most confident in systems that incorporate cryptographic proofs, independent attestations, and real-time or monthly reporting.

FAQ

What is Proof-of-Reserves (PoR)?

Proof-of-Reserves is a cryptographic method that verifies an exchange holds enough on-chain assets to cover all user balances, typically using Merkle trees and published wallet addresses.

How often should PoR reports be updated?

Data shows monthly or bi-monthly updates provide meaningful transparency, while real-time dashboards offer the highest confidence during periods of market volatility.

Does PoR guarantee an exchange is solvent?

PoR confirms asset holdings at a snapshot in time, but full solvency requires liability disclosure, third-party audits, and consistent historical reporting.

What reserve ratio is considered healthy?

A ratio of 100% means full coverage of user assets. Ratios above 100% indicate over-collateralization, providing an additional financial safety buffer.

Can users verify their own balances?

Yes. Many exchanges provide Merkle tree tools that allow users to confirm their account balances are included in the total liabilities without revealing personal data.