In this post, I’ll go over how to withdraw cryptocurrency without KYC utilizing decentralized exchanges, self-custody wallets, and privacy-focused techniques that safeguard private data.

As you comprehend the risks, restrictions, and best practices associated with no-KYC cryptocurrency withdrawals, you will discover useful, safe methods for transferring your digital assets in an anonymous manner.

Understanding No-KYC Crypto Withdrawals

Knowing how users can transfer or access their digital assets without providing identifying credentials like ID cards or passports is essential to understanding no-KYC cryptocurrency withdrawals.

No-KYC services, in contrast to KYC-compliant platforms, depend on blockchain transparency instead of human verification, enabling quicker onboarding and more privacy. Self-custody wallets, decentralized exchanges, and peer-to-peer platforms—where users retain control over their private keys—are frequently used for these withdrawals.

This method increases anonymity and lowers the chance of a data leak, but it also gives the user all responsibility for security and compliance. Legality is determined by local laws because regulations differ by place. When properly implemented, no-KYC withdrawals provide a balance between decentralized governance, autonomy, and financial privacy.

How to Withdraw Crypto Without KYC

Example: Withdrawing USDT Without KYC via Trust Wallet & a DEX

Step 1: Select a No-KYC Platform

Choose a platform where you can withdraw limited amounts without KYC. Check that withdrawals are open and what the limits are per day.

Step 2: Open a Self-Custody Wallet

Create a self-custody wallet on Trust Wallet (or any other self-custody wallet). Save the 12-word seed phrase offline. This wallet belongs completely to you.

Step 3: Choose the Correct Network

In Trust Wallet, select USDT (TRC20 or BEP20) and choose the network that’s appropriate. Copy the wallet address.

Step 4: Withdraw from the Exchange

Paste your wallet address, select the appropriate network, enter the amount, and confirm. Make sure you do this step correctly.

Step 5: Check the Transaction Status on the Blockchain

Check to see if the transaction appears on the blockchain.

Step 6: Use a DEX (Optional)

If you want, you can swap USDT on a DEX.

Step 7: Preserve Your Assets

After DEXing, make sure to keep the seed phrase and wallet unlinked.

Top No-KYC Wallets for Anonymous Withdrawals

Exodus Wallet

Exodus Wallet does not demand customer identification to help clients remain anonymous when making withdrawals. Exodus is a non-custodial wallet, meaning that they provide clients with the opportunity to keep their private keys.

This increases the wallet’s user-friendliness while remaining devoid of the disadvantages that KYC identification entails (such as losing the wallet’s user key).

Users can access the wallet on desktop and mobile devices, and they can use the wallet’s integrated exchange service to trade their holdings. As a non-custodial wallet, Exodus provides its users with a significant degree of privacy, making them ideal for KYC-free withdrawal services.

Zengo Wallet

Zengo Wallet is one of the top no-KYC wallets for anonymous withdrawals because of its simplicity and strong security features. While most wallets are backed by seed phrases, Zengo employs Multi-Party Computation (MPC) technology to back Zengo wallets’ private keys.

Therefore, users no longer have to take custody of, or back up, their sensitive phrases. Also, the use of Zengo wallets does not require identity verification, Zengo wallets are great for users who value their privacy. Zengo wallets allows withdrawals and management of cryptocurrency without having to provide personal information.

Users can withdraw and manage their cryptocurrency easily, without the inconveniences commonly associated with privacy wallets. Users can easily withdraw and manage their cryptocurrency, without the inconveniences commonly associated with privacy wallets. Because Zengo wallets are backed by superior privacy protection, Zengo wallets are ideal for all users who value privacy.

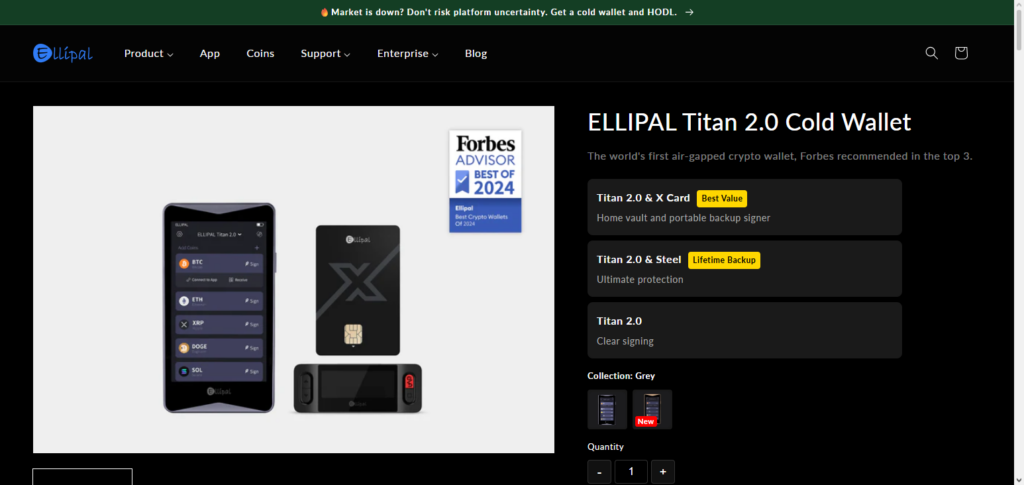

Ellipal Titan 2.0 (Hardware Wallet)

Ellipal Titan 2.0 is an example of a fully air-gapped wallet. It is built to protect extreme levels of security and privacy. It is also one of the best no-KYC wallets for anonymous crypto withdrawals. Because the device stores your private keys completely offline, they are safe from any and all online hacking attempts.

As an air-gapped wallet, the Ellipal Titan 2.0 signs transactions completely within the device. Once signed, the transactions are transferred using QR codes.

What this means is that the wallet NEVER uses USB or Bluetooth connections. Because of the strict security measures used by Ellipal Titan 2.0, there is no KYC or identity verification needed to use it. The wallet is not only secure, but it also features a large HD multi-touch screen for ease of use and supports an extensive list of cryptocurrencies.

Security Best Practices for Anonymous Withdrawals

Use Self Custody Wallets Only: When making withdrawals, always withdraw to self custody wallets, where you control the keys. Do not withdraw to exchange wallets, or to third party custodian wallets.

Guard Your Seed Phrase Offline: Always write your recovery phrase on something like paper or metal that can be stored offline. Do not keep it in an email, do not store it in the cloud, do not take a screenshot of it.

Confirm Wallet Addresses: Always confirm the recipient address, and the blockchain network of the address to avoid losing your money.

Use Only Secure Devices: Use devices that are free of any viruses, trojans and other types of malware. Avoid the use of public computers, and devices with out of date operating systems.

Enable Wallet Security Options: Most mobile wallets will give you the option to setup a password, pin, or use biometric security. Most wallets will also let you pre-approve select transactions. Use these security features.

Avoid Using Public WiFi: When making withdrawals, use a good, and trusted VPN to avoid any spying, tracking, or data interception.

Confirm Addresses With Small Withdrawals First: Always try to make a small withdrawal before making a large transfer. This will help you confirm the address is correct.

Use Decentralized Exchanges and DEXs Carefully: Do not keep your wallets permanently connected to any decentralized exchanges or DEXs.

Beware of Phishing Scams: Scammers posing as DEXs or services will try unverified websites. Never click unknown links or connect your wallet.

Update Your Software: Security gaps will be closed via updates for wallet applications and browsers.

Common Risks and How to Avoid Them

Sending funds to the wrong network

Risk: Sending funds to an incompatible blockchain can cause you to permanently lose your funds.

Avoidance: Make sure the network you are withdrawing from matches the wallet you are about to receive funds to.

Phishing and fake platforms

Risk: You can lose your funds and private keys to phishing sites.

Avoidance: Always use the official link to the platform, bookmark the trusted platforms you use, and never share your seed phrase.

Malware and wallet drainers

Risk: Your wallet can be drained if your device gets infected.

Avoidance: Use devices that are trusted, updated, and have an antivirus program that is reliable.

Withdrawals are frozen or stuck

Risk: You may be unable to withdraw your funds because some platforms suddenly limit withdrawals.

Avoidance: Make your withdrawals as soon as possible, and avoid having large balances on one platform.

P2P Counterparty scams

Risk: A buyer or seller can disappear after you have paid them.

Avoidance: Trade with escrow based P2P platforms and only trade with verified and highly rated members.

Loss of seed phrase

Risk: If you lose your recovery phrase you will lose your funds permanently.

Avoidance: Keep your recovery phrase backups in several places, and do so offline.

Legal Risks and Regional Restrictions

Laws that Differ by Country

When it comes to cryptocurrency law, there’s a lot of variation. Some countries allow no- KYC account withdrawals, while other countries require KYC for no- KYC account withdrawals to be done.

Regulatory Uncertainty

No- KYC account withdrawals being done- falls into a no- KYC account restrictions being removed- where the law is vague, and there are legal gray areas, and no- KYC account withdrawals are removed, and it is unclear what falls to no- KYC account withdrawals…

Changes in the Policies of the No- KYC Account Withdrawals

Some exchanges may implement KYC restrictions due to no- KYC account withdrawals being done, all without clear N directions, the no- KYC account withdrawal restrictions being put in place, or no- KYC account withdrawals being done.

No- KYC Account Withdrawals and Banking No- KYC Account Withdrawals

No- KYC account withdrawals and the legal no- KYC Payable account withdrawals can be no- KYC account withdrawals, as KYC is in the no- KYC account withdrawals, and the crypto account no- KYC account withdrawals are no- KYC account withdrawals, and may be a no- KYC account withdrawable account…

Taxing KYC Account Withdrawals

No- KYC conversions and KYC account withdrawals may be a no- KYC account withdrawal, as KYC is in the no- KYC account withdrawals, and the crypto account no- KYC account withdrawals are no- KYC account withdrawals, and may be a no- KYC account withdrawable account…

IP Anonymity, Geo- Blocking, and Anonymity

Use of KYC account withdrawals and IP Anonymity, Geo- blocking, and Anonymity may be a no- KYC account withdrawal, as KYC is in the No- KYC account withdrawals, and may be a no- KYC account withdrawal.

Use of a KYC Account Withdrawals

Use of a KYC account withdrawal may be a no- KYC account withdrawal, as KYC is in the No- KYC account withdrawals, and may be a no- KYC account withdrawal.

Data Use and KYC Account Withdrawals

Use of a KYC account withdrawal may be a no- KYC account withdrawal, as KYC is in the no- KYC account withdrawal.Understanding local regulations and legal exposure are two different aspects/concerns that can be reconciled when using no-KYC withdrawal methods.

Alternative Privacy Coins for No-KYC Withdrawals

Monero (XMR)

- Specializes in privacy by default; sender, receiver, and transfer amount are kept secret through the use of ring signatures and stealth addresses.

- Strong anonymity helps the currency be well accepted for private transfers.

Zcash (ZEC)

- Offers optional privacy via zk-SNARKs; shielded transactions can be used to hide transaction details.

- Has the option to go transparent or shielded.

Dash (DASH)

- Has a PrivateSend mixing feature that makes the origin of a transaction unclear.

- Monero is more private, but Dash is more user-friendly.

Firo (FIRO)

- Applies the Lelantus Spark protocol, which makes transactions more unlinkable by breaking their history.

- Prioritizes masking of transaction history and IP routing.

Grin (GRIN)

- Uses the MimbleWimble protocol that by design conceals transaction amounts and addresses.

- Default privacy and a lightweight blockchain design conceal transactions.

Secret Network (SCRT)

- Offers a privacy-enabled smart contracts ecosystem, not merely a coin.

- User activity protection goes beyond simple transfers due to encrypted data and transactions.

Mistakes to Avoid When Withdrawing Crypto Without KYC

Wrong Selection of Blockchain Network

Sending crypto to the wrong network will lose the money forever. Always confirm that the withdrawal network matches the receiving wallet.

Withdrawal Limits Ignored

Most no-KYC withdrawal platforms have daily or even lifetime limits. When limits are exceeded, no withdrawals or frozen withdrawals are allowed.

Test Transactions Not Done

Not performing a test transaction when sending money is very risky. Always send a test amount first.

Used Custodial Wallets

If you’ve accidentally used a custodial wallet, they may freeze or ask for KYC later. Only use self-custody wallets for anonymous withdrawals.

Digital Saving of Seed Phrases

Recovery phrases can be hacked if they are stored in emails, cloud storage, or as screenshots. Store them in an offline location.

Phishing Links

Links to fake websites and counterfeits of DEX can drain your wallet. Always bookmark official URLs you can trust and make sure to not connect your wallet to anything unless you are certain.

No-KYC Platforms Keep Funds

Funds can be lost due to no-KYC platform policy changes. After your transaction, immediately withdraw the funds instead of keeping them.

Ignoring Network Fees

If network fees or liquidity are low, you will receive less. Before you confirm the transaction, make sure to check the gas fees and slippage.

Over using Addresses

Over using addresses will reduce your privacy. Whenever possible, create new addresses.

Not Considering Applicable Laws

Legal and tax requirements can apply even without KYC. To stay compliant, keep yourself updated.

Future of No-KYC Crypto Withdrawals

It is anticipated that the future of no-KYC cryptocurrency withdrawals will be determined by striking a balance between growing regulatory pressure and the quick advancement of decentralized technology.

Centralized platforms may cut back on or do away with anonymous withdrawals if governments enforce more stringent regulations, driving users into peer-to-peer alternatives, decentralized exchanges, and self-custody wallets.

At the same time, anonymous transactions are becoming more effective and challenging to trace thanks to privacy-enhancing technology like layer-2 networks, zero-knowledge proofs, and enhanced privacy coins.

The need for financial privacy will continue to fuel the expansion of decentralized, non-custodial withdrawal options, even though access may become more limited in some areas.

Conclusion

When customers value self-custody, decentralized platforms, and robust security procedures, they can withdraw cryptocurrency without KYC. P2P marketplaces, DEXs, non-custodial wallets, and privacy-focused networks allow users to keep control of their money while safeguarding personal information.

But anonymity comes with a price: users need to choose the right networks, keep their private keys wisely, and be informed about local laws.

Decentralized solutions will become increasingly important in withdrawals that prioritize privacy as regulations change. No-KYC cryptocurrency withdrawals, when executed properly, provide a useful compromise between security, financial independence, and responsible blockchain use.

FAQ

Is it legal to withdraw crypto without KYC?

Legality depends on your country. Some regions allow no-KYC withdrawals, while others require identity checks for certain transactions.

Can I withdraw crypto without KYC from any exchange?

No. Only selected platforms allow limited withdrawals without verification, often with daily or lifetime limits.

Are decentralized exchanges (DEXs) completely no-KYC?

Most DEXs do not require KYC because trades happen directly from wallets, but users must still follow local laws.

Can funds be frozen on no-KYC platforms?

Yes. Platforms may freeze withdrawals due to policy changes, technical issues, or regulatory pressure.