The Best Tickmill Alternatives for Pro Traders who Need Tight Spreads, Quick Execution, Deep Liquidity, and Cutting-Edge Trading Platforms will be covered in this post.

Brokers with minimal commissions, robust regulatory protection, and support for algorithmic methods are essential for professional traders. Here, we examine the best options that provide serious market players with competitive price, dependable performance, and institutional-grade tools.

Key Point & Best Tickmill Alternatives for Pro Traders

| Broker | Key Point |

|---|---|

| Pepperstone | Known for ultra-low spreads, fast execution speeds, and strong support for MetaTrader and cTrader platforms. |

| IC Markets | Offers raw spread accounts with deep liquidity and is popular among scalpers and algorithmic traders. |

| CMC Markets | Provides a wide range of CFDs, advanced charting tools, and competitive pricing for active traders. |

| Exness | Features flexible leverage options, instant withdrawals, and tight spreads for retail traders. |

| Fusion Markets | Focuses on low-cost trading with minimal commissions and competitive spreads. |

| Forex.com | Regulated global broker offering robust research tools and a user-friendly trading platform. |

| OANDA | Trusted broker known for transparent pricing, strong regulation, and powerful trading analytics. |

| Capital.com | Offers multi-asset trading, institutional-grade tools, and global market access at low costs. |

| AvaTrade | Provides diverse trading platforms, educational resources, and fixed spread options. |

| Eightcap | Known for crypto CFD offerings, competitive spreads, and strong MetaTrader integration. |

1. Pepperstone

Pepperstone offers the opportunity of low spreads and fast execution of orders. They are one of the Best Tickmill Alternatives for Pro Traders. They allow scalpers and other professional traders to use certain facilities provided by trading platforms such as MetaTrader and cTrader and include charting tools, programs for automated trading, and social trading.

They also offer access to big global trading markets and tight pricing. They provide educational material and offer quick customer service. They also include features for managing financial risk, which makes them a good choice for professional traders.

Pepperstone Features, Pros & Cons

Features

- Spreads are ultra-low across the major forex pairs.

- Execution and liquidity are fast.

- cTrader and MetaTrader are supported.

- Automated trading has VPS solutions.

- Risk management and advanced charting are provided.

Pros

- Execution quality is outstanding.

- Pricing for pros is excellent.

- Customer service is great.

- The educational resources are strong.

- Account options are flexible.

Cons

- Proprietary platform features are limited.

- ECN accounts come with higher fees.

- Beginner traders are not favored.

- Limited access for some regions.

- In some regions, stock trading is not available.

2. IC Markets

IC Markets has always been placed as one of the Best Tickmill Alternatives for Pro Traders due to its deep liquidity pools and raw spread accounts. IC Markets supports direct market access and low latency execution, while also being compatible with MetaTrader and cTrader.

This broker is designed to meet the needs of high-frequency and algorithmic traders. During peak market hours, IC Markets is one of the few brokers that offer positive pricing for almost all levels of spread. When trading with IC Markets, traders are able to withstand deep and powerful market changes due to the support of high-level analytical and charting tools.

Traders also have the ability to set their own leverage. With risk controls, and 24 hours a day and 7 days a week support, IC Markets helps traders avoid and navigate high latency markets, while maximizing and minimizing their costs and forex, commodities, indices, and crypto CFD trading.

IC Markets Features, Pros & Cons

Features

- Raw spread accounts come with tight pricing.

- Multi-platform support (cTrader, MT4, MT5) is available.

- Algorithmic trading is advanced.

- Tier-1 banks provide deep liquidity.

- Execution is low-latency.

Pros

- Pricing is competitive.

- EAs and scalping are great.

- The coverage of assets is extensive.

- The reliability of trade execution is high.

- Support is available 24/5.

Cons

- Account types come with fees.

- New traders may find it complex.

- The access to Crypto CFDs is limited.

- No trading of physical stocks is allowed.

- There are regional restrictions on accounts.

3. CMC Markets

CMC Markets is considered one of the Best Tickmill Alternatives for Pro Traders because of the company’s extensive CFD range and excellent trading services. CMC Markets’ trading range, as well as its reasonably priced and transparent fee structure, and connectivity to thousands of assets, including forex, shares, commodities, and indices, allow for diverse trading strategies.

CMC Markets offers a trading platform with competitive pricing and thousands of trading assets, including competitive pricing and thousands of trading CFDs. CMC Markets is one of the best providers of Tickmill methods for advanced trading. Pro traders can also use advanced market analysis, trading ideas, and real-time news to execute informed and precise trades.

CMC Markets Features, Pros & Cons

Features

- Thousands of CFDs to trade.

- Next-Gen trading platform

- Risk tools

- Market insights

- Forex rates

Pros

- Good research and education

- Good platform tech

- Global broker

- Good charting

- Plenty of assets

Cons

- Only CFD (no real ownership)

- Higher volume (costs will increase)

- Inactive traders will struggle

- Some tools are tiered

- High fees

4. Exness

Exness ranks as the Best Tickmill Alternative for Pro Traders due to its flexible leverage, ultra-tight spreads, and lightning-fast order execution. Its transparent pricing and trustworthy reputation is inviting to professionals requiring low trading costs with minimal compromises on trading performance.

Exness has pricing that is high end for professional trading, and it has all the major trading platforms and account types that support all kinds of meaningless strategies (scalping, hedging, etc.). Withdrawal systems are reliable, and the support is 24/7.

Exness also has deep liquidity, great professional grade risk management systems, and all the tools to operate smoothly in both stable and unstable market environments so that professional traders can operate seamlessly.

Exness Features, Pros & Cons

Features

- Leverage is flexible

- Spreads are tight

- Withdrawals and deposits are fast

- Supports MT4 and MT5

- Good for automated trading

Pros

- Pricing is transparent

- High volume traders will benefit

- Global liquidity is strong

- Support is fast

- Account setup is fast

Cons

- Research is not strong

- Non-forex is limited

- Research is limited

- Tools are limited by region

- No regional restrictions

5. Fusion Markets

Fusion Markets is renowned as one of the Best Tickmill Alternatives for Pro Traders as a result of their low commission model combined with competitive spread parameters and access to direct market. Fusion Markets services Active Traders as they give high execution speeds and transparent pricing with no hidden fees.

Traders have access to a wide range of currency pairs and CFDs as well as variable tools of leverage and risk management. The broker’s focus on simplicity and cost-effectiveness is most appealing for professional scalpers and day traders. Fusion Markets solid customer support and reliable trading infrastructure maintain the performance and liquidity of a cost-effective alternative.

Fusion Markets Features, Pros & Cons

Features

- Low commissions

- Spreads are tight

- Dma

- Metatrader included

- Good pricing

Pros

- Good for scalping

- Good customer service

- Account tiers are simple

- Good execution

Cons

- Less liquidity

- Tools are limited3. No proprietary platform

- Less tradable assets

- Features mainly for forex

6. Forex.com

Forex.com is a prominent contender for being one of the Best Tickmill Alternatives for Pro Traders for its strong platform, excellent regulation, and great educational tools. Traders seem to enjoy the good spreads, enhanced research and analytics, and the advanced tools offered by the brokerage and the proprietary platform and MetaTrader.

With the ability to chart, use automated systems, and create their own indicators, automated traders appreciate the ability to set complex configurations. Pro traders value the combination of responsive customer service, risk management features, technology, and market access, along with a good level of trust, that Forex.com offers.

Forex.com Features, Pros & Cons

Features

- Strong proprietary platform

- MetaTrader compatible

- Real-time news and research

- Advanced risk management

- Tight spreads on majors

Pros

- Highly regulated

- Good educational material

- Analytics are top-notch

- Institutional clients preferred

- Competitive forex executions

Cons

- Account fees

- Not beginner friendly

- Few cryptos

- High-tier features

- No stocks

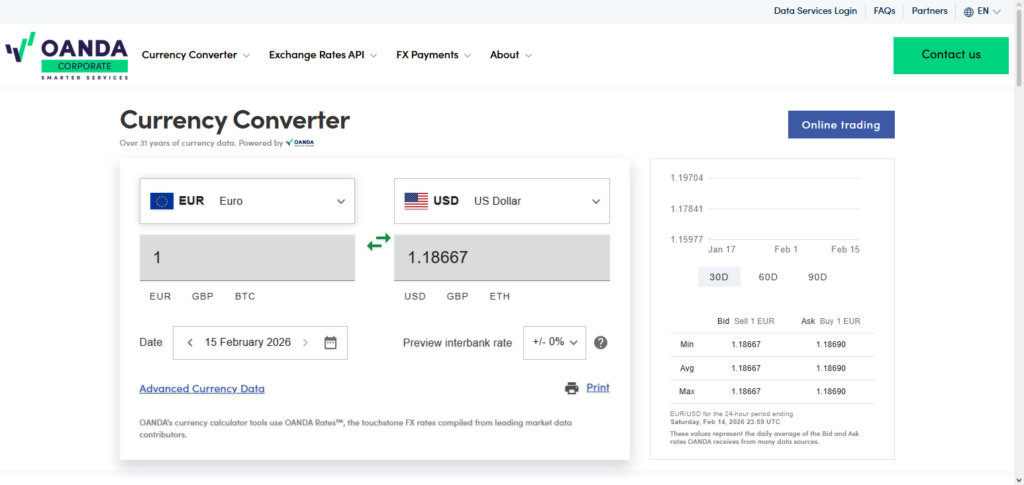

7. OANDA

For Pro Traders, OANDA wins the award for Best Tickmill Alternative for its analytical tools and transparent pricing. OANDA has built an excellent reputation for its deep market liquidity and tight spreads for multiple asset classes, including forex, indices and metals.

|| OANDA’s trading platforms offer and automate strategy integration, advanced charting, data for backtesting, and more. OANDA is known by Pro Traders for its flexible leverage and strong order execution and regulatory compliance. OANDA has research coverage, custom algo trading and APIs, providing the complexity and precision required for pro’s confidence.

OANDA Features, Pros & Cons

Features

- Pricing transparency

- High-end analytics

- Fast execution

- Algo trading API

- Extensive CFDs and forex

Pros

- Global regulation

- Excellent historical data access

- Custom platform

- Support responsiveness

- Good risk management

Cons

- No asset ownership

- Spread widening during volatility

- Less cryptos

- Learning curve

- Fewer advanced trading signals

8. Capital.com

Capital.com is a new addition to the Best Tickmill Alternatives for Pro Traders list. They offer commission-free CFD trading and AI-powered analytics. Their trading platform comes equipped with advanced technical analysis tools, smart insights, and customizable dashboards. Pro traders get access to competitive spread betting, risk management, and trading on all major global markets including forex, stocks, commodities, and indices.

To help traders with the decision-making process, Capital.com offers educational content and real-time news feeds. They provide both website and mobile trading platform, and combine ease of use with professional features, making them a good choice for experienced traders who want a trading platform with a lot of features and tools to make trading effortless.

Capital.com Features, Pros & Cons

Features

- CFD trading with no commission

- AI driven insights

- Simple user interface

- Broad market access

- Features for risk management

Pros

- Excellent for professional analytics

- Highly developed educational tools

- Available on desktop and mobile

- Pricing is clear

- Platforms are easy to use

Cons

- No ownership; only CFDs

- Not every AI driven insight is accurate

- Crypto options are limited

- Spread with possible mark-ups

9. AvaTrade

AvaTrade is one of the Best Tickmill Alternatives for Pro Traders. Apart from offering comprehensive trading tools and educational resources, the trading provider has a very flexible pricing structure. AvaTrade has a multitude of trading platforms.

From the proprietary platforms to the MetaTrader options and other 3rd party providers, AvaTrade boasts advanced charting, trading automation and market analysis. The trading provider also has adequate market coverage with the addition of the popular trading assets such as commodities, cryptocurrencies, forex trading, and other indices including CFDs.

AvaTrade’s regulatory standing guarantees clients ample safety. Traders with precision execution requirements and rich trading environments, AvaTrade offers the tools for high-level trading activities completion.

AvaTrade Features, Pros & Cons

Features

- Multiple platform compatibility.

- Fixed and variable spread pricing.

- Protection against negative balances.

- Good education.

- Wide range CFDs.

Pros

- Algorithmic traders

- Systems traders

- Cost effective trading

- Moderate cryptocurrency

- Advanced trading tools

Cons

- Limited assets

- Complex for beginners

- Advanced tools behind paywalls

- No proprietary platform

- Limited by region

10. Eightcap

Eightcap is one of the Best Tickmill Alternatives for Pro Traders. The trading provider has a very competitive pricing structure, offers integrated trading solutions with MetaTrader 4 and 5, and has crypto CFD capabilities. Eightcap is a market maker and offers the direct market access and deep liquidity via the raw spread accounts geared for the professional trader.

Advanced charting coupled with trading automation and flexible leverage no doubt makes the provider’s execution capabilities ideal for scalping and high frequency trading.

The trading provider also has restricted ultra-thin spread accounts in the Direct Market Access (DMA) categories. In addition to the advanced execution and pricing, Eightcap has multi-asset coverage and with strong regulatory oversight makes it a very desirable trading provider.

Eightcap Features, Pros & Cons

Features

- Raw spreads are competitive

- Supports MT4 & MT5

- Crypto CFD trading

- Execution time is fast

- Liquidity from leading providers

Pros

- Algorithmic trading is possible

- Trading at low costs

- Options for cryptocurrency

- Modern trading tools

- Support is fast

Cons

- Non-CFD assets are limited

- Not suitable for beginners

- Advanced tools are plan-restricted

- No proprietary platform

- Limited access by region

Conclusion

When considering Best Tickmill Alternatives for Pro Traders, think about the various tools and assets you need. Pepperstone and IC Markets are good for scalping and algorithmic trading due to their low spreads and high liquidity. IBKR is good for multi-asset professionals who need institutional platforms and market access.

CMC Markets and OANDA are good for traders who need strong research and analytics and good for advanced charting and thorough market analysis. Other brokers like Exness, Eightcap, and Capital.com have lower prices, but their conditions are more flexible, and trading conditions are more competitive.

Professional traders will need to look at the execution speed, spreads, the technology available on the platforms, the regulations, the assets they cover, and the overall balance of the alternatives to more accurately determine the best fit. The best broker is the one that is most suitable for you.

FAQ

What are the key factors to consider when choosing Tickmill alternatives?

When selecting alternatives for Tickmill, pro traders should look at execution speed, spreads and commissions, liquidity depth, available trading platforms, risk management tools, and regulatory oversight to ensure performance and reliability.

Which brokers offer the tightest spreads for professional traders?

Brokers like Pepperstone and IC Markets are known for ultra-low spreads and competitive pricing, making them ideal for scalping and high-frequency trading.

Are these alternatives regulated?

Yes. Many Tickmill alternatives operate under strict regulatory bodies—such as Forex.com (regulated in the US), CMC Markets (regulated in the UK), and OANDA (global regulation).

Which platforms are best for advanced trading tools?

Platforms like Interactive Brokers (IBKR) and Capital.com deliver professional-grade analytics, customizable dashboards, and algorithmic trading support.

Are these alternatives suitable for beginners?

Some brokers such as AvaTrade and Capital.com offer user-friendly interfaces and educational resources that also cater to new traders, though advanced features are more geared toward professionals.