I’ll talk about the Best Brokers That Permit Hedging in this post, emphasizing platforms that facilitate risk-management techniques with concurrent long and short positions.

Top brokers with flexible accounts, competitive spreads, and cutting-edge platforms to carry out hedging strategies safely and successfully include IC Markets, Pepperstone, Exness, FP Markets, AvaTrade, OANDA, IG Trading, RoboForex, Alpari, and Eightcap.

Why Choose Brokers Allowing Hedging

More Options With Your Risk Management: With hedging, traders can open positions on both sides of the same asset, which can reduce losses from market swings. Hedging brokers give traders more options with multi-position strategies.

Facilitates More Sophisticated Trading Strategies: With hedging brokers, traders can more easily implement advanced strategies like paired trading, and splitting a trade (diversifying the trade within the same position).

Insurance on Trading Risk: Hedging acts as capital protection and trades that go against the trader’s expectations. Brokers that offer trading hedging have trade modifiers.

More Opportunities for Scalping: Hedging is often a requirement for a scalping strategy and means capturing small profits while staying in the trade. Brokers with hedging allow positions to be opened and closed, ‘adding and removing’ positions.

More Control Over Leverage: Risk from leverage can be offset using hedging. Control of exposure is managed more easily with high leverage and hedged accounts.

Regional Compliance: Hedging is restricted in some regions, for example, in the U.S. FIFO. Brokers that allow hedging regionally provide the most flexibility to traders.

Peace of Mind for Traders: Having a broker who allows hedging offers peace of mind for implementing more complex strategies without stress over the limitations of the platform.

Key Point & Best Brokers Allowing Hedging

| Broker | Key Point |

|---|---|

| IC Markets | Offers ultra-low spreads and fast execution, ideal for scalping strategies. |

| Pepperstone | Known for reliable STP/ECN execution and a wide range of trading platforms. |

| Exness | High leverage options with flexible account types for diverse traders. |

| FP Markets | Strong regulatory compliance with competitive pricing and deep liquidity. |

| AvaTrade | User-friendly platform with extensive educational resources for beginners. |

| OANDA | Transparent pricing and advanced charting tools for precise analysis. |

| IG Trading | Global broker with broad market access and robust research tools. |

| RoboForex | Offers flexible account types and high leverage for forex and CFD trading. |

| Alpari | Popular for beginner-friendly accounts and demo options for practice. |

| Eightcap | Low spreads, fast execution, and strong support for MT4 and MT5 platforms. |

1. IC Markets

Established in 2007 as International Capital Markets Pty Ltd in Sydney, Australia, IC Markets has expanded to become one of the biggest ECN forex and CFD brokers globally, subject to regulation by ASIC, CySEC, and other regulatory bodies.

Standard, Raw Spread, and institutional accounts using the MetaTrader 4, MetaTrader 5, and cTrader platforms are among the various account types that IC Markets provides. Because MT4/MT5 accounts are exempt from the FIFO rule, which makes them perfect for expert advisers and hedging techniques, traders can take advantage of ultra-low spreads, deep liquidity, and zero-restrictions trading, including scalping and hedging.

IC Markets – Features, Pros & Cons

Features

- Founded: 2007 (Australia)

- Regulation: ASIC, cysec, FCA

- Platforms: MT4, MT5, & cTrader

- Account Types: Standard, & Raw Spread

- Hedging: Fully supported

Pros

- Ultra-low spreads campaigns ideal for hedging

- ECN execution and deep liquidity

- Scalping and automated trading supported

- Flexibility across multiple platforms

- Global regulation and fund security

Cons

- Educational resources are limited

- Absence of a proprietary platform

- Inactivity fees are applicable

- Responses to support can be significantly delayed

- Availability is limited in certain regions

2. Pepperstone

Owen Kerr and Joe Davenport established Pepperstone, an Australian FX and CFD broker, in Melbourne, Australia, in 2010. Pepperstone, which is well-known for its tight spreads, quick execution, and strong trading infrastructure, provides Standard and Razor CFD accounts that can be accessed through its own platform, MetaTrader 4, and MetaTrader 5.

A wide variety of asset classes are supported by demo and live accounts. Notably, Pepperstone offers competitive leverage, sophisticated order execution, support for algorithmic and professional trading strategies, and the ability to hedge positions under the jurisdiction of several international authorities, including the FCA and ASIC.

Pepperstone – Features, Pros & Cons

Features

- Founded: 2010 (Australia)

- Regulation: ASIC, FCA, DFSA

- Platforms: MT4, MT5, & cTrader

- Account Types: Standard, & Razor

- Hedging: Supported

Pros

- Razor account has competitive and reliable execution with low latency

- Exceptional customer support

- Great for algorithmic trading

- Regulated in multiple major jurisdictions

Cons

- Can be high overnight swap fees

- Limited offerings in crypto

- Absence of proprietary software

- Varies regionally for minimum deposit*

- Demo account expires after 30 days of inactivity

3. Exness

Since its founding in 2008, Exness Group Ltd. has gained a reputation as a hedging-friendly forex broker because it supports MT4 and MT5 and allows unfettered hedging on the majority of accounts. With cheap spreads and extensive liquidity across forex and CFD products, Exness provides a range of account options, including Standard, Pro, and Raw Spread accounts.

The broker offers quick deposit/withdrawal options, VPS hosting, algorithmic trading, and variable leverage rates. Exness offers traders sophistication and regulatory certainties while facilitating hedging methods on forex, indices, and commodities. It is licensed in a number of jurisdictions, including the FCA (UK), CySEC (EU), and others.

Exness – Features, Pros and Cons

Features

- Year of establishment: 2008

- Regulators: FCA, CySEC, FSCA

- Supported Platforms: MT4, MT5

- Types of Accounts: Standard, Pro, Raw Spread

- Hedging: Allowed

Pros

- Possibility of very high leverage

- Deposit and Withdrawal of funds instant in some methods

- Pro and Raw account have tight spreads

- Variety in account types

- Simple to scale size of trade

Cons

- In times of high volatility, spreads can be high and change frequently

- Research tools are limited

- Regulation and coverage is mixed by region

- Support is slow

- Missing cTrader

4. FP Markets

Established in Australia in 2005, FP Markets offers FX and CFD traders transparent ECN and STP execution. FP Markets provides deep liquidity, low-cost trading conditions, and Standard and Raw accounts using MetaTrader 4, MetaTrader 5, and IRESS platforms.

The broker’s accounts allow for scalping and hedging, providing traders with sophisticated multi-position techniques and flexibility in risk management. ASIC, CySEC, and other regulatory bodies oversee FP Markets, which offers a variety of tradable markets, including as currency pairings, commodities, indices, shares, and cryptocurrencies. All skill levels can access both demo and live accounts.

FP Markets – Features, Pros and Cons

Features

- Year of establishment: 2005 (Australia)

- Regulators: ASIC, CySEC

- Supported Platforms: MT4, MT5, IRESS

- Types of Accounts: Standard, Raw

- Hedging: Allowed

Pros

- Low spreads and ECN pricing

- Strong trust and regulation

- Execution of orders is instant

- Range of asset classes is good

- Account types suited to professionals are offered

Cons

- Fees for the IRESS platform

- More education needed for beginners

- Tools for trading automatically are limited

- Support is inconsistent

- Platforms have different minimum deposits

5. AvaTrade

The multi-jurisdictional FX and CFD broker AvaTrade was founded in 2006 and is regulated in Europe, Australia, South Africa, Japan, and other countries. Hedging and sophisticated risk-management techniques are supported by AvaTrade for both MetaTrader 4 and MetaTrader 5 accounts. Traders have access to currency, commodities, equities, ETFs, indices, and cryptocurrencies through normal retail accounts.

Additionally, the firm offers mobile trading, proprietary platforms, and beginner-friendly training materials. Both novice and expert traders can benefit from AvaTrade’s flexible account options, strong risk-management tools, and hedging capabilities.

AvaTrade – Features, Pros and Cons

Features

- Year of establishment: 2006* Starting Year: 2006

- Regulating Bodies: ASIC, Central Bank of Ireland, FSCA, FSA Japan

- Available Platforms: MT4, MT5, AvaTradeGo

- Available Account Types: Standard

- Allowance of Hedging: Yes

Pros

- Covers various parts of the world in regard to regulation

- Good for newcomers

- Available risk and hedging mechanisms

- Demo account available free of charge

- Several tools to trade

Cons

- Certain competitors have more favorable spreads

- Slots for account types are limited

- Charges take effect when the account is inactive

- cTrader is not available

- Some trades take longer to execute

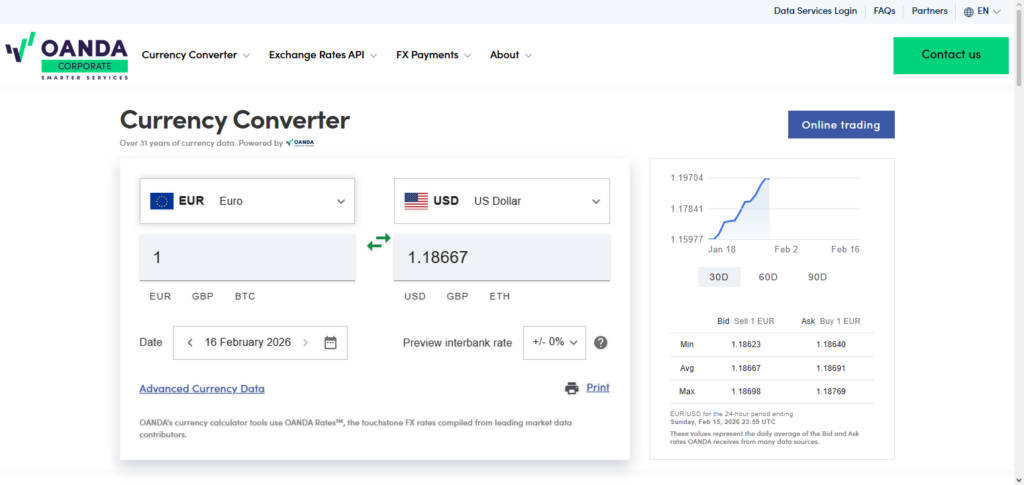

6. OANDA

Top-tier regulators including the NFA, CFTC, FCA, and others oversee OANDA, a reputable forex broker that started operations in 1996. OANDA offers Standard and Professional accounts with sophisticated charting platforms and API access, and is well-known for its clear pricing and narrow spreads.

A lot of OANDA clients use MT4 accounts with hedging enabled through custom settings, while hedging availability may differ by platform and area. OANDA is a great option for traders who employ hedging as part of their risk-management plan because of its excellent regulatory status, extensive forex coverage, and analytical tools.

OANDA – Features, Pros & Cons

Features

- Starting Year: 1996

- Regulating Bodies: FCA, CFTC, IIROC, ASIC

- Available Platforms: MT4, OANDA Trade

- Available Account Types: Standard, Premium

- Allowance of Hedging: Yes (depends on the platform and region)

Pros

- Pricing transparency is one of the highest in the industry

- High compliance with regulations

- Comprehensive and effective tools for research and charting

- Beginner friendly

- Order sizes are flexible and can be customized

Cons

- Spreads may be large when news trading

- Some regions have low flexibility (less leverage)

- cTrader is not available

- Less instruments available for trading in comparison to other brokers

- Hedging rules depend on the region

7. IG Trading

Founded in the UK in 1974, IG Trading is one of the biggest and most established forex and CFD brokers in the world. IG provides a large selection of tradable instruments, such as equities, commodities, options, currency, indices, and cryptocurrencies.

Standard, DMA (Direct Market Access), and professional accounts are available. Strong platforms including Instagram’s in-house platforms, MetaTrader 4, and mobile apps are also available.

Along with comprehensive research tools and sophisticated risk-management capabilities, Instagram allows hedging on a variety of account kinds. The broker offers strong safety and competitive trading conditions and is licensed by the FCA, ASIC, and other authorities.

IG Trading – Features, Pros & Cons

Features

- Founded: 1974 (UK)

- Regulation: FCA, ASIC, NFA (varies by region)

- Platforms: IG platform, MT4

- Account Types: Standard, DMA

- Hedging: Supported

Pros

- Very established and trusted broker

- Wide range of markets for trading

- Excellent research & educational resources

- Platforms are customizable

- Strong global regulatory framework

Cons

- Some accounts have higher minimums

- Some products have wider spreads

- Fee structure is difficult

- Advanced users only for Direct Market Access

- cTrader is not offered

8. RoboForex

The international forex broker RoboForex Ltd. was founded in 2009 and provides a range of accounts, such as Pro-Standard, Pro-Cent, ECN, and R StocksTrader accounts. The broker offers liberal hedging policies on MT4/MT5 accounts with no FIFO restrictions, and it supports trading on the MetaTrader 4, MetaTrader 5, and cTrader platforms.

RoboForex provides extensive instrument coverage, VPS for algorithmic trading, and leverage up to 1:2000 (region-dependent). RoboForex, which is regulated by the IFSC (Belize), is a viable option for traders wishing to aggressively manage risk because to its high leverage, extensive liquidity, and hedging support.

RoboForex – Features, Pros & Cons

Features

- Established: 2009

- Regulation: IFSC Belize

- Platforms: MT4, MT5, cTrader

- Types of Accounts: Pro‐Standard, ECN

- Hedging: Allowed

Pros

- Extremely high leverage (up to 1:2000)

- Allows hedging & scalping

- Wide choice of platforms

- Automated trading is good

- Wide range of assets

Cons

- Regulation is offshore

- Unequal quality of customer support

- Some pairs have variable spreads

- Limited educational material

- Some withdrawal methods have fees

9. Alpari

Established in 1998, Alpari was among the world’s first retail FX brokers. Although its operations in the US and the UK have evolved over time, the global brand still operates under different licensed corporations and provides Standard, ECN, and demo accounts through the MetaTrader 4 and MetaTrader 5 platforms.

Alpari is appropriate for traders using multi-position strategies since it offers hedging and EAs for automated techniques on MT4/MT5. Although regulatory coverage differs by location, the broker’s durability, range of account kinds, and easily accessible platforms continue to draw in a large audience.

Alpari – Features, Pros & Cons

Features

- Established: 1998

- Regulation: Varies by region

- Platforms: MT4, MT5

- Types of Accounts: Standard, ECN

- Hedging: Allowed

Pros

- A long history in the industry

- Clear account tiers

- Good for beginners

- Compatible with MetaTrader

- Availability of demo accounts

Cons

- Varying regulatory coverage

- Less transparency than the major brokers

- Less advanced instruments

- Spread may be larger

- Customer support is not reliable

10. Eightcap

Standard and Raw accounts with access to the MetaTrader 4 and MetaTrader 5 platforms are available from Eightcap, a regulated Australian forex and CFD broker. Established in the 2000s, Eightcap offers traders educational materials, a variety of funding choices, and competitive spreads. Hedging and algorithmic trading using expert advisers on MT4/MT5 are typically permitted with its accounts.

Customers can trade cryptocurrencies, equities, commodities, indices, and currency. Eightcap is a reputable option for hedging and diversified trading methods because it is regulated by reputable bodies like the FCA (UK), offers segregated customer funds, and protects against negative balances.

Eightcap – Features, Pros, and Cons

Key Features

- Established: 2009 (Australia)

- Regulations: ASIC, FCA (UK subsidiary)

- Trading Platforms: MT4, MT5

- Account Varieties: Standard, Raw

- Hedging: Yes

Pros

- Raw accounts have competitive spreads

- Regulation in most major jurisdictions

- Hedging & EA trading supported

- Execution speed is fast

- Platforms easy to use

Cons

- Thin educational resources

- Certain regions have limited choices for funding

- Not suited for high volume trading

- No proprietary trading platform

- Support hours are limited

Conclusion

Choosing the best broker for hedging is essential for risk management and trading strategy optimization. Hedging is efficiently supported by brokers such as IC Markets, Pepperstone, Exness, FP Markets, AvaTrade, OANDA, IG Trading, RoboForex, Alpari, and Eightcap, who offer strong interfaces, a variety of account kinds, and adaptable trading conditions.

With competitive spreads, strong liquidity, regulatory monitoring, and MetaTrader 4/5 or cTrader platforms, the majority of these brokers provide traders with security and flexibility to employ multi-position strategies. These brokers are frequently ranked as the best options for hedging-friendly trading settings for traders looking for expert risk management and strategic flexibility.

FAQ

What is hedging in forex trading?

Hedging is a risk management strategy where traders open multiple positions in the same or correlated instruments to offset potential losses. Brokers that allow hedging let traders hold opposite positions simultaneously without restrictions.

Which brokers are best for hedging?

Top hedging-friendly brokers include IC Markets, Pepperstone, Exness, FP Markets, AvaTrade, OANDA, IG Trading, RoboForex, Alpari, and Eightcap due to their support for MT4/MT5, competitive spreads, and flexible account types.

Can hedging be done on MetaTrader 4 and 5?

Yes. Most of the best hedging brokers support MT4 and MT5, allowing simultaneous long and short positions. ECN/STP accounts usually have no FIFO restrictions, enabling advanced strategies.

Are there regulatory concerns with hedging?

Hedging is legal, but some regions like the US enforce FIFO (First In, First Out) rules, limiting it on MT4. International brokers like IC Markets or Pepperstone usually allow full hedging for compliant accounts.

What account types allow hedging?

Standard, Raw Spread, ECN, and Pro accounts on these brokers generally allow hedging. Always confirm with the broker, as some regional accounts may have restrictions.