In this article, I will handle Amina Bank, secure and innovative banking solution that integrates more digitized and crypto offerings.

Amina Bank provides dependable, convenient, and advanced banking instruments that combine traditional financial services with the additional integration of the latest technological tools.

What is Amina Bank?

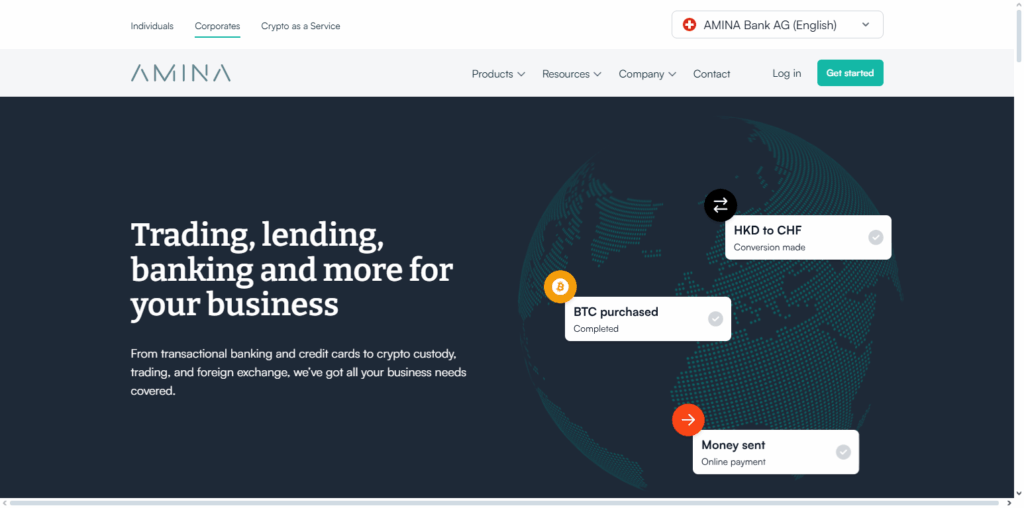

Amina Bank is a Swiss FINMA-regulated neobank integrating traditional banking and blockhain services. Blockchain users can open euro and swiss franc multilingual account and soon will be able to open accounts in USD and HKD.

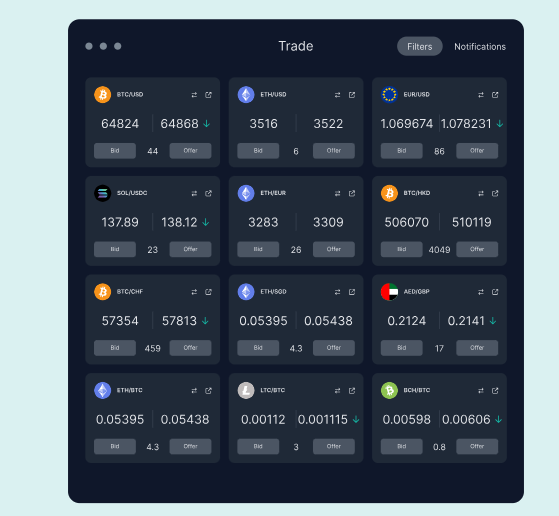

They also provide global payment services and crypto services which include crypto custody, staking, tokenized gold, and crypto spot trading. They also provide a Web3 startup package and a payment network for instant cross-border transactions among users.

Amina Bank Overview

| Feature | Details |

|---|---|

| Bank Name | Amina Bank |

| Type | Commercial / Digital / Retail Banking (specify as applicable) |

| Core Services | Savings & Checking Accounts, Loans, Credit Cards, Digital Banking Services |

| Security Features | Two-Factor Authentication, Data Encryption, Fraud Detection Systems |

| Innovative Solutions | Mobile Banking App, AI-Powered Financial Tools, Online Account Management |

| Customer Support | 24/7 Support via Phone, Email, and Chat |

| Target Audience | Individuals, Businesses, Digital Banking Users |

| Mission | Provide secure, innovative, and customer-focused banking solutions |

| Website | [Insert Official Website URL] |

How to Get Started with Amina Bank

Step 1: Visit the Official Website or Mobile App

- Amina Bank’s website, or download the mobile banking app to your phone from the App Store or Google Play.

- In the interest of security, be sure to visit the official site.

Step 2: Choose the Type of Account

- Choose which one of the following accounts you would like to have: Savings Account, Checking Account, Business Account, or Digital Account.

- Each of the account types comes with a unique set of features. Evaluating these beforehand enables you to pick the right account.

Step 3: Fill Out the Registration Form

- Type your full name, date of birth, contact details, and address in the appropriate sections of the application form.

- If you seek a business account, include the name and the registration documents for the business.

Step 4: Submit Identification Documents

- Provide a government-issued ID (passport, driver’s license, or national ID).

- Depending on the account, a proof of address document like a utility bill or bank statement may also be required.

Step 5: Verify Your Identity

- This can be achieved through the app or website, which may help you complete the required steps for identification verification.

- ID verification may include photo verification, OTP (One-Time Password) confirmation, or video KYC. In accounts that they facilitate the for, Amina Bank is of great assistance for every step or requirement you need to comply with.

Step 6: Account Funding

- Make an initial payment based on the account you have chosen.

- Depending on your account settings and geography, you may be able to perform online transfers, cash deposits, or checks.

Step 7: Security Feature Configuration

- For your own protection, activate Two-Factor Authentication (2FA).

- Establish a strong password, a PIN, and any biometric identification (fingerprint or facial recognition) in addition to the other security features.

Step 8: Banking Services Usage

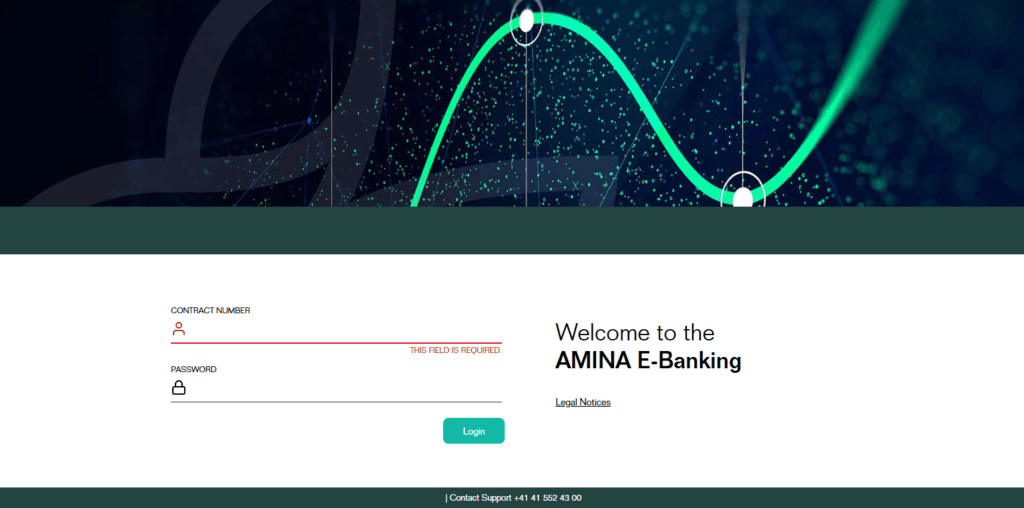

- Use the bank’s website or mobile application to log in.

- Access to loan applications, investment services, and payment of bills are some of the other services that are provided along with instant fund transfers.

Trading

Benefits of Choosing Amina Bank

Safe Banking Environment

- Two-factor authentication and advanced encryption keep your personal information and funds protected.

- Fraud detection and risk monitoring minimize exposure to unauthorized transactions.

Cutting Edge Digital Services

- Use banking apps, manage your account online, and utilize AI powered tools for your banking needs.

- Banking is simple and available to you whenever you need it.

Customer Focused

- Always available customer support, whether by chat, phone or email.

- Easy to use systems for banking and tailored services problem solving for banking on a personal and business level.

Diversity in Banking Services

- Customized savings and checking accounts, loans, credit cards, and investments.

- Flexible options for your banking needs on both a personal and business level.

Responsive and Effective

- Easy account opening and transactions with no unnecessary steps.

- Payment systems, bill payments, and transfer made easy so you can focus on your other priorities.

Dependability and Trust

- A good reputation and regulated to provide secure and dependable banking services.

- Trust built through predictable behavior, transparency and clearly defined policies.

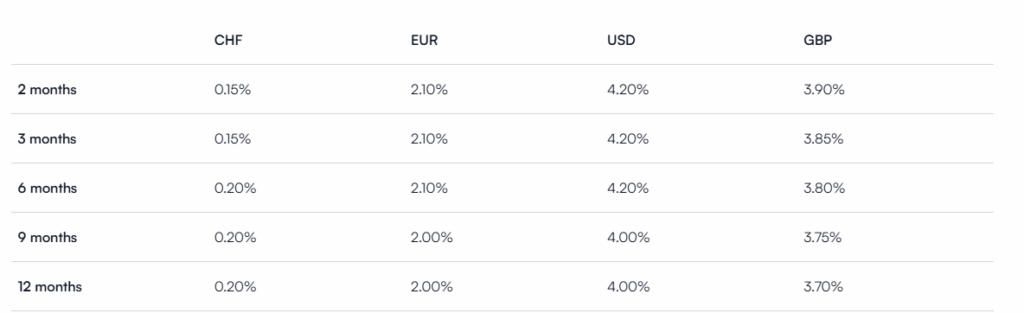

Deposits

Testimonials and Success Stories

- In 2024, revenue increased by 69%, approximately USD 40.4 million and assets under management increased by 136%, USD 4.2 billion.

- Over five years, maintained a zero-default lending book and strong risk management.

- In 2024, operated with liquidity and capital ratios well beyond regulatory requirements: e.g., 228% Liquidity Coverage Ratio and 34% CET1 ratio.

- Award winning global and local digital banking transformations. Recognized for seamless digital banking and multilingual support.

- Recognized in the “Blockchain 50” as one of the most promising blockchain/crypto companies.

- Partnership with Tenity to provide innovative banking solutions for Web3 startups and fintechs worldwide.

- Changed SEBA to AMINA to signify their dedication and ambition in client-driven bridging of traditional to digital financing.

The AMINA difference

Safety

Be assured that your assets are managed and stored in the most protected and trusted environment.

Transparency

One central access point for all your assets with a seamless banking experience.

Performance

Be ahead of the curve and benefit from high performing innovative products.

Secure Banking Solutions

Two-Factor Authentication (2FA)

- A secondary verification step is a requirement at the time of login.

- Accounts cannot be accessed by intruders even if a password is stolen.

Advanced Encryption Technology

- Customer data and financial transactions are a lot more secure thanks to sophisticated encryption.

- Sensitive information remains confidential while in transit and at rest in the app.

Fraud Detection & Risk Management

- Accounts are monitored to detect suspicious transactions in real time.

- Alerts which are timed to precede the transaction help prevent fraud.

Secure Online & Mobile Banking

- Accounts may be managed, funds transferred and payments made in a safe digital environment.

- Multilayered regulatory automated controls monitor and secure every transaction.

Regulatory Compliance & Data Protection

- Banking applicable laws and policies within your jurisdiction and of the industry are followed.

- Customer privacy policies are in place to prevent data breaches.

Account Recovery & Emergency Support

- Lost credentials may be restored to account recovery within minutes.

- Security related issues have telephonic diagnosis and guidance by a support agent at all hours.

Pros & Cons

| Aspect | Pros | Cons |

|---|---|---|

| Security | Advanced encryption, two-factor authentication, and fraud detection | Some advanced security features may require tech familiarity |

| Digital Banking | User-friendly mobile app and online platform, AI-powered financial tools | May not have physical branches in all regions |

| Customer Support | 24/7 multilingual support via chat, phone, and email | Response times may vary during peak hours |

| Financial Products | Wide range: savings, checking, loans, credit cards, investment options | Some niche products may have eligibility requirements |

| Innovation | Cutting-edge solutions for digital and crypto banking | New technologies may require learning curve for some customers |

| Reliability | Strong regulatory compliance and trustworthy reputation | Limited global presence compared to traditional multinational banks |

Conclusion

Amina Bank is Safe, Innovative, and Customer-Centric Offerings and Solutions. Supporting your business and personal banking needs, with state of the art digital banking conveniences, Amina Bank is Safe, Innovative, and Customer-Centric.

Banking is Safe, Innovative, and Customer-Centric. Amina Bank employs advanced technology and digital banking conveniences, state of the art digital technology, Highly advanced technology and digital banking conveniences. Bank your digital banking needs with Amina Bank. Safe, Innovative, and Customer-Centric.

FAQ

Is AMINA Bank regulated?

Yes — the bank holds a licence from the Swiss Financial Market Supervisory Authority (FINMA).

Where are AMINA Bank’s offices?

Its main headquarters is in Zug, Switzerland. Additional hubs include Abu Dhabi (UAE) and Hong Kong.

What kinds of services does AMINA Bank offer?

Services include traditional banking (fiat accounts, payments) and digital asset/crypto‑services such as custody, trading and integrated asset management.