In this article , I will discuss the Best Aggregator Tools For DEX Trading, focusing on the ones that assist users in finding the best prices on all decentralized exchanges.

Such tools consolidate trades, reduce slippage, and provide a smooth experience across different blockchains.

Regardless of whether you are a novice or a seasoned trader, an appropriate aggregator will significantly increase your productivity and outcome in the DeFi realm.

Key Point & Best Aggregator Tools For DEX Trading List

| Platform | Key Point |

|---|---|

| Matcha | Aggregates best prices across multiple DEXs. |

| ParaSwap | Offers gas-efficient swaps and MEV protection. |

| Jupiter | Top aggregator for Solana token swaps. |

| Atlas DEX | Cross-chain DEX aggregator with bridge support. |

| XY Finance | Focuses on cross-chain liquidity aggregation. |

| Rubic | Multi-chain swaps across 70+ blockchains. |

| Swoop Exchange | Simplifies asset swaps across major networks. |

| Swapzone | Non-custodial crypto exchange aggregator. |

1.1inch

1inch has proven itself as an exceptional aggregator tool for DEX trading owing to its remarkable capability of splitting a single trade across different decentralized exchanges to obtain better slippage and rate efficiency.

Unlike its competitors, 1inch Pathfinder’s algorithm evaluates a plethora of liquidity sources in real time which allows capture of value on every swap. 1inch has no competition in DEX trading due to its unqiue capabilities to provide deep liquidity from diverse networks, low operational costs, and superior security.

Features

- Best Rates Across Multiple DEXs: 1inch optimizes the route for token swaps by splitting the trade among various decentralized exchanges.

- Gas Fee Optimization: Users can save considerable fees on Ethereum because it provides gas-tokens and optimized routes.

- Limit Orders: Users are allowed to set a defined buy or sell price which offers them more freedom similar to centralized exchanges.

2.Matcha

Matcha is one of the best aggregator tools for DEX trading due to its simple and easy-to-use interface which pools liquidity from a wide variety of decentralized exchanges. What sets Matcha apart from its competitors is its emphasis on disclosed transparent pricing, ensuring that traders do not incur hidden costs.

Automatically routed through the 0x protocol’s powerful trading infrastructure, it found optimal paths for every trade which not only guaranteed rate slippage but also ensured a smooth user experience for participants across different blockchains.

Features

- Intuitive UI/UX for Users: New users will appreciate that the platform has no overwhelming features as they seek to navigate its straightforward matching and trading capabilities.

- No Hidden Fees: There are no extra trading fees that Matcha includes aside from gas fees, meaning everything is upfront.

- Order Routing: Users are ensured the lowest price by routing orders through a multitude of DEXs.

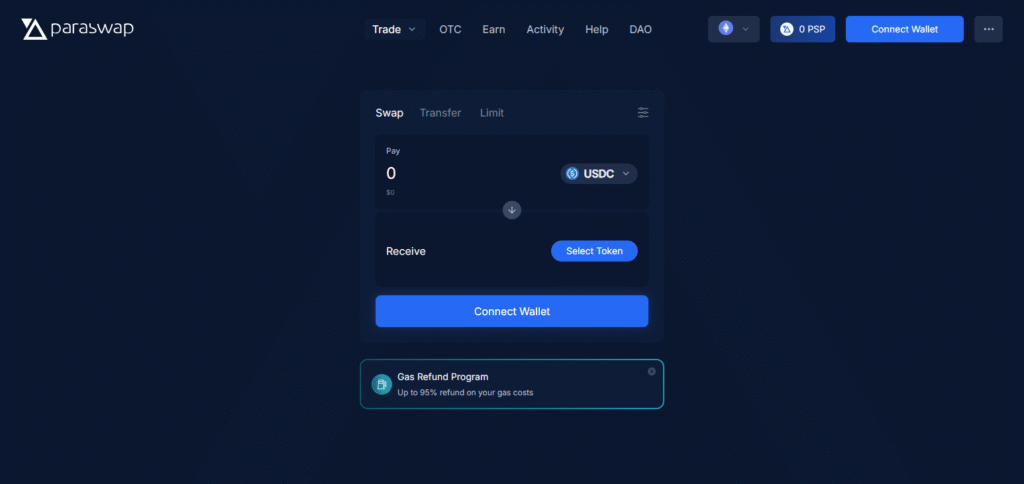

3.ParaSwap

ParaSwap is among the top aggregator tools for DEX trading since it not only retrieves the best rates across platforms, but also optimizes transactions for gas fee savings.

It stands out because of its ability to batch multiple trades into one transaction, which streamlines and lowers the cost of the swaps.

With MEV protection integrated, ParaSwap further guarantees users are protected from front-running attacks, providing a secure and performant space for more complex trades spanning multiple networks.

Features

- Cross-chain Operability: Apart from the Ethereum network, BNB chain and Polygon, they also operate on various other blockchain networks.

- Submit Private Transaction: They are able to reduce the chances of front-running by allowing users to submit private trades.

- Best rate algorithms: They aggregate prices from dozens of exchanges, providing trades at the lowest prices.

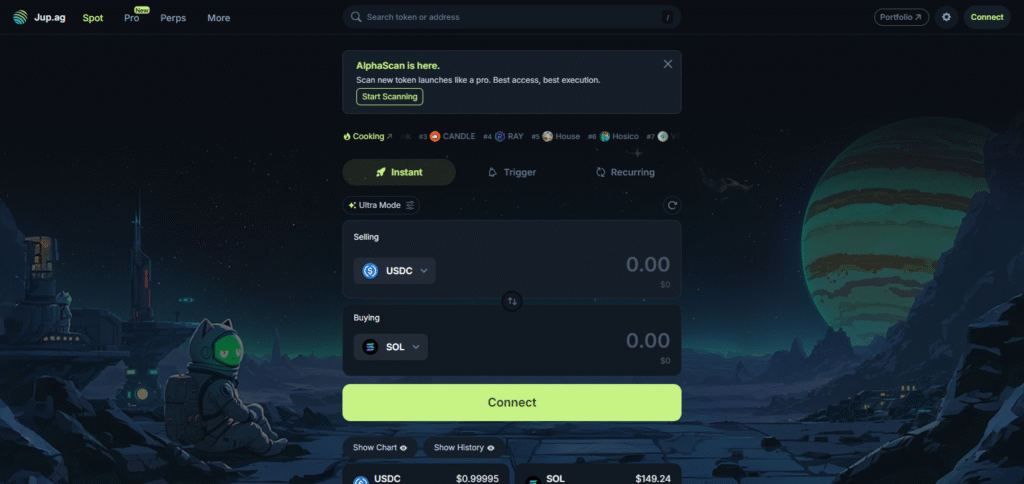

4.Jupiter

Jupiter has emerged as a leading aggregator tool for DEX trading globally, with a specialization in Solana’s ecosystem due to its speed and low fees.

Its proprietary technology that consolidates liquidity from multiple DEXs guarantees users the greatest swap prices and slippage is imperceptible.

Intelligent routing makes sure trades are executed preferentially by looking at several sources of liquidity. Regardless of whether you are a casual or a sophisticated trader of Solana’s offerings, efficiency and value are always present with Jupiter.

Features

- Solana Native: Jupiter is built specifically for Solana, making swaps fast and cheap.

- Best Price Aggregation: It scrapes all Solana DEXes like Orca, Raydium, and Serum for the best prices and least fees.

- Advanced Routing: Advanced routing enables complex multi-hop trades, allowing trades to be executed in the order that maximizes savings.

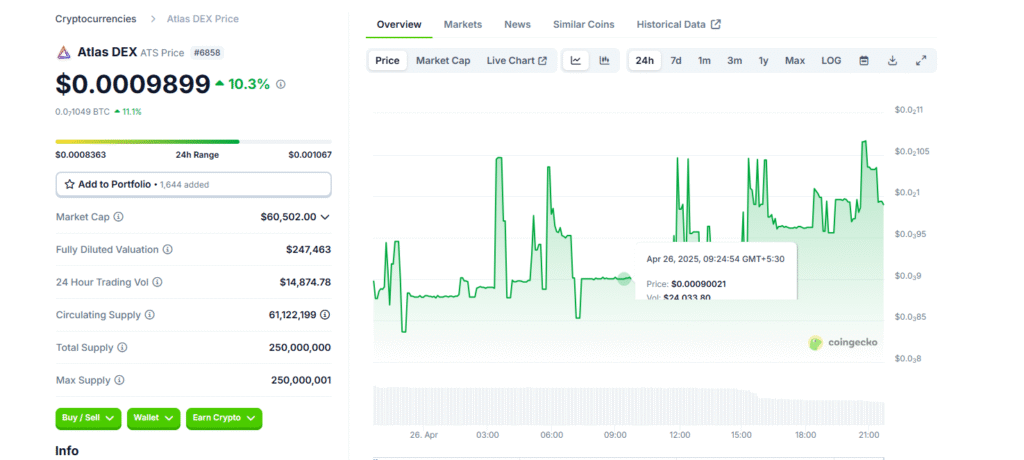

5.Atlas DEX

Atlas DEX’s aggregator DEX trading tool offers cross-chain liquidity aggregation with the purpose of maximizing trading opportunities.

Its distinct characteristic is the perfect blending across blockchains; users are able to trade across various networks with no complications. Atlas DEX smart routing performs best price discovery and takes care of slippage control.

An accessible user interface, cross-chain functionalities, and DEX aggregators make it a very suitable option for traders who need access to various assets and sources of liquidity in the DeFi market.

Features

- Cross-Chain Swapping: Enable users to swap tokens from one blockchain to another without needing a bridge.

- Fast Transaction Times: Designed for fast execution so that slippage and lag is minimized.

- User-Friendly Dashboard: Show all sources of liquidity and expected returns in clearest manner possible.

6.XY Finance

XY Finance is one of the most advanced aggregator tools for DEX trading since it specializes on cross-chain liquidity aggregation.

Through the integration of multiple blockchains, XY Finance allows users to access a larger pool of assets and effortlessly trade across different networks.

It’s enhanced routing system guarantees minimal slippage and optimal price execution, making it perfect for profit maximizing traders. XY Finance stands out as a leader in the DeFi industry because of its extensive cross-chain compatibility.

Features

- Multi-Chain Aggregation: Supports cross-chain swaps for Ethereum, BNB, Polygon, Arbitrum and more.

- DeFi & GameFi Focus: XY Finance targets especially the movements of assets related to NFT, GameFi and DeFi.

- Liquidity Routing: Routes with best multiple sources of liquidity for swaps automatically.

7.Rubic

Rubic is the top aggregator tool for DEX trading, being the first to offer effortless cross-chain swaps spanning over 70 blockchains.

Its multi-chain approach is what sets Rubic apart; allowing users to consolidate different network transactions into one. This single transaction removes numerous parties and makes trading far more convenient.

Rubic is also well known for its ease of use features. With its powerful routing algorithms, the best prices and liquidity can be achieved, proving Rubic to be a leader for versatile DeFi trading.

Features

- Cross-Chain and Multi-Chain: Rubic supports swaps of over 70 blockchains without manually bridging them.

- One-Click Swap: Execute complex cross-chain transactions in less than one click.

- Broad DEX Integration: Inform users with hundreds of DEX and liquidity providers on the best price swap rate, to give accurate trading values based on market prices.—

8.Swoop Exchange

Swoop Exchange is among the best aggregator systems for DEX trading as it consolidates liquidity from several decentralized exchanges for a seamless experience.

What makes Swoop distinctive is its optimal routing algorithm which takes care of slippage and offers the best prices while executing trades.

By providing access to liquidity across multiple networks, Swoop reduces transaction costs and enhances trading efficiency. Swoop Exchange is a powerful tool for users looking to ease cross-chain trading owing to its uncompromising speed and simplicity.

Features

- Low-Cost Swaps: Swoop concentrates on DEX trades having the least possible fees.

- Real-Time Best Prices: Swoop Exchange has the capabilities to combine and review the price being offered in many decentralized exchanges and updates it in real time.

- Simple Navigation: Quick DeFi knowledge for effortless swaps that are user-friendly.

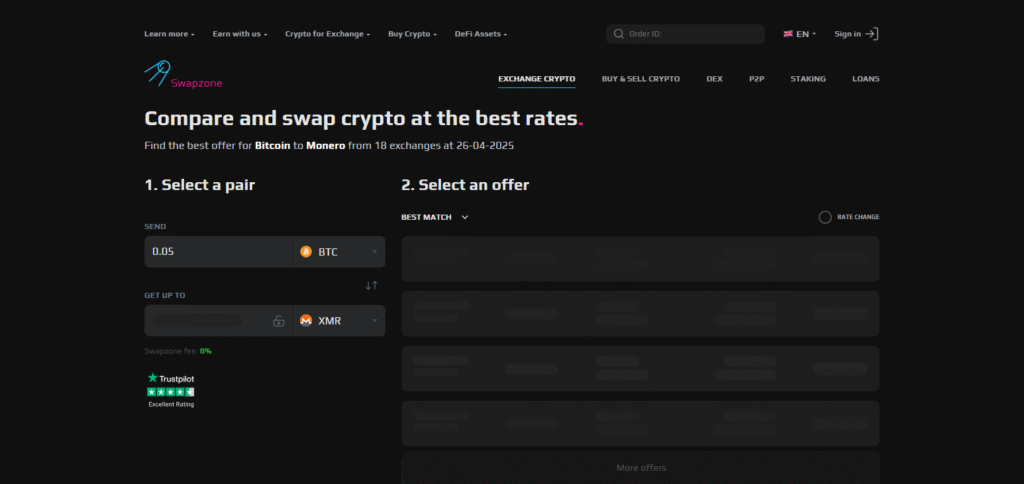

9.Swapzone

Swapzone stands out as an aggregator tool specializing in DEX trading because of its simple and clear exchange procedure. It differs from its competitors by offering customers multiple exchange choices and access to various liquidity providers, thus guaranteeing optimum prices.

Additionally, Swapzone operates on a non-custodial basis which means that complete authority over funds remains with the users. Concentrating on ease and safety, Swapzone enables traders to obtain the best prices and smoothly move through the decentralized exchange system.

Features

- Wide Asset Variety: Swapzone offers aggregation of dozens of cryptocurrency and stablecoin Exchange for an array of assets.

- No Registration Needed: Users do not have to create an account in order to swap assets.

- Transparent Comparisons: It displays every quoteable exchangable asset and lists all rates, fees and estimated times for each.

Conclusion

To summarize, the top aggregator tools configured for optimized DEX trading include 1inch, Matcha, ParaSwap, Jupiter, Atlas DEX, XY Finance, Rubic, Swoop Exchange, Droidex, and Swapzone which have specialized features to maximize trading efficiency.

From cross-chain liquidity aggregation to complex routing strategies, these platforms guarantee that users are getting the most competitive prices, slippage is minimized, and the transactions are done securely and seamlessly.

Deciding on the most suitable aggregator is determined by the liquidity tier required, network integration, overall experience, and many more factors. Regardless, every tool has immense contributions to the world of decentralized trading.