The purpose of this article is to discuss the best autonomous finance tools that have been able to save money, invest, and budget usefully without human intervention.

I will discuss how AI applications and robo-advisors save, invest and budget effortlessly. These tools identify spending, automate finance transfers, and manage portfolios effortlessly.

These finance tools manage money without human supervision and help to save time and wealth effortlessly.

These tools manage wealth in the most efficient and intelligent way and save time, money and wealth for the future.

Key Points & Best Autonomous Finance Tools That Manage Money Without Human Input

| Tool | Key Point |

|---|---|

| Cleo | AI chatbot with “roast mode” that motivates savings through humor |

| Plum | Automated micro-savings by analyzing spending and moving spare change into savings |

| Chip | Smart savings app that calculates affordable amounts to save daily |

| Digit | AI-driven budgeting that automatically transfers money into savings goals |

| Qapital | Rule-based saving where custom triggers (like rounding up purchases) build savings |

| Wealthfront | Robo-advisor investing with tax-loss harvesting and automated portfolio management |

| Betterment | AI portfolio optimization for retirement and general investing |

| YNAB (You Need A Budget) | AI-enhanced budgeting that learns spending habits and adjusts plans |

| Monarch Money | All-in-one AI finance dashboard for tracking, forecasting, and managing goals |

| PocketSmith | Future cash-flow forecasting using AI to project finances years ahead |

10 Best Autonomous Finance Tools That Manage Money Without Human Input

1. Cleo

Cleo, an artificial assistant, allows users to manage their finances through interactive conversation. The assistant syncs with users’ bank details, reviews their financial activities, and gives advice.

More so, to encourage users to adjust certain destructive spending behaviors, cleo gives comments through her roast mode. The feature enables users lose their money in interactive spending games without realizing it.

In a method to finance entertain users and save money, users are gamified to avoid poor spending and manage their finances better. Thus, the virtual assistant automates to manage their finances uninterrupted.

Features Cleo

- AI Chatbot enables money management through casual banter.

- Roast Mode offers humorous take on poor spending behavior.

- Budgeting Tools assist in tracking and managing spending.

- Savings Challenges for users to earn gamification rewards.

- Cash Advance provides temporary access to funds.

2. Plum

Plum is an intelligent savings and investment tool that automates the process of savings so that users are not distracted with changing it manually.

The tech tool analyzes a user’s spending behavior, and income, and lifestyle to determine savings.

Plum then transfers a savings amount to a separate account without users noticing. The round-up feature also secludes and saves small change.

The tool saves money and also offers users investments on their savings. Plum enables users to easily build their savings and spend money easily through a finance tool that automates passive finance.

Plum

- AI analyzes individual income and expenditure.

- Micro-Savings is an automatic severs-transfer to savings.

- Round Up feature saves excessive amounts.

- Savings Rules supports goal-based funds like “save on payday”.

- Passive Investments enables user funds to grow.

3. Chip

Chip is a savings app that moves money from checking to savings each day, based on how much Chip calculates users can afford to save each day.

These calculations rely on spending patterns that Chip analyzes to make savings moves that aren’t disruptive. Chip is more than a savings app, though.

Chip also has accounts to earn interest on and investment options. Users automate savings, which is often the hardest part to do consistently, and Chip removes the mental load

from the task of capture to help people save at higher rates. Chip is perfect for those who want to save but struggle with the discipline.

Chip

- Daily Savings assess amounts user can afford.

- AI driven analysis for an undisturbed lifestyle.

- Savings Accounts users can earn usury.

- Beyond Savings for users to invest.

- Consistent Automation supports incremental savings.

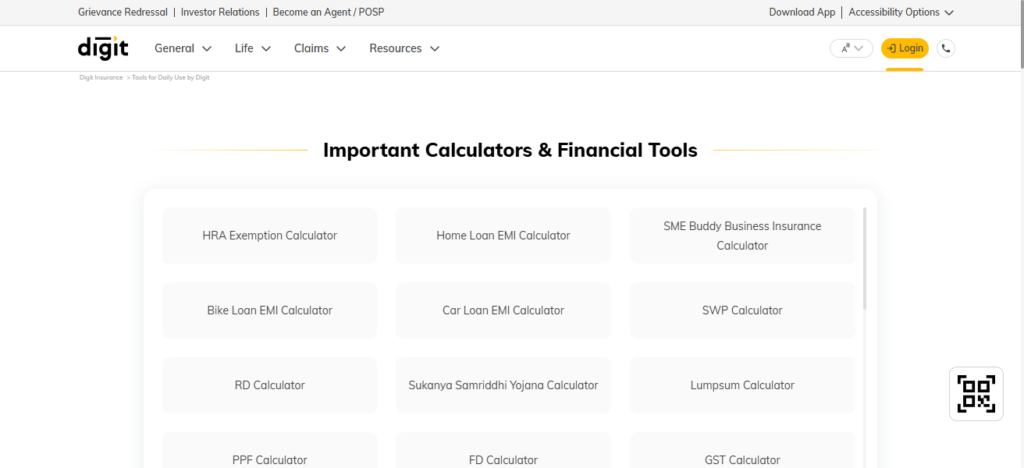

4. Digit

Digit analyzes users spending patterns to create tailored budgeting and savings plans. Using those patterns, Digit determines how much to save each week and moves that amount to a designated Digit savings goal.

Digit also provides a personalized debt repayment strategy, and helps with retirement planning. Users can set goals for spending, and Digit prioritizes saving

for those goals instead of using up the funds on unimportant purchases. Good budgeting is usually a very manual task, but Digit handles all of the work with its AI.

Digit allows users to gain financial confidence. To satisfy users’ desire for hands-off savings, digit has created a super passive savings system that users can take advantage of as they please.

Digit

- Goal Based Saving technique supports automatic saving.

- AI supervises user income and expenditure.

- Debt Strategy supports tailored user debt payment.

- Retirement Tools provides an account for savings.

- Passive Saving users do not need to save manually.

5. Qapital

Qapital has a more hands-on saving option that works by having users set customized automated savings rules.

Small custom by rule savings actions, eg. coffee savings, build to large savings over time. Qapital is more gamified than digit, making saving a more enjoyable and frequent activity that works to reach financial goals.

Qapital also achieves a more passive savings feature through investment account integration, making building wealth even easier.

Qapital works to help reach saving goals through automation paired with a savings behavioral nudging gamified system.

Qapital

- Custom Rules users can apply rules for gaming savings.

- Savings Rule for habitual savings.

- Savings Motivation creates an entertaining commitment to saving money.

- Growth through Investment allows money to increase while working passively.

- Consistency through Automation provides effortless progression.

6. Wealthfront

Wealthfront is one of digit and Qapital’s more traditional competitors. Wealthfront is a compeitively priced automated investment account that diversifies by using ETFs and actively tax loss harvests.

Wealthfront rebalances automatically, and its AI works financial taools eliminating the need for a human.

Wealthfront is the traditional investment paired with digit and Qapital’s saving. It also has cash accounts with a good interest for its competitors.

Wealthfront would be great for those looking for passive growth over a long time without having to be hands-on with the process.

They merged the facets of savings, investing, and planning into a fully autonomous solution for finances.

Wealthfront

- Robo-advised ETFs access to pre-built portfolios.

- Harvesting opportunities during tax season to gain the most from returns.

- Rebalancing to ensure alignment of investments is automated.

- Interest cash accounts with rates that are not average.

- Planning tools that are profound for retirement and post retirement.

7. Betterment

Betterment is also a leading robo-advisor and offers the ability to use AI to manage portfolios for retirement, investing, and achieving financial goals.

It handles asset allocation, rebalancing, and tax strategies so everything is managed seamlessly. Betterment also gives personalized digital advice and offers managed funds to make investing simple for all levels.

Everything stays in the system, so portfolios can be fully managed without additional human oversight.

Betterment is very strong in retirement and long-term growth, so it is a very solid option for passive investors.

It removes the complexity of investing, allowing more time for other life pursuits and wealth-building.

Betterment

- Optimization portfolios with AI for better efficiencies.

- Allocation of assets automatically across all investments.

- Strategical tax reductions to reduce tax impacts, includes tax harvesting.

- Digital advice that is customized to your experience level for all.

- Planning for retirement is the main focus, along with long-term growth.

8. YNAB (You Need A Budget)

YNAB is a budgeting app and gives users control over finances with the help of AI. YNAB is unique in that it teaches users to “give every dollar a job,” encouraging more mindful spending.

It stays on track through its automation that learns and shifts budgets to fit user spending. YNAB is a financial tool that provides debt and savings goals and also stays on track with those goals.

Setting up the software initially but knowing that it’ll save time in the future adjusted YNAB. Automate support are structured budgeting systems and YNAB fit has anyone wanting effortless support to discipline and clear up their finances.

You Need A Budget (YNAB)

- Assigning every dollar a task is the budgeting philosophy.

- Habits Adjustment is AI enhanced to track spending.

- A focus of debt reduction while simultaneously saving.

- Clarity budgeting is structured around a system that provides guidelines.

- Support through Automation reduces the effort manually over time.

9. Monarch Money

AI tracks, predicts, and manages finances in one place with all accounts and investments in a single budget with a financial integration that all assets and liabilities to a net worth are consolidated, providing a full automated.

Money earned, spent, saved, and given to goals and money automation sets the gives a time financial to the future. Collaboration allows transparent money integration with finances that manages each with a family or partner.

Monarch Money

- All-in-one screen where accounts, budgets, and investments are consolidated.

- Tracking Automation that is AI powered to forecast budgets.

- Progress monitoring along with tools for target goals.

- Smarter decisions through cash flow forecasting.

- Collaboration for couples and families.

10. PocketSmith

Without time insumation, automating projections changing as habits PocketSmith offers real-time with leading a full one focus a future financial of.

Without ideal calaculating manual to help plan financial goals, PocketSmith offers projections. years ahead.

Integrating budgeting and forecasting functions, PocketSmith aids users in preparing for milestones such as home acquisition or retirement. Its autonomous feature provides users with confidence in their financial planning.

PocketSmith

- Habitual spending changes for updates in real time.

- Years into the future for cash flow estimations powered by AI.

- Predictions of cash flow months into the future.

- Expenses are estimated for the future to enhance cash flow.

- Spending habits change with the updates in real time.

Conclusion

In Conclusion For long-term storage of wealth, the strongest stable currencies are the Swiss Franc (CHF), US Dollar (USD), Euro (EUR), Japanese Yen (JPY), and British Pound (GBP).

These currencies have foundations of strong, low inflation economies that are trustworthy on the global scale.

They all possess low volatility which makes them stable anchors for preserving wealth for future generations.

FAQ

Which currency is considered the safest globally?

The Swiss Franc (CHF) is widely regarded as the safest due to Switzerland’s strong economy and neutrality.

Is the US Dollar stable for wealth storage?

Yes, the US Dollar (USD) is the world’s primary reserve currency, trusted for global trade and investment.

Why is the Euro reliable?

The Euro (EUR) represents multiple strong European economies, offering diversification and resilience.

Is the Japanese Yen a safe option?

The Japanese Yen (JPY) is stable thanks to Japan’s low inflation and export-driven economy.

Does the British Pound hold long-term value?

Yes, the British Pound (GBP) is one of the oldest and most resilient global currencies