In this article, I will discuss the Best Banks For Unlimited Transactions, particularly on those that allow businesses to make high volumes of payments without limit.

These banks have multi-currency accounts as well as international transfers for low fees, addressing the needs of businesses to manage their finances in a hassle free and economical manner while ensuring seamless movement across various regions and markets.

Key Point & Best Banks For Unlimited Transactions List

| Account Name | Key Features |

|---|---|

| HSBC Global Account | Global access, multi-currency support, international payments, robust security. |

| Airwallex Business Account | Multi-currency accounts, global payments, FX solutions, integrations with platforms. |

| Novo Business Checking Account | No monthly fees, integrates with apps, simple setup, free ACH payments. |

| Relay Business Account | Digital-only, no monthly fees, excellent for startups, integrates with QuickBooks. |

| Wise Business Account | Low fees for international transfers, multi-currency accounts, fast payments. |

| Revolut Business Account | Global business account, multi-currency, team management, crypto integration. |

| Payoneer Account | Global payment platform, multi-currency support, widely accepted, high fees. |

| N26 Business Account | Easy setup, no fees for basic features, mobile app for tracking expenses. |

| Monzo Business Account | Free plan available, simple budgeting, integrates with accounting tools. |

| Chase International Business Account | Access to global markets, multi-currency, business loans, strong US-based presence. |

1.HSBC Global Account

Unlimited transactions are possible with one of the best HSBC Global accounts which has immense international presence and effortless multi-currency features.

It allows businesses to send and receive funds from around the world without any limit on the number of transactions.

The account has advanced security protection, easy-to-use online platform, and global market access making it suitable for users with high volume international transactions.

Its advanced security protection and easy to use online platform together with extensive market access makes it best for businesses with regular cross border transactions. Its unmatched customer service and dependable exchange rates further make it perfect for international transactions.

| Detail | Information |

|---|---|

| Bank Name | HSBC Global Account |

| Industry | Banking, Financial Services |

| Established Year | 1865 |

| Key Features | Multi-currency account, fee-free transactions, global money transfers, digital security |

| Market Position | Leading international bank with extensive global reach and services |

2.Airwallex Business Account

Airwallex Business Account is an outstanding option for businesses with international dealings as it allows for limitless transactions.

The mark of distinction for Airwallex lies in its provision of multi-currency accounts which have minimal conversion charges, thus making cross border transactions instant and cheap.

Additionally, the platform is compatible with several business tools which makes managing finances easy.

With no restrictions on transfers and scalable options, Airwallex is specifically designed for businesses that need high volume international payments done efficiently and effortlessly.

| Detail | Information |

|---|---|

| Bank Name | Airwallex Business Account |

| Industry | Financial Technology, Cross-Border Payments |

| Established Year | 2015 |

| Key Features | Multi-currency accounts, high-speed international transfers, borderless cards, expense management |

| Market Position | Leading fintech platform with extensive global reach and services |

3.Novo Business Checking Account

Novo Business Checking Account is a leading competitor in the industry, offering simple account management features and best of all, it has no fee structure.

Additionally, ACH transfers are unlimited and free, and no maintenance fees are charged, making it an ideal account for startups and small businesses where costail efficiency is crucial.

Managing company funds is more simpler with seamless integration with major business tools such as QuickBooks, and Stripe.

Not to mention, the first mobile business checking account which allows users to conduct unlimited transactions on the go.

| Detail | Information |

|---|---|

| Bank Name | Novo Business Checking Account |

| Industry | Financial Technology, Business Banking |

| Established Year | 2016 |

| Key Features | No monthly fees, unlimited ATM fee reimbursements, seamless integrations, built-in invoicing |

| Market Position | Leading fintech platform for small businesses and entrepreneurs |

4.Relay Business Account

Due to its fee-free structure and digital-first approach, Relay Business Account allows for businesses that require unlimited transactions.

Startups and growing businesses can particularly benefit from its no monthly charges and unlimited payments offering.

Moreover, Relay accounts can be integrated with different accounting software, making financial tracking and management simple.

With multi-user access, Relay allows funds to be divided into separate categories, which helps businesses streamline their high transaction volumes with ease. This flexibility and control represents transparency which allows Relay to be perfect for high volume trading firms.

| Detail | Information |

|---|---|

| Bank Name | Relay Business Account |

| Industry | Financial Technology, Business Banking |

| Established Year | 2019 |

| Key Features | No account fees, up to 20 checking accounts, physical and virtual cards, seamless integrations |

| Market Position | Leading fintech platform for small businesses and entrepreneurs |

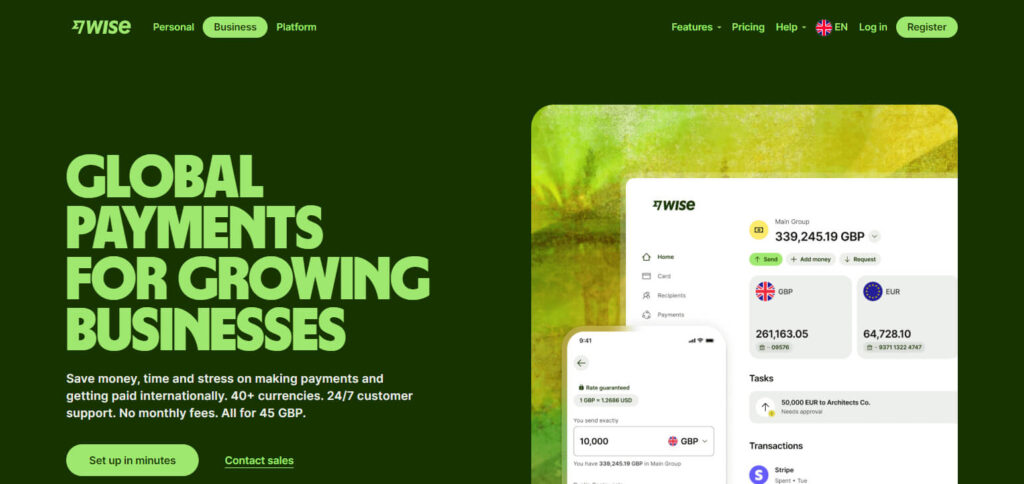

5.Wise Business Account

Wise Business Account’s international low-cost transfers and multi-currency accounts make it great for transactions without limits.

Unlike traditional banks, Wise lets users conduct payments across borders at a reasonable fee which is beneficial for businesses with a lot of international dealings.

Its capacity allows receiving and sending funds from and to over fifty currencies making it easy for businesses to operate globally without restrictions.

The platform guarantees ease of use and transparency with the placement, ensuring affordable and efficient management of limitless transactions for businesses, all while eliminating fees to manage funds.

| Detail | Information |

|---|---|

| Bank Name | Wise Business Account |

| Industry | Financial Technology, Cross-Border Payments |

| Established Year | 2011 |

| Key Features | Multi-currency accounts, mid-market exchange rates, no monthly fees, physical and virtual cards, 24/7 customer support |

| Market Position | Leading fintech platform with extensive global reach and services |

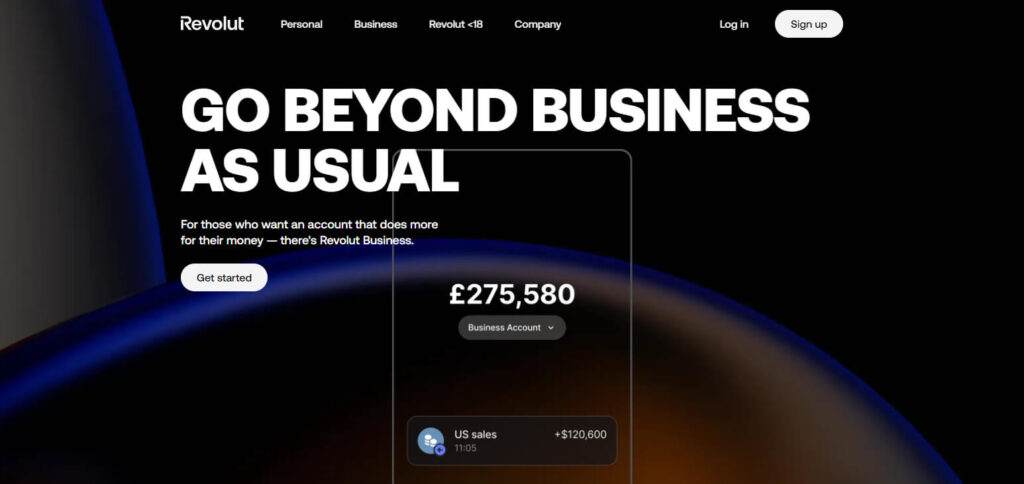

6.Revolut Business Account

Revolut’s Business Account has no rival when it comes to limitless transactions since it offers flexible and cheap options to process payment. Businesses can send and receive funds effortlessly through multi-currency accounts with low fees and no cap on transactions.

Revolut’s advanced platform works perfectly with the accounting tools of the company and can be used by multiple users at once. All these features make it perfect for teams.

By utilizing Revolut, businesses can manage growth effortlessly with low transaction costs, outstanding platform functionality, and seamless payment processing without due diligence for concealed fees.

| Detail | Information |

|---|---|

| Bank Name | Revolut Business Account |

| Industry | Financial Technology, Cross-Border Payments |

| Established Year | 2015 |

| Key Features | Multi-currency accounts, high-speed international transfers, physical and virtual cards, expense management |

| Market Position | Leading fintech platform with extensive global reach and services |

7.Payoneer Account

Because of its incredible global infrastructure and ability to process high-value transactions economically, Payoneer is one of the best banks regarding the number of transactions one can carry out.

It permits international payments to sail through without any concealed charges.

Moreover, Payoneer’s platform features effortless integration with eCommerce platforms and marketplaces which helps businesses handle eCommerce payment processing on a bigger scale.

In addition, Payoneer’s extensive network is indispensable for business looking to perform unlimited international transactions. Their reliable services also make it a desirable option.

| Detail | Information |

|---|---|

| Bank Name | Payoneer Account |

| Industry | Financial Technology, Cross-Border Payments |

| Established Year | 2005 |

| Key Features | Multi-currency accounts, global payment solutions, physical and virtual cards, seamless integrations |

| Market Position | Leading fintech platform with extensive global reach and services |

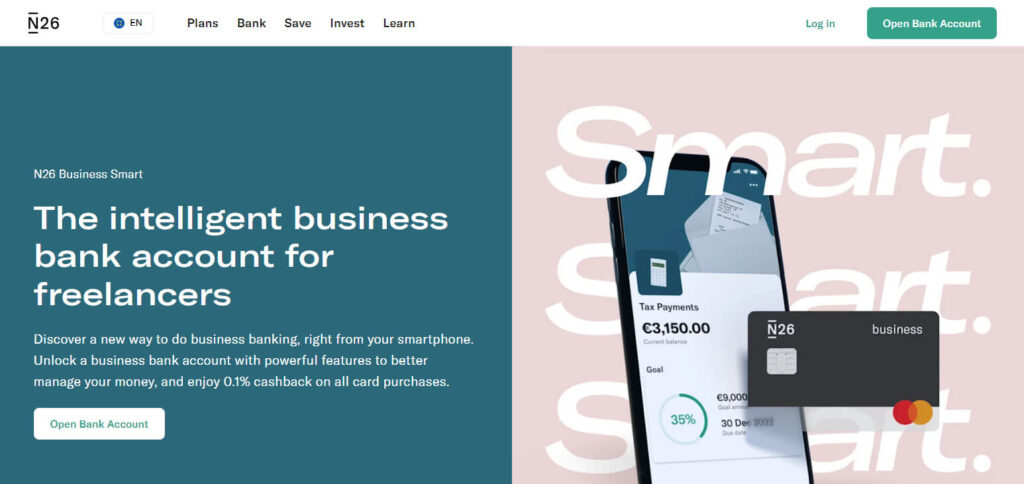

8.N26 Business Account

N26 Business Account is great for unlimited transactions as it has a very simple fee structure, free domestic transfers, and no fee whatsoever.

The freemium mobile app and the mobile app’s integration with bookkeeping apps makes it most favorable for freelancers and small businesses.

N26 has no limits on transactions, enabling customers to make as many payments as required without worrying about any restrictions.

N26 helps in providing businesses with an efficient and economical way of managing expenses. With real-time notifications and expense tracking features, businesses can easily keep track of unlimited transactions’ effortlessly.

| Detail | Information |

|---|---|

| Bank Name | N26 Business Account |

| Industry | Financial Technology, Business Banking |

| Established Year | 2013 |

| Key Features | Free business account, virtual card, physical Mastercard, SEPA transfers, 0.1% cashback |

| Market Position | Leading fintech platform for freelancers and self-employed individuals |

9.Monzo Business Account

Monzo Business Accounts offer transparency and flexibility which makes it suitable for businesses with high transaction volume.

The basic plan has no monthly fees, allows unlimited payments, and provides easy transaction management. Accounting integration enables real-time expense tracking.

With Monzo’s business mobile apps, companies can receive instant spending alerts and manage large numbers of transactions without worrying about costs or limits.

| Detail | Information |

|---|---|

| Bank Name | Monzo Business Account |

| Industry | Financial Technology, Business Banking |

| Established Year | 2015 |

| Key Features | No monthly fees, multi-currency accounts, seamless integrations, 24/7 customer support |

| Market Position | Leading fintech platform for small businesses and entrepreneurs |

10.Chase International Business Account

The advantage Chase International Business Account provides are phenomenal for businesses that require incessant transactions.

This account has seamless access to multi-currency and global markets. Chase provides businesses with a self-service feature that allows them to make limitless local and international transfers free of charge.

With strong security measures and 24/7 support, businesses can handle high volume transactions without any worries.

Remember, effective borderless business transactions, strong operational integration with other business tools, and the extensive Chase network all foster the effortless management of boundless transactions on the chase account.

| Detail | Information |

|---|---|

| Bank Name | Chase International Business Account |

| Industry | Banking, Financial Services |

| Established Year | 1799 |

| Key Features | Multi-currency accounts, global payment solutions, extensive branch network, digital security |

| Market Position |

Conclusion

Ultimately, the top banks for businesses offering unlimited transactions provide integration, minimal fees and efficient global reach, which every business needs to excel in the modern world.

Accounts from Airwallex, HSBC, Novo and the like stand out for being able to cope with unrestrained transactions. These banks make sure that businesses can multi-task with their resources.

By means of effective international payments, multi-currency accounts and integration with business devices, they help manage funds simply and profitably while removing the focus from needless growth complications.