I’ll talk about the Best Brokers with No KYC Trading Options in this post, emphasizing sites that let users trade without requiring complete identity verification.

These brokers offer access to the cryptocurrency, FX, and futures markets as well as speedy account setup and withdrawal times. In order to assist traders in selecting the best no-KYC trading platform, I will go over important features, privacy advantages, and possible hazards.

Key Point & Best Brokers with No KYC Trading Options

| Broker | Key Point |

|---|---|

| Coinexx | Offers multi-asset trading including crypto, forex, and commodities with low withdrawal fees. |

| PrimeXBT | Margin trading platform with advanced charting tools and cross-asset leverage up to 100x. |

| StormGain | User-friendly crypto trading platform with integrated wallet, staking, and interest-earning features. |

| SimpleFX | Provides both crypto and forex trading on a simple, browser-based interface with fast execution. |

| LMFX | Offers flexible account types with competitive spreads and access to MetaTrader 4/5 platforms. |

| EagleFX | Focused on low-latency forex and crypto trading, emphasizing fast withdrawals and tight spreads. |

| FinexBox Broker | Crypto exchange with high liquidity and spot trading options for multiple cryptocurrencies. |

| BaseFEX | Derivatives-focused platform offering leveraged crypto contracts and futures trading. |

| TradeOgre | Lightweight crypto exchange emphasizing privacy and a wide selection of altcoins. |

| Bybit (no‑KYC tier) | Allows limited trading without full verification, appealing to privacy-conscious crypto traders. |

1. Coinexx

Coinexx is an offshore multi-asset broker that uses well-known platforms including MetaTrader 4 and MetaTrader 5 to allow trading in forex, commodities, indices, and cryptocurrency CFDs. Quick account setup and cryptocurrency-only deposits and withdrawals allow traders to get started without requiring a lot of identity verification.

Because the broker is unregulated, it is only appropriate for seasoned traders who are at ease with no regulation, despite its reputation for ECN-style execution with tight spreads and leverage up to 1:500. Coinexx is frequently included in rankings of the Best Brokers with No KYC Trading Options for flexible access because it does not demand complete KYC for basic accounts.

Coinexx Features

- Multitude of trading assets (forex, commodities, indices, crypto CFDs)

- Support for MetaTrader 4 and 5

- Withdrawals and deposits with crypto

- Tight spread execution

- Your liquidity provision has high leverage

Coinexx – Pros & Cons

| Pros | Cons |

|---|---|

| Minimal initial KYC for basic access | Unregulated — higher risk |

| Supports multiple asset classes (crypto, forex, commodities) | No fiat deposit options |

| Tight spreads & competitive pricing | KYC required for larger withdrawals |

| Works with MetaTrader 4 & 5 | Limited transparency on operations |

| Crypto funding adds privacy | Customer support response can be slow |

2. PrimeXBT

PrimeXBT is a leveraged trading platform that focuses on traditional markets like forex, commodities, and indexes as well as cryptocurrency futures and CFDs. It appeals to both professional and speculative traders because it provides technical tools, sophisticated charting, and huge leverage up to 1000:1 on specific markets.

Its very easy account setup is one of its unique features; in the majority of areas, you may open an account and trade without having to complete KYC verification, however PrimeXBT might ask for identification for significant transactions or compliance checks. PrimeXBT is frequently listed as one of the Best Brokers with No KYC Trading Options for traders who are concerned about their privacy because of this policy.

PrimeXBT Features

- Trading CFDs and futures for cryptocurrencies

- Forex, commodities, and indices trading

- Instruments for charting and risk management

- Margin across assets

- High leverage

PrimeXBT – Pros & Cons

| Pros | Cons |

|---|---|

| No‑KYC tier available for small accounts | High leverage increases risk |

| Wide range of markets (crypto, forex, commodities) | Not regulated in many regions |

| Advanced tools and charting | Full KYC required for high limits |

| Strong liquidity on major pairs | Limited fiat funding options |

| Cross‑asset margining | More complex for beginners |

3. StormGain

A cryptocurrency trading platform called StormGain integrates the spot and futures markets into a single web interface and app. With features like leveraged trading, a built-in wallet, staking options, and cryptocurrency interest accounts to generate income from holdings, it caters to retail traders.

Because of its emphasis on user-friendliness and educational materials, StormGain frequently draws in novice traders who wish to do both contract trading and buying/selling in one location. In contrast to conventional brokers, StormGain concentrates more on cryptocurrency markets than on commodities or forex. Check the platform’s policies for your area because, despite the goal of a simplified onboarding process, full KYC can still be necessary for greater withdrawal limits or compliance.

StormGain Features

- Integrated wallet for cryptocurrencies

- Trading of cryptocurrencies (spot and with leverage)

- Having earn/stake features made easy

- Interface for mobile is prioritized

- Account setup is instant.

StormGain – Pros & Cons

| Pros | Cons |

|---|---|

| Beginner‑friendly interface | Focused only on crypto |

| Built‑in wallet and staking/earn features | Withdrawal limits without KYC |

| Quick onboarding | Fees can be higher than some competitors |

| Mobile‑first trading | Fewer advanced analysis tools |

| No‑KYC for small trading tiers | Regulation coverage limited |

4. SimpleFX

SimpleFX is an online trading platform that provides cheap spreads and quick execution for forex, CFDs, and cryptocurrency markets. It is notable for its ease of use, clear pricing, and compatibility with Bitcoin-based accounts, which let traders to deposit and withdraw funds using cryptocurrency.

SimpleFX is mentioned in discussions of the Best Brokers with No KYC Trading Options because it facilitates cryptocurrency funding and frequently does not impose stringent KYC for basic trading and withdrawals, particularly for individuals who value speedy setup and anonymity. The platform prioritizes effective market access above intricate identity verification or onboarding processes.

SimpleFX Features

- Trading via a browser is possible

- Support for markets of crypto and forex

- Funding via bitcoin is possible

- Execution of trade is rapid

- The costs are reasonable

SimpleFX – Pros & Cons

| Pros | Cons |

|---|---|

| No‑KYC at basic level | Smaller liquidity pool |

| Quick browser‑based access | Partial regulation only |

| BTC‑funded account possible | Limited advanced features |

| Transparent pricing | Charts and tools are basic |

| Supports crypto + forex markets | Customer support can lag |

5. LMFX

Currency pairs, metals, energy, indices, and some cryptocurrency CFDs are all accessible through the international forex and CFD broker LMFX (Le Marché Forex). Through platforms such as MetaTrader 4, it offers a variety of account types with variable leverage and competitive spreads.

Although regulatory status and KYC standards vary by location, LMFX places a strong emphasis on quick execution and client service. In many places, standard verification is required in order to access full capabilities and greater limits. LMFX isn’t usually emphasized among no-KYC choices because it is primarily a regulated broker that offers regular asset trading with crypto CFDs as an add-on.

LMFX Features

- Trading in currency pairs in forex

- Access to CFDs for commodities/indices

- Several variants of accounts

- MT4

- The spread is reasonable

LMFX – Pros & Cons

| Pros | Cons |

|---|---|

| Good for forex & CFD trading | KYC normally required for full access |

| Competitive spreads | Crypto access is not primary |

| Multiple account types | Limited regulatory oversight |

| MetaTrader 4 platform support | Fewer advanced features |

| Flexible leverage | Not truly anonymous/no‑KYC |

6. EagleFX

EagleFX is primarily a forex and cryptocurrency broker that emphasizes competitive spreads, low-latency execution, and fast cryptocurrency deposit and withdrawal options. It markets itself as serving traders looking for quick transactions and easy access without a lot of red tape. Like many offshore brokers,

EagleFX’s verification policies might differ by area and regulatory expectations, despite some users reporting simple onboarding and minimal KYC. Make sure you check the criteria before trading big sums because it is primarily a CFD broker and not a licensed cryptocurrency exchange, especially if you desire minimum identity verification.

EagleFX Features

- Trading of CFD cryptocurrencies and forex

- Deposit and withdrawal options for crypto

- Execution with low latency

- Spread is tight and the pricing is easy

- Onboarding is facilitated

EagleFX – Pros & Cons

| Pros | Cons |

|---|---|

| Easy onboarding process | Unregulated broker |

| Some no‑KYC functionality at low levels | Limited range of advanced tools |

| Fast crypto funding/withdrawals | KYC likely for higher limits |

| Tight spreads and transparent costs | No fiat deposit options |

| Simple, beginner‑friendly interface | Asset selection is limited |

7. FinexBox Broker

Known for providing a wide range of altcoins and comparatively easy access in contrast to larger international exchanges, FinexBox is a cryptocurrency exchange that facilitates spot trading in a number of tokens.

FinexBox is included in community listings of the Best Brokers/Exchanges with No KYC Trading Options where privacy or little onboarding is a priority because, as many users have pointed out, it has historically not enforced rigorous KYC for basic trading. Always verify the platform’s current regulations, though, as regulatory constraints are growing globally and KYC might be necessary for compliance or higher withdrawal restrictions.

FinexBox Broker Features

- Spot trading for crypto

- Large variety of altcoins

- Market structure of order books

- Funding for crypto only

- Easy trading interface

FinexBox Broker – Pros & Cons

| Pros | Cons |

|---|---|

| No‑KYC possible for basic accounts | Lower liquidity than big exchanges |

| Wide altcoin selection | No fiat/on‑ramp options |

| Quick deposits/withdrawals | Basic interface and tools |

| Privacy‑focused trading | Charts and analytics are limited |

| Simple order book structure | No formal regulation |

8. BaseFEX

Leveraged perpetual contracts on a range of digital assets were available on the cryptocurrency derivatives platform BaseFEX. It drew traders looking for high-leverage bets and futures without extensive onboarding.

Derivative markets have moved to more modern platforms, and BaseFEX has been mostly shut down or reorganized in recent years; always make sure a service is operational and compliant before utilizing it. Among current no-KYC lists, BaseFEX is generally not advised because to the lack of historical information and the changes in derivatives offerings. (Status may vary; always perform updated checks.)

BaseFEX Features

- Derivatives contracts for crypto

- Futures trading of a perpetual nature

- Options for trading at a loss

- Different types of orders

- Tools for professional charting

BaseFEX – Pros & Cons

| Pros | Cons |

|---|---|

| Focus on leveraged derivatives | Platform is largely inactive/defunct |

| Quick onboarding | Unregulated and risky |

| Professional charting and orders | Low trade volume |

| Leverage available | No fiat support |

| Clean interface approach | Very high risk environment |

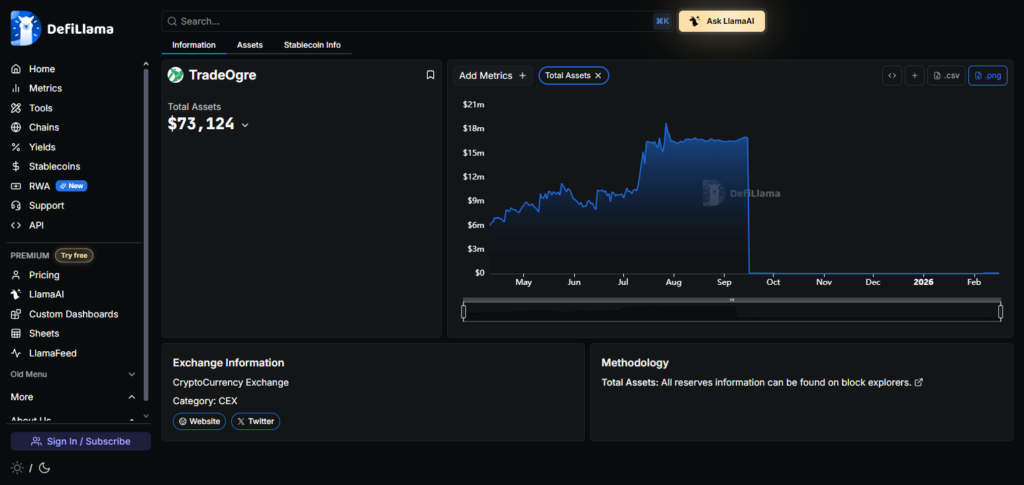

9. TradeOgre

With a minimal UI that focuses on basic deposit and trading features, TradeOgre is a lightweight centralized cryptocurrency exchange that is well-known for listing a large variety of tiny cryptocurrencies.

It is a prime example of a Best Brokers/Exchanges with No KYC Trading Options for consumers who value their privacy because it does not demand KYC for trading or withdrawals. Traders who seek fast access to specialized coins will find TradeOgre’s ease of use, wide token support, and lax verification appealing, but they should also compare security and liquidity to bigger, more regulated platforms.

TradeOgre Features

- Spot trading of crypto

- Collection of altcoins is very large

- No-KYC trading is intentional

- Interface is minimal and lightweight

- Funding for crypto only

TradeOgre – Pros & Cons

| Pros | Cons |

|---|---|

| No‑KYC required | Very low liquidity |

| Very wide altcoin access | Minimal trading tools |

| Fast crypto deposits | No fiat support |

| Simple, lightweight interface | Charts are basic |

| Great for privacy | Limited security transparency |

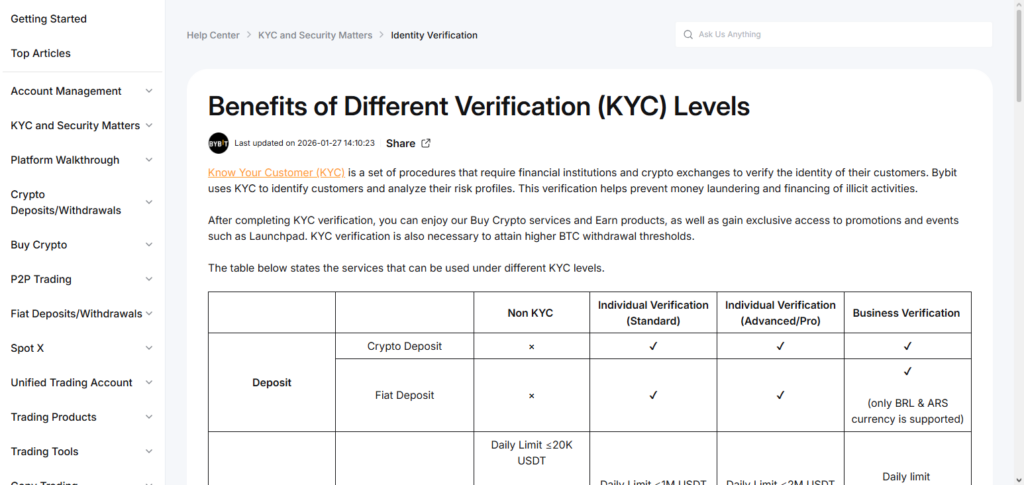

10. Bybit (no‑KYC tier)

Bybit is a significant international cryptocurrency derivatives and spot trading platform that provides a large selection of assets, high liquidity, and cutting-edge trading tools. Bybit offers a no-KYC tier in several jurisdictions, which permits users to register accounts and trade up to a particular amount of money without undergoing complete identity verification.

For users who wish to start trading immediately without compromising their privacy, this places it among the Best Brokers with No KYC Trading Options; nevertheless, complete verification could be necessary for greater withdrawal limits or regulatory compliance. Bybit is well-liked by both novice and experienced traders due to its robust liquidity and product selection.

Bybit (No-KYC Tier) Features

- Trading of derivatives with leverage and crypto

- Liquidity of the market is deep

- Types of orders that are advanced

- Platforms for the web and mobile

- No-KYC tier with small limits for withdrawals

Bybit (No‑KYC Tier) – Pros & Cons

| Pros | Cons |

|---|---|

| No‑KYC tier available | Withdrawal limits without KYC |

| Very strong liquidity | Full KYC needed for high limits |

| Spot + derivatives markets | Regional restrictions apply |

| Advanced trading tools | Fees on certain features |

| Good support/education | Not truly anonymous when verified |

Conclusion

In summary, the best brokers with no KYC trading options minimize the requirement for thorough identification verification while giving traders flexible access to the financial and cryptocurrency markets.

Privacy-conscious customers and those looking for quick account setup and withdrawals are catered to by platforms such as Coinexx, PrimeXBT, StormGain, SimpleFX, TradeOgre, and Bybit’s no-KYC tier.

Although these brokers provide ease of use, quicker access to trading, and occasionally more leverage, consumers should be mindful of the hazards involved, such as the lack of regulatory control and possible security issues.

To guarantee a safe and effective trading experience, selecting the best no-KYC broker necessitates striking a balance between ease, safety, liquidity, and asset diversity.

FAQ

What does “No KYC” mean in trading?

“No KYC” means a broker or exchange allows account creation and trading without completing full identity verification. Users can deposit, trade, and withdraw within set limits while maintaining privacy.

Are no-KYC brokers safe to use?

Safety varies. While many no-KYC brokers like Bybit, Coinexx, and TradeOgre are operational and trusted by communities, they often lack full regulation. Users should prioritize secure wallets, two-factor authentication, and small trade limits.

Which assets can I trade on no-KYC brokers?

No-KYC brokers often support cryptocurrencies, forex, CFDs, and derivatives. For example, PrimeXBT and StormGain offer both crypto and forex, while TradeOgre focuses on altcoins.

Are there withdrawal limits on no-KYC accounts?

Yes. Most brokers allow small withdrawals without KYC, but higher amounts typically require verification. For instance, Bybit’s no-KYC tier has daily withdrawal caps to comply with regulations.