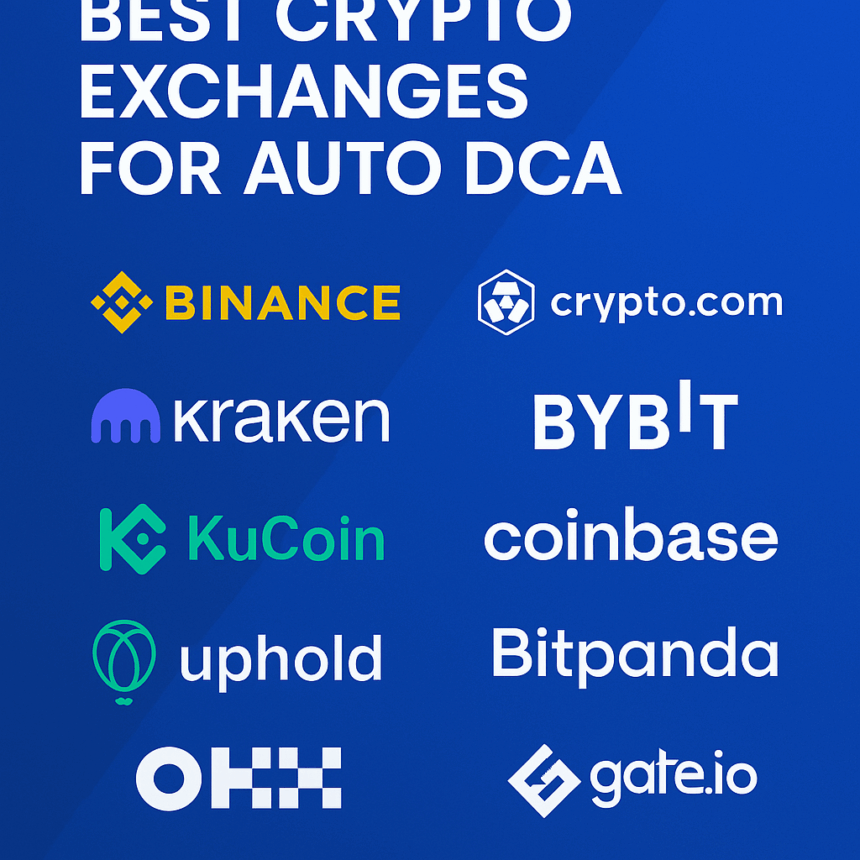

This article will cover the Best Crypto Exchanges for Auto DCA (Dollar-Cost Averaging). Auto DCA allows investors to purchase cryptocurrency at set intervals without actively managing the schedule or market conditions.

It is important to select the exchange that has efficient automation, low trading fees, and a good selection of coins. In this guide, I show you the easiest platforms to use for setting up and managing your DCA strategy.

| Exchange | Key Features |

|---|---|

| Binance | Auto-Invest bots, 460+ coins, staking integration |

| Kraken | U.S.-licensed, 470+ coins, flexible payment options |

| KuCoin | 900+ coins, advanced DCA bots, ultra-low trading fees |

| Uphold | Simple DCA setup across crypto, stocks, and metals |

| Crypto.com | Automated buys, fiat card support, cashback rewards |

| Bybit | Short-term DCA options, deep liquidity, low fees |

| Coinbase | Regulated U.S. platform, seamless card-based recurring buys |

| Bitpanda | Multi-asset platform, easy-to-use interface, EU compliance |

| OKX | Advanced trading tools, automated recurring buys |

| Gate.io | Wide range of supported assets, flexible DCA options |

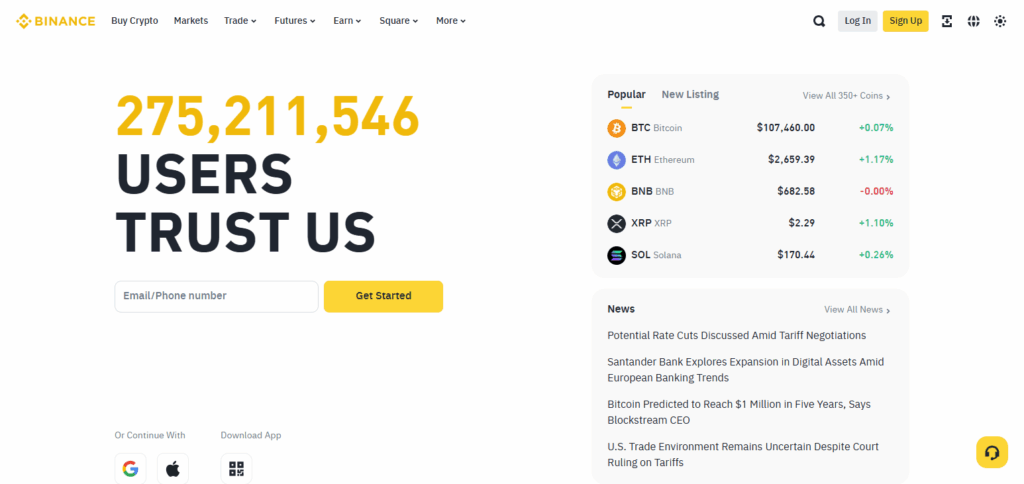

1. Binance

An industry leader for trading engines, Binance takes the crown on Auto DCA as well. Users of the exchange can automatically purchase over 460 cryptocurrencies using the more than 20 Auto-Invest bots Binance offers.

The platform’s integration of staking means users can passively earn while investing consistently. Beginner investors are also catered to with pre-built portfolios, allowing them to diversify seamlessly.

Binance remains a user favorite, whether novice or experienced, because of the low trading fees, numerous payment methods like fiat deposits, and the intuitive user-friendly interface.

The automation of processes is seamless and the robust security measures such as SAFU (Secure Asset Fund for Users) put in place to protect users’ funds make the deal even sweeter.

Binance Features

- Most extensive choice of cryptocurrencies and highest trading volume.

- Options/futures markets and sophisticated trading tools.

- Discounts and low fees are offered.

- Staking, savings and DeFi are parts of an elaborate ecosystem.

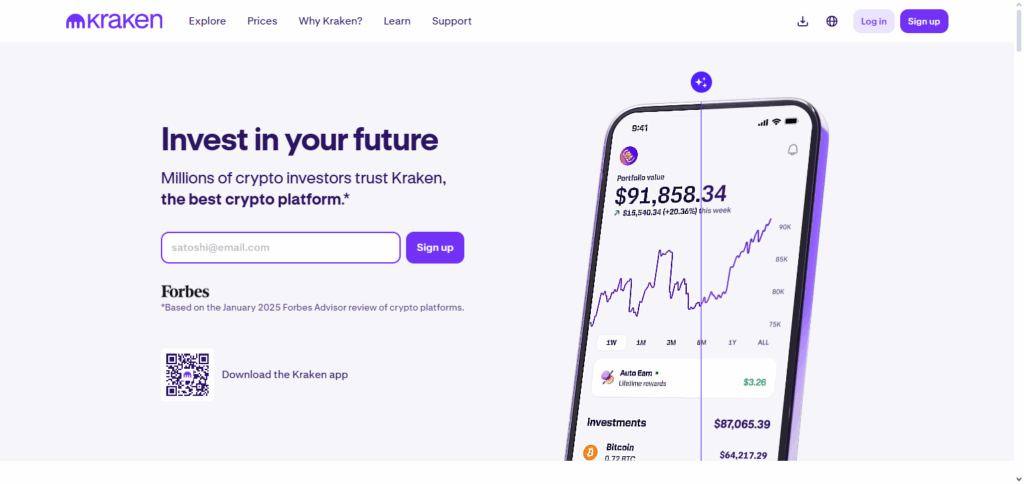

2. Kraken

Kraken is immensely popular for its high security features and the range of supported cryptocurrencies exceeding 470. It receives special recognition for being a US licensed exchange.

With flexible payment methods like bank transfers and credit cards, Auto DCA is made accessible to a broader audience and is user friendly.

Investing becomes simpler due to Kraken’s recurring buy feature which allows users to automate regular purchases of their preferred cryptocurrencies over time, mitigating losses from market fluctuations.

The regulatory compliance is important as well, ensuring the currency trading markets remain a safe trading environment. In addition, passive income can be earned through staking rewards, applying a DCA strategy without needing to monitor the asset.

Kraken Features

- Strong compliance and heightened security.

- Margin trading and wide support of fiat currency.

- Staking and futures trading is supported.

- Striking customer service and intuitive platform.

3. KuCoin

KuCoin is unique for its low trading fees as well as its cutting-edge DCA bots. With support for 900+ cryptocurrencies, KuCoin has one of the largest selections for DCA. The platform gives KCS discounts, lowering fees for active traders.

KuCoin’s trading bot enables users to set strategies and automate purchases, making it perfect for those seeking more control over their instutitional investments.

The exchange also supports margin trading, futures, and staking, so users can diversify their portfolio while remaining disciplined with their investments.

KuCoin Features

- New tokens and massive selection of altcoins.

- Margin and futures trading is permitted.

- Peer to peer trading and lending are available.

- Generous community rewards and referral bonuses.

4. Uphold

Uphold is a multi-asset platform that streamlines the process of Automated DCA for crypto, stocks, and even metals. Uphold’s AutoPilot feature allows users to schedule buys on a recurring basis, with customizable frequency and payment methods.

Uphold is especially user-friendly with its novice-friendly, no-surprise pricing model. The platform allows for fiat deposits, letting users fund their investment straight from the bank.

While automated funding fees of 2.49%-3.99% do apply, the platform’s versatility with assets and user-friendly interface position it strongly within the realm of automated investing.

Uphold Features

- Stocks, cryptocurrencies and precious metals on one platform.

- Zero minimum deposits and limitless instant transfers.

- Simple cryptocurrency purchase gateways.

- Payment processing and cross-asset swaps are supported.

5. Crypto.com

Its customers have unlimited access to the semi-automated DCA option in which computerized purchases of selected assets are made with a fiat card-linked payment account.

Recurring purchases configured to take advantage through the Crypto.com Visa Card offer cashback rewards. The platform endorses staking providing an opportunity for investors to passively earn income while executing their DCA strategy.

Automated investments through Crypto.com are simple to set up owing to the company’s intuitive interface while multi-factor authentication and other security measures offered help ensure the funds are secure.

Crypto.com Features

- Offers a wide array of cryptocurrencies alongside its native token, CRO.

- Cash back on crypto Visa cards.

- Interest can be earned on deposits of cryptocurrency.

- Defi wallet and NFT market integrated.

6. Bybit

As for Bybit, offers the most suited option for users looking to execute short-term DCA. Offering timeframes from 10 minutes to 4 weeks. There is ensured efficient trade execution from the platforms deep liquidity and for frequent micro-investing its low fees make it very attractive.

Users can hedge their funds while trading due to the platforms futures trading support enabling them to maintain a disciplined DCA approach.

Bybit’s intuitive interface makes it very easy to use, Advanced trading tools allow users to automate their cryptocurrency purchasing providing great options for traders.

Bybit Features

- Perpetual contracts highlight this derivatives focused platform.

- Options for significant leverage (up to 100x)

- For active traders user-friendly mobile app.

- Advanced order types and management of risk.

7. Coinbase

Coinbase is known as a regulated U.S. exchange due to its FDIC insurance and card-based recurring buys. It allows users to set up Auto DCA with credit/debit cards, making it easier for long-term investors.

Coinbase’s customer-friendly design helps with easy automation, its strong regulatory compliance safeguards which include cold storage further enhance security.

Even though Coinbase’s fees are higher than other exchanges, its regulatory compliance and user-friendliness makes it the most preferred option for beginners.

Coinbase Features

- Simple signup process for users.

- Great security and regulation adherence.

- Provides educational material about crypto with incentivized learning.

- Large number of supported crypto coins.

8. Bitpanda

Bitpanda is a multi-asset platform since it allows the trading of various assets like crypto, stocks and even ETFs. It lets users set up recurring purchases across multiple asset classes with its Auto-Invest feature.

Buying, selling and trading is easier as they can spend their assets like cash with Able to spend their assets like cash with Bitpanda’s Visa card adding flexibility to their investment strategy.

The platform operates under the regulations of European authorities, giving it compliance and security. Bitpanda makes it easy to automate investments with their payment options like bank transfers and credit cards.

Bitpanda Features

- Support for digital currencies, stocks and metals, ETFs.

- Intuitive interface and many ways to make payments.

- Ability to stake assets and participate in savings schemes.

- Bitpanda card for convenient purchases.

9. OKX

Under its scope of services, OKX provides Auto DCA tools and supports more than 300 cryptocurrencies. The platform provides staking rewards, enabling users to earn passively, even while performing their DCA.

OKX has sophisticated trading tools for futures and margin trading, which supports their more seasoned investors.

The exchange’s security measures, consisting of multi-layer encryption, protects the user’s funds. OKX is stable automated investment choice due to having low fees, deep liquidity, and liquid markets.

OKX Features

- Extensive selection of spot trading, options, and futures.

- Reduced fees coupled with high liquidity.

- Top-tier security measures, alongside an advanced API.

- Integration of NFTs and DeFi.

10. Gate.io

Gate.io provides Auto DCA tools for effortless repeat purchases of 600+ available cryptocurrencies. The platform provides staking rewards, enabling users to earn passively through investments.

Gate.io is reliable for automated investing because of its low trading fees and advanced security like cold storage.

The exchange’s user-friendly design guarantees straightforward configuration, catering to novices and skilled traders alike.

Gate.io Features

- Growing collection of newly add altcoins and tokens.

- Available margin trading, futures and options trading.

- Allows new token launches through the token offering launchpad.

- Strong community incentives.

Conclusion

Ultimately, the optimal crypto exchanges for auto DCA (Dollar-Cost Averaging) strategies have user-friendly interfaces, dependable automation options, and cost-effective fees.

Services such as Binance, Kraken, and Coinbase are well-known for their reliable automation features and extensive collections of assets which makes them stand out.

On the other hand, KuCoin and Crypto.com provide more adaptable plans and easy-to-use applications that make repetitive buying easier.

Selecting the ideal exchange is a balance between supported cryptocurrencies, required fees , and the desired level of automation, all of which facilitate an efficient DCA strategy.