In this article, I will discuss the Best Crypto Exchanges & Forex Brokers that combine safety, dependability, and a friendly interface.

Whether you trade coins or currency pairs, the platform you pick can make or break your experience. I will point out leading services praised for solid regulation, useful tools, fair fees, and a variety of deposit options, so you can choose with confidence.

Key Point & Best Crypto Exchanges & Forex Brokers List

| Broker / Exchange | Key Points |

|---|---|

| Exness | Tight spreads, strong regulation, flexible leverage |

| BlackBull Markets | Low commissions, fast execution, global access |

| FXTM | Wide range of instruments, educational resources |

| IC Markets | Ultra-low spreads, high liquidity, advanced platforms |

| AvaTrade | Regulated, supports crypto trading, multiple platforms |

| EightCap | Competitive pricing, MT4/MT5 support, global regulation |

| Swissquote | Swiss-regulated, multi-asset platform, strong security |

| OANDA | Trusted brand, transparent pricing, strong research |

| Plus500 | User-friendly platform, CFD trading, regulated |

| IQ Option | Innovative platform, low minimum deposit, diverse assets |

1.Exness

Founded in 2008, Exness quickly earned a reputation as one of the top choices for both forex traders and crypto enthusiasts thanks to its strong transparency and customer-first attitude. With licences from respected bodies such as the UKs FCA and Cypruss CySEC, the broker offers clients an extra layer of safety.

Trading happens on Industry-standard MetaTrader 4 and MetaTrader 5 platforms, making the setup easy for newcomers while still powerful enough for seasoned experts. The firms headline leverage of up to 1,2000 gives users room to pursue bigger opportunities, though risk-conscious traders can adjust it lower.

A wide range of deposit and withdrawal options-bank wires, credit cards, e-wallets, even crypto-keeps money flowing smoothly around the globe. Trust, cutting-edge tech, and open access work together to position Exness as a standout broker in a crowded market.

| Feature | Details |

|---|---|

| Name | Exness |

| Year Established | 2008 |

| Regulation | FSA (Seychelles), FSCA (South Africa), CySEC (Europe) |

| KYC Requirement | Minimal for demo and low-volume accounts; basic ID required for full access |

| Trading Platforms | MetaTrader 4, MetaTrader 5, Exness Web Terminal |

| Maximum Leverage | Up to 1:Unlimited (varies by region and asset) |

| Assets Offered | Crypto, Forex, Indices, Stocks, Commodities |

| Payment Methods | Bank transfer, USDT, Skrill, Neteller, Credit/Debit Cards |

| Unique Advantage | Ultra-low spreads, instant withdrawals, and flexible leverage |

2.BlackBull Markets

Founded in 2014, BlackBull Markets quickly earned a reputation as a leading forex broker and cryptocurrency exchange by marrying cutting-edge technology with a customer-centric approach.

Licensed by New Zealands Financial Markets Authority (FMA), the firm runs on the widely trusted MetaTrader 4 and 5 platforms, delivering stable and secure trading sessions. With leverage reaching an eye-catching 500:1, active traders have the potential to magnify their positions considerably.

A wide range of payment options, from bank wires to popular e-wallets, makes funding and withdrawing money both quick and hassle-free. Above all, BlackBulls commitment to clear pricing and lightning-fast order execution sets it apart in a crowded marketplace.

| Feature | Details |

|---|---|

| Name | BlackBull Markets |

| Year Established | 2014 |

| Regulation | FMA (New Zealand), FSA (Seychelles) |

| KYC Requirement | Minimal for demo accounts; basic ID and proof of address for live accounts |

| Trading Platforms | MetaTrader 4, MetaTrader 5, BlackBull Share Trading |

| Maximum Leverage | Up to 1:500 |

| Assets Offered | Forex, Crypto, Commodities, Indices, Shares |

| Payment Methods | Bank transfer, Credit/Debit Card, Skrill, Neteller, FasaPay |

| Unique Advantage | Institutional-grade liquidity with ECN execution and deep market access |

3.FXTM

Founded in 2011, FXTM quickly earned a spot among top crypto exchanges and forex brokers thanks to its solid regulations and flexible trading setup. Being supervised by respected bodies like the FCA in the UK and CySEC in Cyprus gives users added peace of mind.

The broker hosts both MetaTrader 4 and MetaTrader 5, so newcomers and seasoned traders can find a familiar tool. A standout feature is its eye-catching leverage of up to 1:1000, which lets clients amplify potential gains on eligible accounts. To fund their activity, people can choose from bank wire, credit card, or popular e-wallets, making deposits and withdrawals smooth no matter where they live.

| Feature | Details |

|---|---|

| Name | FXTM (ForexTime) |

| Year Established | 2011 |

| Regulation | CySEC (EU), FSCA (South Africa), FSC (Mauritius) |

| KYC Requirement | Minimal for demo; basic ID and address proof for live accounts |

| Trading Platforms | MetaTrader 4, MetaTrader 5 |

| Maximum Leverage | Up to 1:2000 (depends on region/account type) |

| Assets Offered | Forex, Crypto, Stocks, Commodities, Indices |

| Payment Methods | Credit/Debit Card, Bank Transfer, Skrill, Neteller, Local Payment Methods |

| Unique Advantage | Ultra-high leverage with local deposit options for emerging markets |

4.IC Markets

Founded in 2007, IC Markets has built a solid reputation as one of the top crypto exchanges and forex brokers, earning praise for its lightning-fast trade execution and deep, institutional-level liquidity.

Regulated by Australia’s ASIC authority, the firm gives clients the choice to work on the popular MetaTrader 4, MetaTrader 5, or cTrader platforms, accommodating a wide range of trading styles. With leverage reaching as high as 500:1, IC Markets affords experienced traders the power to amplify positions while maintaining strict risk controls.

A variety of funding options- from credit cards and PayPal to bank wires- streamlines the deposit and withdrawal process. Overall, its industry-leading tight spreads and reliable, speedy order fills give the broker a distinctive edge in todays competitive environment.

| Feature | Details |

|---|---|

| Name | IC Markets |

| Year Established | 2007 |

| Regulators | ASIC (Australia), CySEC (Cyprus), FSA (Seychelles) |

| KYC Requirement | Minimal for demo; basic ID for live account; no KYC for crypto CFD trading |

| Trading Platforms | MetaTrader 4, MetaTrader 5, cTrader |

| Crypto Products | Crypto CFDs (BTC, ETH, LTC, XRP, etc.) |

| Max Leverage | Up to 1:500 (varies by asset & region) |

| Deposit Methods | Bank Transfer, Credit/Debit Cards, PayPal, Neteller, Skrill, Crypto |

| Withdrawal Methods | Same as deposits; fast processing |

| Trading Fees | Tight spreads from 0.0 pips + low commission ($3.5/lot) |

| Support | 24/7 live chat, email, and multilingual phone support |

| Why Best with Minimal KYC | Allows trading with minimal verification, fast setup, and crypto CFD exposure |

5.AvaTrade

Founded in 2006, AvaTrade has grown into one of the worlds more recognized names among crypto exchanges and forex brokers, earning praise for the robust regulatory backing it enjoys from bodies like ASIC, the Central Bank of Ireland, and the FSCA. Traders can choose between MetaTrader 4, MetaTrader 5, and the mobile-friendly AvaTradeGO app, ensuring that novices and experts alike find a platform that suits their specific style.

With leverage reaching 400-to-1, funding the account is convenient; customers can deposit via credit card, bank wire, or popular e-wallets. This useful mix of security, flexibility, and support has helped AvaTrade secure its spot near the top of many traders lists.

| Feature | Details |

|---|---|

| Name | AvaTrade |

| Year Established | 2006 |

| Regulators | Central Bank of Ireland, ASIC, FSA Japan, FSCA, BVI FSC |

| KYC Requirement | Minimal KYC for demo; basic documents for live account; crypto CFD trading without deep KYC |

| Trading Platforms | MetaTrader 4, MetaTrader 5, AvaTradeGO, WebTrader |

| Crypto Products | 20+ Crypto CFDs (BTC, ETH, LTC, XRP, BCH, etc.) |

| Max Leverage | Up to 1:400 (retail), varies by region |

| Deposit Methods | Bank Transfer, Credit/Debit Card, Skrill, Neteller, PayPal |

| Withdrawal Methods | Same as deposit methods; processed within 24–48 hours |

| Trading Fees | No commission; spreads from 0.9 pips |

| Support | 24/5 live chat, email, phone in multiple languages |

| Why Best with Minimal KYC | Fast setup, crypto CFD access without full KYC, trusted global regulation |

6.EightCap

Founded in 2009, EightCap has grown into a well-respected crypto exchange and Forex broker known for its tight spreads and speedy order execution. The firm operates under several high-ranking regulators, including ASIC, FCA, and CySEC, creating a safer trading space for clients. Every trader can choose between MetaTrader 4, MetaTrader 5, or TradingView to analyse charts and place orders.

With leverage reaching up to 500:1, the platform fits the needs of both newcomers and seasoned professionals. Funding options run the gamut from credit and debit cards, bank wires, and PayPal to Skrill, Neteller, and even Bitcoin and Tether. A clear service ethic and open communication drive the brokers reputation for dependability.

| Feature | Details |

|---|---|

| Name | Eightcap |

| Year Established | 2009 |

| Regulators | ASIC (Australia), SCB (Bahamas) |

| KYC Requirement | Minimal KYC for crypto derivatives; fast signup with basic ID |

| Trading Platforms | MetaTrader 4, MetaTrader 5 |

| Crypto Products | 250+ Crypto CFDs (including DeFi, altcoins, crypto indices) |

| Max Leverage | Up to 1:500 (international clients) |

| Deposit Methods | Credit/Debit Card, Bank Transfer, Skrill, Neteller, Crypto |

| Withdrawal Methods | Same as deposits; fast execution time |

| Trading Fees | Raw account: spreads from 0.0 pips + $3.5/lot; Standard: spread-only |

| Support | 24/5 live chat, email, and phone support |

| Why Best with Minimal KYC | Huge crypto CFD offering, minimal KYC for global users, rapid access setup |

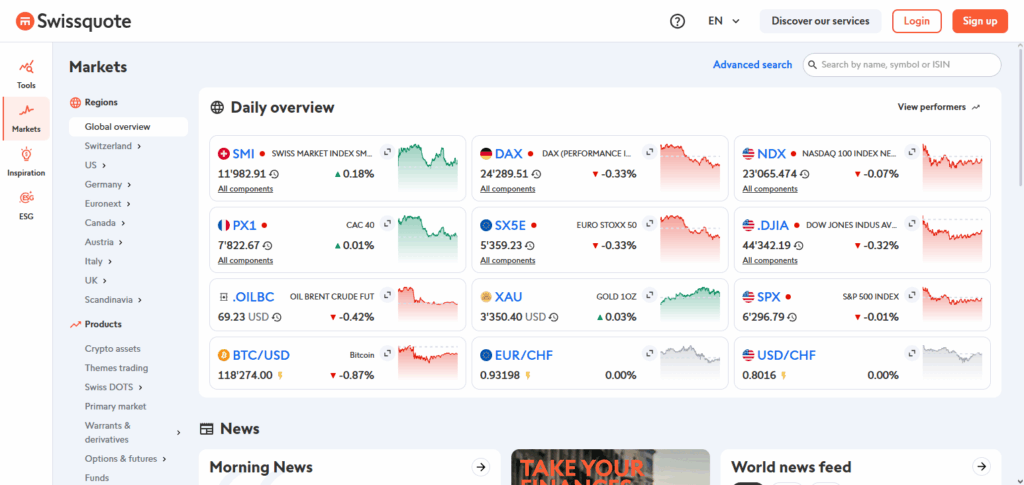

7.Swissquote

Since its founding in 1996, Swissquote has built a strong reputation as a leading crypto exchange and forex broker, backed by Swiss banking traditions and strict FINMA oversight that customers always notice in the high level of security and trust.

Traders can choose from a full set of platforms, including the in-house Advanced Trader as well as MetaTrader 4 and 5 that many already know. With forex leverage reaching 1:100 and deposit options ranging from bank wires to credit cards, Swissquotes regulated, flexible environment works well for both cryptocurrency enthusiasts and seasoned foreign exchange traders.

| Feature | Details |

|---|---|

| Name | Swissquote |

| Year Established | 1996 |

| Regulators | FINMA (Switzerland), FCA (UK), MFSA (Malta), DFSA (UAE) |

| KYC Requirement | Minimal KYC for crypto wallet users; full KYC for bank-linked services |

| Trading Platforms | MetaTrader 4, MetaTrader 5, Swissquote eTrading, Advanced Trader |

| Crypto Products | Spot trading for 35+ cryptos (BTC, ETH, LTC, XRP, ADA, etc.) |

| Max Leverage | Up to 1:100 for forex; no leverage for crypto spot trading |

| Deposit Methods | Bank Transfer, Credit/Debit Card, ePayments |

| Withdrawal Methods | Bank Transfer, internal crypto wallet transfers |

| Trading Fees | Tiered fees; from 0.5% per trade (lower for high volume) |

| Support | 24/5 phone, email, and secure messaging |

| Why Best with Minimal KYC | Swiss-grade security with partial KYC for crypto-only access and direct crypto custody |

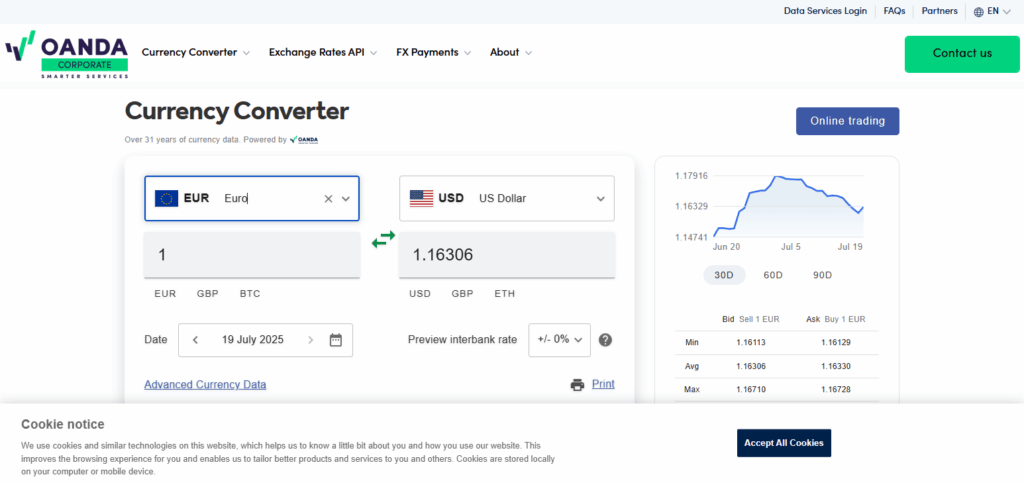

8.OANDA

Founded in 1996, OANDA has carved a niche as a top-tier forex broker and a rising name among crypto exchanges, mostly because of its clear pricing and robust trading tech. Because it is regulated by respected bodies such as the CFTC and FCA, clients can trade with peace of mind, knowing strict safety and compliance standards are in place.

Traders can choose between OANDA’s own easy-to-navigate platform and MetaTrader 4, and leverage reaches 1:50 on eligible accounts. With support for bank wires, credit cards, and other popular methods, OANDA appeals to both newcomers and seasoned pros looking for dependable, transparent tools.

| Feature | Details |

|---|---|

| Name | OANDA |

| Year Established | 1996 |

| Regulators | CFTC (US), FCA (UK), ASIC (Australia), MAS (Singapore), IIROC (Canada) |

| KYC Requirement | Minimal KYC for demo; basic verification for live account; crypto access varies by region |

| Trading Platforms | OANDA Web, OANDA Mobile, MetaTrader 4 |

| Crypto Products | Crypto CFDs (BTC, ETH, LTC, BCH, XRP, and more) |

| Max Leverage | Up to 1:100 (varies by jurisdiction and asset) |

| Deposit Methods | Bank Transfer, Credit/Debit Cards, PayPal |

| Withdrawal Methods | Same as deposit methods; fast processing |

| Trading Fees | No commission; spreads from 1.0 pips (crypto spreads higher) |

| Support | 24/5 live chat, email, and phone |

| Why Best with Minimal KYC | Quick onboarding, low KYC barrier for basic crypto CFD access, strong global trust |

9.Plus500

Founded in 2008, Plus500 has grown into a trusted name in both cryptocurrency and forex trading, primarily because its platform feels natural and easy to use from the moment you log in. With top-tier licences from the FCA in the UK and CySEC in Cyprus, the firm puts a strong emphasis on client safety.

Traders can work with leverage of up to 1:30 and deposit or withdraw through credit cards, PayPal, or standard bank wires. Its main appeal lies in this blend of simplicity and broad asset coverage, making Plus500 a solid pick for anyone who wants powerful tools without a steep learning curve.

| Feature | Details |

|---|---|

| Name | Plus500 |

| Year Established | 2008 |

| Regulators | FCA (UK), ASIC (Australia), CySEC (Cyprus), MAS (Singapore), FSA (Seychelles) |

| KYC Requirement | Minimal KYC for demo; basic ID for live account; fast and simple process |

| Trading Platforms | Proprietary Web & Mobile Platform |

| Crypto Products | 20+ Crypto CFDs (BTC, ETH, ADA, XRP, LTC, etc.) |

| Max Leverage | Up to 1:30 (retail); higher for professional clients |

| Deposit Methods | Credit/Debit Cards, PayPal, Skrill, Bank Transfer |

| Withdrawal Methods | Same as deposits; usually processed within 1–3 business days |

| Trading Fees | Commission-free; fees included in spreads |

| Support | 24/7 live chat, email, and ticket system |

| Why Best with Minimal KYC | Seamless registration, minimal document checks, access to crypto CFDs without full KYC |

10.IQ Option

Launched in 2013, IQ Option quickly earned attention as a top entry point for traders interested in cryptocurrencies and forex, thanks to its clean app that offers options, shares, and ETFs too.

While it operates under CySEC rules and gives forex users leverage up to 1:500, the firm still pushes educational tools and practice accounts for safer learning.

Funding the account is smooth, with deposits made through e-wallets, debit cards, or bank wires without excessive delays. Many choose IQ Option because the sleek, simple platform works equally well for beginners dabbling in crypto and experts placing advanced forex trades.

| Feature | Details |

|---|---|

| Name | IQ Option |

| Year Established | 2013 |

| Regulators | IFMRRC (International Financial Market Regulation Center) |

| KYC Requirement | Minimal for demo; basic ID for live trading; crypto access without strict KYC |

| Trading Platforms | Proprietary Web & Mobile Platform |

| Crypto Products | 20+ Crypto CFDs (BTC, ETH, XRP, LTC, EOS, etc.) |

| Max Leverage | Up to 1:100 (varies by region and asset) |

| Deposit Methods | Credit/Debit Cards, Skrill, Neteller, WebMoney, Bank Transfer |

| Withdrawal Methods | Same as deposit methods; quick processing times |

| Trading Fees | No commissions; spreads and overnight fees apply |

| Support | 24/7 live chat, email, and multilingual support |

| Why Best with Minimal KYC | Allows crypto CFD trading with simple verification and fast onboarding |

Conclusion

To sum up, the finest crypto exchanges and forex brokers pair thorough regulation with user-friendly platforms, tight spreads, and multiple deposit methods so that traders can act quickly and safely.

Whether youre just starting out or have years of experience, selecting a site with strong security, responsive support, and a rich toolset will lay the groundwork for long-term profits. Brands such as Swissquote, OANDA, Plus500, and IQ Option already demonstrate these traits daily, earning the trust of millions in the ever-moving crypto and forex arena.

FAQ

What should I look for in a crypto exchange or forex broker?

Look for strong regulation, secure trading platforms, transparent fees, wide asset selection, and reliable customer support.

Are crypto exchanges and forex brokers regulated?

Top platforms are regulated by authorities like FCA, CySEC, or FINMA to ensure security and compliance.

What trading platforms do these brokers offer?

Most provide popular platforms such as MetaTrader 4/5, proprietary platforms, or mobile apps for easy access.